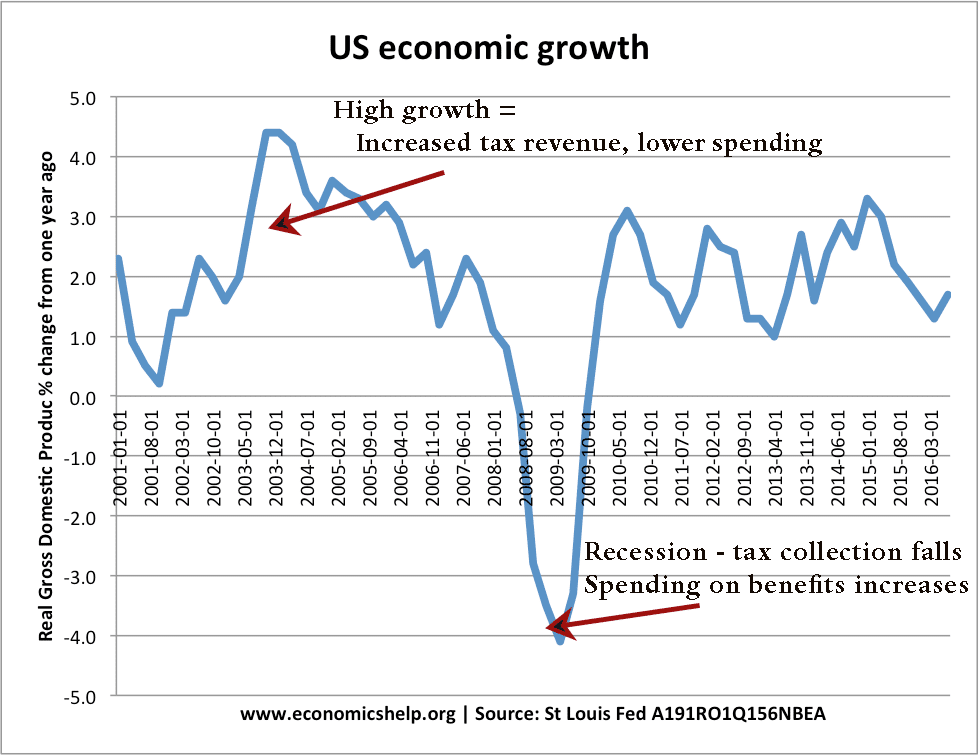

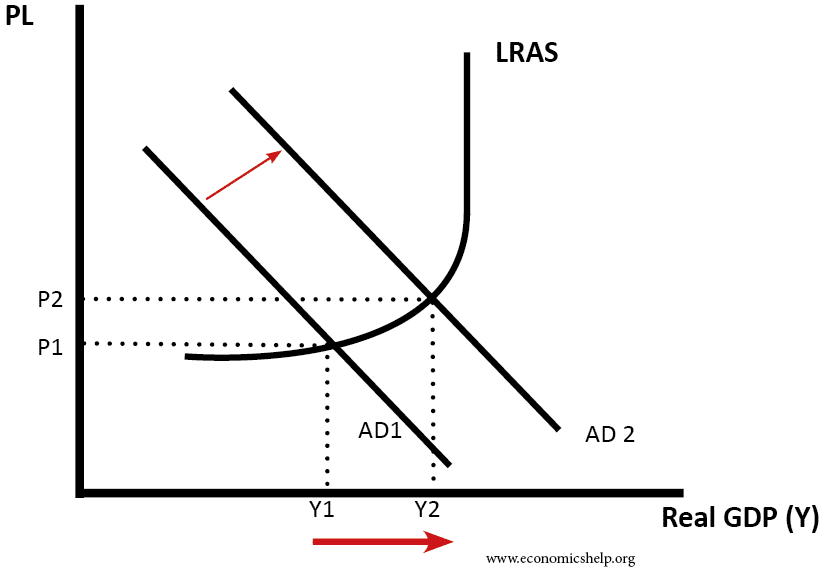

In a recession, fiscal policy and monetary policy can, in theory, be used to increase aggregate demand and boost economic growth. However, in practice, there can be many difficulties with preventing a recession. If the world economy was to get close to recession in 2020, could policymakers act decisively to prevent a recession?

Factors which make it difficult to prevent recessions

1. The difficulty of predicting recessions. Even in mid-2008, some economists and analysts were not convinced we were heading to a deep recession. Inflation was still moderately high, and Central Banks delayed cutting interest rates because they were not convinced the economy was heading for a recession. Economic forecasts are difficult to predict with accuracy. Even current economic data might not be reliable and there is a delay of a few months before economic growth data is published. In these two months, the economy may have deteriorated quite sharply. There is then a time lag in implementing policy and it affecting the economy.

