2022 was a shocking year for the world economy, with the Ukraine war pushing up inflation and oil prices, causing economic disruption and lower growth.

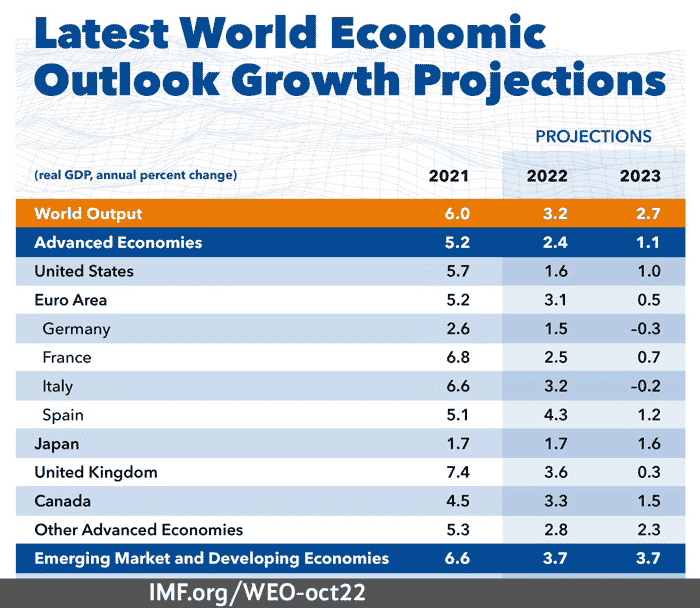

But, the IMF and World Bank predict 2023 will be even worse with major economies being pushed into a recession by the twin pressures of high inflation and high interest rates.

Kristalina Georgieva of the IMF states a third of the world will be in recession in 2023, making it the third worse year since 1991.

Yet are their forecast of small declines in GDP actually too optimistic? Could the recession be deeper than the IMF’s cautious forecast? Will recessionary pressures explode underlying threats such as high debt, low productivity and ageing populations?

Or is it the case that with falling inflation, the worse could soon be over?

Why Recession

Firstly, why is recession forecast? Why are economists so united about the inevitability of recession – Across the developed world, consumers face an unwelcome combination of higher inflation, falling real wages and higher interest rates.

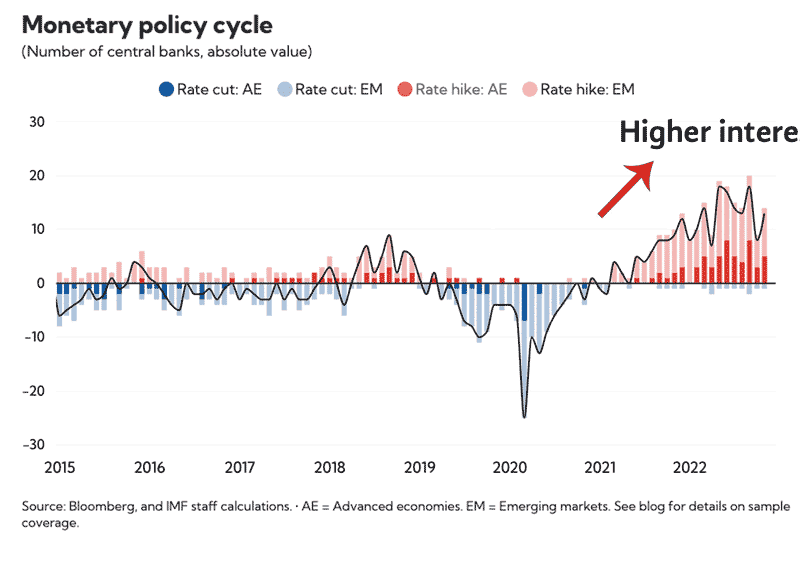

Central banks are expected to increase rates to almost 4 percent through 2023—more than 2 percentage points over their 2021 average. This raise in interest rates is a shock because it is 15 years since we had similar interest rates. The concern is that many businesses and households will struggle to adjust to the new climate because they had gotten used to an era of ultra low rates. Many plans were made on the basis of interest rates remaining low but now investment will be shelved and households struggle to pay mortgages.

