Readers Questions Could you please explain the comparison between the Keynesianism & monetarism?

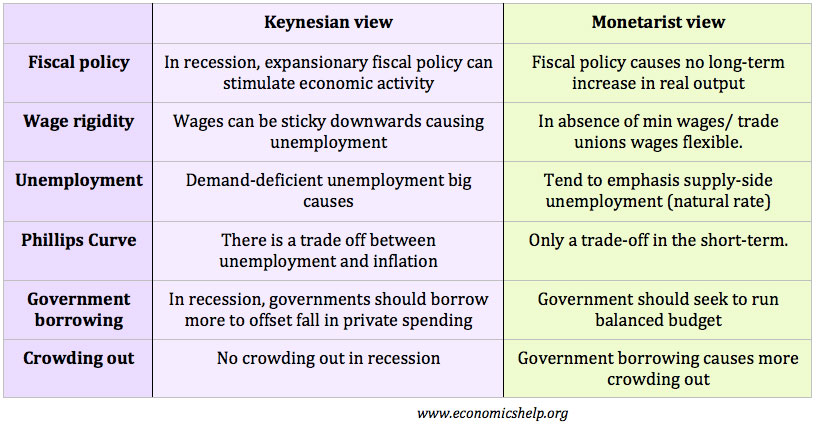

Keynesianism emphasises the role that fiscal policy can play in stabilising the economy. In particular Keynesian theory suggests that higher government spending in a recession can help enable a quicker economic recovery. Keynesians say it is a mistake to wait for markets to clear as classical economic theory suggests. See more at Keynesian economics

Monetarism emphasises the importance of controlling the money supply to control inflation. Monetarists are generally critical of expansionary fiscal policy arguing that it will cause just inflation or crowding out and therefore not helpful.

Principles of Keynesianism

- In a recession/liquidity trap, government intervention can stimulate aggregate demand and real output through government borrowing and higher government spending. Therefore Keynesians advocate expansionary fiscal policy in a recession.

- Keynesians reject the theory of crowding out presented by Monetarists. Keynesians say that if there is a sharp rise in private sector saving (and fall in spending), government spending can offset this decline in private sector spending.

- Paradox of thrift. A key element in Keynesian theory is the idea of a ‘glut’ of savings. Keynes argued in a recession, people responded to the threat of unemployment by increasing saving and reducing their spending. This was a rational choice, but it contributes to an even bigger decline in AD and GDP. This is why government intervention may be needed.

- Keynesians usually believe there is a degree of wage rigidity. In a recession, Keynes said wages might be ‘sticky downward’ as unions resist nominal wage cuts, and this can lead to real wage unemployment.

- In a recession, when an economy has spare capacity, increasing aggregate demand (AD) will have an impact on real output and only minimal effect on the price level.

- Keynesians believe there is often a multiplier effect. This means an initial injection into the circular flow can lead to a bigger final increase in real GDP.

- Generally, Keynesians are more likely to stress the importance of reducing unemployment rather than inflation.

- Keynesians reject real business cycle theories (an idea that the government can have no influence over the economic cycle)

Monetarism

- Monetarists are more critical of the ability of fiscal policy to stimulate economic growth.

- Monetarists /classical economists believe wages are more flexible and likely to adjust downwards to prevent real wage unemployment.

- Monetarists stress the importance of controlling the money supply to keep inflation low.

- Monetarists more likely to place emphasis on reducing inflation than keeping unemployment low.

- Monetarists stress the role of the natural rate of unemployment. (supply side unemployment)

Convergence of Keynesianism and Monetarism

The distinction between Keynesian and monetarists positions is a bit more blurred. For example, many ‘Keynesian’ economists have taken on board ideas of a natural rate of unemployment, in addition to demand deficient unemployment. ‘New Classical’ economists are more likely to accept ideas of rigidities in prices and wages.

Related

More specifically Keynesian fiscal spending is meant to counter households’ and businesses’ (assumed) increased saving during a recession. This can make a bit of a difference to analyzing some problems. See here for more.

Schools of Thought

Money as an asset

Cost of holding money

Money and GDP

Importance of Money

Inflation

Demand for money

Interest Rate

what do monetarists say about the natural rate of unemployment being affected by an increase in money supply?

whats the link btw natural rate of unemployment and money supply?

what is the difference between Keynesian and monetarists regarding AD and AS?

I really enjoy your site is very educative

I really enjoy ur site and it is educative