In recent years, the UK private rental market has seen a surge in demand, and the average price of renting rising 40%. Yet it is the least favoured form of housing tenure, with many renters paying an increasingly unaffordable share of income on rent. The crisis costs the government £27 billion in housing benefits, leads to inequality and intensifies the cost of living crisis, especially for the younger generation rent.

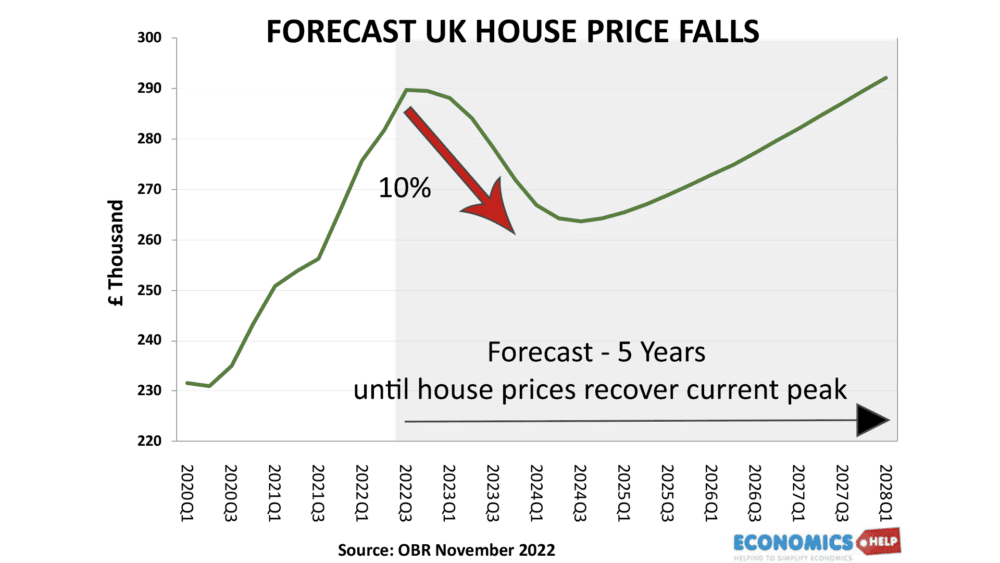

With house prices forecast to fall in 2023, what are the prospects for renters? Will rents also follow house prices or will they continue to rise?

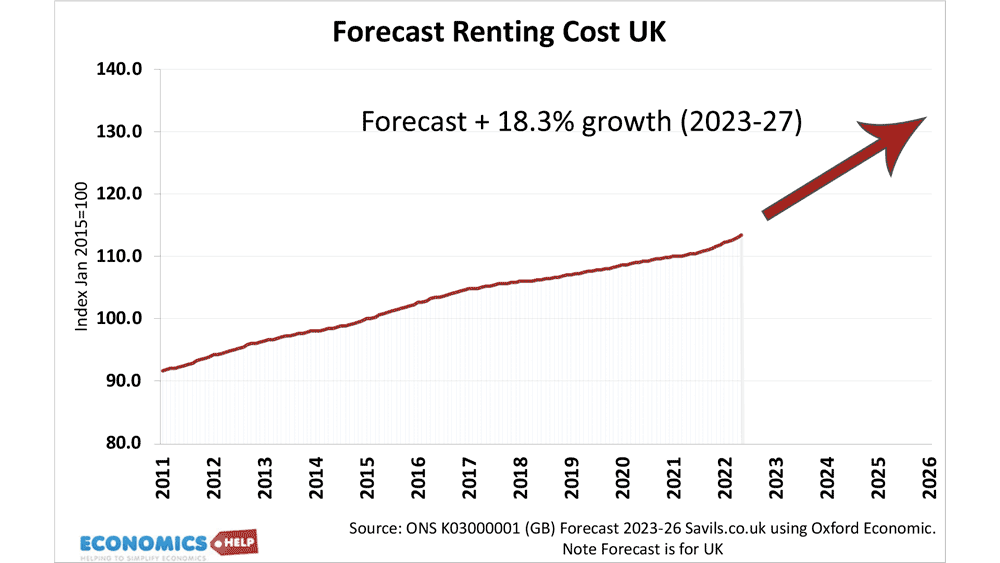

In the last house price fall of 2008, rents did fall a small amount, but after 10% rise in 2022 Savills forecast rents will rise 18% from 2023 to 2027. No matter what happens to house price, rents are going up. How did we get into this state?

