Sainsbury’s and Asda have announced a plan for a merger. They argue it will lead to lower prices for customers, no job losses and is necessary to deal with the threat of new discounters like Lidl and Aldi and the impending arrival of Amazon.

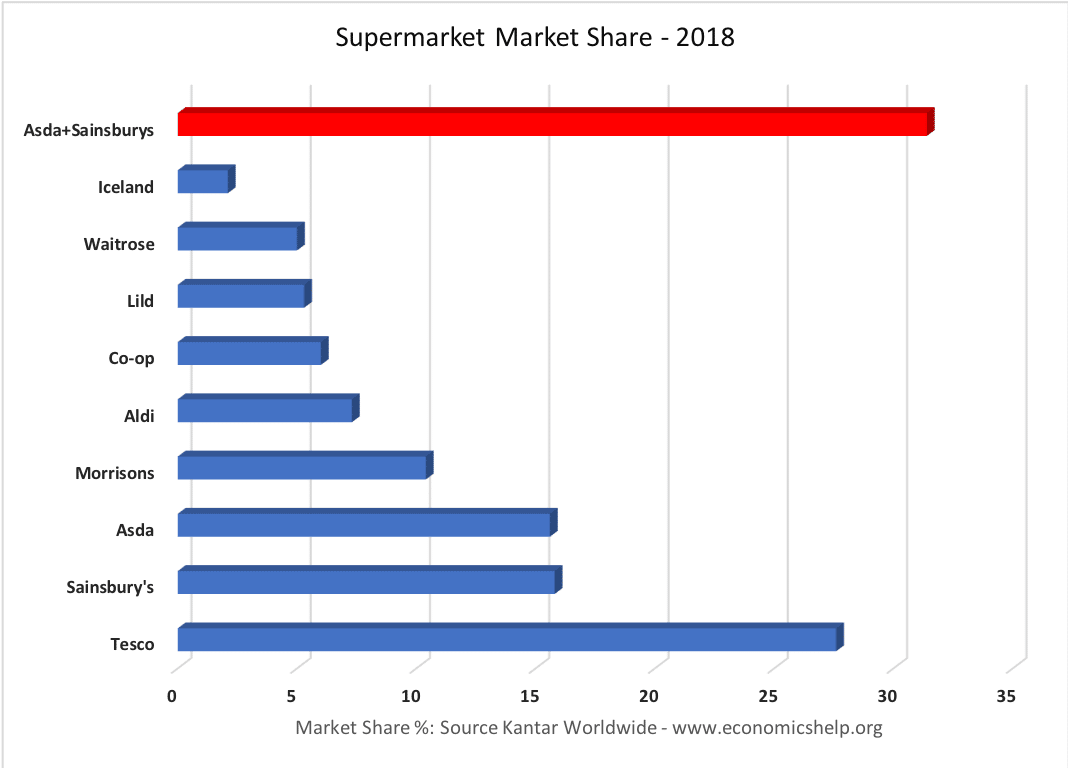

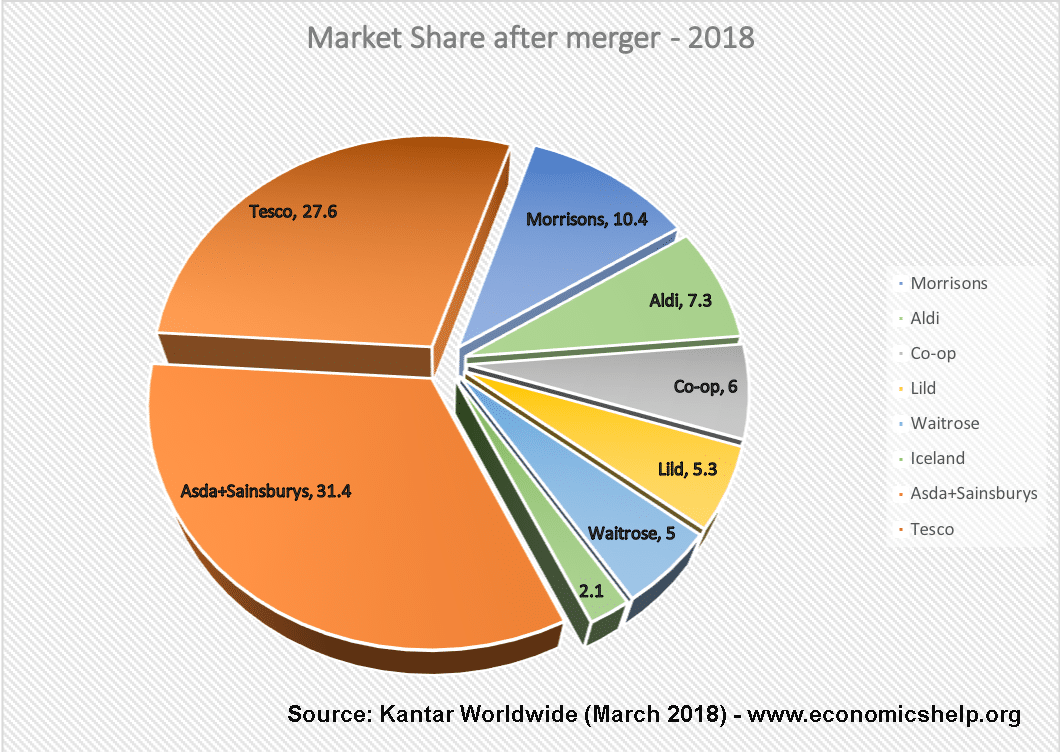

Others are more cautious arguing that the new firm will have 31% of market share – effectively creating a powerful duopoly with Tesco that has around 30% of market share.

In 2003, the Competition authorities in the UK blocked the takeover of Safeway by Asda and Sainsbury’s due to impact on the national market share. Safeway was taken over by Morrisons – who had a smaller share. However, with Competition