After a bankbench rebellion, the chancellor Rachel Reeves was visibly upset in parliament this week, perhaps she had just been given the latest UK economic forecasts.

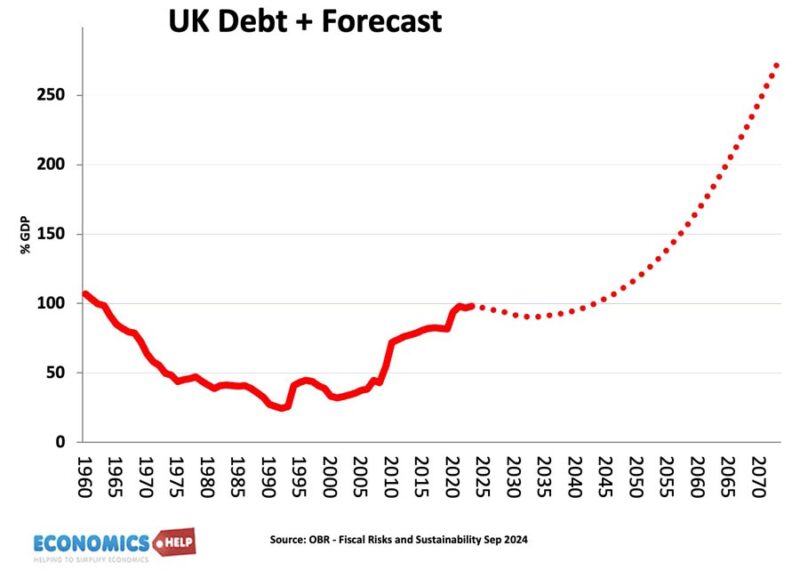

When the OBR published this forecast for UK debt, one commentator said it was misleading and alarmist, because it assumes policy never changes. But, the evidence from recent years is that actually the government do seem incapable of preventing a fiscal doom loop of low growth and higher debt. The government have tried to means test winter fuel and reform health related benefits, yet despite a super-large majority, the changes were so politically toxic they have been effectively abandoned, meaning political capital has been squandered on unpopular policies which hardly save any money. It reminds you of the old Woody Allen joke that not only is the food terrible but they are also small portions.

Spending

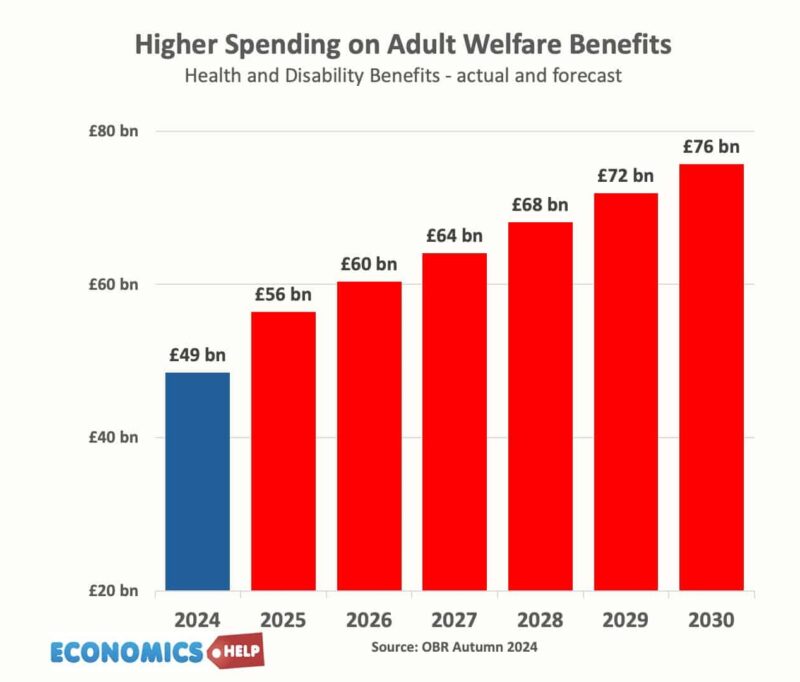

Welfare spending on working age adults is set to rise from £48bn to £75bn by the end of the decade. The initial bill would have meant it only increased to £70bn, but now this has been effectively shelved. After the welfare bill’s defeat, one Labour MP was heard to remark I don’t know why this means taxes have to rise. Just a few billion here and there, but the billions do add up. The chancellor has already seen the £10bn of fiscal headroom wiped out. No wonder, UK households are saving at an unprecedented rate, an increasingly pessimistic population expecting higher taxes and economic stagnation.

