Russia is a medium sized economic with a GDP of $1.48 trillion (USD) about half the size of the UK $2.7 trillion (2020)

The strengths of the economy is based on exports of oil and natural gas. And with these sales, since 2014, Russia has built up foreign currency reserves of $630bn – a large sum for size of the economy. In theory, these Russian foreign currency reserves of Euros, Dollars, Chinese Renminbi and Yen can be used to support the Ruble. If the Ruble falls due to an economic crisis, the Russian Central Bank can sell its foreign currency reserves (sell Euros to buy Rubles) and the value of the Ruble is maintained. This large currency reserve was built to withstand economic sanctions and give Russia more economic leverage.

However, in response to invasion of Ukraine, the Western world has imposed sanctions on the Russian Central Bank by limiting access to SWIFT – the means of transferring international money and also freezing assets of the Russian Central Bank. This means the Russian Central Bank cannot access its own foreign currency reserves and so the huge fund of reserves becomes practically useless. The Russian Central Bank owns its reserves but it doesn’t control them. This will have very large scale impacts on the Russian economy and Russian living standards.

Knock on effects of this sanction

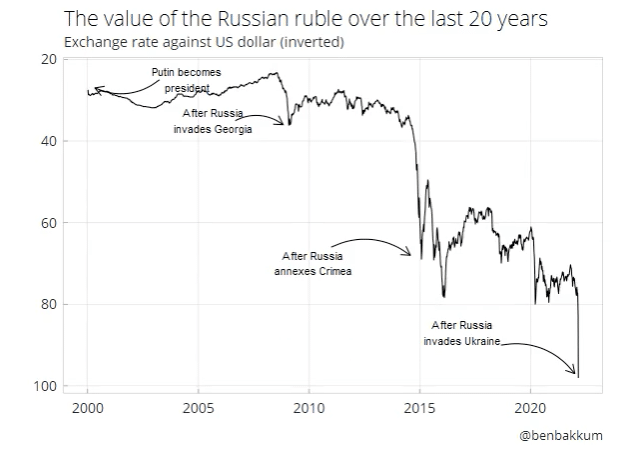

Depreciation in the Ruble. If Russia cannot sell foreign currency reserves, the Ruble will fall in value. The Ruble is also falling for several other reasons, such as capital flight, loss of confidence, export limits and Russians seeking any safe haven currency. As the Ruble falls, the price of imported goods will rise increasing the cost of living and pushing up inflation.

Higher interest rates. Because the Russian Central Bank cannot intervene by selling foreign currency, it is trying to prevent a rout on the Ruble by doubling interest rates to 20% – which will increase the cost of borrowing and make investment more difficult.

Run on the bank. Before the 2022 crisis, the Russian private sector had foreign currency claims of $65 billion in Russian banks. Basically, Russians felt confidence they could always access foreign currency they could use to buy goods and services in the West. However, the Russian commercial banks kept very little actual foreign currency cash in the banks. The system worked because people trusted they could always withdraw and if a commercial bank had a liquidity shortage, the Russian Central Bank would step in with its own large foreign currency reserves.

On the first Monday after the sanction, Russians queued up to withdraw dollars and Euros, but almost immediately, bank machines stopped giving any Euros – the actual cash is not there. It is a classic run on the bank because people fear for their deposits they go to a bank to withdraw but the bank can’t actually meet the demand, when everyone wants to withdraw at the same time.

The issue for Russia is that as the Ruble falls, the government will not be able to access its foreign currency reserves. It does have some physical gold reserves, but that is practically difficult to use. It could send gold ingots by railway to China, but it is slow and limited.

Russia can still gain foreign currency from the direct sale of oil and gas, these sales can be used to purchase imports and the goods it needs. But, this may not be enough to fight a prolonged war – especially as sanctions are widened and the West looks to divest from Russian energy.

It is worth mentioning that this ultimate sanction of blocking a Central Bank is relatively unprecedented it has been imposed on North Korea, Iran and Venezuela, but not a relatively strong economy like Russia.. North Korea and Iran are very isolated and Iran has relied on direct sales of oil and an almost barter economy – transferring large pallets of cash for oil. But, for an economy like Russia which has become very interdependent with the industrialised world, this will be a huge shock. The Kremlin might claim the Russian economy can become ‘autonomous’ but in reality, the economy is a long way from this and it will take a long time and a long period of economic hardship for the economy to become self-reliant.

Also, it is worth bearing in mind, in the globalised world, we don’t have such things as a national car industry, a national airline industry. Economies of scale are so large that most industries have become very global. For a medium sized economy like Russia to develop its own car and airplane industry would be incredibly difficult and it would prove much more costly than its competitors.

How does this affect the average Russian?

The average Russian will see an unprecedented fall in living standards. Over the past 30 years, Russians have become used to being able to buy foreign imports like iPhones, designer clothes and German cars. But, this is going to become very difficult. Firstly the devaluation of the Ruble will make these very expensive. But, in addition Western firms are limiting their access to Western markets and Russian incomes are likely to fall very steeply as the economy is hit by a fall in demand and confidence.

Inflation. The significant fall in the Ruble will push up import prices and cause wider inflationary pressures. At the moment, consumers are rushing to buy electronic goods before they go up in price or become unavailable. In Russia, they are joking ‘don’t drop your iPhone, you won’t get another.’

The Russian economy will not just be hit by the banning from SWIFT, but a range of other sanctions are also hitting the economy. Western companies and individuals do not want to be associated with the Russian economy and are selling Russian assets and not using Russian companies. Confidence in the economy is falling dramatically as people are re-evaluating what is valuable. All the foreign assets and access to foreign currency can no longer be taken for granted.

Related