Numbers of private rented households rising

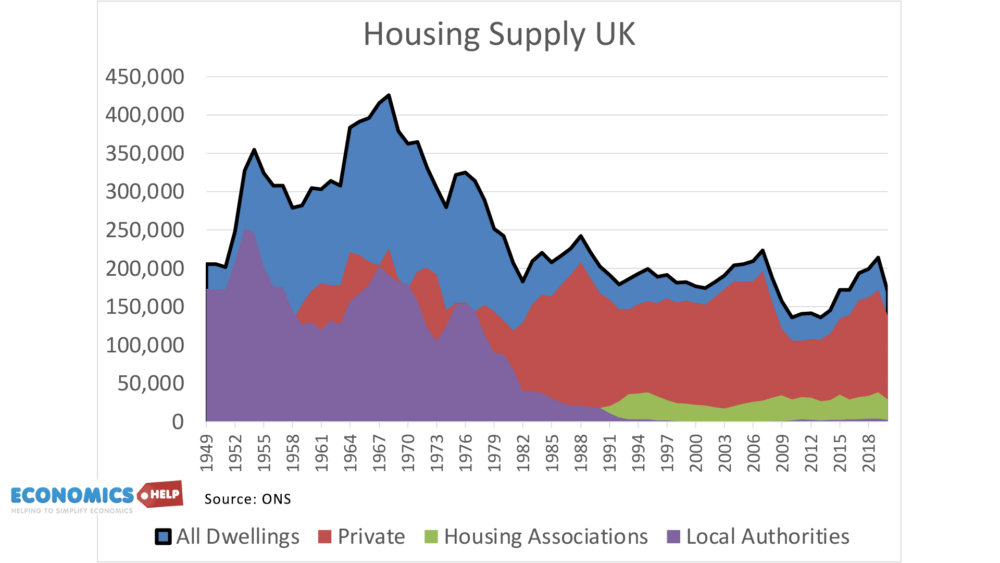

Firstly, since the 1980s, the “Right to Buy” scheme promoted by Margaret Thatcher led to the sale in council housing with no corresponding increase in supply.

Understandably popular with former tenants who can buy at a discounted price, the consequence has been a fall in the availability of social housing, with councils often having to rent back their former properties at a higher price. 40% of former council houses are now in the private rented sector. The waiting lists for council housing is so acute, it is a real crisis.

Cost of private renting

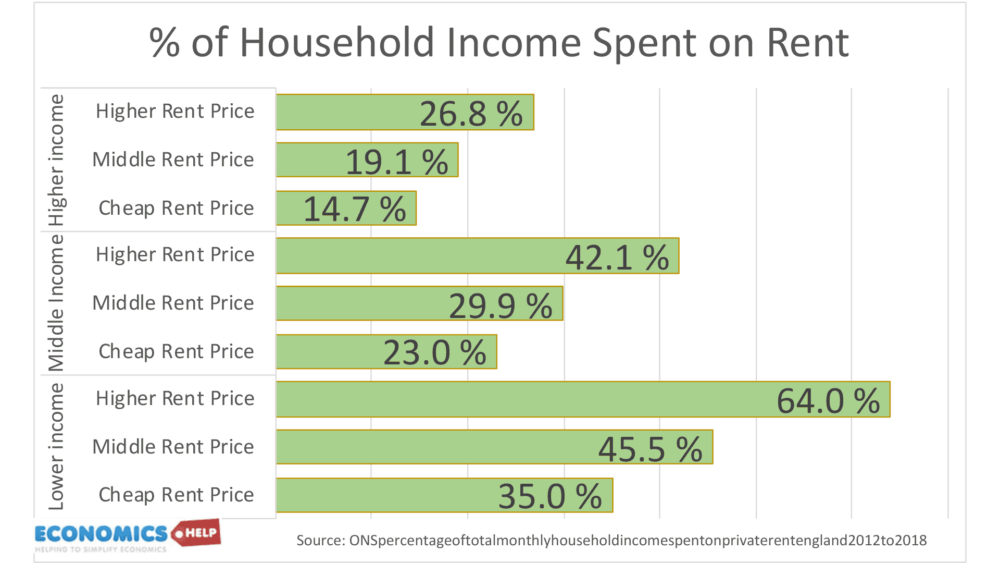

In 1980, the average working-age family renting spent 12% of its income on housing, today it is nearly three times (32%) Private renters in London spend on average 42% of their income

Research from the ONS shows that for low-income renters living in high price areas, the proportion can rise to 62% of income.