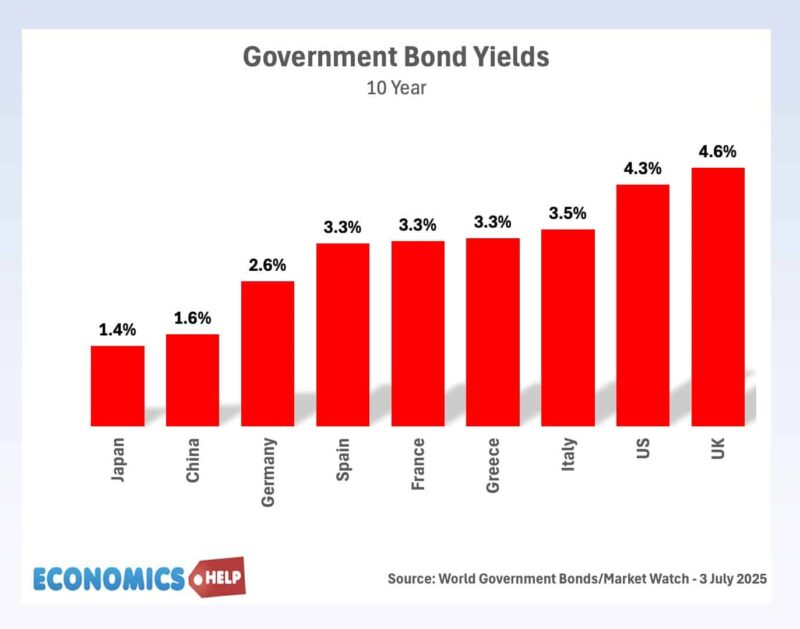

The truth is the UK economy is walking on a tightrope and has been for the past few years. This is not 1997, when the economy was doing well. It is not even 2010, when bond yields were low and markets and Central Banks were happy to buy debt like there was no tomorrow. This is 2025, and government debt is rising around the world, but this time interest rates are higher, and unfortunately, UK bond yields are amongst the highest. This has already increased UK debt interest payments, which was a major reason for borrowing being higher than expected in recent years. On the one hand, Labour backbenchers and the public want more spending, but the chancellor feels constrained by the bond market. The defeat and the chancellor’s wobble earlier in the week did cause a spike in bond yields. They fell back down but highlights the precarious nature of finances. Memories of Liz Truss haunt this Labour government.

