Readers Question: How do bond spreads affect the value of the Dollar or Euro?

A bond yield refers to the interest payment that you receive from holding the bond yield. If the yield is 4%, you can expect £4 a year from a £100 bond.

A bond spread refers to the differences in bond yields. For example, it could mean the spread between different government 10 year bond yields. In the US bond yields may be 2%, whereas in the Eurozone, bond yields may be 4%.

There could be many different reasons for this bond spread (difference) But, if markets are concerned that one country is at risk of debt default or liquidity shortages, investors may be unwilling to hold those bonds and therefore bond yields go up to try and attract investors. (See inverse relationship between bond price and bond yield)

If investors are nervous about holding Eurozone bonds, due to fears of illiquidity, then international investors will be demanding less Euros – they would prefer to hold dollars and buy US bonds. Therefore, in this case, we would expect to see an appreciation in the US dollar and a fall in the Euro.

If you look at government bond yields (FT) – Greece has a high bond yield 6%. If Greece had its own currency, you would expect the Greek Drachma to fall.

Argentina has had periods of high bond yields because investors are nervous about holding Argentinian debt due to fears of a debt default. This corresponded with a fall in the Argentinian currency.

However, high bond yields are not necessarily a reflection that markets are nervous about the state of government finances. Bond yields can rise when markets are optimistic about future economic growth. See: Factors affecting bond yields

However, it is worth bearing in mind, many other factors determine exchange rates, apart from bond spreads, such as:

- Higher interest rates can attract hot money flows. If people are confident of a country and they see high interest rates, they may move their currency to benefit from better interest rates.

- Relative inflation rates. If inflation is relatively low in a country, then demand for the currency will be higher in the long-term as their goods will become more competitive.

- See: Factors influencing exchange rate

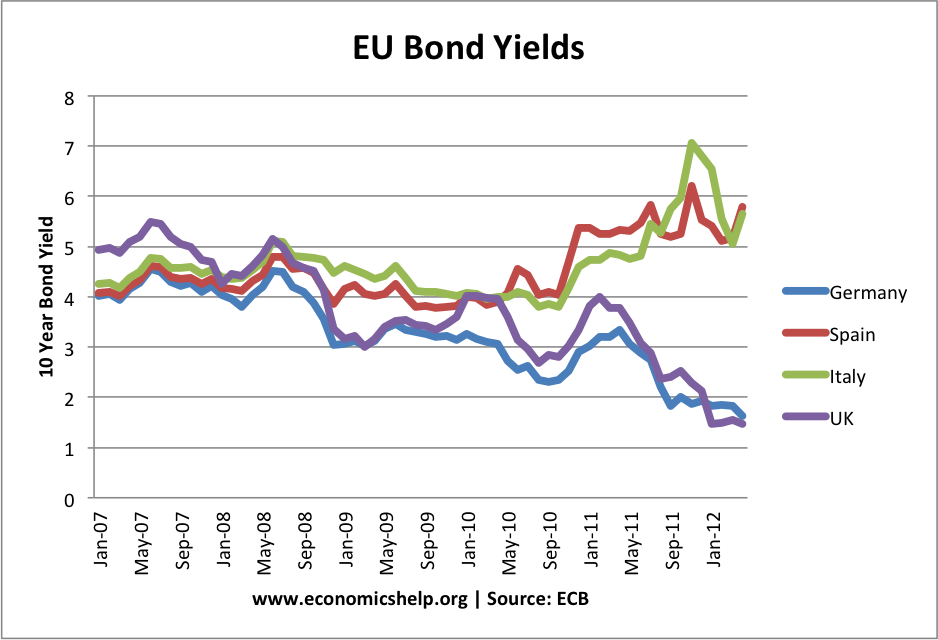

Narrowing of bond yields on Eurozone

The ECB decision to purchase bonds and intervene in the market (since 2012) to provide liquidity has calmed investors and lead to lower bond yields amongst members of the Eurozone

Bond Yield Spread

A bond spread could refer to the difference between two different instruments within the same country. For example, you could compare the bond yield on corporate bonds compared to the yield on Government bonds. A high yield spread on corporate bonds over government bonds, may indicate investors are nervous about the likely performance of the corporate sector (e.g. recession) therefore, they prefer the safer investment of government bonds, which give lower return but are considered safer.

This bond spread gives no direct impact on exchange rate. Though often countries with weak economic growth (poor corporate sector) see a fall in the value of the exchange rate. This is because in a recession, the Central Bank often cuts the base interest rates, leading to an outflow of hot money.

A yield curve spread refers to the yield on different ages of maturity.