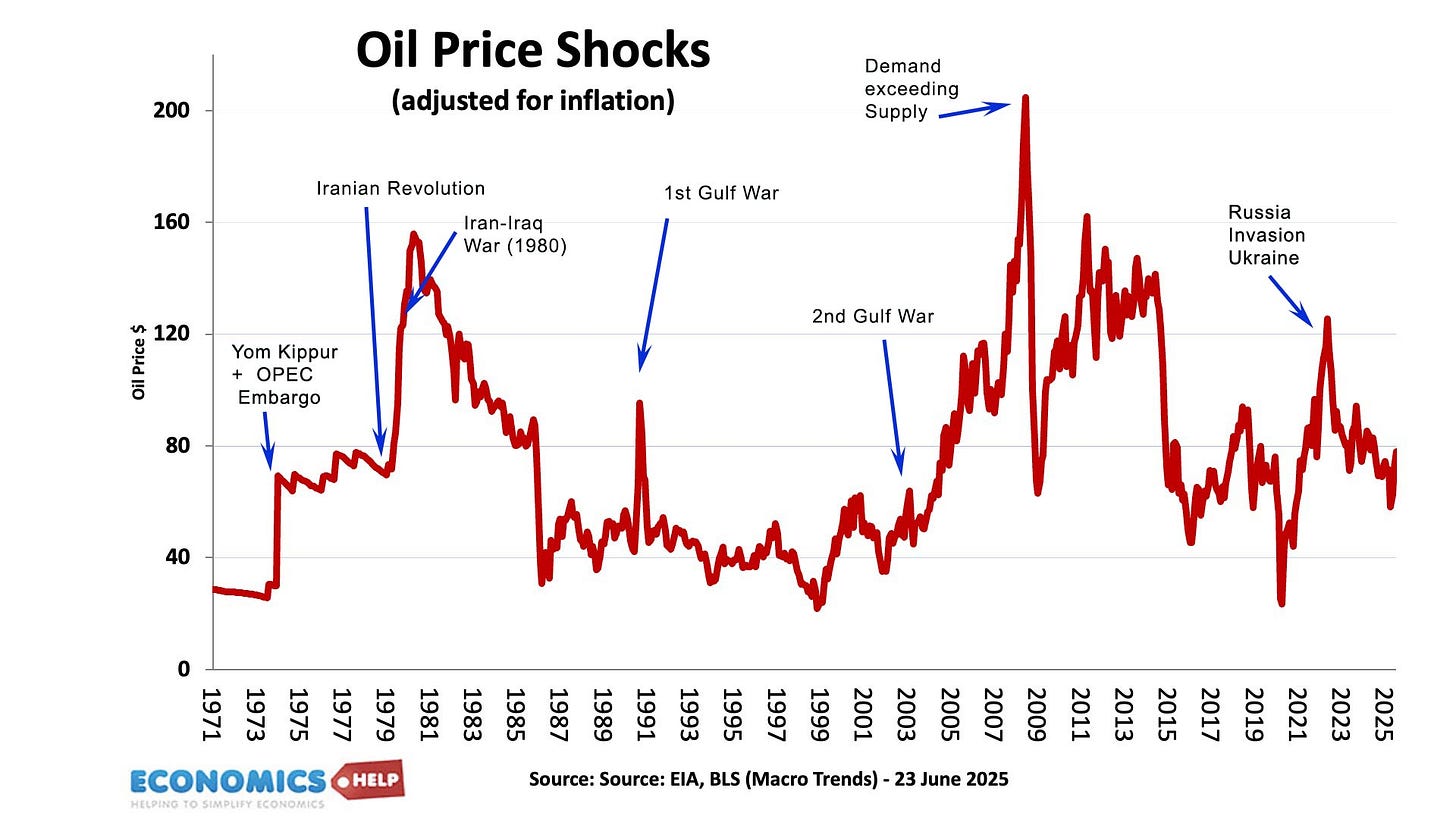

In 1973, in response to the Yom Kippur War, OPEC introduced an oil embargo which caused prices to rise 300%. It ushered in an era of high inflation and political volatility. In 1979, the Iranian revolution caused another 300% rise in oil prices which caused a secondary inflation shock and the deep recession of 1981.