Economic Growth

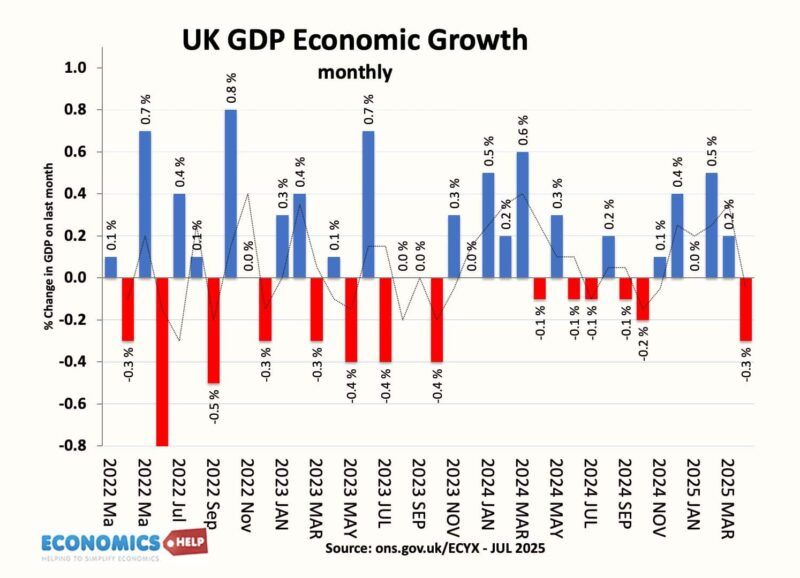

If the economy was growing like 1997, it would be a different matter, but it isn’t. In terms of economic growth the most charitable assessment would be more of the same. Monthly growth is highly volatile, but seems to be bouncing around 0%. Growth in the past 12 months is actually 1.2%, fairly similar to the post-2008 average.

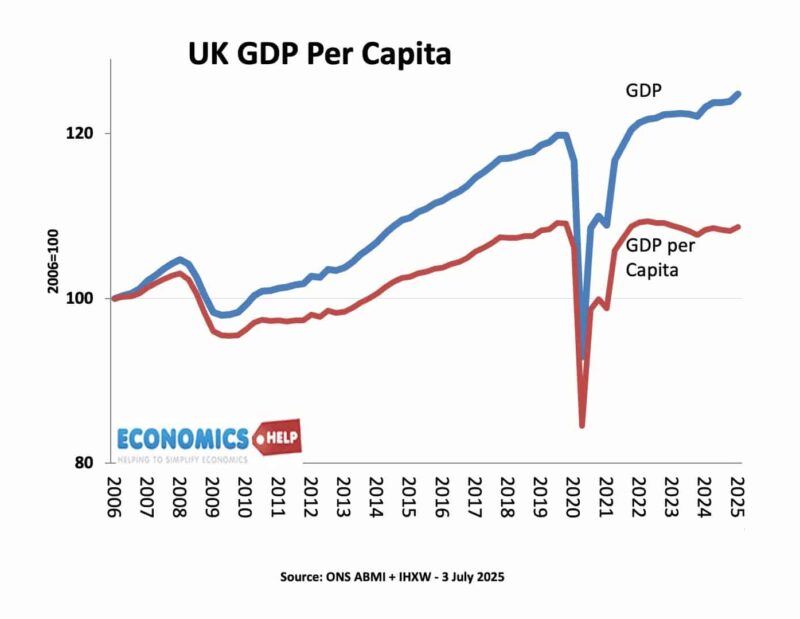

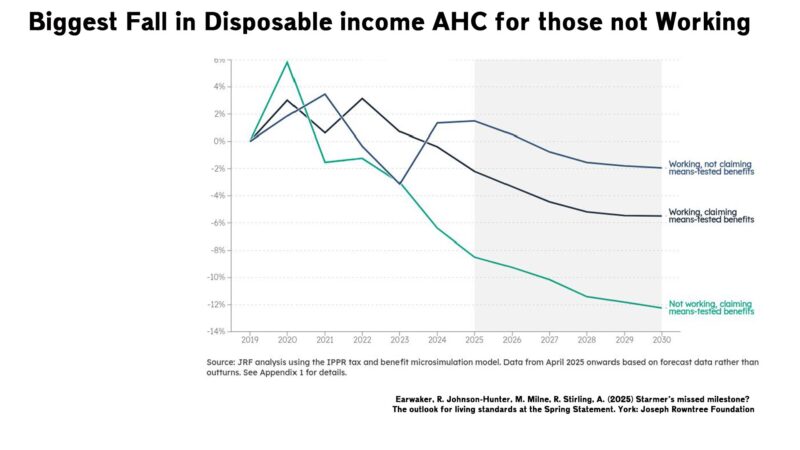

But, whilst economic growth has averaged just over 1%, real GDP per capita, which takes into account population growth is another matter. GDP per capita is still lower than pre-pandemic, and this is the heavy weight on living standards, government finances and the hope to do the nice things that might make a difference. Ironically, one of the brighter parts of the economy is the rise in real wages over the past 2 years. In particular, low-income workers have benefited from the rise in minimum wage. The numbers doing low-paid work have fallen considerably. But, bar staff and cleaners aside, households are not overly excited by this brief rise in real wages (just 2% rise over parliament), the savings ratio has risen for three reasons. Firstly, prospects for future real income growth are pretty grim. The OBR predict fairly stagnant living standards, the Joseph Rowntree Foundation predict if you include housing costs, living standards will fall by the end of the parliament.

