In March 2022, the EU, US and other western countries introduced a range of sanctions on the Russian economy. These sanctions have hurt the Russian economy, but they are also causing unprecedented strain on the West and Europe in particular. The big economic threat to Europe involves:

- Higher inflation from rising energy prices

- Threat of running out of gas this winter

- Risk of recession

- Loss of investments in Russia

- Decline in exports to Russia

Video version

Oil sanctions

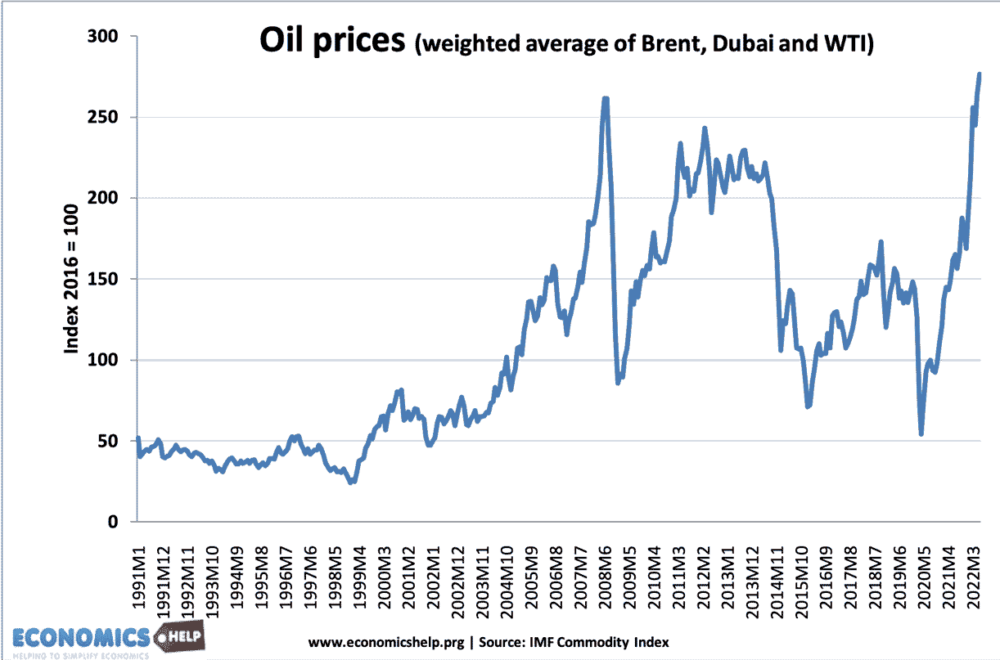

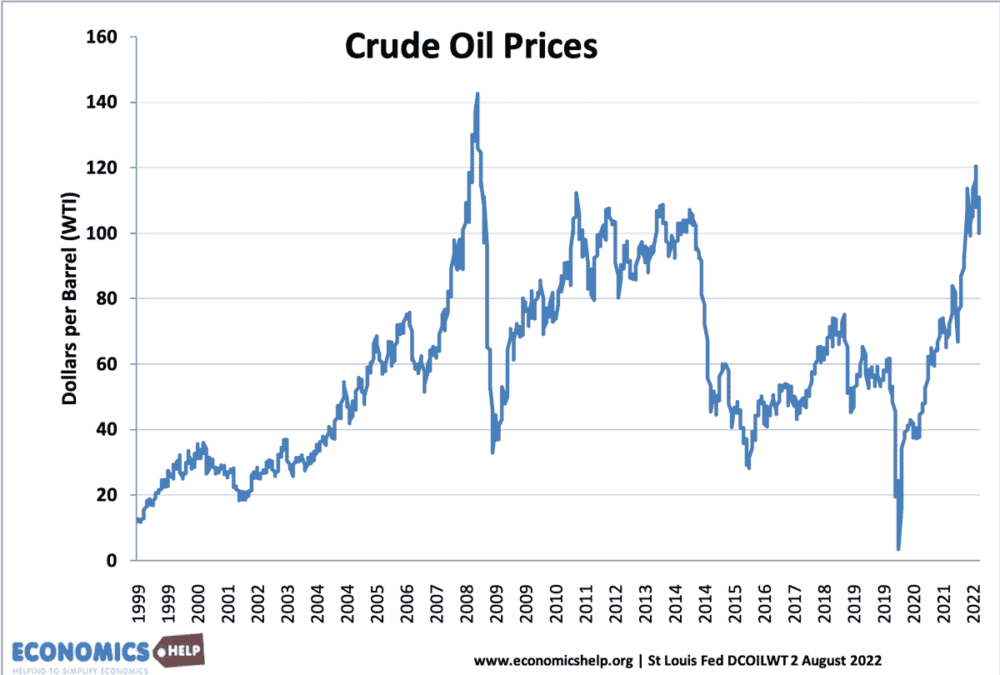

The EU has announced a virtual embargo on Russian oil (with some exception for oil through pipelines) to be phased in over the next six months. Oil exports are the biggest revenue source for Russia, and it is a major global producer, contributing around 10% of the world’s oil exports or 5 million bpd of crude oil and 2.5 million bpd of petroleum products. The EU is particularly dependent on diesel imports, buying around 50-60 million tons per year from Russia. By refusing to buy Russian oil, it will put upward pressure on oil prices, at a time when capacity is already quite tight.

(Though with just using WTI index oil has come down from peak of $120 in March to $100.

Oil industry

One issue with the oil industry is that since 2014, investment has been limited as firms are less willing to invest huge sums given the perceived global over-capacity, plus the knowledge we may have reached peak oil demand as the world switches to renewable alternatives. This oil investment was further hit during the Covid lockdowns. When the economy recovered in 2021, oil prices were already rising. The Ukraine war and sanctions put further upward pressure on the price. If Russian production falls, there is some scope for other countries, e.g. US, Qatar and Saudi Arabi to increase supply, but there isn’t the same willingness to sink huge investments in long-term projects. When Iranian sanctions were tightened in 2017/18, oil prices increased from $50 to $80 as Iran exports fell from 3 to 1.7 million bpd. (Carnegie Endowment.org)

In a worst-case scenario from cuts to Russian supply, JP Morgan predict oil could rise to $380. Although incredibly unlikely, even modest rises have proved very damaging.

However, oil prices may well fall back, as they have already started to do in recent months. As Russia sells less to Europe, it is compensating to a large extent by increasing exports to China and India (who are buying at a big discount). The important thing is overall supply may not be cut that much, though Europe may pay higher average prices than Asia.

