Readers Question: However I was intrigued by something I read on the internet regarding Conservative plans to include housing costs in the Bank of England’s inflation target.

- Mortgage interest payments are included in the RPI measure of inflation.

- However, the official measure of inflation is currently the CPI. The CPI excludes mortgage interest payments.

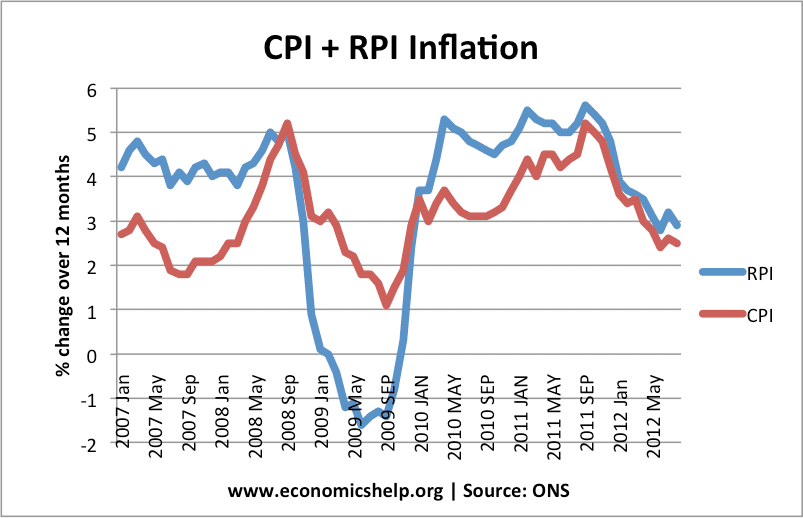

- It is important which measure is used. At the moment, RPI is negative. Using the RPI measure we have deflation of 1.6%

- However, the CPI still shows a positive figure. CPI is currently 1.8%.

Current Inflation Rates

So that is a big difference. If for example benefits pensions were index linked to RPI, we could see falling nominal value of benefits rather than modest increases.

I feel that RPI is more volatile – especially when interest rates are changing rapidly. The main reason RPI is negative and CPI is positive is the sharp fall in interest rates in recent months. This means mortgage payments have fallen so RPI inflation has fallen. However, although we have negative RPI, the underlying inflation rate still shows some positive price rises.

I think that even if the Conservatives made the RPI the official measure, the Bank of England would still be looking at CPI when deciding monetary policy.

If the government has an inflation target of 2% and RPI shows deflation, this indicates the Bank should be increasing its monetary stimulus significantly more. But, at the last meeting, they paused their policy of quantitative easing

Also, when interest rates rise, (and this could be at the end of 2009 early 2010), RPI will rise much faster than CPI. To target RPI of 2% when mortgage payments are rising could be a mistake causing monetary policy to be too tight.

Overall

It makes sense to look at both inflation measures and bear in mind changes in the RPI can be misleading to the state of the economy.

Even if RPI beacme the official measure of inflation I don’t think monetary policy would change that much because policy makers would still be looking at both.

“the CPI excludes housing costs”

A half truth, at best. The CPI sample uses what is called rental equivalence when determining price change for owned units, imputing changes in owned housing unit prices from the monthly rent of rented housing units with similar features located in the same area.

This is because the goal of the CPI is to come up with a measure of the cost of “shelter,” and to isolate the actual consumer price of a home from the price of a home’s investment component. The way the CPI sees it, when you purchase a home, you are in a sense buying two things: an actual means of shelter (“a roof over your head”), and an investment asset that can increase or decrease in value over time. The CPI avoids having its shelter index subject to changes in the the latter of these two components by imputing its owned housing prices from the cost of rental units.

Also, saying “the CPI excludes housing costs” encourages another misintepretation: that the CPI does not deal with any costs related to housing. This is untrue, the CPI prices a broad array of housing-related items, everything from maintenence services and gardening costs to furniture and bedding.

I suggest you be a little more careful in your wording.

thanks, I usually refer to mortgage interest payments as the difference, have updated. I was listening to BBC recently and they were referring to it as housing costs, and probably picked it up there.