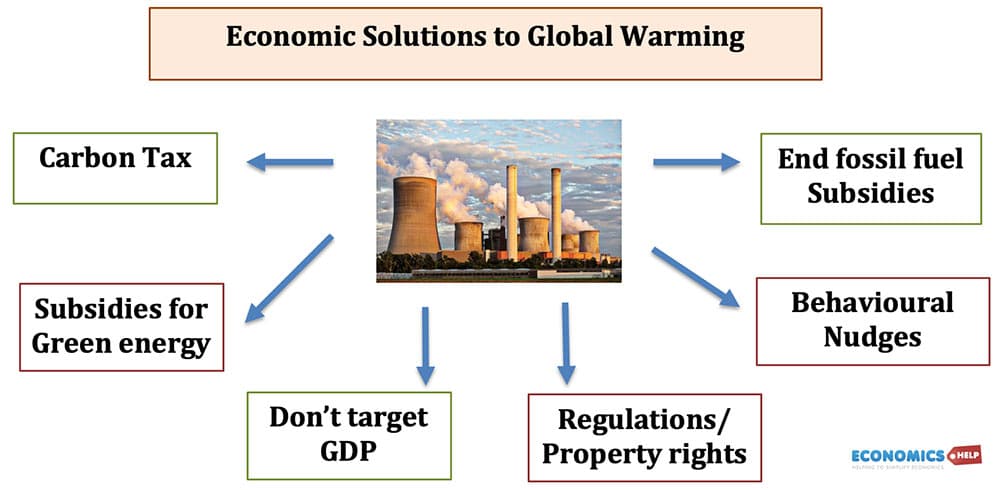

Global warming is a major economic and social problem facing the world. One study by Swiss Re, a provider of insurance suggested global warming could cost $23 trillion in lost output by 2050. In addition to the economic costs are perhaps the much more important costs to the environment, natural habitats and the life chances of future generations. To reduce the scale of global warming, what are the economic solutions. In brief economic solutions can include.

List of policies

- Carbon Tax

- End subsidies of fossil fuels

- Subsidise non-renewable energy

- Shift focus from GDP to Genuine Progress Indicator

- Behavioural shift amongst households, firms and government

- Cost-Benefit analysis to include future generations.

- How to pay? Carbon tax/Willingness to borrow/Global tax rates (end tax havens)

- Regulations and property rights, e.g. Protection of rainforests.

More detail on Economic policies

1. Carbon Tax. A carbon tax places a levy on the production and/or consumption of goods that emit carbon dioxide/methane. The tax would be proportionate to the amount of carbon emitted. For example, there could be a tax levy for frequent flyers on long-haul air flights. A carbon tax would lead to a very substantial increase in the cost of generating electricity from coal-fired power stations. A carbon tax has various advantages.

- It makes producers and consumers face more of the social cost involved. It doesn’t ban long-haul flights but it will encourage many consumers to take a holiday closer to home. It doesn’t ban coal-powered electricity, but it makes it significantly less attractive than more environmentally friendly alternatives.

- The tax will raise significant amounts of revenue which can be used to fund alternative sources of energy.

- A carbon tax is not a panacea, there may be a case just to end coal-powered electricity, but it can play a very helpful role in pushing market-oriented changes in the economy.

- There are difficulties in accurately measuring negative externalities and how much tax to charge.

- To be truly effective there needs to be global coordination, otherwise, there is a temptation for busines to outsource pollution to countries without a carbon tax.

2. End subsidy of fossil fuels. If a carbon tax is politically difficult, at the very least we should end the current subsidies which are still in place for fossil fuels. Subsidy for goods with negative externalities is a double failure. It is exacerbating the existing market failure by encouraging consumption and production of the very goods which are damaging the environment and social welfare. For example, the IMF found that the production and burning of fossil fuels, oil, gas and are subsidised by $5.9tn in 2020.

- One justification of subsidies for fossil fuels is to make energy cheaper for low-income consumers, but this is a false equivalence. Rather than trying to reduce poverty by making fossil fuels cheaper, poverty should be reduced by directly tackling it in form of subsidies for environmentally friendly practices or direct income support.

