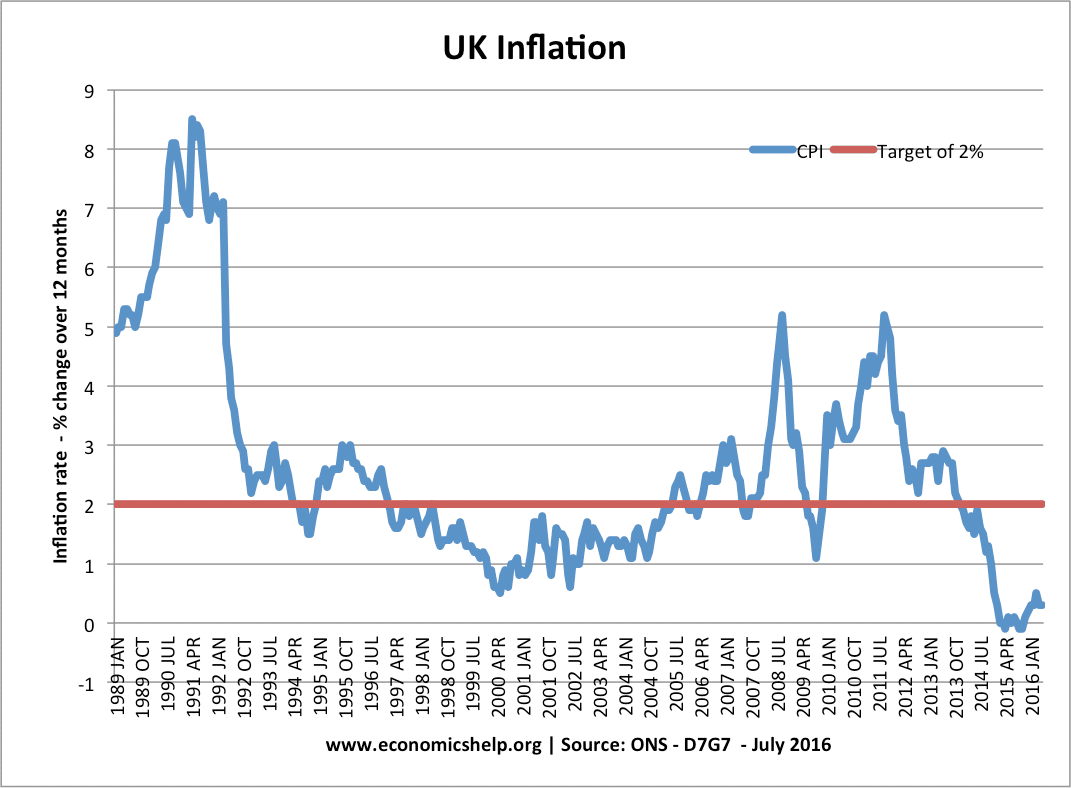

In the UK, there are quite a few different measures of inflation. All measures seek to show the annual change in living costs. However, different measures of inflation give different inflation figures. For example, RPI can often give a higher rate of inflation than CPI. CPI can also be misleading. For example, an increase in VAT would cause CPI to increase, but a core inflation measure like CPI-CT, would stay lower

It is important to be aware of different measures of inflation because the rate of inflation has an important bearing on monetary policy.

Usually, an inflation rate of CPI 4.5% would encourage the Bank of England to raise interest rates. But, if this inflation rate was due to cost-push factors, such as higher taxes, the inflation rate may not be due to overheating in the economy.

Inflation is calculated by:

- Finding out the most commonly bought goods (e.g. Family expenditure survey)

- Measuring the change in prices and then applying the weight of the good to the price change.

Different Measures of Inflation

1. Consumer Price Index (CPI) – official measure. Based on the EU HCIP (Harmonised Consumer index prices)

- Includes taxes.