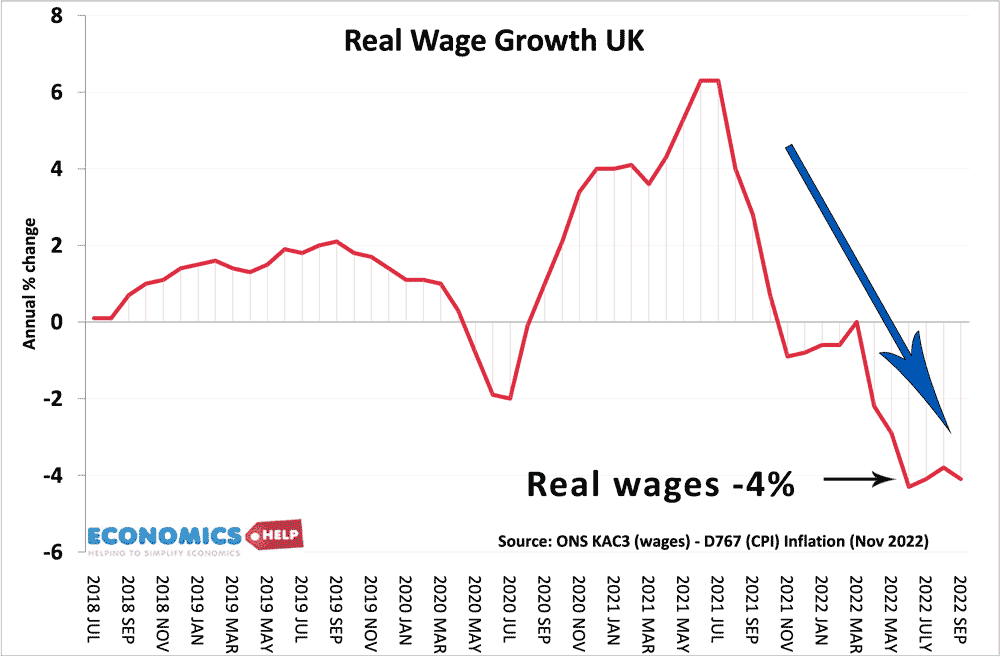

Secondly, real wages are falling at an unprecedented level – especially countries like the UK and Germany, who both face the prospect of deep recession. The falling real wages is leading to unprecedented strike action with workers trying to maintain the real value of their wages

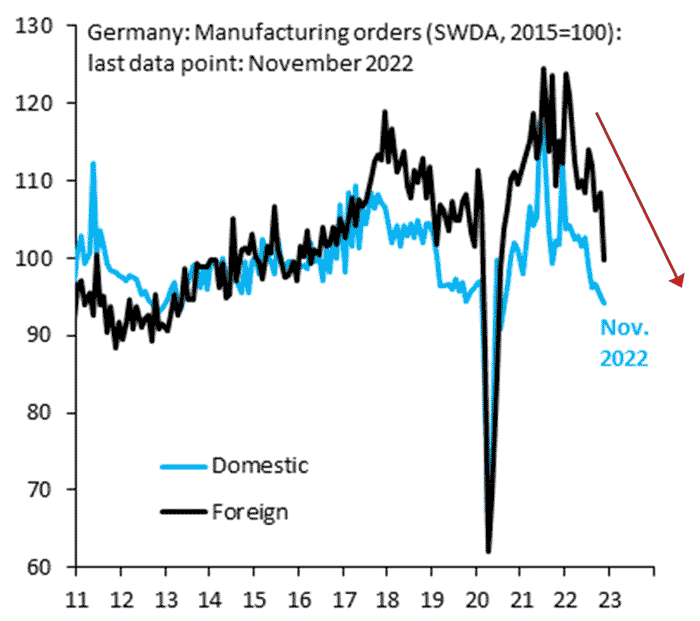

Thirdly, higher gas prices have caused the worst kind of inflation – higher costs, but lower demand. For example, Germany, one of the strongest economies in the EU, relied heavily on cheap fossil fuels from Russia. But, since the war, has stopped importing from Russia. But the cost has been higher energy prices and declining industrial output, which is pushing an economy reliant on manufacturing into recession.