And this week, the OBR reported that they tend to be overly optimistic on long-term economic forecasts. Growth is lower than past forecasts, Inflation has been higher than forecasts and borrowing is higher than forecast. It’s hardly revelatory, they’ve been overly optimistic on productivity growth since 2009. But, if growth is lower, it blows another hole in spending forecasts, and will necessitate more tax rises.

Tax the Rich?

Many wonder why a Labour government didn’t tax the wealthy more. For example, since bond yields rose and the Bank of England started to reverse QE, the Treasury will be paying a total of £150bn to fund the Bank of England’s interest payments to commercial banks from QE. Tiering reserves like the ECB do could save an estimated £55bn over 7 years.

But it has been dismissed. Now Labour have raised some taxes on the rich, VAT on school fees, changes to capital gains, higher stamp duty and abolition of non-dom status, has created media headlines of the rich fleeing Labour Britain escape to low-tax countries like Dubai. Henley and Partners argue in their Wealth Migration report that suggest UK will lose 16,500 millionaires, topping the global list for losing rich people.

However, the good news it that these headlines, though widely picked up are also misleading. In 2024, the 9500 millionaires reported to be leaving represent only 0.3% of the UK’s 3 million millionaires. Furthermore, whilst the rich are always leaving, they are also still arriving. Net migration of the super-rich from 2013 to 2024 was around zero.

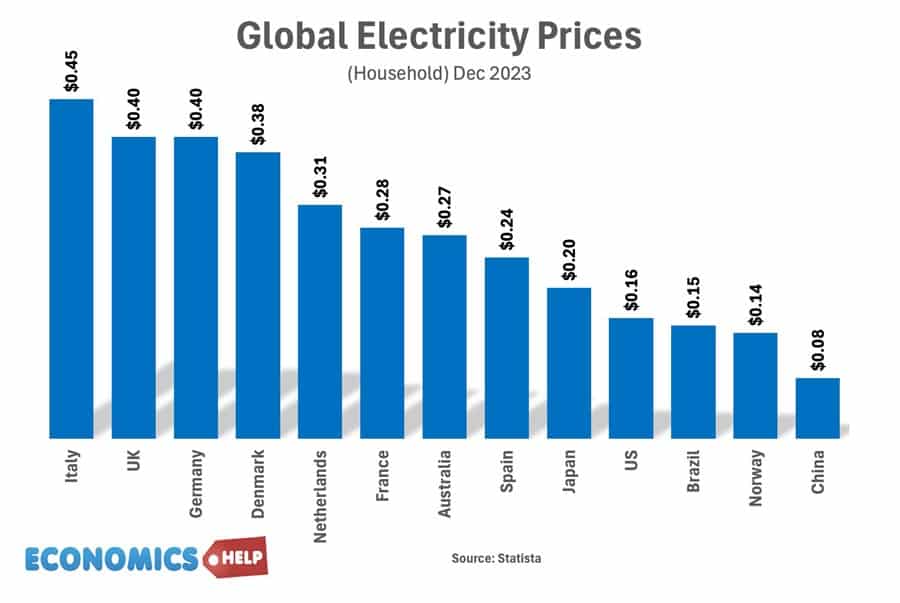

The biggest economic concern for the British electorate is the cost of living, and there is growing pessimism some 49% never expect the cost of living crisis to end, and in terms of inflation, the UK is once again something of an international outlier with inflation higher than comparable countries. The big factor causing inflation is rise in energy prices and the UK’s electricity costs which are the highest in Europe. This spike in inflation largely reflects global factors and the past policy choices of UK governments from decisions on nuclear power to the structure of the energy industry. But the big challenge for Labour is whether they can do anything about the cost of living in the next four years. Without major reform of the energy industry, and good luck in global gas prices it will be a big challenge.