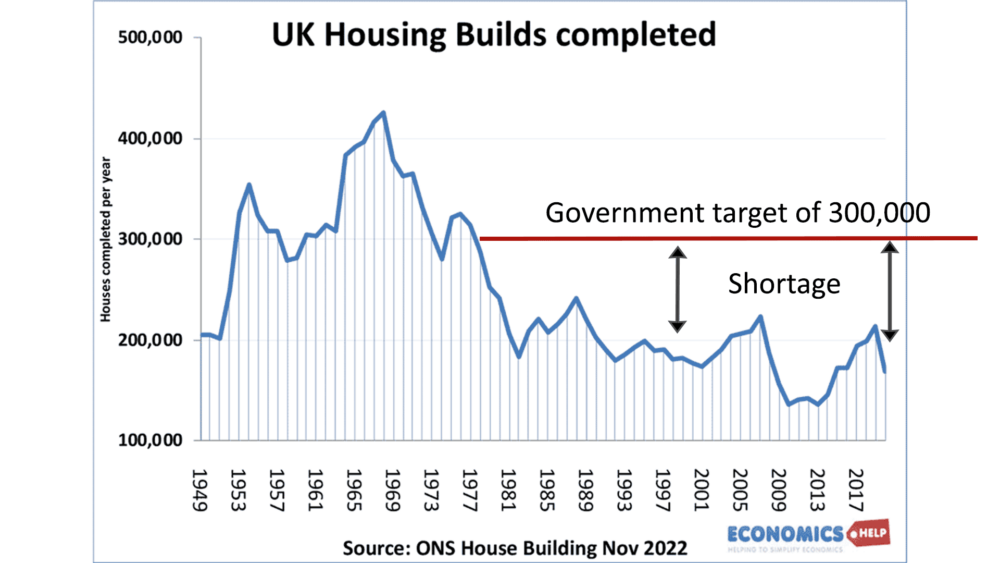

With the government not investing in housing, the bulk of homebuilding is now left to the private sector, but there are several reasons why insufficient homes are being built.

- Lack of available land

- Barriers and delays in the planning system

- Increasingly skill shortages in the construction sector.

The government have a commitment to build 300,000 homes a year to meet the growth in demand and current backlog. Experts say this target is really a bare minimum, but there is little if any hope of getting anywhere close to the target.

There is a fundamental political conflict between the wish to increase the housing stock, but local opposition to new housing developments. It is highlighted by the likely backbench revolt against setting councils compulsory building targets. If targets are advisory rather than mandatory, supply will definitely fall. Many MPs talk of the need to build houses, but at the same time are aware of local pressures which oppose building homes in their own constituencies.

Given the deadlock in building sufficient homes and increased housing unaffordability, the government sought to support first time buyers with the “Help to Buy scheme” a government-backed mortgage loans enabling more to buy. But this is a classic example of dealing with symptoms rather than the underlying causes. It has merely inflated demand to buy and pushed up prices. A Parliament report stated the scheme has cost £29 billion in cash terms and they found it does not provide good value for money, and has inflated prices more than its subsidy value and would have been better spent on increasing housing supply.

It also reflects the political influence of homeowners vs renters. When mortgage costs soared in September, there was an outcry from papers and the political establishment. Even the legendary Martin Lewis argued the government should consider supporting mortgage payers. At this point, renters may through their arms in the air and say we have a permanent crisis.

