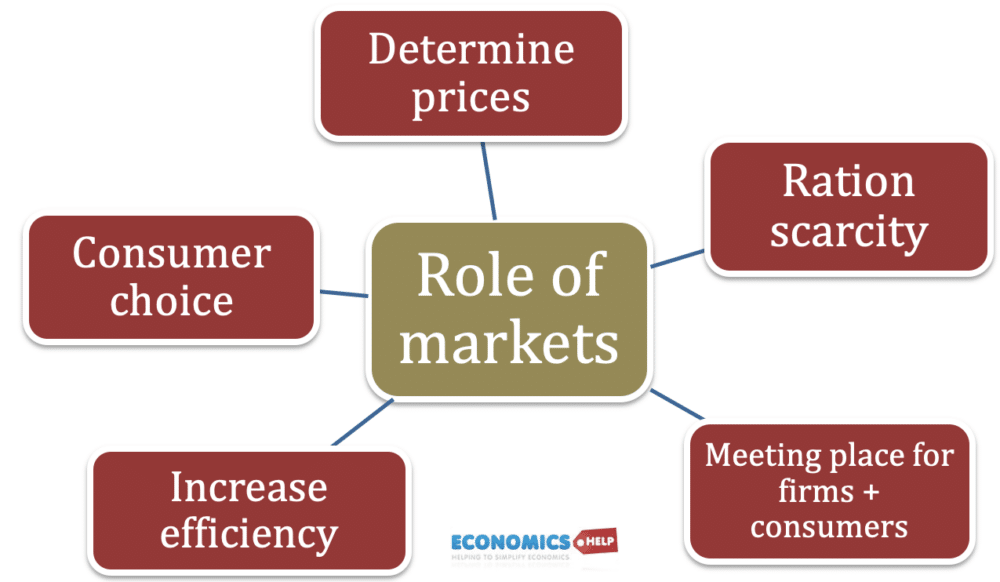

Markets are places where buyers and sellers can meet to sell and purchase goods and services.

- Markets provide places for firms to sell their goods and gain revenue.

- Markets provide places for consumers to buy the goods and services that they need.

Markets are mostly self-regulated, relying on the principles of supply and demand to determine prices.

Why markets are important

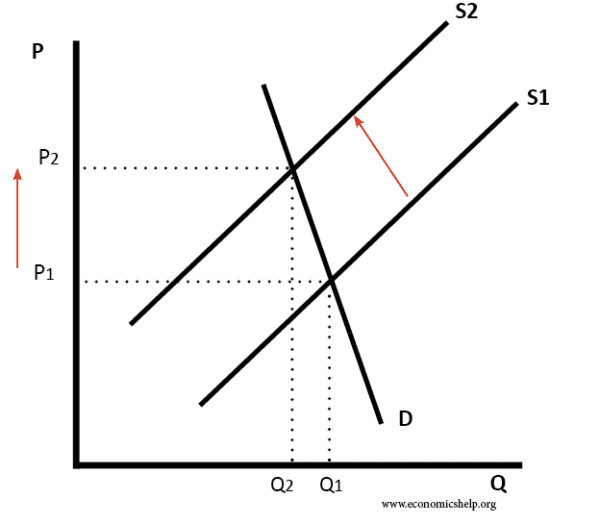

1. Ration scarcity. Suppose a good is becoming scarce and close to running out, then the supply of the good will fall. Causing the price to rise.

The rise in price will deter consumers from buying and encourage them to look for alternatives. Also, as prices rise, it will provide incentives for firms to either find new supplies or create suitable alternatives. For example, if a new pest destroys wheat crops, the price of wheat will rise encouraging consumers to find alternatives like barley and rice. In the long-term, farmers will seek alternatives to wheat or new production methods that avoid the crop

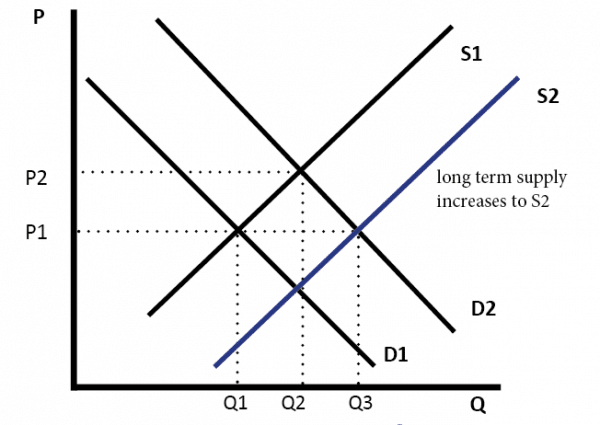

2. Incentives. Markets create incentives for firms to respond to shortages and surpluses. Suppose a good becomes very popular, market forces will push up prices to P2.

