Readers Question: Do you believe the Coalition Government has used the right macroeconomic policies with regards to reducing the budget deficit?

No. I’ve written a few times that I believe the coalition government made a big mistake in prioritising deficit reduction over economic recovery in 2010.

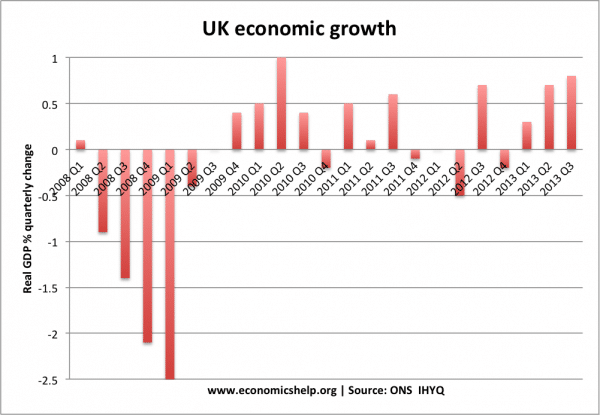

The consequence of trying to reduce the budget deficit at the wrong time (in a recession) is lost output, higher unemployment and falling real wages. Austerity wasn’t the only reason for the double dip of 2011. The weakness of the EU economy was a major factor. But, government austerity did adversely affect demand and confidence.

See: How austerity affects the economy

The main thing that can be said about the UK is that the austerity was relatively mild – spending cuts were a small % of GDP compared to European austerity. Combined with a loose monetary policy, UK recovery is currently better than many European economies.

Doesn’t the current economic recovery of 2013 prove that the government were correct?

Source: ONS

During 2013, the UK economy shows signs of recovery and appears to be one of the ‘strongest’ economies in Europe. This could be taken as a sign that the government got it right. But, I would look at it in a different way. Even with austerity policies, the economy will eventually recover. But, the economy could have recovered sooner. If the economy had recovered sooner, wages may have risen earlier, unemployment would be lower. Also with an earlier recovery, the government cyclical tax revenues would be in a stronger position.

If we hadn’t pursued austerity wouldn’t we have had a bond crisis and unsustainable deficit?

If we had run larger budget deficit, public sector debt would be slightly higher. For example, if we had borrowed an extra £20 billion to invest in public sector investment, rather than a public sector debt of £1,211.8 billion (75.9%) of GDP -we might have had a debt £1,231 billion (76.1% of GDP)But, it’s not a huge difference in the long run.

But, this borrowing of £20 billion, would also have helped improve tax revenues. And the economic growth, would help public finances in the long term. Stronger recovery would mean that the government cut spending later with less impact on economic growth. Borrowing costs have been very cheap for the government. With an independent Central Bank there was never a chance of a bond crisis like Euro members faced.

Has government fiscal policy been offset by monetary policy?

Given the looseness of monetary policy, the devaluation in the Pound, you would expect a recovery at some stage. I would say, that the willingness of the Bank of England to tolerate above target inflation and keep pursuing monetary expansion has definitely offset the (relatively minor) fiscal contraction of the government. In this case, the UK has been relatively lucky compared to Eurozone economies. Southern Eurozone economies have pursued fiscal austerity, whilst at the same time had an ECB committed rigidly to low inflation. The consequence is European deflation

Does it matter to keep criticising past mistakes?

Yes. As an economist, you feel this recession offered a classic textbook case of where fiscal policy was needed to play a role in economic recovery. In a recession, with zero interest rates, the government can and should be willing to offset the decline in private sector spending and investment.

The problem is that there is a strong political attachment to austerity. See: why is austerity politically popular

- The idea that we ‘deserve’ austerity after the years of excess.

- The idea that good housekeeping means reducing budget deficits no matter the state of the economy.

If we are not careful, unnecessary austerity policies are being vindicated as successful. We only suffered for five years! Our policies are a success because eventually there was a recovery.

For a more balanced post with arguments for and against deficit reduction. See: Should pace of deficit reduction be slowed?

Related