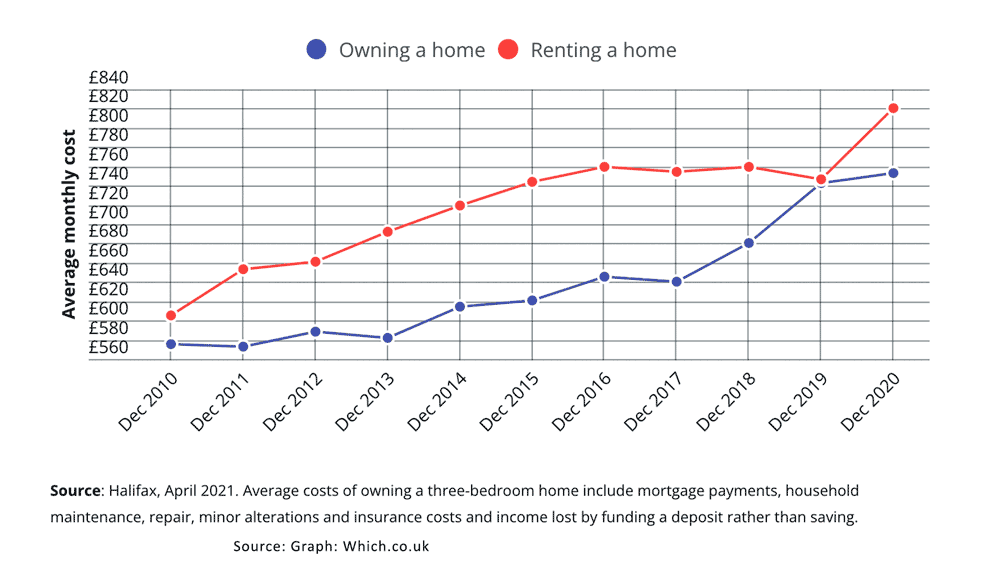

Research from Halifax found the cost of renting is higher than homeownership – even with maintenance costs included. There is also the not inconsiderable fact that homeowners have the prospect of rent-free retirement. The need for retired renters to continue paying market rents is a future crisis in the making.

Why is renting going to get even more expensive?