- Excludes mortgage interest payments and housing costs

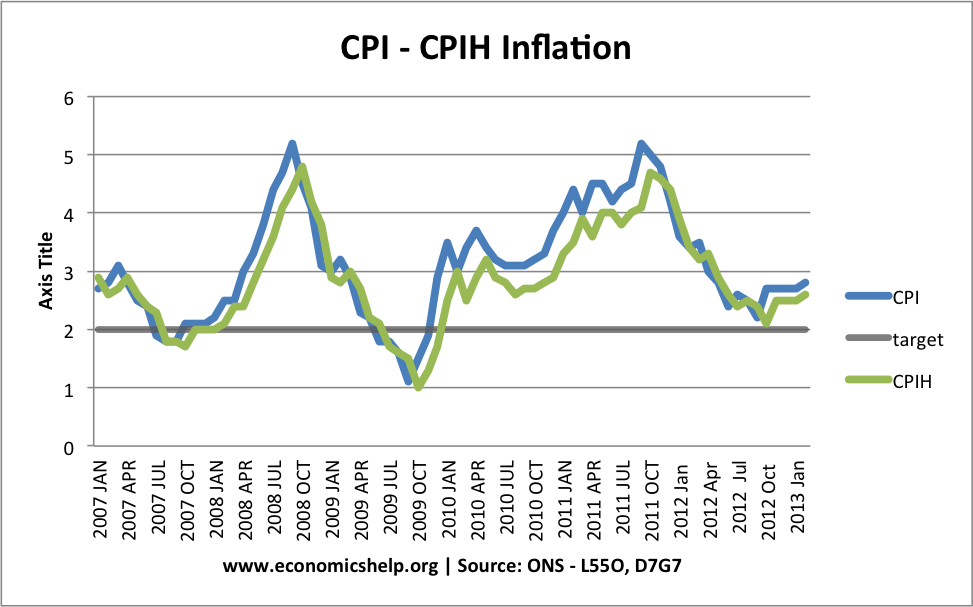

- Includes some financial services not included in RPI

2. CPIH – CPIH It is based on CPI, plus it includes housing costs, such as mortgage interest payments. Owner occupiers cost (OOH) account for 12% of the CPIH weighting. Mortgage interest payments are the biggest part of OOH. Mortgage interest payments average 10% of household expenditure.

