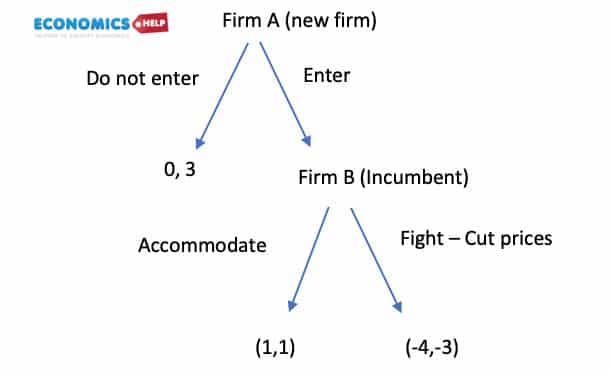

This decision tree is a simple example of game theory for firms deciding whether to enter the market and how existing firms should respond.

- If firm A (new firm) does not enter the market it makes £0 profit and the incumbent firm, firm B makes £3 profit.

- However, if Firm A does enter the market, the outcome depends on how Firm B responds.

- If firm B accommodates the new firm and keeps prices the same, the outcome will be £1 and £1 each.

- However, an alternative strategy for the incumbent firm is to fight and cut prices. This leads to a loss, Firm A makes -£4 and Firm B makes -£3.

What will be the outcome?

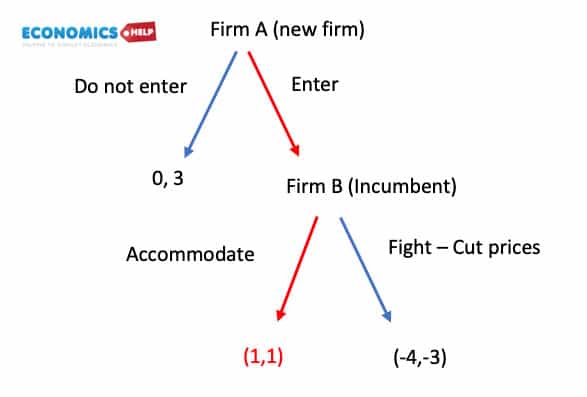

- If firm B wishes to maximise profits, then in response to firm A entering, it will do best to accommodate, meaning both firms will end up at £1, and £1.

- If firm A knows that firm B will accommodate and not start a price war, then it will be willing to enter because it will make £1, which is better than ‘do not enter’ and £0.

- Therefore the dominant strategy for A is to enter and B is to accommodate. We can also say this outcome (1,1) is a nash equilibrium because neither firm can benefit from changing the strategy

Long-term strategy

This game considers only the short-term outcome, would it be different if we extend the time frame?

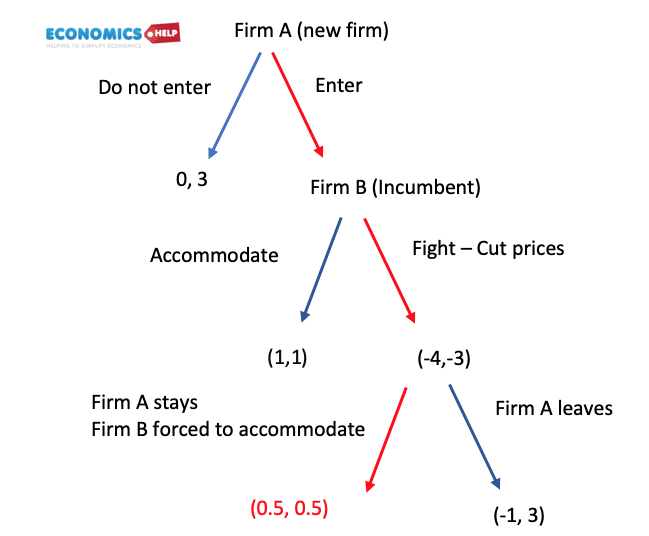

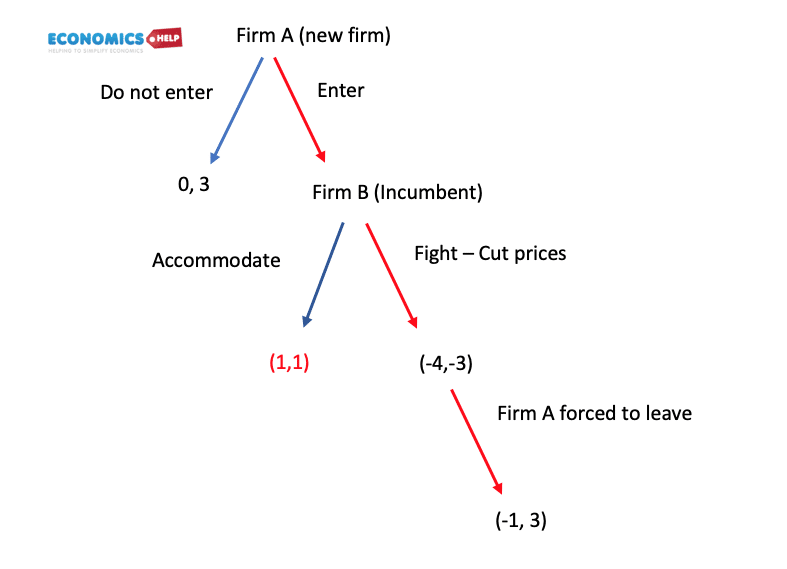

Firm B may consider more than just short-term profit. It was making £3 and would be unhappy with a new firm entering because it will only be able to make £1 in the long-term. Furthermore, if the firm B has been in the industry a long time, it may have accumulated substantial savings from past profit. Therefore, when firm B enters, it may decide to fight and cut prices – even though it makes a short-term loss

In the short-term the incumbent firm B will make a loss of -£3, but the new firm also makes a loss of -£4. Therefore, it hopes that the new firm (firm A) may realise it can’t afford to enter the market and absorb this kind of loss.

If firm A then leaves, firm B will be able to go back to the pre-existing monopoly and make £3 again. It can use this profit to pay back its temporary losses.

There is an additional benefit to this strategy for firm B (incumbent); it will deter other firms from entering the market because they will know the incumbent firm will start a price war so any new firm will end up make a loss. This enables firm B to enjoy a ‘quiet’ monopoly.

Game theory under uncertainty

The issue for the incumbent firm is that it doesn’t know how long it will need to fight the new firm. If the new firm gives up quickly, then it will be a good strategy to fight. However, if the new firm has lots of resources (e.g. it is a big multinational) then the new firm may be willing to make a loss for a considerable time. Then it puts pressure on firm B to give up and accommodate the new firm – but then it has made unnecessary losses from the price war.

In this scenario, firm B fought the new firm, but lost. Firm A stuck to its guns stays and firm B has to accommodate. Then both get £0.5, £0.5

For the incumbent firm B, it is a risk. Fighting could lead to lower profits (0.5 rather than 1) but, if fighting is successful, it gains big reward – £3.

One consideration is that governments usually bring in legislation to outlaw price wars – selling below cost, so there is this practical difficulty in starting a price war.

See also