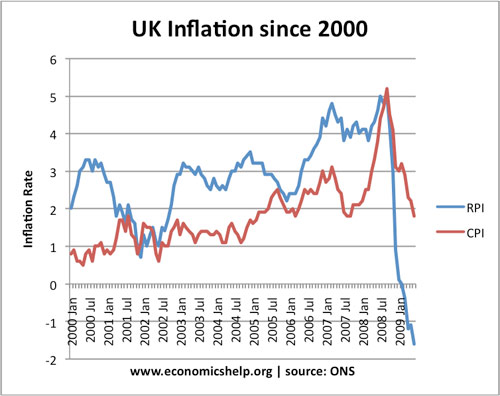

UK Inflation Since 2000

Readers Question: How can we have both inflation and deflation in the economy at the same time? (the RPI falling to 0% and CPI rising to 3.2%)

Deflation requires a fall in prices. We would need a negative inflation rate (e.g -0.3%) to have deflation

Note if the inflation rate fell from 4% to 3%, this is not deflation, but, it means prices increase at a slower rate

In some circumstances, we could see a negative value for RPI (e.g. -0.2%) and a positive figure for CPI (e.g. 2%). Would that mean we have deflation?

RPI used to be the official statistic, but recently it was changed to CPI.

The main reason that RPI is currently much lower than CPI is the fact RPI includes the impact of mortgage interest payments. Therefore since interest rates have fallen many people have seen a decline in the cost of mortgage payments. This explains why RPI could become negative when other prices are still rising.

(It is rather ironic that cutting interest rates to boost growth and inflation causes a fall in the RPI inflation rate. Increasing interest rates to reduce inflation, increases the RPI inflation rate)

If you have a mortgage you will probably see a fall in the cost of living at the moment. But, if you don’t have a mortgage, then you will find many prices (e.g. food) still increasing in price.

CPI is a more reliable guide to a typical basket of goods. (unaffected by interest rates). I feel that CPI is a better guide to underlying inflation. If CPI becomes negative then this will be the best evidence that we are experiencing widespread deflation.

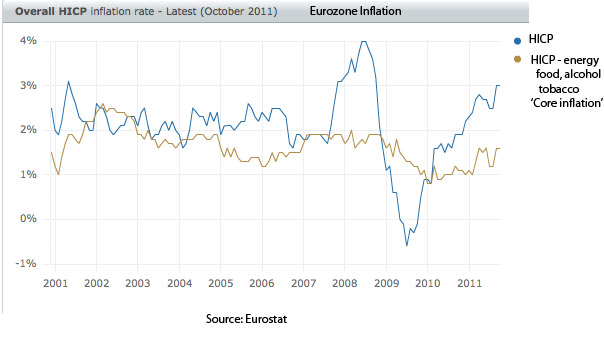

Headline Inflation and Core Inflation

Another issue is the difference between headline inflation and ‘core-inflation’. Core inflation excludes volatile factors such as energy, food, taxes alcohol and tobacco. Arguably core inflation gives a better guide to underlying inflationary pressure. This may be important for Central Banks when deciding whether they need to increase interest rates or not.

EU Core Inflation less volatile than Headline inflation

Source: Eurostat

A Note on Deflation and Deflationary Pressures

As reader Ralph Musgrave pointed out, there is a difference between deflation and deflationary pressures. Deflation is a fall in prices.

Deflationary pressures refers to reduced growth / reduced demand in the economy. e.g. Deflationary fiscal policy involves higher tax and lower spending to reduce growth rates. But usually, deflationary policies don’t cause a fall in prices. (except in a depression where the impact on prices is very significant)