2. Reluctance to act decisively. Central Bankers may be focused on their inflation target and this might make them reluctant to decisively cut interest rates or boost the money supply. Unconventional approaches may be politically difficult. A government may wish to prevent a recession by an aggressive expansionary fiscal policy – higher spending, tax cuts and larger budget deficit, but this will lead to political turmoil as people oppose the radical budget for different reasons. Sometimes the easier policy response is to make small changes – changes which are ineffective in preventing a recession. Keynes noted the pressures to pursue conventional approaches.

“Worldly wisdom teaches that it is better for the reputation to fail conventionally than to succeed unconventionally.”

– John Maynard Keynes.

3. Confidence. In an economic downturn, confidence may be so low that cuts in interest rates and taxes do not have the effect of increasing demand. For example, in a liquidity trap, lower interest rates are ineffective in increasing spending because they do not change people’s behaviour. This occurred during the 2009 recession when interest rates were slashed to 0.5% but failed to encourage spending and lending. Confidence is to a large extent beyond the control of Central Banks and governments. If business are very negative about the economic prospects, even encouraging words from government officials may be insufficient to change investment and spending plans.

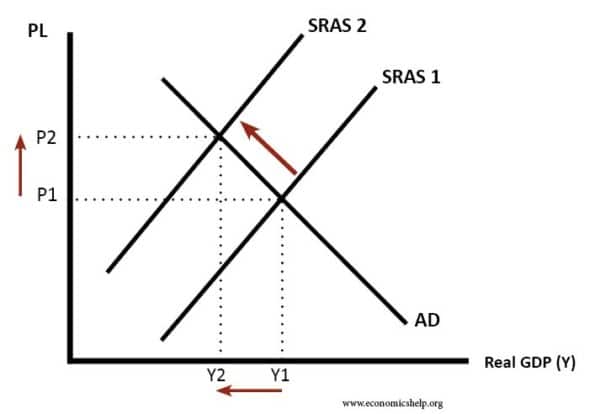

4. Supply-side shock. A supply-side shock could be a rise in oil prices (like in 1973 and to a lesser extent 2008). This supply-side shock causes SRAS to shift to the left leading to higher inflation and lower output. This stagflation is difficult for policymakers to deal with because it is impossible to use interest rates to deal with both inflation and lower output at the same time.

5. Balance sheet recession. In a balance sheet recession, firms, banks and consumers have lost substantial sums and become highly indebted. Banks become reluctant to lend because they need to improve their balance sheets. These losses may be aggravated by falling asset prices (such as house prices). Therefore in a balance sheet recession, it can be very difficult for policies to make any difference. For example, when interest rates were cut in 2008 to 0.5%, it didn’t really make much difference because banks didn’t want to lend. Even though it was cheaper to borrow, it was very difficult to get sufficient loans from banks

6. Hysteresis. This is an argument that when unemployment is high it is difficult to change that fact. – Workers become de-skilled and de-motivated. Therefore, even an increase in AD doesn’t solve unemployment because many workers don’t have the relevant skills and capacities to get a job.

7. The paradox of thrift. – In an economic downturn, people often want to save more – this is a rational response to increased risk of unemployment. But, ironically a rapid rise in saving just makes the recession worse and creates a powerful force to reduce demand. See: Paradox of Thrift

8. Negative multiplier effect. Once there is an initial shock to the economy – such as a fall in business investment or a rise in the exchange rate. This can lead to a negative multiplier effects. As firms cut back investment, workers see smaller paychecks and this leads to less consumer spending. This negative spiral creates a strong force of its own which can be hard to reverse in the short-term.

9. Fears over Debt/bond yields

One policy response to a recession is to pursue expansionary fiscal policy (higher government spending and lower tax) this requires an increase in government borrowing. However, governments may be reluctant to borrow for fears that higher borrowing leads to fears over debt default and higher bond yields. This was an issue for several countries in the Eurozone during the 2010-11 crisis. (though less so since Mario Draghi promised to do ‘whatever it takes’ in the form of bond market intervention.

10. Global nature of downturns. To some extent, all economies are at the mercy of the global trade cycle. If the EU enters into recession, it will have a strong downward effect on the UK economy because 50% of our exports are destined for Europe. Similarly, a global trade war between US and China will have an adverse effect on economic growth, which may be difficult to overcome without a political settlement which is difficult to implement in short-term.

Natural Trade Cycle. For a long time, it was felt that economic growth was subject to a natural cycle of high growth (booms) followed by low growth or recession. It was felt that it was not possible for an intervention to prevent these cycles. However, in recent decades, it appears that economic cycles have become less pronounced; i.e. booms less noticeable, but recessions shorter and deeper. Therefore, although it is not possible to smooth the business cycle, it is possible to minimise fluctuations so as to avoid an actual downturn. Some have credited independent Monetary policy as helping to minimise trade cycles

Related

1 thought on “Problems in Preventing a Recession”

Comments are closed.