An explanation of financial crisis

Readers Question: What is the difference between financial crisis and economic crisis.

There is no clear-cut distinction as they are closely interconnected.

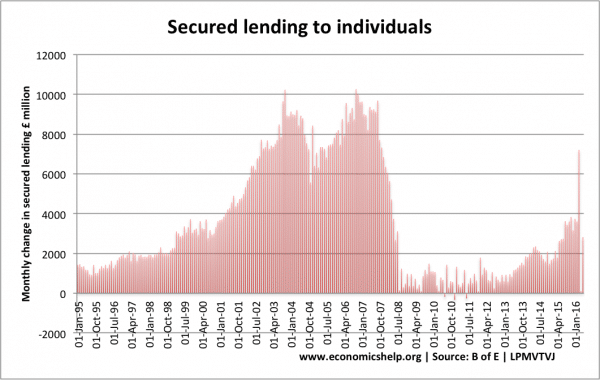

However, the financial crisis refers to the problems in the finance sector. In particular, this involves the mortgage defaults and rise in bank losses leading to a decline in bank lending.

In early 2008, many felt that this financial crisis would be limited to the banking sector and the housing market. However, the shortage of credit has had a very powerful impact on the real economy. Because banks are not lending, investment and consumption have fallen contributing to a serious economic recession. It is this fall in GDP / Economic output which made a financial crisis into an economic crisis.

How financial crisis caused economic crisis

- Housing Boom and Bust. In the US, cheap credit, an inflow of capital from Asia, and lax regulation all contributed to a boom in the US housing market. In particular, there was a rise in unorthodox mortgage lending. These subprime mortgages were often bundled as mortgage securities which were sold around the world. When mortgage defaults started to rise in the US, banks started having to write off bad loans. Banks around the world lost money and so became reluctant to lend. For more: See sub-prime mortgage crisis explained

- Bank lending is crucial to the modern economy. Many businesses were struggling to refinance loans or take out loans for investment. The effect was a fall in investment and spending in the economy.

- The mortgage defaults caused a fall in house prices. The fall in house prices has proved a powerful impact on consumer spending. Housing is the biggest form of wealth so with households seeing a decline in wealth and rise in negative equity, consumer spending has fallen.

How economic crisis aggravated financial crisis

The recession was primarily caused by the credit crunch and falling house prices. However, the economic recession is now aggravating the financial crisis.

- Because firms are going bankrupt banks are losing more money and reluctant to lend.

- Rising unemployment is causing a rise in repossession rates.

- Falling house prices have meant banks lose more when they have to repossess houses

Financial Crisis and Debt Crisis

- This led to a debt crisis, with greater pressure on governments to reduce spending and budget deficits.

- The fiscal crisis was worse in the Eurozone because:

- The ECB wouldn’t act as lender of last resort

- Indebted countries also had poor prospects for economic growth, because, without the ability to devalue in the Euro, they were uncompetitive and low export demand.

- EU debt crisis explained

2 thoughts on “Financial Crisis Explained”

Comments are closed.