However, this higher price acts as a signal for firms to increase supply to S2 – so other time the market responds to this change in demand. For example, in recent years, there has been growing demand for lithium batteries, this creates incentives for firms to build new lithium mines to meet growing demand.

3. Invisible hand – determine prices

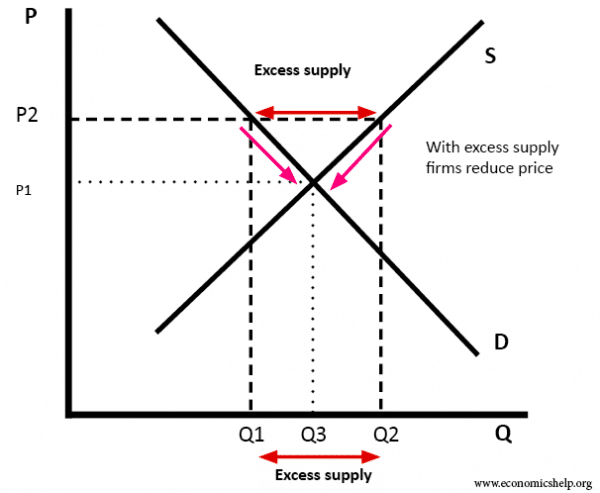

For example, suppose there was excess supply of a good, such as rental housing. In the below case there are houses unoccupied.

Market forces will cause prices to fall. Firms cut the price of renting until they have let out their housing.

4. Efficiency. When a market is functioning properly, then consumers will have a choice about where to buy their goods and services. If one firm allows costs to rise or provides sub-standard services, then it will become unprofitable and go out of business. Therefore, in a market economy, there is a strong incentive for firms to be efficient, cut costs and offer a good service to consumer.

5. Consumer choice. Without markets, consumers would struggle to get the goods and services they need. Markets enable consumers to choose the cheapest (or best) product, leading to a greater range of choices. New markets can continually spring up offering consumers choices there were not aware of.

Types of markets

- Physical market. A traditional marketplace is a physical location where sellers and buyers can set up their stalls or shops.

- Global market. When markets have international sellers and international buyers, e.g. going to buy car, you can buy imports from abroad or Currency markets, where you can easily buy from a dealer in any country.

- Virtual markets. Increasingly the market is online with consumers able to visit sellers through the computer and internet. This has made markets more global.

Limitations of markets

- Public goods are not provided because there is no profit incentive to provide goods, which is difficult for firms to charge, e.g. street lighting is not practical because of who would pay towards it. If it is provided, consumers could free-ride (enjoy without paying) Other important public goods not provided by free market, include legal system, law and order and protection of private property.

- Externalities. A market is efficient at allocating resources if the costs are met by firm and consumer. However, many goods and services create external costs to other people in society. For example, when you generate coal-powered electricity, there are very substantial costs of pollution, global warming – for people around the globe. In a market, this external cost is not included in the price and so we get over-consumption of these goods with negative externalities.

- Positive externalities. Similarly, goods which have significant positive externality may be under-provided and under-consumed.

- Merit/demerit goods. These are goods where consumers may make poor choices due to lack of information or irrational behaviour. For example, addictive goods like smoking and gambling – in a free market, consumers may get caught in addictive consumption which reduces their personal welfare.

- Inequality. Markets provide goods and services – so long as people can afford them. If people are unemployed or have no income, then they may lack basic necessities because they can’t afford them. Inequality in a free market can increase because of monopoly power, monopsony employers, inherited wealth and unequal opportunities.

- Monopolies tend to work inefficiently. A firm with monopoly power can set high prices and not be subject to the same competitive pressures.

How to make markets work better

- Internalise externalities. A Pigovian tax makes consumers pay the full social cost of a good, rather than just a private cost, e.g. carbon tax.

- Government provision of public goods

- Remove monopoly power by encouraging competition

- Avoid unnecessary bureaucracy and red-tape.

Alternatives to markets

One thing about markets is that it is often hard to envisage any alternative. The two main options could be

- Gift-giving economy. Anthropologists state in some communities, there are not the same market forces. People contribute to the community and are happy to give excess wealth and food to those in need. There is an expectation that the ‘favour’ will be returned.

- Utopian socialism. Similar to the gift-giving economy is the ideals of ‘utopian socialism’ where people work for the common good and resources and distributed according to need.

- Centrally planned economy. Under communism in Soviet Union, the economy was arranged by central planning with planners deciding what to produce and who should get it. The aim was to create equality, but it also led to inefficiency, shortages and surpluses and inflexibility.

Conclusion

There are many limitations of markets, however, they can be part of the solution towards economic development and providing decent living standards. The economist Greg Mankiw’s sixth principle of economics is

Markets are usually a good way to organize economic activity.

Most economists would agree with this to some extent. If only because there are few practical alternatives. However, very few economists would argue we should just rely on markets. There needs to be a balance with government intervention dealing with the worst excess of the markets, such as inequality and externalities.