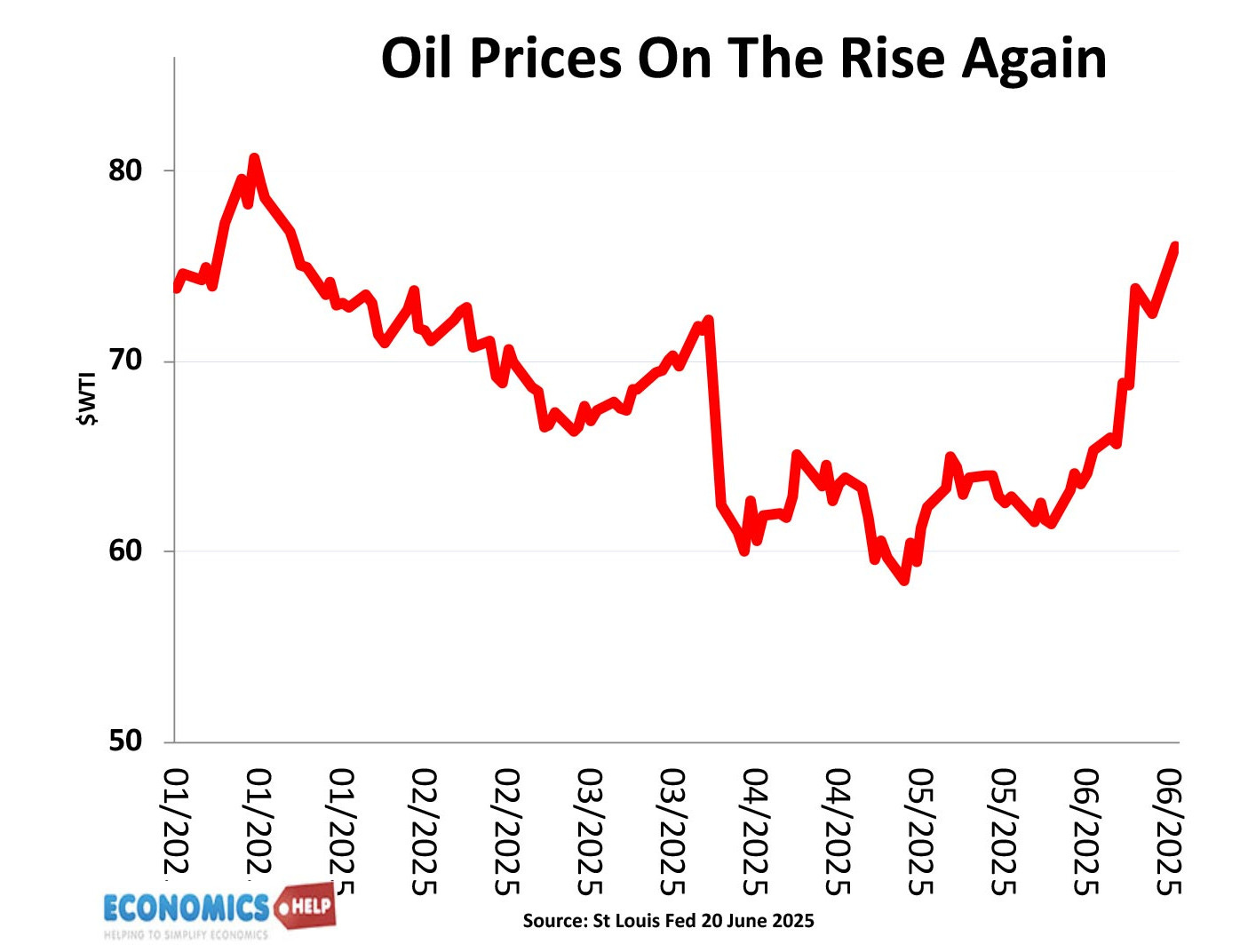

After falling in the early part of 2025, oil prices have recently soared on the back of the growing conflict in the Middle East. If Iran were to close the Straits of Hormuz, Citigroup suggest oil prices will soar to $90, JP Morgan say in a worst-case scenario $120. And even if the straits aren’t fully closed the cost of insurance and the cost of transporting oil from the Gulf to China has already more than doubled since last week.

Currently, 20% of the world’s oil passes through the straits, and any disruption would cause oil prices to rise. Higher oil prices would inevitably lead to more inflation. You can see there is a pretty strong relationship between movements in oil prices and US inflation rates. The global inflation of 2022, was in large part, caused by rising oil and gas prices. This not only increases the price of petrol, but the cost of transporting just about every good. In particular, the new conflict has caused a big rise in the price of refined products like jet fuel and diesel. The UK imports a third of its diesel and two thirds of jet fuel. Expect air tickets to go up pretty quick. It is true, that the world is less dependent on oil than in the 1970s. These days, we have more efficient engines and more electric vehicles, and so not everyone will face higher petrol prices. But, from food prices to transport, oil is still deeply embedded in the economy.

