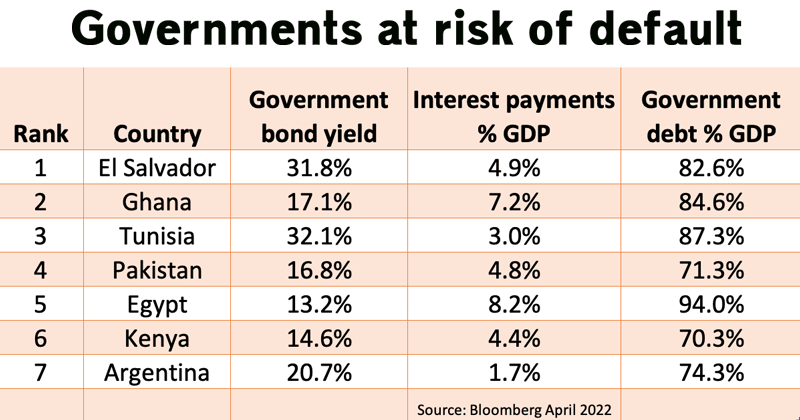

Earlier this year, the World Bank warned up to 40 nations are at risk of defaulting on their sovereign debt. Already Sri Lanka, once hailed as an economic jewel, has badly defaulted as the country slides into economic turmoil. But, the bank warns many others, such as El Salvador, Ghana, Tunisia, Egypt, Kenya and Argentina are all at risk of sliding into default.

Default means government fail to keep up with scheduled repayments, usually resulting in a restructuring of debt and investors losing out.

This shows that countries at risk of default have debt levels over 70% and interest payments as a % of GDP between 1.7% and 8.2%. The risk of default is highlighted by the government bond yield – with higher bond yields needed to compensate the greater the risk of default is.

However, these raw stats do not show the whole picture.

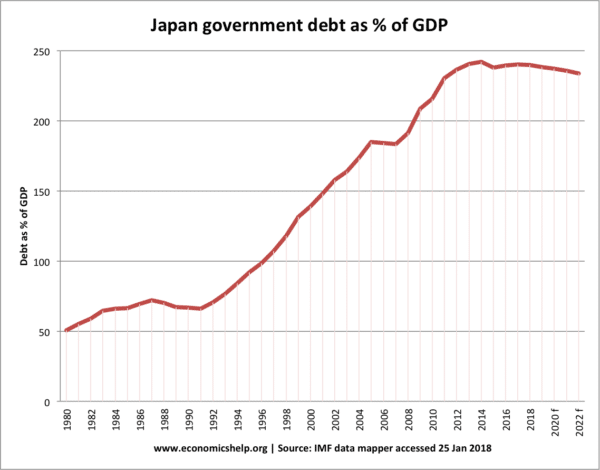

What causes countries to default? Why has Argentina with debt around 75% of GDP defaulted fives times in the past few decades, but Japan with over 240% of Debt to GDP has no risk of default?

Government debt is usually bought by the private sector – banks, pension funds, and investment trusts. It can be bought by domestic investors or overseas investors. It is when a government owes foreign creditors a high share of debt that default often becomes more likely. For example, Japan’s huge public sector debt has mostly been bought by domestic investors, who have high appetite for saving in secure government bonds. This has insulated Japan from any risk of default. However, developing countries, which lack domestic savings, often look abroad to foreign investors to borrow money to fund investment. In this scenario, default is more likely.

Causes of sovereign debt default

Boom and bust. During periods of growth, governments can become optimistic and wish to borrow more to fund investment in the economy, to enable higher growth in the future. Investors see these developing economies as a source of potential growth offering better returns than stable economies like the US. However, when economic growth becomes negative, tax revenues dry up and confidence evaporates, leading to the governments struggling to meet repayments.

