Readers Question: As the cause of inflation to a large part is down to energy costs, if they are temporary, will we see large deflation if we see a return to something close to ‘normal’? Typically deflation would be a bad thing, but in this case would it be?

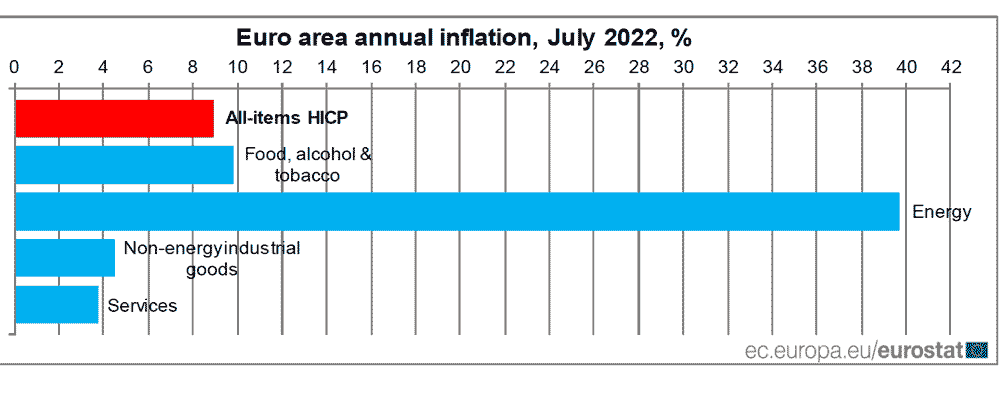

Firstly, you are correct a large part of current inflation is due to energy costs, as this example from the EU suggests

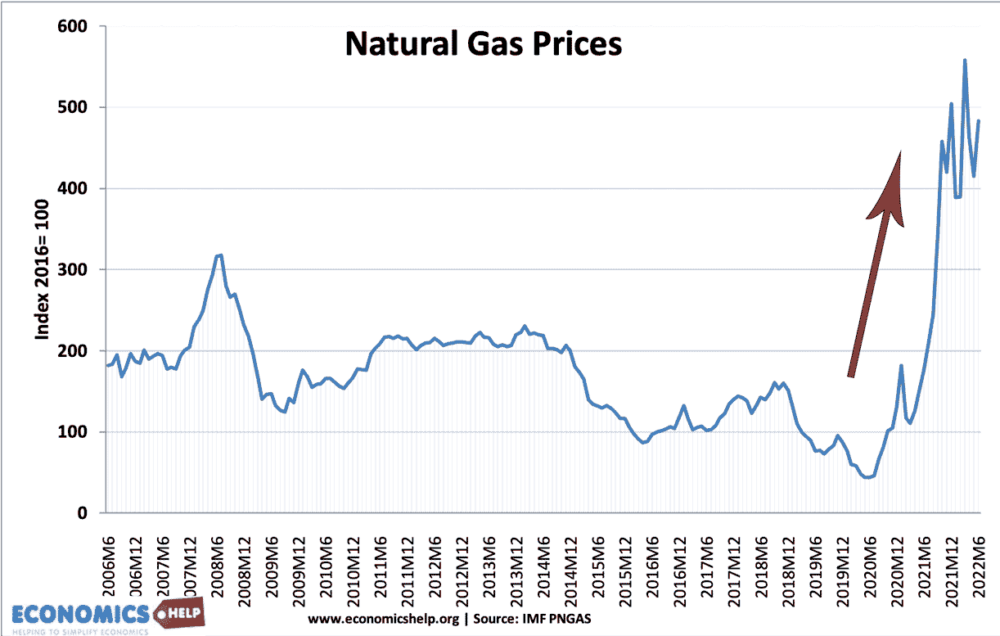

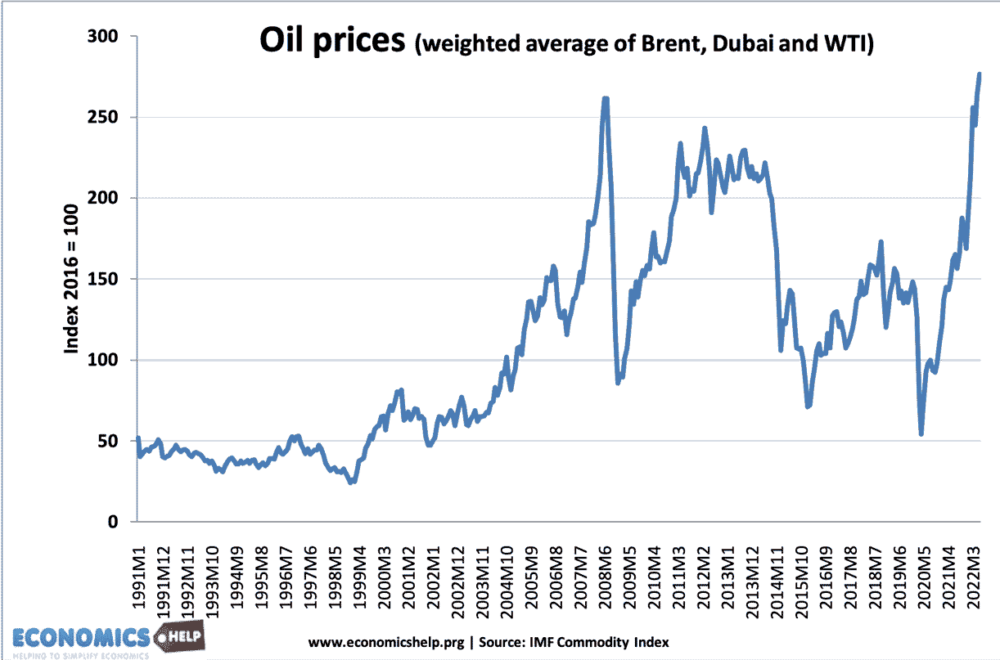

It is quite conceivable that sometime next year energy prices could plummet back to more normal prices

If energy prices plummetted would that cause deflation?