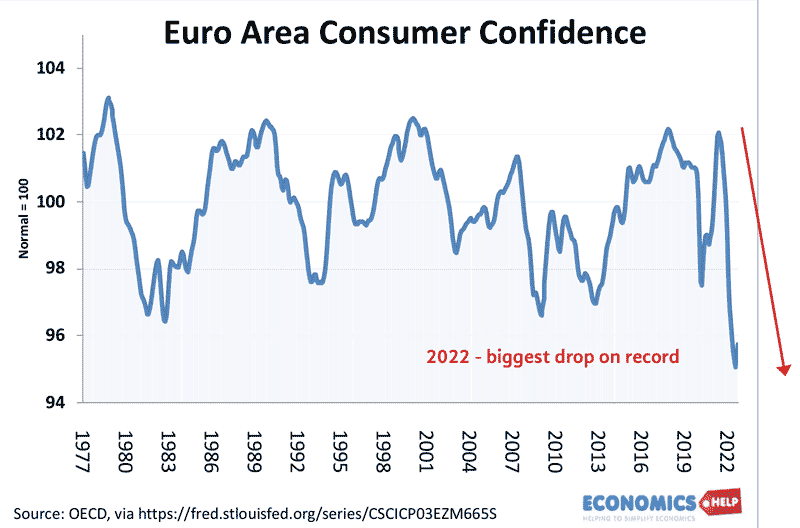

All these factors have caused greater uncertainty – and we can see this in sharp falls in consumer confidence, not only in Europe, but also the US which is seeing a similar fall in confidence. This will lead to lower spending and a fall in business investment.

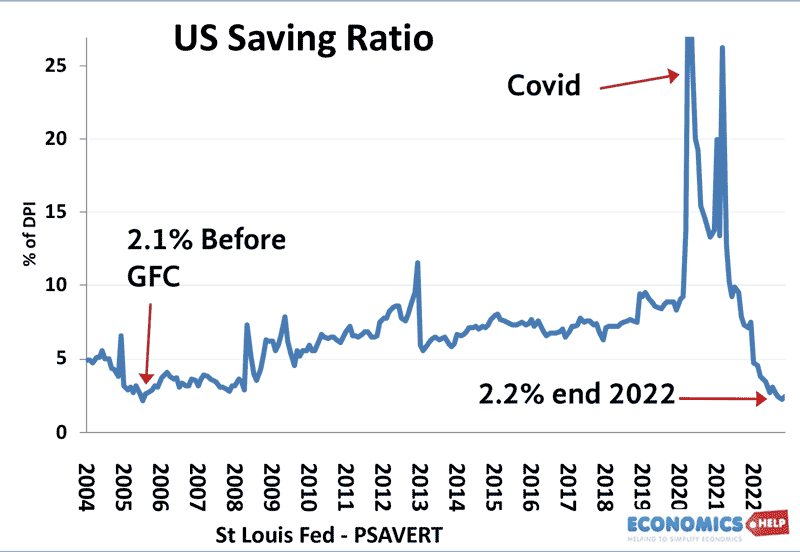

During Covid, the US generated record savings levels, but these are being quickly eroded by inflation and falling real wages. The US savings rate fell to lowest level since just before the financial crisis. It means many households have little room for manoeuvre when rate rise.