Wrong Kind of Inflation

Furthermore, rising oil prices create the wrong kind of inflation – that is due to rising costs, and not rising wages. When the cost of living jumps because of oil, it can easily cause a fall in real wages, exactly what we saw in 2022. Therefore, we get stagflation – higher prices but lower real wages, and lower economic output. Also, oil induced inflation creates a real headache for Central Banks. Do they increase interest rates to reduce inflation or do they cut interest rates to help with falling economic growth? If 2022 is anything to go by – higher inflation will cause higher interest rates, even though higher interest rates do little to address the root cause of this kind of cost-push inflation. Higher interest rates for longer will have big a effect on heavily indebted households. Also, it will be bad news for governments with high deficits The jump in interest rates in 2022, caused debt interest payments to become major parts of government spending in both the US and UK.

A reduced supply of oil through the Straits of Hormuz would particularly affect the Chinese economy. China imports nearly 1.8 million barrels a day from Iran. Given the Chinese economy has already struggled this year with the ongoing tariff war, it would be another unwelcome shock to the Chinese economy. Now, it is pretty unlikely the Straits of Hormuz would be completely closed because, economically, Iran would be the biggest loser. It can ill-afford to lose oil exports, which are its main source of revenue in proping up a depleted economy. China will certainly be keen to avoid closing this source of oil imports. Also, it is worth bearing in mind Iran is not the only country with territorial waters in the Strait of Hormuz. Oman and the United Arab Emirates will want to keep the straits operating normally.