Commission allowing a merger between Tesco and Booker wholesaler, they are more confident they will be allowed.

How would the market look after the merger?

The big two would have a combined market share of 59.2% of the market

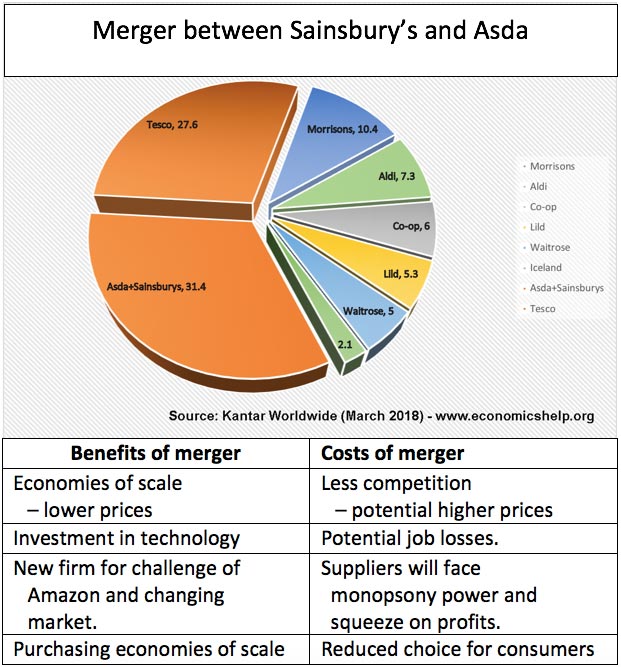

Potential benefits of merger

Economies of scale

Any merger gives the potential for economies of scale. This could include organisational economies – reducing overheads from two companies into one. However, it is likely the supermarkets will continue as two separate brands, so we are not sure how much restructuring will actually occur. There could be transport economies – with a larger firm able to share transport networks and achieve lower average costs.