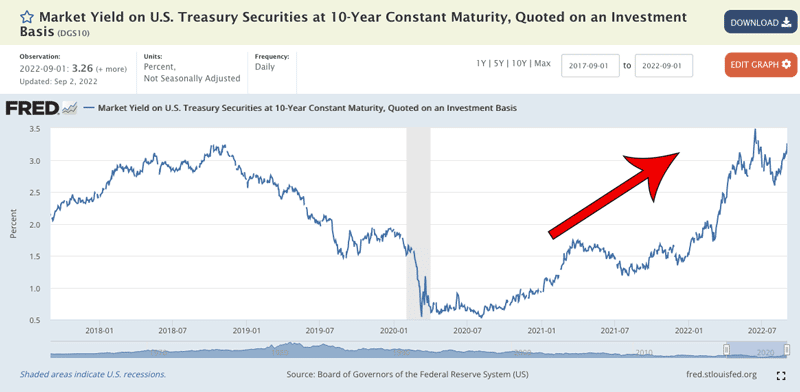

Rising interest rates

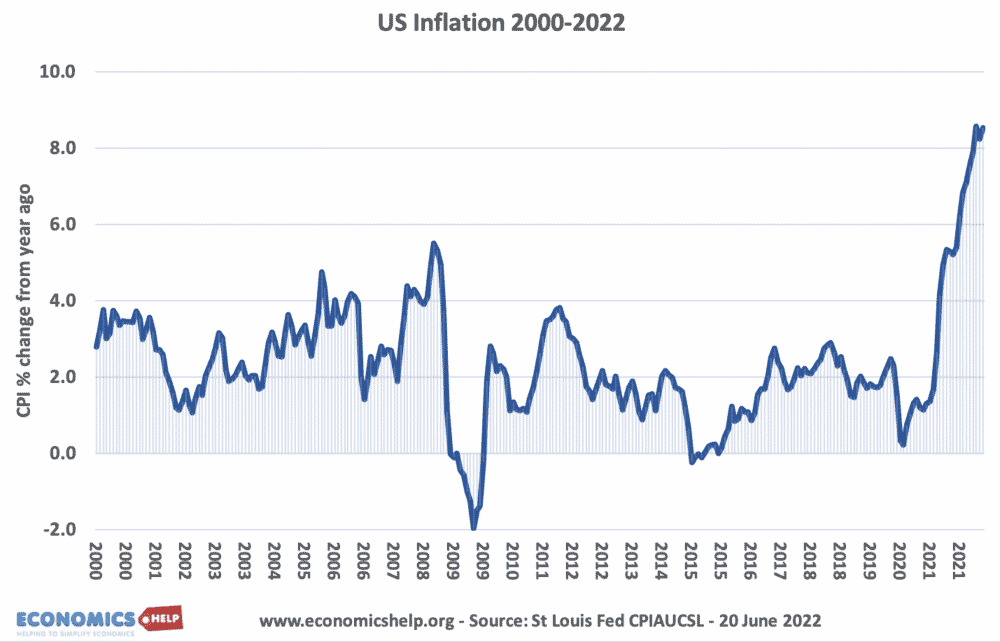

Debt on government bonds is subject to market interest rates. In the US high inflation has caused the Fed to raise interest rates, this will push up borrowing costs around the world. When US rates increase investors find it more attractive to save in the US because there is a combination of security and high yields in the US. Therefore, in a time of high US interest rates developing economies need to push up their interest rates to continue attracting credit and this makes developing economies sensitive to interest rates. In the early 1980s, it was rising US interest rates in response to high inflation, that caused the great raft of Third World debt defaults. 2022, is seeing significant increases in interest rates in response to the high cost-push inflation of 2022.

Devaluation in the Exchange rate

Most sovereign debt is denominated in dollars. A devaluation in the local exchange rate increases the cost of repaying foreign creditors, meaning that it can soon run out of foreign exchange reserves as the currency devalues. For example, the pressures on currencies in South East Asia in 1997 caused foreign capital reserves to quickly evaporate and then there is difficulty meeting foreign repayments. As the currency devalues it can cause a negative spiral with the devaluation encouraging investors to sell off assets and local inhabitants to try and sell the domestic currency and buy foreign currency. This can easily cause a ‘debt run’ where there is a sudden stop in capital inflows and capital flight. This was a major reason behind the 1995 Mexico debt crisis.

Covid and 2022 inflation

All the potential economic problems have been exacerbated by recent events which have caused both supply-side and demand-side shocks. Firstly many countries which relied on tourism saw Covid hit domestic tourism, causing a fall in foreign exchange earnings and a rise in unemployment as the tourist sector was badly hit. Just as there were signs of recovery in early 2022, the Ukraine war caused a devastating rise in commodity prices, notably food and oil. For commodity importers, such as Sri Lanka, Kenya and Egypt, this has worsened their balance of payments and reduced foreign earnings. With countries struggling to import basics like food and fuel, there are no funds left over to pay debt interest payments.