Global instability

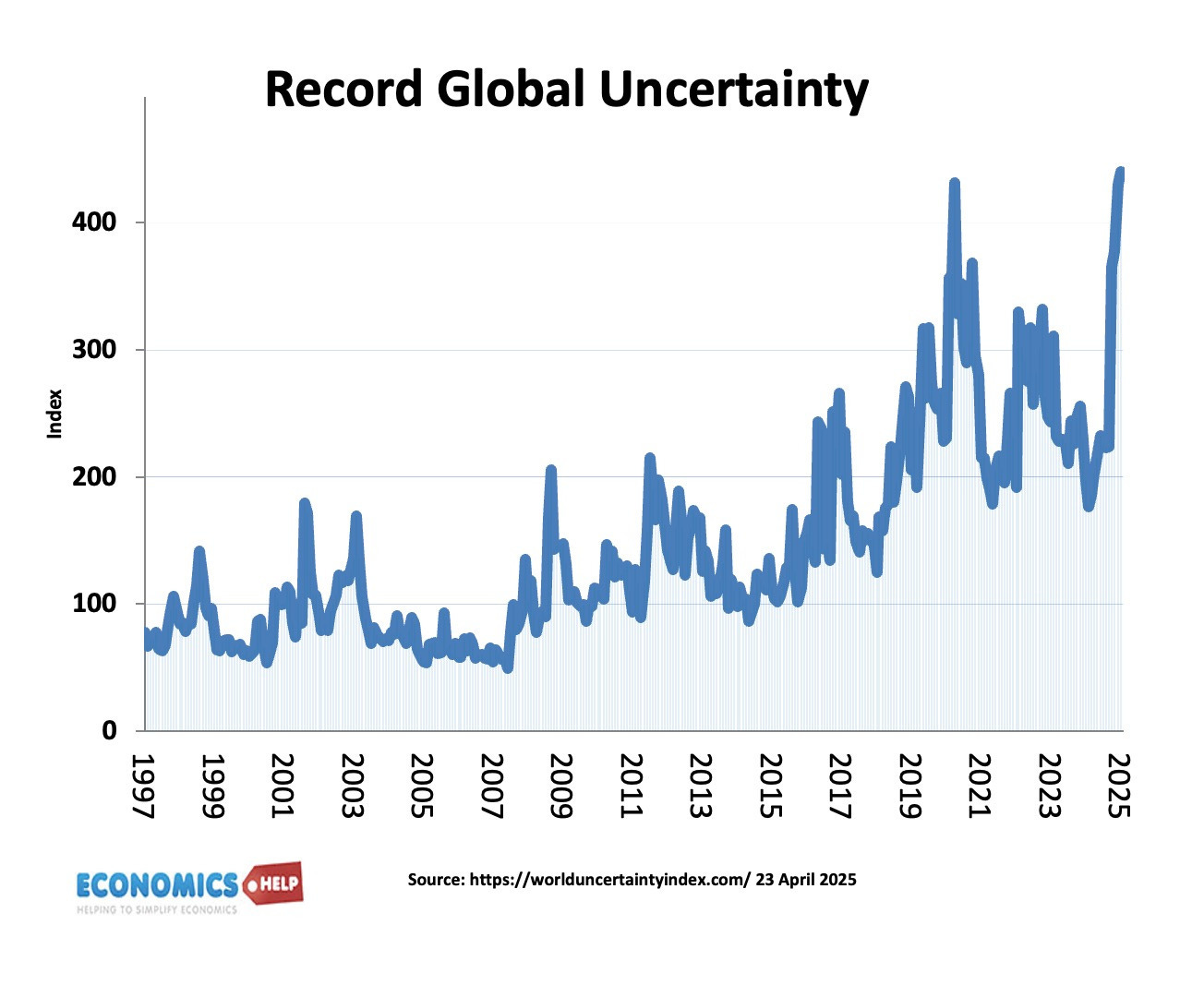

But, whether oil prices rise or fall, the potential for widening conflict is yet another factor contributing to global instability. Even before this crisis, the world was seeing unprecedented levels of economic and trade uncertainty. Although the trade war has faded from the headlines, it is still very much a reality that is yet to be fully felt by the global economy. Despite some moderation of tariffs in recent weeks, the budget lab at Yale, argue that as of June 17, the average US tariff rate for consumers is 15.8%, the highest level since 1936. This is lower than the temporary tariff rate of 22% we saw in mid-April. But, still high enough to cause significant disruption to a household’s cost of living and firm’s cost of production. One of the big effects of high tariffs in 2025 is the impact on reducing investment. With tariffs changing every week, and businesses uncertain what will happen to their costs, many are delaying decisions about where and when to build new factories. The high tariffs is failing to see a major new increase in manufacturing investment in the US. The threat of disruption to oil supplies and global trade in the Middle East will only add to the uncertainty and delay.

US Slowdown

After strong growth in 2024, the US saw a contraction in the early part of 2025, with GDP falling 0.2%. To some extent, this reflects the statistical noise of firms importing inventories to avoid tariffs, but with consumers increasingly stretched, there is a risk that this decline in growth will become more permanent. The Federal Reserve downgraded forecasts for US growth to just 1.4%. Yet, this is before the effects of new disruptions from the middle east may further weak consumer sentiment. Yet despite a fall in the rate of economic growth, the Fed chose not to cut interest rates because they see an unwelcome combination of rising inflation and rising inflation expectations. Consumers are certainly pessimistic about inflation prospects with one year inflation prospects of 6%. It is possible consumers are overly pessimistic about the impact of tariffs on inflation. Yet ironically,y high inflation expectations can become self-fulfilling as firms raise prices and workers demand wage rises in anticipation. Yet, it is a rise in the price of oil that would do most to actually cause a return to high levels of inflation.

The other underlying trend of 2025 is the growth in government debt or more accurately the market reluctance to keep buying government debt at low interest rates. We have seen rising bond yields in US, Japan and most advanced countries. The US in particular, is forecast record record levels of government borrowing for peace time. Any kind of conflict or economic shock, usually causes higher levels of government borrowing than anticipated. Not only even more borrowing, but higher interest rates to service the debt.

Falling Oil Prices

It is worth bearing in mind, a permanently higher price of oil is not guaranteed. Oil prices were falling in 2025 for two main reasons: global oversupply and weak economic growth, partly caused by the trade war. These two long-term factors won’t go away. OPEC could happily increase supply. In fact the fall in oil price was so extreme it was causing some high cost US producers to shut down production because it was no longer profitable. Higher oil prices could lead to increased US production. The US is certainly very different from the 1970s, when it imported up to 40% of oil. Today it only imports 9% of its oil consumption, so is less affected. Nevertheless, financial markets already have many warning signs and frailities, could they absorb another shock. This video looks at problems facing economy.

https://www.bbc.co.uk/news/articles/c056pyv723vo

https://budgetlab.yale.edu/research/state-us-tariffs-june-17-2025

$19,998 a day last Wednesday to $47,609

https://www.ft.com/content/23737db5-4e47-486d-9b70-d531cff083c5