- Similarly, there are concerns for jobs dependent on fossil fuel industries, but here a solution is to maintain subsidies dependent on switching to alternative energy, and if necessary give support to any worker affected by job losses.

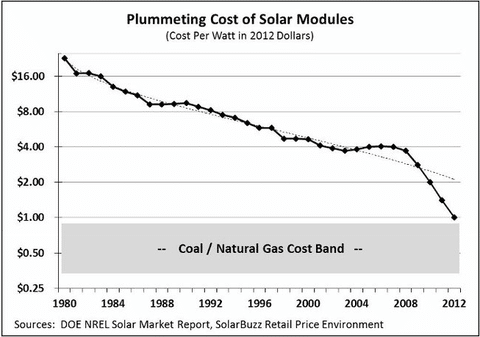

3. Subsidise Green Energy. In recent years, there has been a very significant fall in the price of renewable energies, solar power, wind.

4. Change of priorities. Environmentalists claim, with some justification, that economics has traditionally placed too much emphasis on maximising GDP and promoting economic growth. This has encouraged a consumerist approach which places stress on the environment. Economists are increasingly aware of the limitations of GDP and have developed alternative measures of economic welfare, such as Genuine Progress Indicator. The GPI includes many factors such as the human impact on the environment and use of time

If measures were given more prominence by politicians it would help shift society to a less consumer and materialistic based society, where preserving the environment would be given more weighting in decisions by households, firms and governments.

5. Behavioural change Whilst government policy can play a key role in shifting the nature of the economy, there are also limits to government action. It also depends on individual choices. To some extent, this is beyond economics and more dependent on personal and social values. Are people actually willing to make sacrifices to help the environment? However, some choices can be influenced by behavioural economics science. For example, making it easier to buy insulation for homes. Changing road systems, which make it more attractive to give up the car to walk and cycle. The use of nudges can be applied to environmental issues, even as simple as providing more electric charging points which will encourage consumers to ditch diesel cars for electric cars.

Whilst a change in individual behaviour is the ideal solution, we cannot rely on it alone. There is a free-rider issue. If other people make sacrifices to reduce their carbon footprint, some individuals will think they don’t need to. They can enjoy current levels of consumption and get a better environment. In other words, we hope other people look after the environment. Once a significant number are unwilling to change their own personal behaviour, then others will become more disinclined to make changes in their lifestyle – thinking ‘why should I make a sacrifice’ when so many others don’t? This is why regulations and taxes which affect all people are often perceived as fairer as it forces ‘everyone to be in it together.

6. Future generations priced into decisions. Traditionally economics has evaluated decisions based on current costs and benefits. But, this is unsuitable for environmental decisions because so many costs and benefits will affect future generations. In deciding projects, future welfare needs to be included in any cost-benefit analysis. For example, if we evaluate the opening of a new coal mine, it is tempting to look at the impact on jobs, the economy and immediate pollution levels. However, if we also include how this new decision affects future years, it may tip the balance into not opening the mine, but forcing a shift in energy uses.

7. How to pay for a switch to a Green economy? The world definitely has the resources to pay for a radical switch to a green economy. The use of carbon taxes, clamping down on global tax havens (e.g. Apple alone has $200bn in cash reserves in off-shore tax havens). Even if taxes cannot be raised for political reasons, there is a very strong case for governments borrowing to fund the protection of the environment. Borrowing now will reduce future costs of environmental damage. The cost of inaction is likely much greater than economic costs in the future. There are also times, in a low inflationary environment, when printing money can be an appropriate way to finance projects. (see: Printing money and inflation.)

8. Property rights/regulations for the environment. A problem with the environment is that businesses and consumers can use environmental resources to maximise their utility. This can lead to the destruction of rainforests as we consume meat grown on former Brazilian rainforests. One solution is to give property right to the environment itself. Restrict clearing of forests and see the environment has an agent in its own right, rather than something to be consumed.

Related