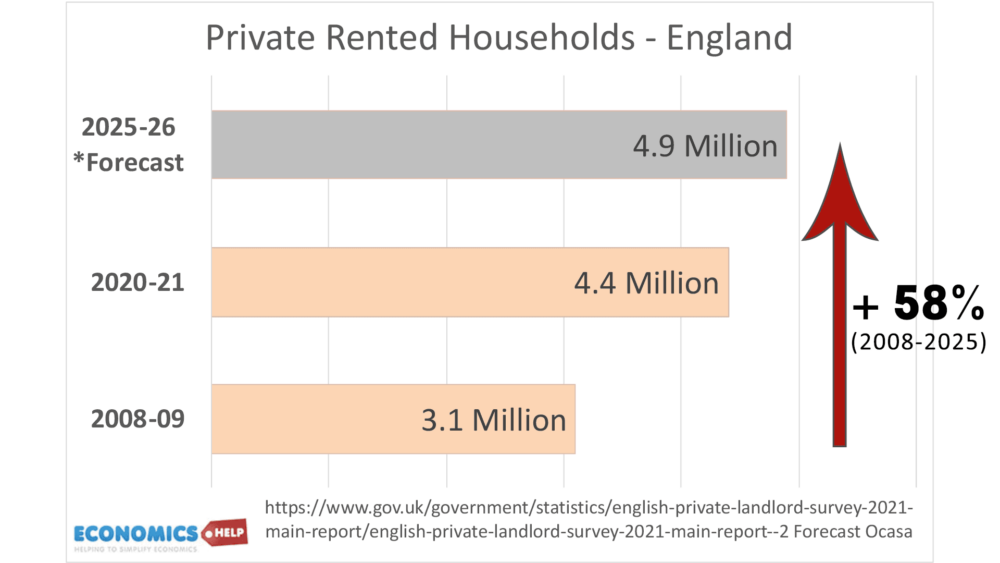

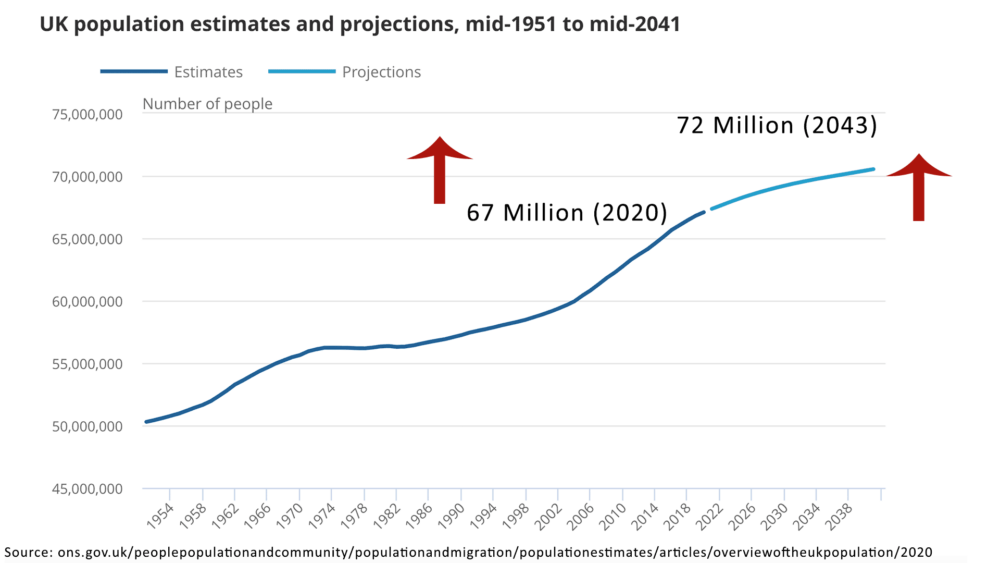

The population of the UK is forecast to rise to 72 million by 2043. However, the growth in single-person households means the number of households will rise at a faster rate – 3.7 million more households in the next 25 years. From 2008-2025 a 58% increase – this is despite young people living with their parents for longer.

64% of this future growth will be persons over 75 years.

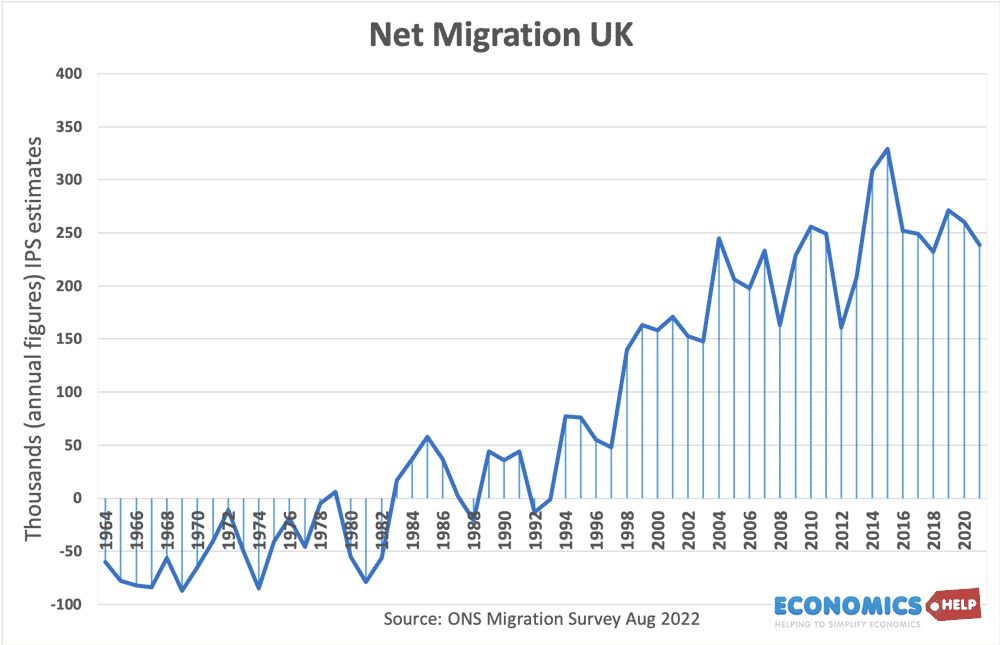

A significant cause of growth in population is being driven by net migration, which reached a record of 500,000 last year. Despite Brexit reducing migration from Europe, it has been compensated by migration from non-EU countries, as the UK seeks to fill labour shortages and attract foreign students.