Printing money

When countries face domestic pressure of not being able to pay wages and purchase basic items, there is a temptation for Central banks to print money and provide temporary relief to governments struggling to meet demand. This happened in Zimbabwe in 2006, and Sri Lanka in 2022. However, printing money at a time of falling output causes inflation to accelerate only making the situation worse and accelerating the fall in the value of the currency.

Poor policy

In addition to all the external factors, a debt crisis usually involves some degree of bad policy. For example, in the case of Sri Lanka, the government reduced its tax base through unsustainable tax cuts. It’s policy of banning chemical fertilisers was hastily introduced 0 causing lower output in the all-important agriculture sector. Bad policies on top of external events can rapidly cause a developing economy to unravel.

In the case of Argentina, there have been five debt defaults since 1982 (1982, 2001, 2005, 2014 and 2020) A recurring theme in Argentina’s case has been poor political management, with successive governments borrowing aggressively during periods of growth, but then failing to manage the economy, leading to low growth, high inflation and an inability to meet future debt payments. One problem with sovereign debt is that governments can have a political incentive to take risks in borrowing, knowing that the future costs of excess debt will not be faced for a few years, likely by a different government.

Rising government debt. Whilst there isn’t a simple link between government debt and default. Higher levels of borrowing can be damaging for developing economies which have limited opportunities to sell debt to domestic markets.

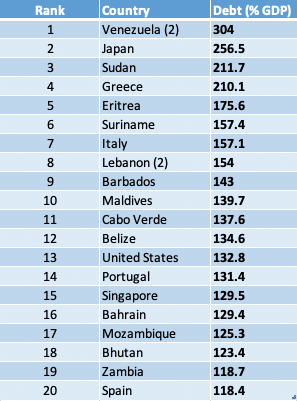

This shows the highest levels of national debt as % of GDP, according to the World Bank (2021). Many of the countries in the top 20 are at risk of default. But, not Japan, Italy, US or Spain.

China as major credit lender. In recent years, China has emerged as a major source of credit. Eagerly lending to developing economies. According to a 2021 report “Banking on the Belt and Road:”, 44 countries owed debt to China equivalent to 10 percent or more of GDP, with some owing more than a quarter of GDP. Some have criticised China’s aggressive lending to countries that are liable to default, arguing it is ‘debt diplomacy’ with China able to gain strategic concessions from debtor countries. For example, gaining a 99-year lease in the Hambantota Port project in Sri Lanka. However, other China scholars are less negative arguing that Chinese lending in Africa does not show signs of debt diplomacy, but has been able to meet high demand for funds.

Sanctions

Russia is likely to default on debt repayments in 2022, but not because it can’t or doesn’t want to pay but because of sanctions meaning the electronic methods of repayment are not open to Russia. Russia claims this is a ‘technical default’

Euro defaults

In 2010-14, several Eurozone economies faced rising interest rates and the risk of default because of the unique circumstances of the Euro. At the time, monetary policy was set by the ECB and countries did not have the ability to devalue exchange rates, or increase the money supply to provide liquidity and buy any shortage of bonds on the market. The result of this was that markets feared many countries with high budget deficits could face liquidity problems and there was an exodus from countries like Italy, Ireland, Greece and Portugal.

This contrasts with the example, of the UK. The UK had one of the highest budget deficits in the EU. But, outside the Euro, the Pound could devalue to restore competitiveness and the Bank of England could pursue quantitative easing and purchase government bonds. In the UK, bond yields stayed very low.

When the ECB announced it would do ‘whatever it takes’ to provide sufficient liquidity in Eurozone bond markets, then the bond crisis eased for all countries. Only Greece (who had a more fundamental debt problem) was forced to partially default.

This shows countries with their own currency and independent monetary policy rarely default – especially if the majority of debt is owned by domestic investors.

External links

- More than 40 countries at risk of debt default

- Are you ready for a coming spate of debt defaults? World Bank

Further reading