In the past two years, I’ve spent £450 fixing broken suspension on my car. I’m not the only one, Kwik Fit estimated the costs to motorists from pothole damage to be £1.7bn. Yet fixing roads has suffered from government cut backs, especially affecting local councils. 62% of local authorities now outsource pothole fixing to subcontractors, who then often subcontract to smaller firms. It is a piecemeal approach, with each taking a cut. The Asphalt Industry Alliance claim it would cost £17bn and take 12 years to fix all the British potholes. Yet, specialist machines like the Dragon Patcher can fix 150 day at a cost of £9, but there is a big upfront cost and when you’re in penny pinching mode, it is easier to avoid investment and outsource to the lowest bidder.

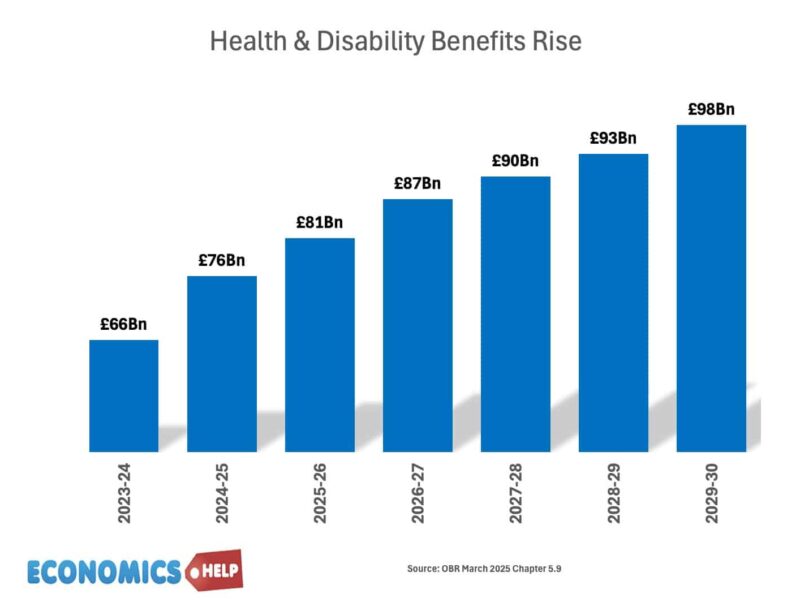

Welfare Benefits

Since 2010, the number receiving sickness benefits has soared 40%, yet reported health conditions have been relatively stable. True, Covid caused health problems, but the surge in UK sickness benefits is not mirrored in other European countries it is a UK issue. Why is there such a surge in sickness benefits? It’s complicated, but the rise in the pension retirement age has put more stress on those who struggle to work later in life. We save on pensions but pay more on incapacity benefit. Healthy life expectancy has fallen in many regions in recent years, with average healthy life expectancy in the north west of 59. Another interesting factor is that less than half of the disabled actually claim disability or incapacity benefits. But this share has been rising in recent years. This could reflect the rise in the cost of living. If you lose housing benefit or income support, one way to survive is to now apply for PIP payments or incapacity benefits, previously they didn’t.

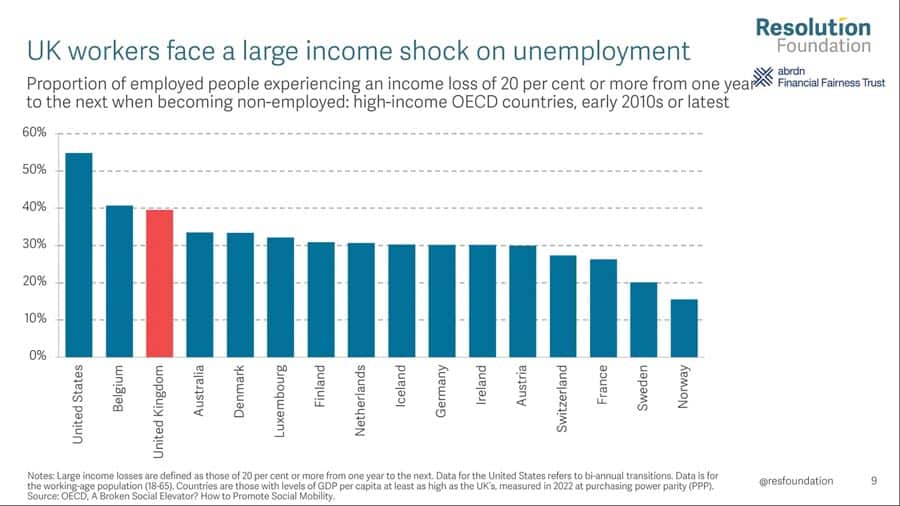

The UK has one of the lowest unemployment benefits in Europe. Since 2010, real unemployment benefits have fallen 5%. But, whilst unemployment and unemployment benefits have fallen, the UK has seen a surge in those claiming sickness and disability benefits. It’s like welfare whack-a-mole, you save on some benefits, but then it causes higher demand elsewhere in the system.

Greater Uptake

Also, in recent years, there is greater awareness of the benefits due to social media. You could argue Covid furlough payments and energy price subsidies have all made people more willing to take government benefits. The government plan to means test winter fuel allowance and save money saw a surge in people claiming for means tested pension credit. It cost an extra £200m. Even the whole debate on welfare reforms is causing record new claims for welfare benefits.

You could argue underfunding of health care is contributing to a rise in sickness benefits, although the IFS state there is little evidence to suggest waiting lists are linked to benefit claims. However, underfunding of basic health systems have arguably caused higher demand elsewhere in the health care system, which is more expensive than nipping problems in the bud. Between 2018 and 2022-23 local practise funding per patient was £12 lower. In May 2025, 6% of appointments were more than a month after booking. But, the real problem is getting an appointment at all, with many facing an anxious 9am struggle to get through. The problem is that if people give up and become undiagnosed, it can be more expensive to treat later.