Gas

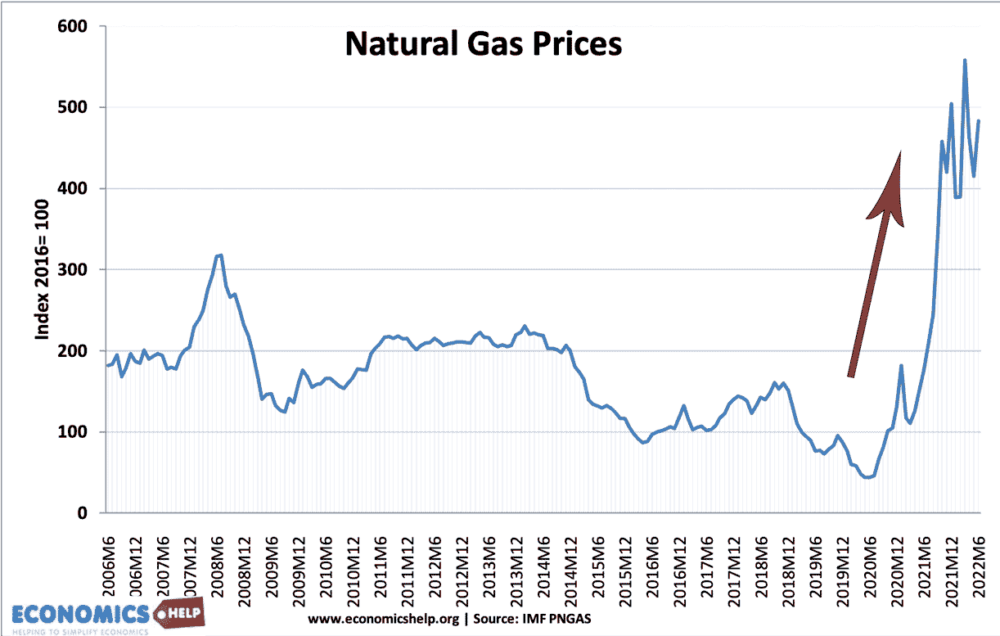

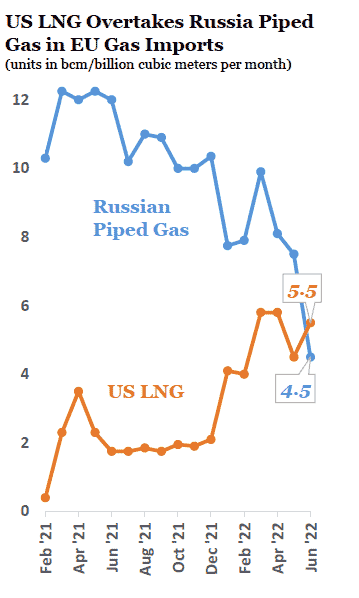

A bigger concern for Europe is natural gas. In 2021, Russia supplied the EU with around 40% of its natural gas, with Germany and Eastern European countries particularly reliant on it. In response to sanctions, gas flows from Russia have dwindled, leaving Europe concerned it may face a shortfall over the winter. A shortfall of gas would have devastating effects on the German economy which relies on natural gas in many of its manufacturing industries. It is also important for home heating and a small share of electricity generation. Already firms have cut back on the use of gas, for example, the escalating cost of fertilisers has caused firms to cut back on production and a survey suggests 16% of German industrial firms are considering reducing or stopping production. (Bloomberg)

Gas is quite price inelastic because it is difficult to replicate the physical pipelines from Russia direct to Europe. The US has responded by increasing sales of LNG and there is scope for more from Qatar and Indonesia, but this is not a perfect replacement as Europe does not currently have sufficient LNG storing facilities.

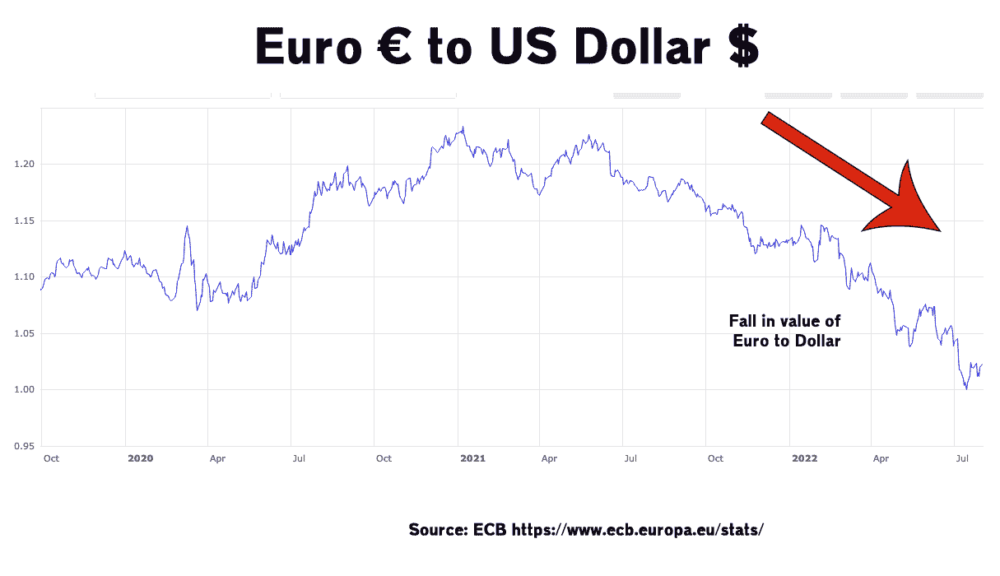

The threat of losing gas supplies is already hitting business confidence and investment and there are fears of Germany and the EU heading into recession. The IMF estimate German GDP could fall 4.8% if Russia halts gas supplies. The Euro has fallen against the dollar due to these forecasts.