Electricity Prices

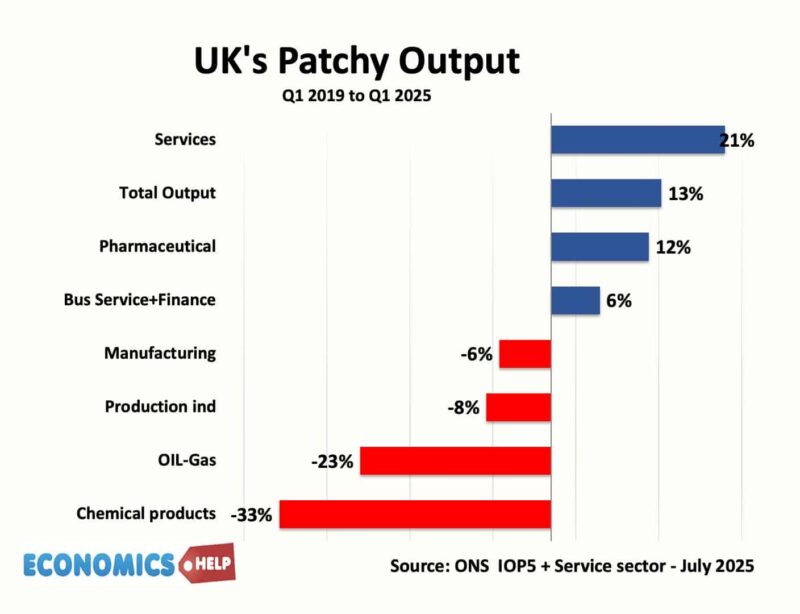

The problem is that the high electricity prices are decimating parts of British industry. The government were involved in a high profile bailout of a steel works, with a prospective loss of 2,700 jobs, but less visible are declines in other manufacturing industries.

Since 2019, the chemical sector is down 33% industrial production down 8%. It reflects a loss of competitiveness, high electric costs and is making economy more reliant on service sector.

