The Russian fossil fuel industry is facing a real crisis. Western sanctions and Russia’s own embargo on exports to the West mean that the industry is facing long-term decline. Already there have been reports of ‘capping’ of natural gas facilities. This means that natural gas is burnt at its source because the industry cannot sell or store the gas coming from wells. As revenues from gas and oil fall and the west divest from Russian fossil fuels, how will this affect an economy that has become overly reliant on this particular industry? Can an economy easily pivot away from fossil fuel production? Will Russia be able to rely on exports to China and India?

Recently Gazprom switched off the natural gas Nordstream 1, citing maintenance concerns, but the real reason is political, with Russia seeking to cause maximum inconvenience to Europe in response to sanctions. Whilst these hurt Europe, it will also hurt an important part of the Russian economy.

How will Russia fare transitioning away from natural gas and fossil fuel exports?

Firstly, it is easy to underestimate how adaptable economies can be. No matter how much damage and disruption an economy faces, usually, entrepreneurs and individuals can find a way around the disruption to create new businesses and deal with shortages. For example, after Western sanctions, Russia was forced to close many car factories for two months due to a lack of spare parts. But, recently the national Lada factory has re-opened and is selling cars once again. Admittedly the new cars are missing top-end components, such as air-conditioning, SBS brakes and airbags, but it is an example of how companies can find a way to deal with shortages and keep going.

However, whilst economies are often more adaptable than we might expect, I still think Russia will struggle to transition from a fossil fuel-based economy. Firstly, the shutting off of gas to Europe is quite a sudden change and it will take a long time for resources to shift elsewhere. Secondly, the fossil fuel industry is by far the most dominant industry accounting for 45% of Russian government revenue, and this dominance will make it difficult to transition. In economics, it is something known as the Dutch Disease. When the Dutch economy discovered large sources of natural gas in the early 1960s, it distorted the economy causing an appreciation in the exchange rate and dominating any capital investment. The result was the wider manufacturing economy struggled from an overvalued exchange rate and lack of capital investment. When natural gas sales started to fall, the rest of the Dutch economy struggled with a current account deficit, falling tax revenue and the manufacturing industry left behind international competitors.

Now, the Dutch economy has recovered from the Dutch Disease and is performing quite strongly, but Russia may find it much more difficult. Firstly, fossil fuels are much more important in Russia. Secondly, the economy has a poor track record of entrepreneurship outside fossil fuels. We could characterise the Russian economy as “Crony Capitalism”. An economy dominated by a few large monopolies. To own a company and make a profit, you need the right connections with Putin and the Kremlin. Even this year, there have been numerous reports of oil executives falling out of hospital window beds in suspicious circumstances. A reminder that it is a very dangerous economy to become successful.

In this kind of climate, there is much less motivation for taking risks to set up a new company. Another problem for the Russian economy is that the most damaging aspect of sanctions on Russia is the withdrawal of western companies, who can’t be seen to associate with Putin’s regime. Without western multinational investment and access to western components, it will be harder for new companies to develop, especially in markets which are globally integrated. Russia might point to continued close ties with China, India and Iran. But, there is evidence that even Chinese companies are reluctant to do business with Russia because of fears they may become subject to western sanctions. The final area of concern for revitalising the Russian economy is the large outflow of the richest, youngest and most mobile workers. Demoralised by the new status of Russia, 100,000 IT professionals have left the country. One estimate suggests that 3.8 million Russians have left the country since the start of the year.

Oil Industry

The Russian oil industry is likely to prove more durable. Sanctions on Russian oil have, so far, only had a limited effect on reducing demand. With Russia able to export large quantities to China and India (at a discount) With high global prices of oil, it is likely that Russia will find a way to continue exporting oil. For example, crude oil has been shipped to refineries in China and India, and then the finished petroleum products can end up being shipped to the West.

Russian Price Cap.

The G7 countries have announced a plan which seeks to cap the price of Russian oil by refusing to pay above a certain amount. The G7 hope that with the EU and UK dominating the insurance of oil shipping, they are in a position to enforce this price cap, which will prevent price rises for the West, but limit funds for Russia. However, economists are not certain how effective this price cap will be. With Russia claiming they won’t take part and won’t sell at a discount. If they can sell sufficient quantities to non-Western economies, the price cap may prove limited. Nevertheless, there already is an unofficial oil price cap with China negotiating a discount on the global crude price of oil.