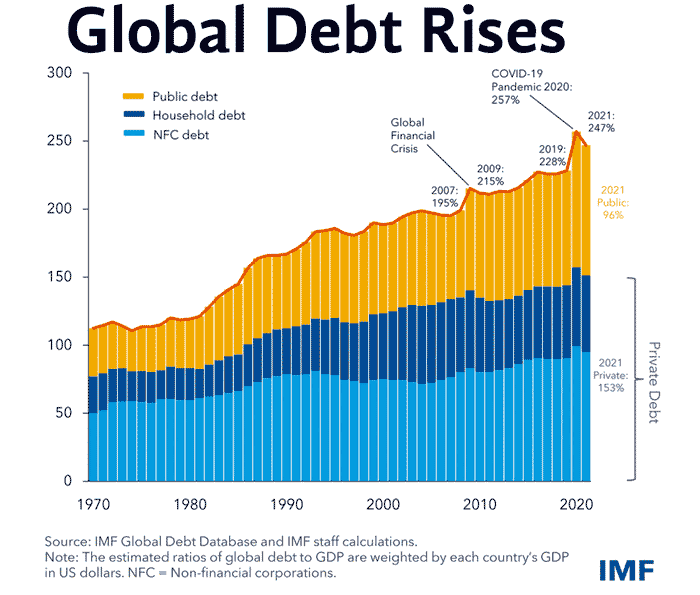

In Europe, the worst of the price rises were absorbed by government bailouts. But, this has come at a high cost of growing public debt that cannot be sustained. As the UK’s experience shows markets are now more concerned about debt, and this means there is little room for fiscal stimulus, despite the monetary tightening. What this means is that when we enter recession there is little room for economic policy. Interest rates can’t be cut because of inflation. Government’s have limited scope for higher spending and expansionary fiscal policy.

Reasons for recession

Big forecasters like the IMF and World Bank tend to make cautious forecasts and are unwilling to stick their necks out for dramatic changes. Some economists fear that 2023 could be much worse than forecasts suggests. This is because, as the economy moves into recession, it creates a negative spiral, that magnifies underlying weakness. Firstly, housing markets are overvalued around the world and higher interest rates is the tipping point to cause a big fall in house prices, which will inevitably cause lower growth.

Secondly, private and public debt have reached record levels following the great financial crisis, weak growth, covid, government bailouts all push up debt. A further downturn will worse debt positions and could lead to debt crisis like in 1982 where a similar recession caused problems across the world. This could be contagious as debt problems spiral. For example, Japan has public sector debt at 260% of GDP is very nervous about the prospect of higher interest rates

All these short-term pressures are on top of underlying problems, such as low productivity growth, global warming ageing population and geo-political uncertainty.

Whilst there is hope oil prices may continue to fall, the ongoing war in Ukraine is liable to caused continued upward pressure on oil and gas prices. Europe has survived so far by importing Liquid Natural Gas but a cold winter and continued economic conflict between Russia and Europe winter will make it hard to fill gas reserves for next year. Commodity price experts predict it will take several years for gas prices to return to pre-war levels. High gas prices are here to stay and this is bad news for European industry.

The strongest economy in the past few decades is China, but it also faces its own unique problems. A property market in disarray, house prices are falling and firms going bankrupt. It will be a real test for the Chinese government with the uncertainty of mass Covid cases disrupting the economy. And its not just domestic pressures, the war in Ukraine and the increasing authoritarianism of China is discouraging foreign investors as the new motto is “anywhere but China”.

Why this recession is different

This is a recession more grievous than previous recessions because the average worker is being squeezed from multiple angles, leading to an unprecedented fall in real wages. The good news is that the labour market remains strong with low unemployment and numerous vacancies. Pay is low, but jobs are available. But, this hints at an underlying weakness with labour participation falling post-covid, leading to lower productivity – a major problem of the past ten years. The consequence is that we are likely to get a low unemployment recession – a very rare occurrence.

Reasons for optimism

Given the wealth of bad news, why are forecast for recession at the moment quite mild? Is there any reasons for economic optimism. Firstly, inflation is expected to drop sharply during the first half of 2023. The record energy price rises from last Feb will drop away. Secondly, weak growth will moderate demand and keep oil prices below $100. Thirdly momentum in the US economy is relatively strong, unemployment low and a robust labour market.

Not all countries will enter recession. More hopeful sources of growth include India. India is set to be the most populous country in 2023 and is predicted to maintain strong growth of 6%, with access to cheap oil and growth of manufacturing and service sectors.

Uneven Recession

Another feature about the recession of 2023, is that it will be very uneven in effect. Some households especially young people renting or with high mortgages will struggle in 2023, but older households with smaller mortgages and more savings will be insulated from many of the recessionary pressures. It is a recession which will be very hard for low-income groups, but not everyone will feel the pinch in the same way. So the headline fall in GDP may mask the extent of the economic pain.