Not necessarily

Though energy is very important to inflation, the current cost-push inflation has (to some extent) become embedded in general prices. So, even if energy prices fell, we may have residual inflation from other goods as the economy re-adjusts to lower energy prices. It is like energy prices are rising 40%, and this causes inflation of 9%. If energy prices fell 40%, then the inflation rate might fall to 3 or 4%. Because inflation is so high, it will take much longer to see inflation fall close to 0%.

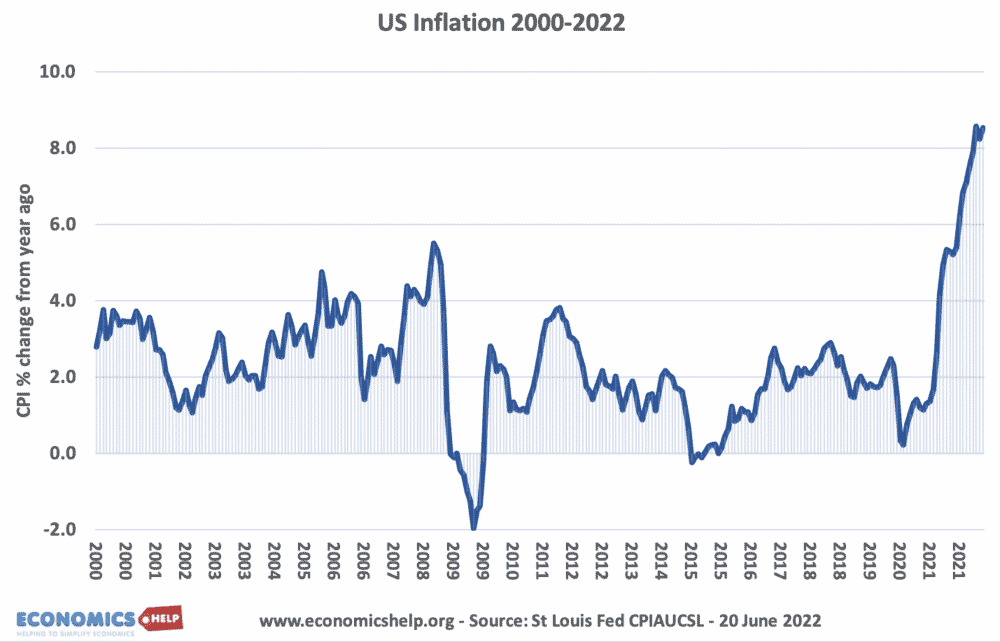

However, if the fall in energy prices is sufficiently large and the economy quickly catches up to changed inflation expectations (perhaps helped by lower growth) then we could get actual deflation, (like we did briefly in 2009) after the post-recession fall in oil prices.

Brief period of deflation in 2009 was caused by the record oil prices reversing.

Would deflation caused by falling energy prices be a good form of deflation?

Basically, yes. Because this deflation represents lower costs and so we get the best of both worlds – lower prices, but also the capacity to have lower business costs and more output.

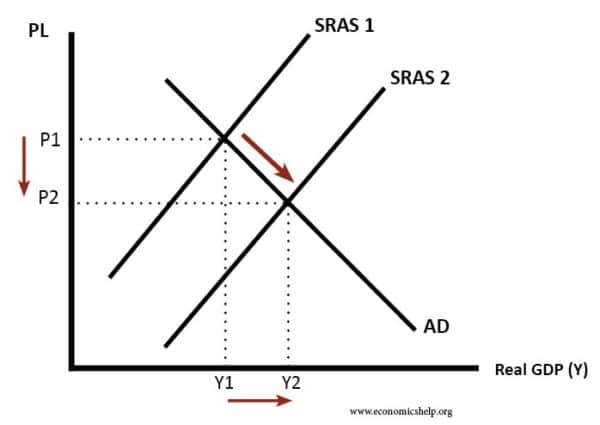

It can be described by a simple AD/AS diagram.

Lower

Lower energy prices shift SRAS to the right causing lower prices, but also higher real GDP.

Lower energy prices would be like a big increase in disposable income for hardpressed households and could see a rise in spending and saving.

At the moment higher energy prices are causing the worst of both worlds – lower output, higher inflation (stagflation). Falling energy prices would hopefully cause the opposite.

However deflation is always a danger

Having said that there is always a danger that the ‘good’ deflation could easily turn into the ‘bad’ deflation (see: Types of deflation) – especially if lower energy prices are caused by a recession. If prices fall and we get a fall in consumer spending, then all the problems of deflation (higher debt burden, reluctance to spend) could contribute to weaker growth.

For example, in theory, the deflation of 2009 caused by lower oil prices should have been good. But, in practice because it occured during a recession and financial crisis, the problems of deflation probably exacerbated the recession.

Further reading