The domino effect refers to how one action can have a knock-on effect to related subjects. Knock one domino over, and you don’t just affect the first domino, but all the ones who stand in its path.

In economics, the domino theory is often used to explain how an economic problem in one country can spread like a contagion or domino effect to similar countries and firms.

Examples of the domino effect in economics

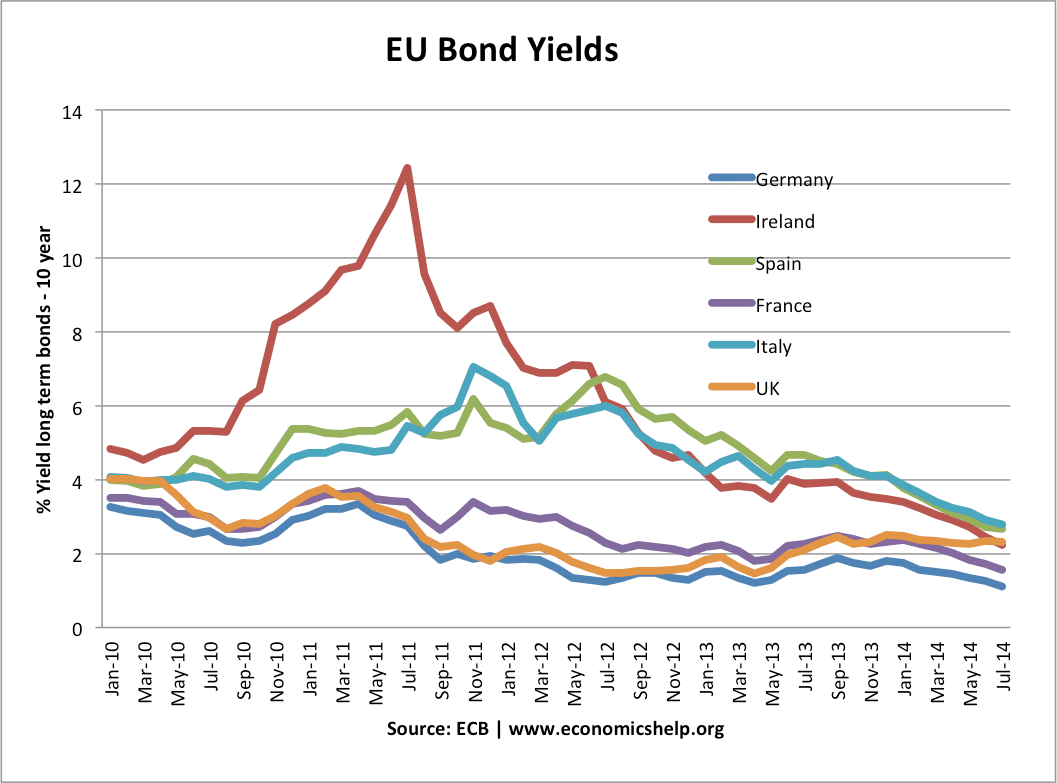

- Debt crisis – 2012-13 Bond yields rise in Greece, causes rising bond yields in other Eurozone economies.

- Credit crunch 2007/08 – a shortage of finance in the US spreads throughout the world and to all banks.

- Devaluation – 1997. A fall in a currency in S.E. Asia caused international investors to lose confidence and sell similar currencies in other Asian economies.

- Negative regional multiplier effect. One major manufacturing firm closes down; this causes unemployment, outward migration of labour, other firms going out of business, declining real incomes.

How the domino effect works

In 2011, when investors realised Greece was at risk of insolvency and bonds were at risk of default, it changed market sentiment. Firstly, investors sold Greek bonds, causing a rapid rise in Greek bond yields.

(Greece is not on this graph, but Greek bond yields rose to over 25% in Jan 2012.

However, this change in market sentiment and loss in confidence caused investors to lose confidence in other Eurozone debt markets. Here the big effect was confidence. Previously investors felt Euro bonds were very secure. However, the realisation that countries in the Euro were not immune meant investors demanded higher bond yields. (In fact, investors realised Euro bonds were riskier because there was no lender of last resort)

The problem is that when investors start to sell, other economies started to experience liquidity shortages. Italy, Ireland and Spain were not insolvent but without the ability to create money, they relied on investors buying a regular quantity of bonds. With the change in market sentiment, bond yields rose, and this further added to the lack of confidence in the bond market.

Rising bond yields and fears over government debt levels also caused a change in fiscal policy. European governments felt that in response to rising bond yields, they should cut spending and increase taxes (in short austerity). However, this austerity had a knock on effect on economic growth. In a period of weak recovery, cutting government spending causes a further fall in economic growth. Lower economic growth has a negative effect on tax revenues worsening the government’s debt position.

If there had been no crisis in Greece, this domino effect would have been much less noticeable in other Eurozone economies.

The crisis was averted when the ECB made commitments to intervene in the bond market and offer sufficient liquidity.

Further Reading: The Euro debt crisis

Devaluation and S.E. Asian Crisis

The Asian financial crisis of 1997 refers to a macroeconomic shock experienced by several Asian economies – including Thailand, Philippines, Malaysia, South Korea and Indonesia. Typically countries experienced rapid devaluation and capital outflows as investor confidence turned from over-exuberance to contagious pessimism as the structural imbalances in the economy became more apparent.

Credit crisis

The credit crisis was a classic example of a domino effect starting from a rise in mortgage defaults (often based in a small number of US states like Florida)

- US increase interest rates – this causes mortgage repayments to become unaffordable for many who had taken out ‘subprime mortgages’

- Mortgage defaults rise. Banks lose money and sell repossessed houses onto a falling housing market.

- House price falls cause a negative wealth effect.

- European banks who had lent money to mortgage companies now lose money and become short of liquidity.

- The general shortage of liquidity in the financial system causes panic and loss of confidence. Bank lending falls sharply causing an economic recession and further declines in spending.

- More on credit crisis

Related concepts

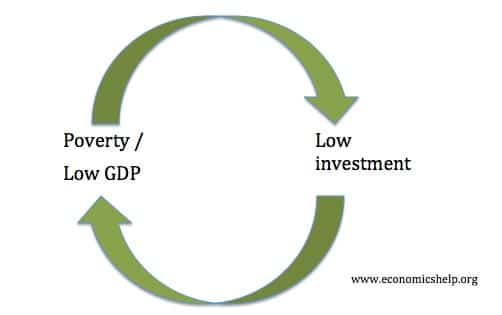

Feedback loop

Multiplier effect – An initial change in injections causes a bigger final change in GDP.

Thanks for the interesting article and statistics