An explanation of what happens if there are net outflows of money from a country. Impact on:

- Real GDP (tends to fall)

- Employment

- Exchange rate – exchange rate will fall

- Balance of Payments – debit on financial account

- Confidence – if big outflows it can cause a negative spiral of declining confidence.

- Government debt – it can be more difficult to finance government borrowing from overseas investors.

It depends whether the outflow of money is small or caused by a loss of confidence (capital flight)

Impact of ‘hot money flows’

Suppose interest rates in one country are very low. This will cause investors to look abroad for better returns on savings.

If UK interest rates are zero, savers get a poor return, so they may look to invest in other countries where interest rates are higher. If interest rates in the US are 3%, it would make sense for a saver to deposit money in US banks (or buy US bonds).

This causes financial flows out of the UK into the US. It is a debit item on the financial account balance of payments.

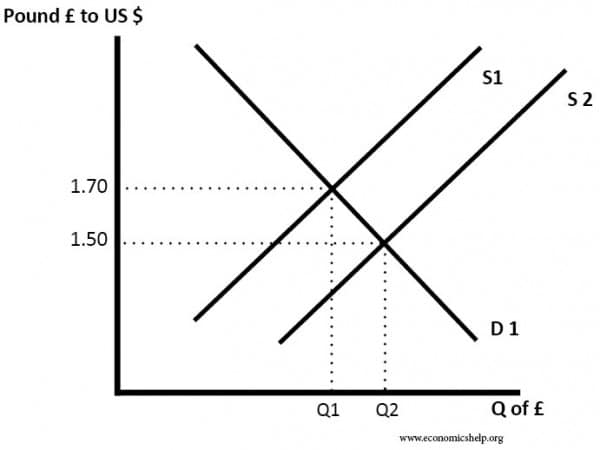

Impact on exchange rate of capital outflows

If there is a large net outflow of money, then we will expect to see a depreciation in the exchange rate. This is because people will sell Sterling in order to buy Dollar assets. The increase in the supply of Sterling on foreign exchange markets will depress the value of the Pound Sterling.

Outflow of money from UK causes value of Pound to fall from £1 = $1.70 to £1 = $1.50

- The impact of a depreciation in Pound Sterling will tend to cause inflation.

- It will make imports more expensive, causing a rise in price of imported goods.

- We say there is a decline in the terms of trade – consumers can buy fewer imported goods/compared to exports.

- The depreciation in the exchange rate will also make exports cheaper, causing a rise in export demand (and higher Aggregate Demand. This rise in export demand can lead to new jobs in exporting industries and a higher rate of economic growth.

- Therefore, if there is a moderate depreciation in the exchange rate, it can boost economic growth.

See more: impact of depreciation in exchange rate

Impact on Aggregate Demand of capital outflows

If we see a significant outflow of savings from the UK to US, it will have only a minimal impact on UK aggregate demand.

People will tend to move savings – rather than cash earmarked for spending.

It will tend to be wealthy people and big investment funds who move savings to the US. For the average consumer, it is not worth shifting £10,000 of savings from the UK to the US, just because interest rates are marginally higher. Therefore, these short-term hot money flows don’t have a significant impact on spending and investment because it is simply moving savings from one country to another.

However, if there is a crisis of confidence and many ordinary people try to shift their money out of the economy (fearing rapid devaluation) then it will start to affect domestic demand. WIth money leaving the economy – there will be less demand for domestic goods.

Capital flight

Hot money flows tend to be fairly short-term. If we get temporary outflows of capital, it might have limited impact on the economy. However, if we get large and sustained capital outflows, it could start to have an adverse impact on domestic investment. If banks see a decline in cash reserves, they have less money to lend for investment. A big drop in the savings ratio would have an impact on investment in the country which is experiencing capital flight. For example, countries like Russia and Venezuela which relied on oil revenues – saw precipitous capital outflows when the price of oil fell. This caused serious problems for these economies. The currency fell quickly and it caused high inflation.

Decline in confidence

If general consumers lost all confidence in a particular country, they may want to put all their savings abroad. This big fall in confidence could lead to capital flight – with a decline in investment and ordinary spending levels. This kind of capital flight can cause a fall in economic growth. For example, Greece has suffered capital flight and this is a factor in the Greek recession. But, this level of capital flight was not caused by lower interest rates, but large structural problems, such as austerity and a collapsing economy.

Impact of capital outflows on the balance of payments

As mentioned hot money flows are counted as part of the financial component of the balance of payments. It is an outflow from the financial account.

In a floating exchange rate, the financial account / current account must balance. So a bigger deficit on the financial account will need a surplus on the current account.

What will happen is that with lower interest rates we get a depreciation in the currency. The depreciation will make exports cheaper and imports more expensive. This will tend to improve the current account balance (exports increase, imports decline) and this offsets the financial outflows.

Readers Question: Generally, one would say that a decrease in interest rates boosts demand and has an inflationary effect, as people & corporations can borrow more cheaply. However, one also often reads that, in times of low interest rates, money often “flees” the country, looking for better returns elsewhere – e.g. developing countries. I would assume that money leaving the country has a deflationary effect. How do these two explanations work together?

You are correct that cutting interest rates, ceteris paribus, tends to cause rising demand, higher inflation and higher economic growth.

Lower interest rates reduce the cost of borrowing, encouraging firms to invest and consumers to spend. In addition, there are other transmission mechanisms – lower interest rates, reduce the cost of mortgage repayments – giving householders more disposable income to spend. These combined factors tend to cause rising aggregate demand, higher growth and higher inflation.

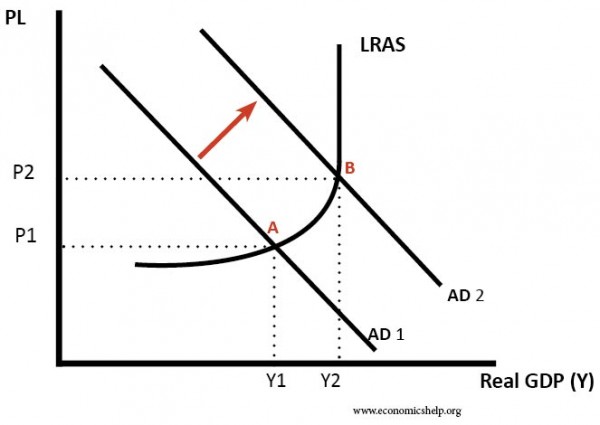

Impact on AD/AS of cutting interest rates

Lower interest rates help to cause rising AD, this leads to higher inflation.

See more detail – impact of lower interest rates

In a floating exchange rate, the financial account / current account must balance. So a bigger deficit on the financial account will need a surplus on the current account.

I appreciated how short sweet and to the point you were with your article.

Truly insightful.

Kind regards

Wesley