More money more waiting lists

Every year, we spend greater amounts of money on the NHS, yet why does the service feels more stretched than ever. The Joseph Rowntree Foundation claims the NHS spends £29bn a year on dealing with the effects of poverty and limited social care. Those who have slipped through the health care system are more likely to end up in A&E needing expensive critical care. A lack of trained staff has caused expensive outsourcing to staffing agencies. A lack of capital investment means extra spending has low productivity. Even routine operations are outsourced to the private sector, A short-term plug, which is more expensive in long term. The NHS is like an emergency service for dealing with costs of society, but it has left no room for health prevention. It is estimated the costs of obesity are in the range of £98bn a year, and alcohol consumption £29bn. The government is announcing a new strategy for NHS to do more for health prevention. It is a good idea to try and move in that direction. The potential benefits are huge One study suggested evidence-based preventative health care could add 20 healthy days per person a year. It’ not just the NHS, making healthy food affordable, healthy habits, and individual choices. Something like the sugar tax was a rare example of a forward-looking policy which raised revenue and caused decline in the sugar concentration of drinks.

HS2

If you’re talking about wasted money, you can’t help but return to HS2 the 230km £100bn railway. One of the most expensive in the world. But, it is worth pointing out, there was actually a good case for increasing rail capacity. The big problem was that ministers at the time wanted to build the best, the fastest, the most impressive railway. If they had a railway which had a lower maximum speed, they could have followed the contours of the M40, it would have been cheaper to build and less disruptive. But, to make it fast, you had to build it straight, to build it straight, you had to build expensive tunnels and cuttings. Even £100m on a tunnel for bats. The greatest irony is that this super-fast railway is super slow to build. Spain, with admittedly more favourable terrain has built 4,000km high-speed rail at an average cost of €17.7 million per km, compared to a European average of €45 million, and a UK average of €232 million. China has built 48,000km of high speed rail and we wonder why everything is made in China these days.

Housing

One of the biggest factors affecting quality of life has been a rise in housing costs over the past 18 years. Social housing sold off, inherited wealth, rising population, high migration, low interest rates. Whatever the reason, higher rents led to a rise in the housing benefit bill, expensive housing, means more government spending on benefits. However, in a bid to rein in welfare costs, caps on housing benefit have meant lower-income households have struggled to rent. This has led to rise in homelessness, but councils have a legal requirement to provide accommodation, even if this means paying for an expensive B and B. Cut housing benefit, and local councils spend more on temporary accommodation, benefit whack-a-mole again. Combined with social care costs exploding because of an ageing population and no specific policy to pay for it, it is no wonder many local councils fear bankruptcy. The government’s plan to try and increase housebuilding rates are a step in the right direction, but given a relative backlog of unbuilt housing it would take many years of building the right kind of housing in the right places to make a serious dent in housing costs.

Local Councils

Local councils have often borne the brunt of austerity, and many departments have been slashed. Yet, their job is made harder by spending more on social care and special needs education. Despite spending over £10.7 billion a year on SEND, local councils have amassed debts of £3-£4bn. The number of children diagnosed with special needs has doubled, but with mainstream schools lacking the finances to support extra care, combined with the legal right for parents to choose a school of their choice, it has created a system in crisis. With local councils unable to cope, there has been a surge in private schools, often funded by private equity, providing specialist education. To meet legal requirements, councils are spending up to £100,000 a year. The Times reports local authorities are spending £1.8 billion a year on the sector, a rise of 300 per cent in just eight years. It is a familiar story, underfunding in the mainstream sector, leaks out into spending into more expensive private sector.

Treasury Times a Year

The whole situation is not helped by the Treasury, which seems to try three times a year, try to fudge the books to meet the approval of OBR. It has caused a reflexive cost-cutting process to meet the latest change in OBR forecasts or deterioration in finances. Rather than thoughtful long-term reforms to get people into work, critics claim welfare reforms are primarily driven by the desire to meet fiscal headroom. I would drop this crazy practice of effectively having to meet almost fictitious targets three times a year. Fictitious in that 5-year forecasts are always wrong anyway. Sometimes you need to invest to save money.

The final indignity is that the extra spending gets pushed onto the public sector debt, and since interest rates rose in 2022, the cost of debt interest payments have gone up. So we are in the situation of paying upward of £100bn on debt interest payments, and who benefits from higher debt interest payments, it is not the average taxpayer? This video goes more into national debt, what is it, why it is rising and does it matter. Do check it out it’s quite interesting.

Sources

- https://ifs.org.uk/publications/health-related-benefit-claims-post-pandemic-uk-trends-and-global-context

- https://www.instituteforgovernment.org.uk/publication/smarter-approach-homelessness

- https://www.theguardian.com/society/2025/jun/29/britains-medieval-health-inequality-is-devastating-nhs-experts-say

- https://www.theguardian.com/business/2025/mar/18/cost-of-fixing-pothole-plagued-roads-in-england-and-wales-soars

- https://www.statista.com/statistics/1120063/china-length-of-high-speed-rail-operation-network/

- https://www.theguardian.com/society/2024/jan/22/patients-england-waiting-times-gp-appointments-nhs-figures

- https://digital.nhs.uk/data-and-information/publications/statistical/appointments-in-general-practice/may-2025#

- https://www.thetimes.com/uk/education/article/private-school-fees-special-educational-needs-send-ehcp-cxq09r77k

- https://substack.com/home/post/p-152279317

- https://www.ft.com/content/1466e900-d322-4064-80dc-89fb9da30712