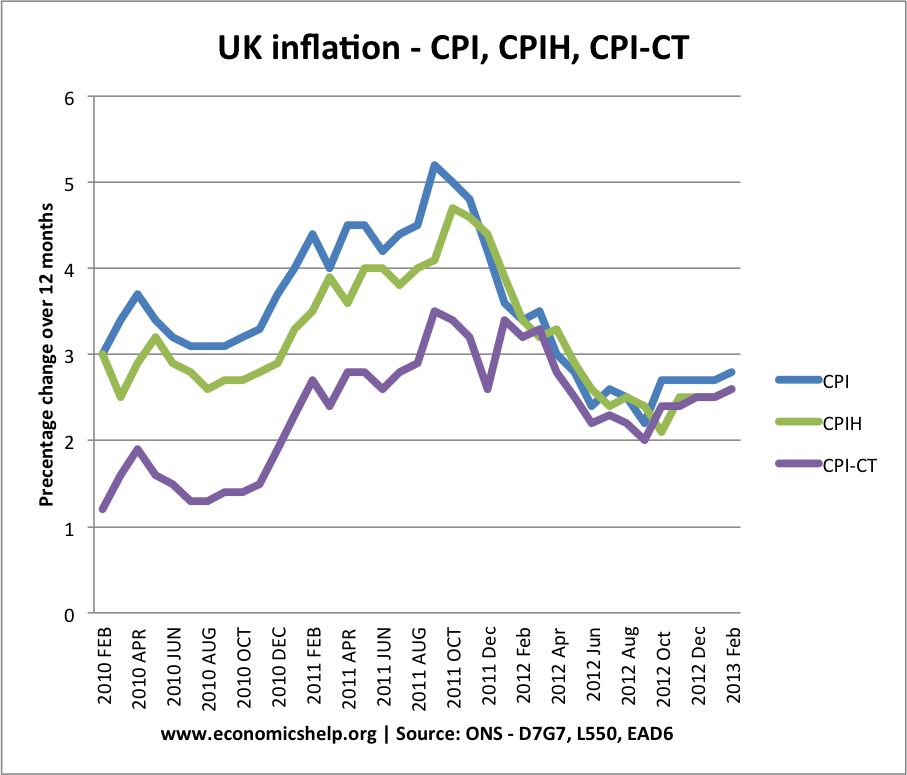

4. CPIY – The CPI – Indirect taxes. This is the CPI measure but excludes the impact of indirect taxes such as VAT and excise duty. It is useful for determining the underlying level of inflation ignoring tax increases which tend to just last for a year. For example, in 2011, the VAT increase caused a jump in CPI, but, CPI-Y remained much lower.

5. CPI-CT This is a similar principle to CPIY. CPI-CT holds indirect taxes rates constant at the rate prevailing at the start of the year)

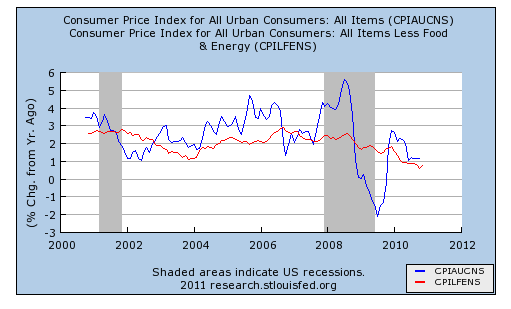

6. Core Inflation – Another measure of inflation seeks to strip away volatile factors such as food and commodity prices. This includes a smaller basket of goods. But, it may be more accurate in showing underlying inflation.

This is a statistic from the US. (Which measure of inflation should we use?) The red line CPIFENS shows ‘core inflation’ with

This is a statistic from the US. (Which measure of inflation should we use?) The red line CPIFENS shows ‘core inflation’ with

Eurostat produces a measure of ‘core inflation’. It excludes more volatile items such as energy, food, alcohol and tobacco

7. RPIJ – RPI but calculated using more internationally recognised geometric mean.

8. Wage inflation. Although not a measure of inflation, wage inflation can give a good guide to underlying inflationary pressures. If wages are rising, then underlying inflationary pressures are likely to be building.

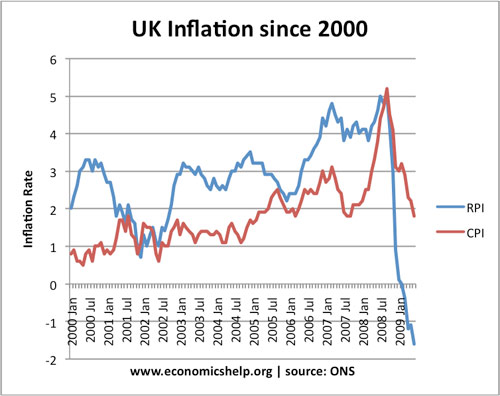

9. Retail Price Index (RPI) – Used to be the official measure. It includes more factors such as mortgage interest payments, Council tax and other housing costs not in CPI. RPI tends to be more volatile than CPI. Changes in interest rates impact on the RPI, but not the CPI. RPI is no longer counted as an official national statistics. It has been superseded by RPIJ – which is similar to RPI but calculated using geometric mean

Outdated Measures

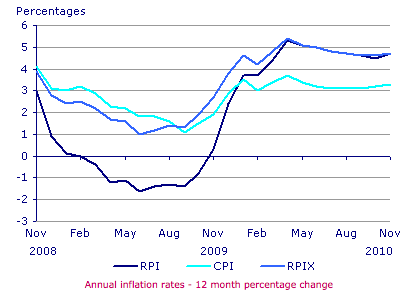

In early 2009, cuts in interest rates led to sharp fall in RPI. Since then RPI has increased at a faster rate.

RPIX – RPI – Mortgage interest payments. Similar to CPI, but not exactly same

source: ONS

Related

Iam.inspired the analysis