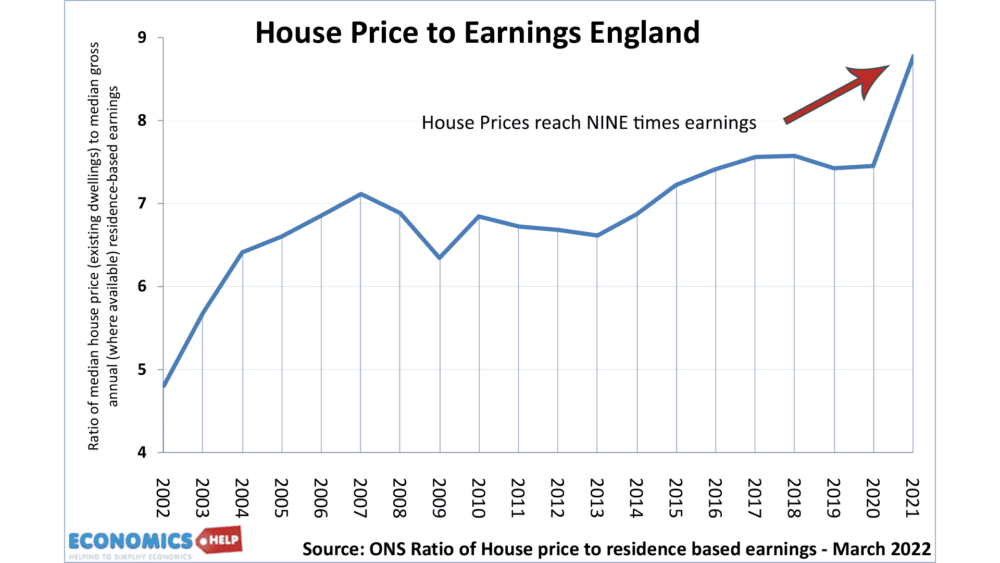

Whilst buying a home is a common aspiration in the UK, many young people, saddled with student loans and falling real wages have no option of saving a typical deposit of £59,000. Record house price-to-earnings ratios do matter for first-time buyers who simply can’t save a deposit or get a mortgage without their parents’ help. Between 2004 and 2017, only 9% of people under 30 whose parents did not own a house were able to get on the property ladder. This figure was 25% for those whose parents did own. Homeownership rates have fallen considerably for young people, leaving people no option but the private rented sector.

Whilst demand is rising, the supply of private rented accommodation is not keeping up. There is a general difficulty in building houses, but also, other factors have worsened the shortage.

Landlords are increasingly finding AirbNB listings to be more profitable. Listings rose from 76,000 in 2016 to 257,000 in Jan 2020 and this continue to rise – often in areas where homes are most unaffordable. A recent Parliament report also highlighted the concern that as older private landlords leave the market, they are not being replaced by new landlords.

And it is worth pointing out, there are nearly 500,000 empty homes in the UK.

Don’t falling house prices put downward pressure on rents?

Around the world, falling house prices can lead to lower rents. But this is unlikely in the UK because of the fundamental shortage of private rented accommodation. As interest rates rise, many landlords will try to push their higher costs on to their tenants, and because of their market power, tenants may have no alternative. Even if house prices very few will be able to make the switch from renting to buying as prices will still remain expensive.

It is not just prices that are a concern. In 2020 23% of privately rented homes did not meet the “decent homes standards” Some 7% of private renters live in overcrowded conditions compared to 1% of owner-occupiers. The cost of badly maintained properties was highlighted by the death of two-year-old Awaab Ishak who died partly from high mould exposure.

Build to Rent

There is some hope from schemes such as build to rent. Specific builds for long-term rent it represented 20% of London’s new housing supply in 2020. The British property federation predicts the development of 200,000 ‘Build to rent’ homes in the next two years. But, this is only part of the picture, with the rented sector still facing large squeezes.

The problem is that the grim economic outlook of the next few years will do nothing to solve the fundamental housing crisis and may even constrain house building further. Economic uncertainty, Rising costs, and planning regulations make it hard to increase supply. Renters are not a particular political priority, despite the crisis in affordability, the government have prioritised a pension triple-lock guarantee rather than public sector pay or state benefits. The result is a net gain for pensioners compared to young people, despite the older people more likely to gain from the benefits of home ownership.

Unfortunately, the problems of the rented sector have serious structural and political problems which have proved difficult to solve. Yet it is one of the most pressing issues facing the UK, with impact on the wider economy. We need the political will to increase supply and give more priority to young renters.

Further reading