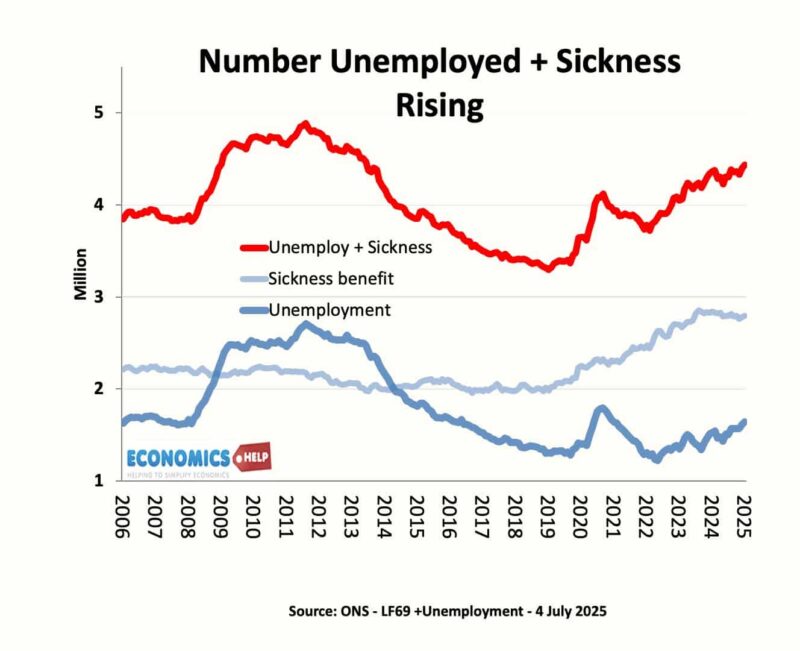

Britain’s Not working

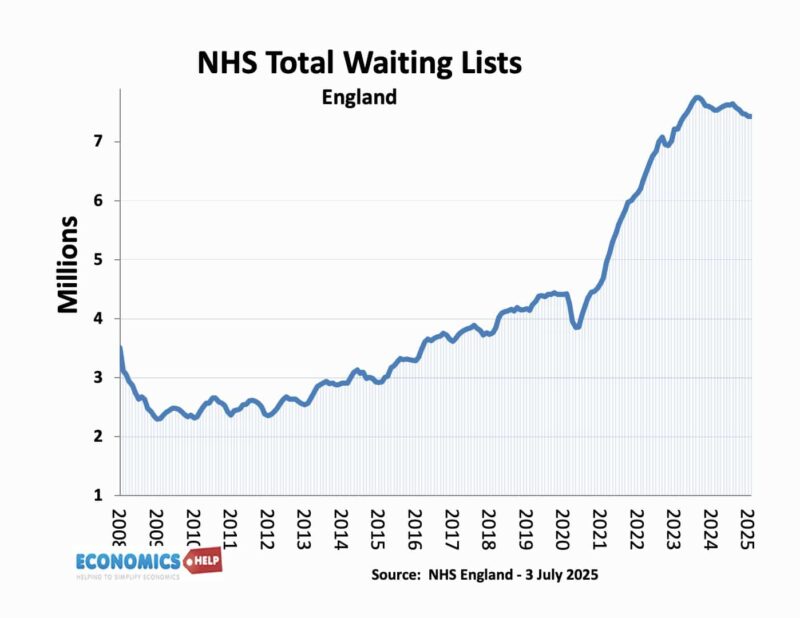

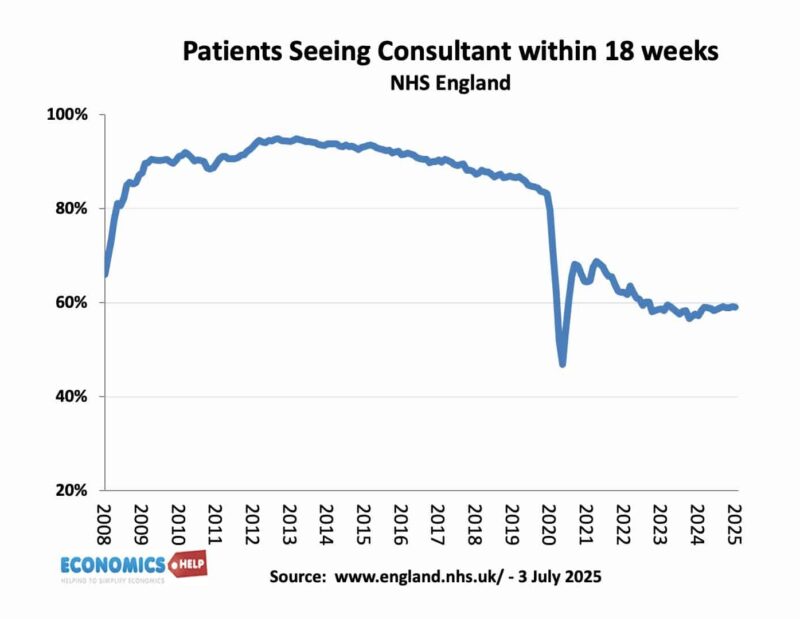

The other big challenge facing the labour government is the rise in numbers not working. Whilst unemployment is relatively low, the numbers not working is as high as the end of the 2012 recession. Since Covid, sickness rates have increased in the UK, placing strain on the health care system. One of the big goals of the government is to reduce waiting lists.

The total number on waiting lists has marginally fallen, the number seeing a consultant within 18 weeks is largely flat.

The goal to shift NHS to better prevention is a worthy goal and worth trying, but the public will also need to see improvements in actualy treatment on frontline services. It remains to be seen whether governments NHS reforms can actually break the link between spending more and better results.

Spending is Rising faster than Tax Revenues

The other problem with rising sickness is that it is placing huge stress on government finances. Unfortunately, the reforms were botched by focusing on fiscal savings rather than how can we actually help people into work. After such a big setback in first year of parliament it doesn’t bode well. You might say so what if the welfare bills rises to £75bn, but with pensions also rising faster than GDP, defence being increased, there will be pressure for further increase in the tax burden. It will be both unpopular but also could affect weak economic growth. There is evidence that choosing to increase NI tax on employers has led to lower employment growth.