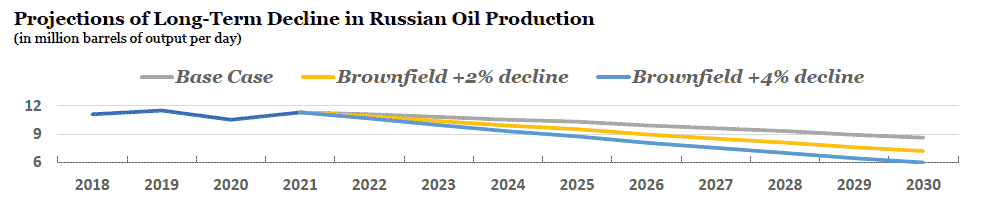

Russia may be more seriously affected by a general fall in oil prices which might occur if there is a global recession. However, in the long-term, we may well have reached ‘peak oil’ and the long-term prospect for oil is not so good as economies (for both environmental and economic reasons) look to diversify to non-fossil fuel-based energies. With ever-improving renewable technology, this is a realistic scenario. The conflict in Ukraine and the attitude of Russia will only accelerate this trend away from relying on fossil fuel imports. The decline of the Russian oil industry may take quite a few years, but it is likely to happen and again the question is – to what extent can the Russian economy cope? Will new sources of revenue be able to take their place?

In addition to the sclerosis in the economy, demographic factors are also not helpful. Russia’s birth rate is 1.50 (below the replacement ratio of 2.1) This is not unique in the western world, but combined with rising mortality rates (especially amongst men) and net emigration it is a cause for concern. Between Oct 2020 and Sep 2021, Russia lost 997,000 people. (Foreign Policy) – Partly because Covid hit Russia hard.

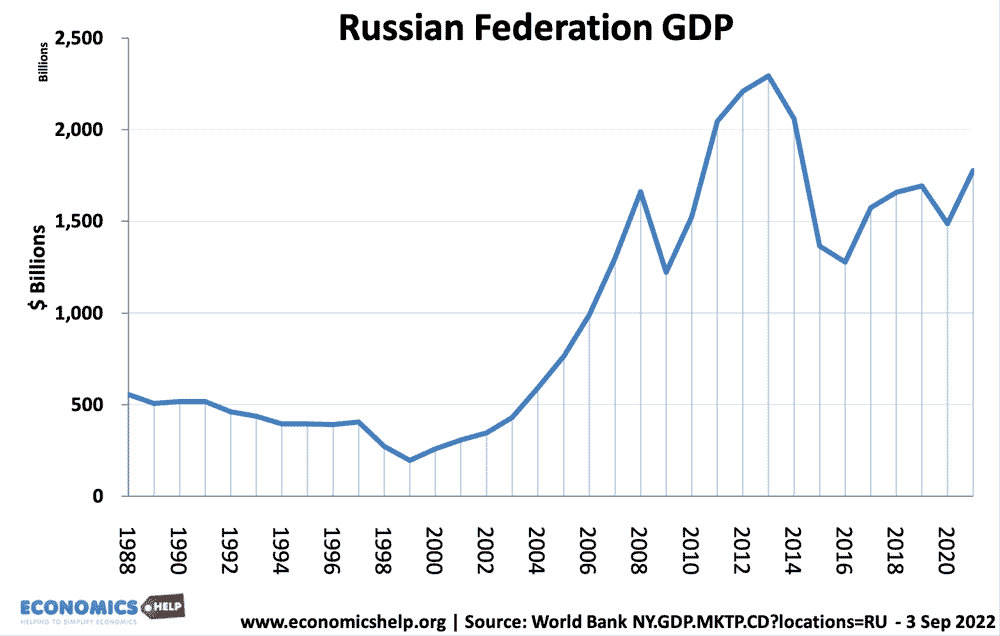

Russia’s economy is still smaller than it was in 2014 when Western sanctions were imposed in response to Crimea occupation. Whilst it is widely felt sanctions on Russia post-Crimea were weak and ineffective, still, Russian GDP is considerably lower. Showing Russia did not respond well to sanctions. Given that 2022 sanctions are significantly deeper and far-reaching, it will be interesting to see how Russia can cope.

Overall, the Russian economy has underlying weaknesses which make the transition to a completely new economy very difficult. Fossil fuel industries are excellent for Crony Capitalism where high productivity, innovation and flexibility are not really needed. Even if you run fossil fuel industries badly, they can still be very profitable. Making a switch to service and manufacturing which are much more competitive industries will be very difficult.

Further reading