Readers Question: Economic theory says that when Quantity (Q.S) increases Price (P) should ordinarily fall. After the 2007 crisis in the USA, the FED pumped billions of Dollars into the economy through QE. However the price of dollars, interest rate has not only fallen lower, but is closer to zero as of today ( 2016). How do you explain this?

It is true that since 2007, the Fed has increased the money supply, but there has been no collapse in the dollar, and inflation has stayed very low.

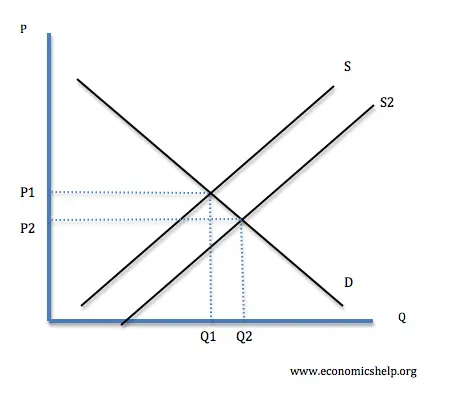

You might expect increasing the money supply would cause a lower value of the dollar. A simple supply and demand diagram.

Traditional economic theory states that ceteris paribus increasing the money supply will lead to inflation and a fall in the value of the currency. However, this makes assumption about the state of the economy.

Why has the dollar not fallen during this period of low interest rates and quantitative easing?

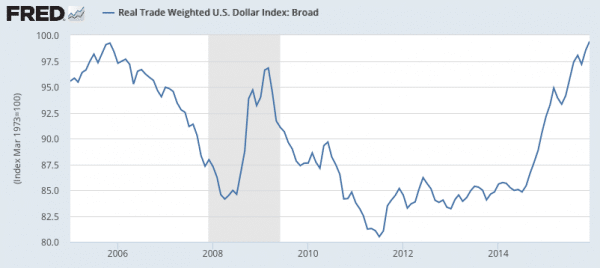

1. Dollar relatively stronger than other currencies.

In normal economic circumstances, low interest rates in US and Q.E. would cause a fall in the Dollar. However, most other major economies are seeing a similar situation of ultra low interest rates and quantitative easing. In the case of Europe, there are great concerns about the state of the Euro, and Eurozone economy, making Euro weak. A currency will fall if interest rates are relatively lower than elsewhere.

Even the prospect of a rise in interest rates from 0.5% to 1.0% have been a factor behind strong rally in dollar since 2014.

In recent months, many oil exporting countries have seen oil prices plummet and therefore their currencies have struggled. The dollar if anything, benefits from weak oil prices.

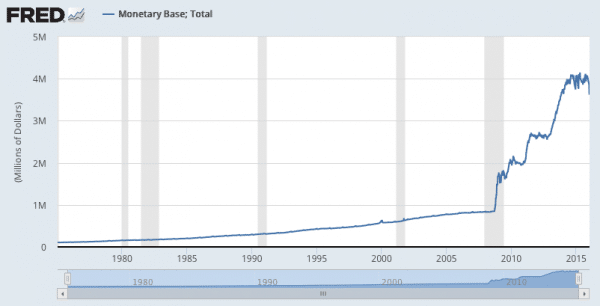

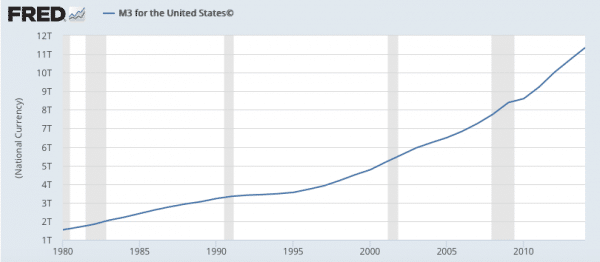

2. The increase in the monetary base has not led to same increase in broad money supply

The sharp increase in the monetary base, caused by the action of the Fed.

The growth in broad money (M3) is not as sharp.

This is because banks have not been so willing to lend out the increased bank reserves from the Fed’s actions.

3. Velocity of circulation

The quantity of money in the economy, is only one part of the equation. The Quantity theory of money states.

MV = PT

- Where M = money supply and V= Velocity of circulation (number of times money is used per year)

- Thus, if you have an increase in the money supply, but a fall in the velocity of circulation, they cancel each other out.

- In a recession, a period of low confidence, people and banks tend to hold onto money and not lend it out as much. This is why Quantitative easing, which increases the quantity of money, may not have much impact on inflation.

- In fact, this is the justification for quantitative easing, if people are hoarding cash, it could lead to deflation, without increased money supply.

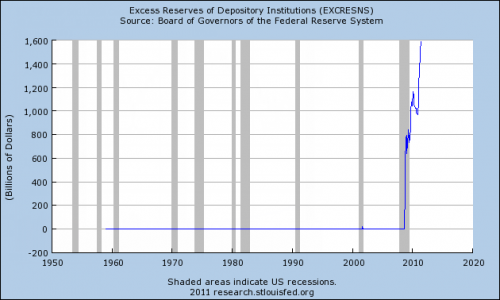

- In the US, there was a sharp increase in bank reserves.

What happened is that commercial banks merely oversaw a rise in their reserves

Banks seeing an increase of excess reserves after quantitative easing.

Banks seeing an increase of excess reserves after quantitative easing.

4. Liquidity trap

The important thing is that there has been an expansion in the monetary base at a time when interest rates are close to zero. Zero interest rates implies that the increase in real balances has only limited use and so doesn’t lead to productive use of these increase in money. Another way to think about it – in a liquidity trap, banks are seeking to improve balance sheets, firms are more reluctant to borrow for investment and so the increase in monetary base tends to be just stored.

Related