Rising energy prices

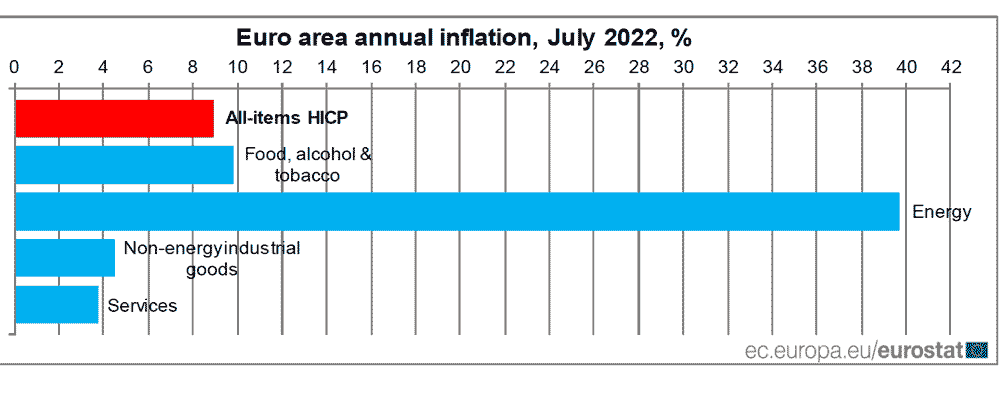

Rising energy prices are a very visible sign of economic turmoil. They have exacerbated the cost of living crisis many western countries are facing. In the EU energy prices have risen 40%, contributing to inflation of just under 9%. Rising energy prices hit those on the lowest incomes and combined with higher food prices can lead to difficult choices for the most vulnerable households. In the UK, the rise in energy prices are making headline news with typical energy bills expected to rise from £1,400 to £3,600 a year this winter, according to a new forecast based on natural gas wholesale prices.

In the UK petrol prices have risen from £1.40 in Jan 2022 to just under a record price of £2.00. A price that has important has knock-on effects for households and businesses. It is hard to disentangle the effects of higher prices from general market conditions and Russian sanctions/retaliation. But, the decline in Russia supply is a contributing factor.

Company loses

Sanctions on exports of technological-based components to Russia will hit western firms who supply these goods, but Russia is a relatively small share of EU exports, so it is not a major loss. Similarly, the withdrawal of western firms from Russia has led to a loss in assets, but in 2022, total financial assets in Russia only account for 1.2% of total Euro area external assets. In Q1 2022, they stood at €385, down 12% from 2022.

More profit for energy companies

As well as all the costs to Europe, it is worth bearing in mind, that the energy companies have been indirectly reaping benefits, with record profits, due to the high energy prices. For example, the 2022 second-quarter profit for BP soared to $8.4 billion, with other energy giants, such as Shell, Total Energies making similar strong profits. It raises the potential for the use of windfall tax to help mitigate the cost of living for householders.

How Russian sanctions have impacted EU economy

Already certain German cities and regions have started to ration gas use, with the German city of Hanover turning off heating in public buildings, requiring cold showers and no air-con. Public buildings will have no heating from April to Sept, and then only a max temp of 20. Also, Germany has been considering previously politically infeasible policies with the Green party considering refiring coal plants and extending nuclear power stations to prevent the use of gas. There have also been calls to consider temporary speed limits on German autobahns.

Higher interest rates

More seriously, the ongoing inflation of just under 10%, will put pressure on the ECB to increase interest rates to prevent inflation from becoming entrenched. But, the higher interest rates come at a time, when growth is already slowing down.

Conclusion

The sanctions are a response from Russia and have definitely caused a serious impact on the west and Europe in particular. This winter may be challenging with rising prices and the risk of gas shortages. All this points to an unwelcome combination of higher prices and lower growth. On the positive side, a slowdown in growth would inevitably cause lower oil and commodity prices. Also, whilst Europe is dependent on Russian gas, Russia is even more dependent on sales to Europe. Threats to cut off gas may evaporate as Russia realises it would be a financial folly to fully cut off supplies to its biggest customer.