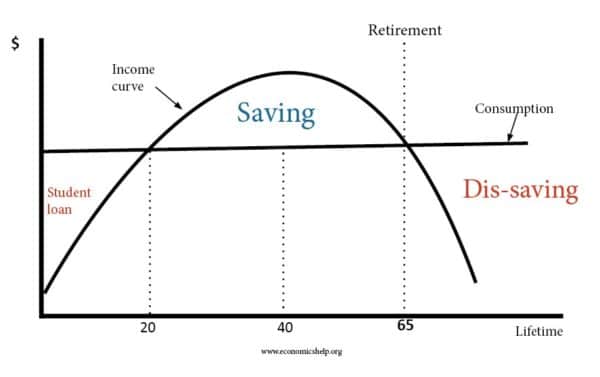

Definition: The Life-cycle hypothesis was developed by Franco Modigliani in 1957. The theory states that individuals seek to smooth consumption over the course of a lifetime – borrowing in times of low-income and saving during periods of high income.

- As a student, it is rational to borrow to fund education.

- Then during your working life, you pay off student loans and begin saving for your retirement.

- This saving during working life enables you to maintain similar levels of income during your retirement.

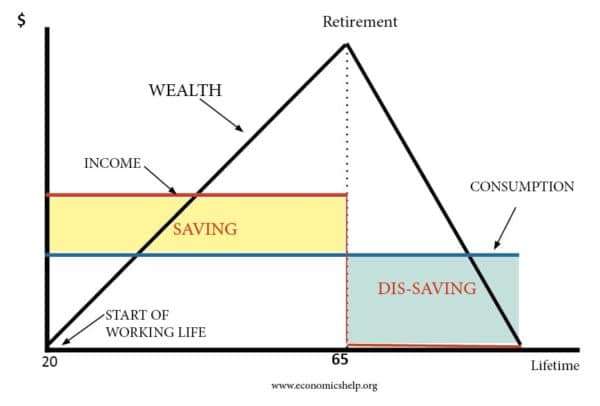

It suggests wealth will build up in working age, but then fall in retirement.

Wealth in the Life-Cycle Hypothesis

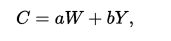

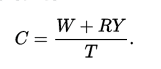

The theory states consumption will be a function of wealth, expected lifetime earnings and the number of years until retirement.

Consumption will depend on

- C= consumption

- W = Wealth

- R = Years until retirement. Remaining years of work

- Y = Income

- T= Remaining years of life

It suggests for the whole economy consumption will be a function of both wealth and income.

Prior to life-cycle theories, it was assumed that consumption was a function of income. For example, the Keynesian consumption function saw a more direct link between income and spending.

However, this failed to account for how consumption may vary depending on the position in life-cycle.

Motivation for life-cycle consumption patterns

- Diminishing marginal utility of income. If income is high during working life, there is a diminishing marginal utility of spending extra money at that particular time.

- Harder to work and earn money, in old age. Life Cycle enables people to work hard and spend less.

Does the Life-cycle theory happen in reality?

Mervyn King suggests life-cycle consumption patterns can be found in approx 75% of the population. However, 20-25% don’t plan in the long term. (NBER paper on economics of saving)

Reasons for why people don’t smooth consumption over a lifetime.

- Present focus bias – People can find it hard to value income a long time in the future

- Inertia and status quo bias. Planning for retirement requires effort, forward thinking and knowledge of financial instruments such as pensions. People may prefer to procrastinate – even though they know they should save more – and so saving gets put off.

Criticisms of Life Cycle Theory

- It assumes people run down wealth in old age, but often this doesn’t happen as people would like to pass on inherited wealth to children. Also, there can be an attachment to wealth and an unwillingness to run it down. See: Prospect theory and the endowment effect.

- It assumes people are rational and forward planning. Behavioural economics suggests many people have motivations to avoid planning.

- People may lack the self-control to reduce spending now and save more for future.

- Life-cycle is easier for people on high incomes. They are more likely to have financial knowledge, also they have the ‘luxury’ of being able to save. People on low-incomes, with high credit card debts, may feel there is no disposable income to save.

- Leisure. Rather than smoothing out consumption, individuals may prefer to smooth out leisure – working fewer hours during working age, and continuing to work part-time in retirement.

- Government means-tested benefits for old-age people may provide an incentive not to save because lower savings will lead to more social security payments.

Other theories

- Permanent income hypothesis of Milton Friedman – This states people only spend more when they see it as an increase in permanent income.

- Ricardian Equivalence – consumers may see tax cuts as only a temporary rise in income so will not alter spending.

- Autonomous consumption – In Keynesian consumption function, the level of consumption that is independent of income.

- Marginal propensity to consume – how much of extra income is spent.

Thanks for the reminder of the theory…

Am a moi university Economic student in Nairobi Kenya.

Thanks for the most summarised note ever. it will help me with presentation. Gulu university. JALON

prof premraj pushpakaran writes — 2018 marks the 100th birth year of Franco Modigliani!!!

Thanks for the analysis on the hypothesis

Nice piece of work for economist.

Been applicable in my presentation at Kyambogo university Uganda

This piece of paper is very important as far as consumption is concerned…

This piece is the best I have seen so far, this is a great work

Thanks for this work.it Will help me in my presentation at metropolitan international University

Very coincise and well articulated. This work reconnects me with themechanics of consumption theories. I appreaciate for a job well done.

Thanks for the most summarised note ever. it will help me with presentation. Gulu university. JALON

Very nice and comprensive information. It will help me in my exams at university of jos Nigeria, studying economics

thank u for the summarized notes,it will help me in my exam at Kibabii university

Great job. Thanks for this masterpiece.

Good job. Thanks for this masterpiece. It reconnects me with the consumption theories.

A good summarised piece of work on life cycle hypothesis, it will help me in my group presentation.

Kenyatta University economics student.