Purchasing economies/bulk buying. One of the most significant potential benefits of this merger is giving the new firm greater scope to gain lower prices for suppliers. Sainsbury CEO states it is necessary to compete with the likes of Amazon who are turning their attention to UK grocery market. But, if they still have a two brand approach – e.g., Asda baked beans and Sainsbury’s baked beans – will there be that much difference.

Investment in technology. The Sainsbury’s CEO Mike Coupe said that the new firm would enable greater investment in technology to offer better service and delivery for customers. For example, mobile phone shopping. This technology already exists but it is still early days. The argument is that the new firm will have more capacity to invest in this kind of technology

The potential dominance of Amazon. Since 2003, when the Competition Commission blocked the merger, Sainsbury’s argued the retail landscape has changed with online retail giants like Amazon changing nature of retail and driving many high street shops out of business as consumers migrate online. Amazon has huge economies of scale and scope to easily move into retail. At the moment Amazon Pantry is a very small player – but given Amazon’s dominance in non-food retail – it can use same infrastructure and customer base to offer an increasing array of grocery shopping.

Potential costs of the merger

Higher prices. The national market share of the big two would then be close to 60%. In many towns, the local market share would be even higher – we would be creating a powerful duopoly. In some towns it could even create monopoly situations. With less competition and virtual monopoly power, the promised price wars may not materialise or not last. In the long-term customers could face higher prices.

- However, the big supermarkets argue that the entry of Lidl and Aldi – show that the market is fairly contestable – there is room for new firms to enter. This contestability means that the market share is less important – if they do make excessive profits consumers can switch to new entrants.

Local suppliers and monopsony. One argument for the merger is that the new firm can gain lower prices from suppliers and pass these onto consumers, but there is a danger that rather than economies of scale, the new firm gains lower prices by using its monopsony buying power – farmers selling produce have little option but to sell to the big supermarkets, so it is hard when they have substantial market power. However, supermarkets have become more aware of this situation and there have been moves to guarantee minimum prices of products like milk.

Potential job losses. Unions fear that the merger will lead to job losses as firms rationalise. Sainsbury’s argue job losses will be limited and the merger could create new jobs. Whether there is a merger or not – greater competition is likely to shake up the industry anyway.

Who will benefit? Shareholders stand to do well out of the new more profitable firm – but will workers and consumers share part of the windfall?

Reduced choice. The merger may lead to less choice as the supermarkets consolidate product lines and supermarkets.

Effect on local shops and smaller supermarkets? How will the merger affect smaller food retailers like the co-op and corner shops? They may struggle to compete with the greater buying power of the big two and become less competitive.

Conclusion

It is an interesting case because the merger creates a firm with monopoly power (UK legal definition a firm with more than 25% market share). In the past, a merger which created this kind of market dominance would almost inevitably be blocked. However, maybe in 2018, circumstances are different.

Supermarkets have shown to be fairly contestable – with Aldi and Lidl showing that new firms can enter and reduce the supernormal profits of the established firms

Amazon has revolutionised the non-grocery retail market, it is very likely there will be huge changes over the next decade as more grocery shopping becomes online and dominated by mobile technology and web technology.

Nevertheless, the Competition and Markets Authority could well decide to block the merger on the grounds it is against the public interest.

Summary

Related

- Sainsbury’s merger at the Guardian

- Sainsbury’s / Asda merger at the CMA

- Pros and cons of mergers

- Case studies of mergers

- UK merger policy

According to analysts, the British Service for Competition and Markets (CMA) is unlikely to approve the merger of the country’s second and third largest retail chains without closing part of their stores. Experts at Global Data believe that the retailer will lose at least 75 outlets. After the announcement of the agreement reached, Sasinsbury’s shares temporarily rose by about 20%. At the close of trading on Monday, growth was 14.5%.

The plans of Walmart and J Sainsbury to unify their British networks became known two days before the announcement of the deal – on Saturday, April 28.

Belonging to the American Walmart retail network Asda operates about 600 stores in the UK. Walmart bought it in 1999 for $ 10.8 billion.