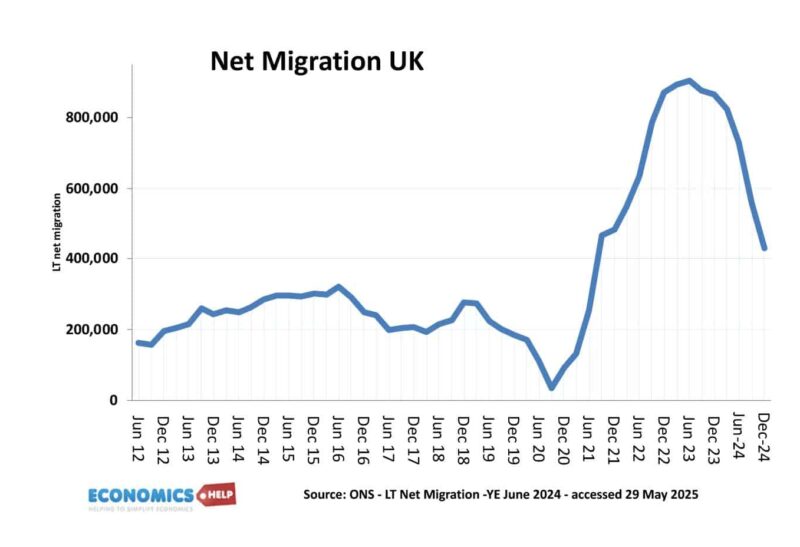

Immigration

Other goals of the government include securing borders and bringing down migration. Migration has fallen in the first year, though largely that was due to policy under the last Conservative government. However, further reforms, plus a fairly weak economy, could see net migration fall further. However, even this is not without a trade off, lower overseas student numbers has placed financial pressure on indebted universities. Higher education is one of few areas where the UK does excel, but it is caught in cross-fire of migration targets. The OBR also forecast that lower migration may also lead to lower tax revenue and higher borrowing.

Europe

On Europe, Labour have negotiated a new trade deal with fewer checks, it may increase GDP by 0.3% over 15 years. It’s kind of symbolic of limited vision, tinkering at the edges, ignoring the elephant in the room, which is the big shock to the economy from Brexit of 4%.

Housing

On housing, Labour have been slightly bolder with lifting some restrictions on house building, but they haven’t gone as far as full zoning laws. Instead housing policy is still driven by national targets. Targets which look hopelessly optimistic, but may also cause more building in areas where they are not so acutely needed.

Brighter Spots?

It’s not all doom and gloom, the Pound has appreciated this year, there hasn’t been a Truss-style meltdown, inflation and interest rates should fall later in the year. But, this is a pretty low bar. The bigger question is can the Labour government create a sea change in the long-term underperformance of the economy? Even the most sympathetic supporter would have to say, there has been no evidence of this so far. Less sympathetic observers may say it has been a wasted year, with great effort squandered on policy u-turns. Some argue that the fundamental problem of British politics is that the electorate have unreasonable expectations of higher spending and lower tax. On the eve of the 2024 election, the IFS stated all major parties were ignoring the difficult decision the country would have to take.

But, despite seeming never-ending fiscal doom loop, there is a hope that things could turn around. Perhaps the global trade war will be peacefully resolved and the UK economy will be carried along on a new wave of global economic growth. Perhaps new technology will lead to a massive reduction in energy costs and transport. Anything can happen in four years, but I wouldn’t bet my house on it. By popular demand, my next video will be on what is Britain good at. It may be quite short, but perhaps you can help out? My subscribers have already suggested a few good ideas. Beer, cricket, English, education, Health and safety consultants, pessimism, sarcasm….

Sources:

https://www.bbc.co.uk/news/articles/cdjxygjrk9ro

https://neweconomics.org/2024/06/scrap-fiscal-rules-and-stop-subsidising-banks-to-fix-our-broken-economy

https://www.ft.com/content/7e175b47-5675-4b1a-9c61-abb41dca93db

https://www.ifs.org.uk/events/general-election-2024-ifs-manifesto-analysis