Readers Question: Why might the public ignore future tax liabilities when making spending decisions?

A tax liability is a tax bill that you will have to pay the government in the future.

In theory, if you have a large tax liability in the future, you will reduce current consumption to be able to pay the tax liability when payment is due.

Ricardian equivalence is a theory that consumers anticipate the future so if they receive a tax cut financed by government borrowing they anticipate future taxes will rise. Therefore, their lifetime income remains unchanged and so consumer spending remains unchanged. See more at: Ricardian equivalence.

However, consumers may not do this for various reasons.

Poor Information. Consumers may be unaware or forget about their future tax liability. They may even know they have to pay it but be reluctant to change spending in the short term because they push it to the back of their mind or don’t want to take part in long term spending.

- Generally, economic theory assumes consumers are rational, but, in practice this is often not the case.

- Each consumer is different. Some consumers do plan long-term spending and consider future liabilities, but approximately 25% of consumers have different psychology and live in the moment, spending what is in their bank account.

Borrowing. Consumers may prefer to maintain current spending and then borrow for future tax liability through credit cards or a loan. There are many different options for borrowing. Remortgaging house, personal loan, credit card.

Autonomous consumption. A large part of consumer spending is automatic – mortgage payments, bills, food all these consumer spending is seen as indispensable so consumers are reluctant to reduce spending. Of course, this doesn’t explain why consumers may continue to buy inessential goods.

Other ideas to consider:

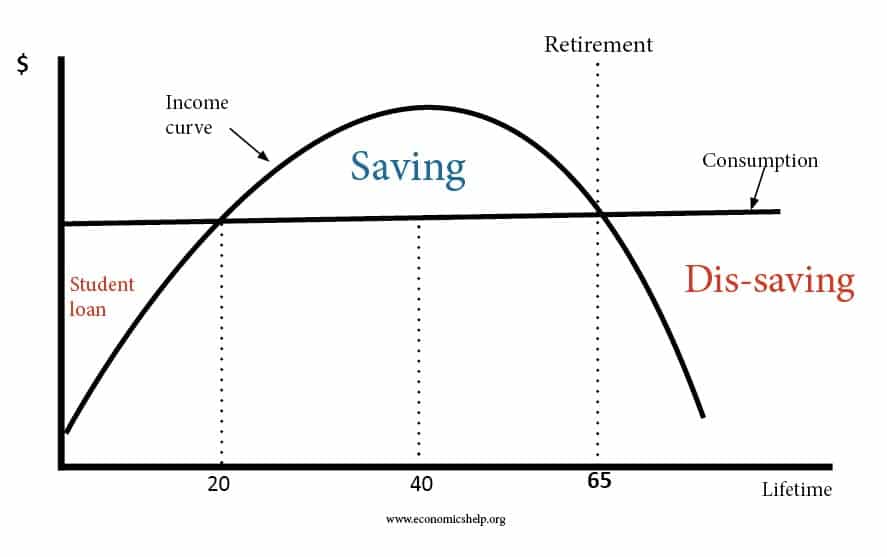

Life-Cycle Hypothesis. This is the theory that consumers seek to smooth consumption over their life. For example, borrowing when a student, saving during periods of work and then running down saving in retirement. In theory, this life cycle hypothesis could be extended to an annual budget of spending.

Related