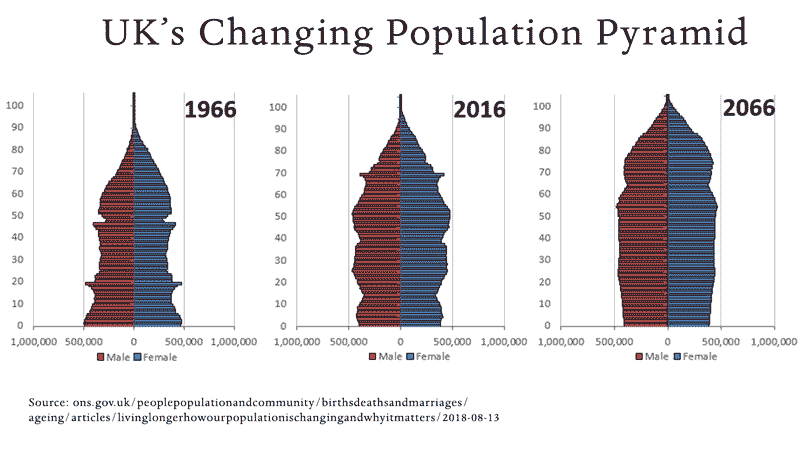

Countries across the world are ageing. We are living longer but birth rates are falling faster than expected.

The UK will soon see more elderly people than young adults. It is the same in the US with older adults more numerous than children by 2035.

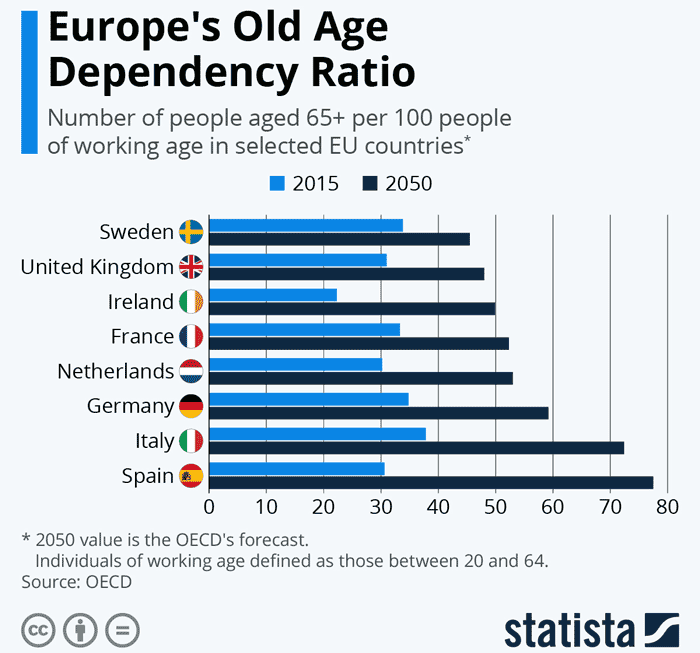

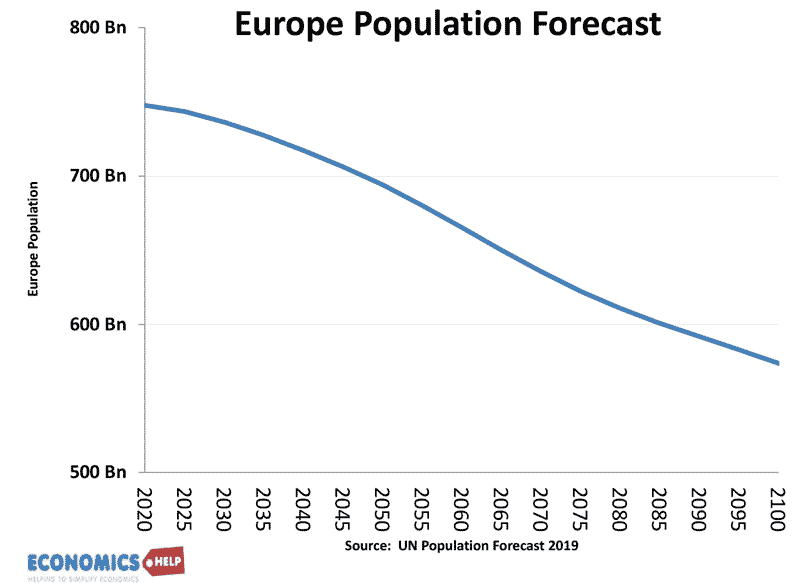

The population of Europe is forecast to fall by 175 million by the end of the century, with a sharp decline in the ratio of young workers to dependents. The dependency ratio will double in most advanced economies. An ageing population causes lower growth, more government spending, and places pressure on already weak economies. The IMF predict the effects of ageing will require a fall in consumption of 25% in China and 13% in the average high income country. But, is it all bad news, and can we learn to thrive with ageing populations?

Costs of an Ageing Population

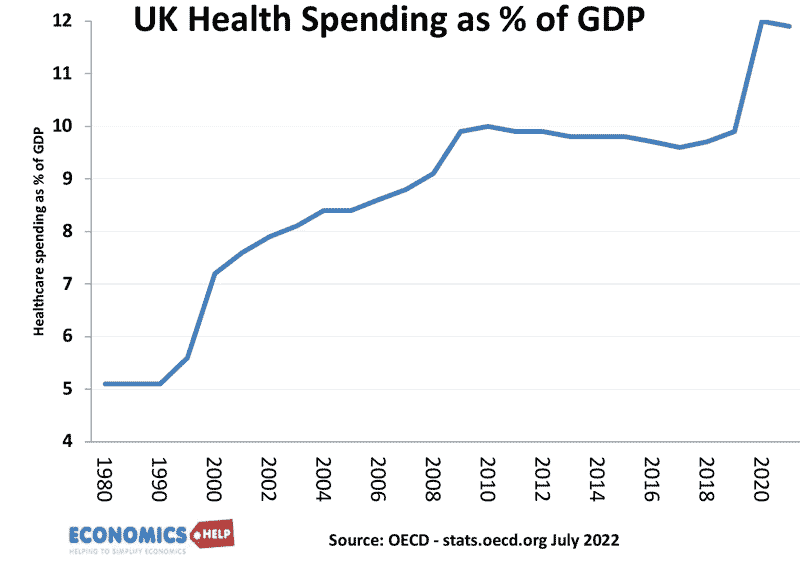

The first cost of an ageing population is more government spending – not just higher pensions, but higher health care spending too. Around 50% of health care spending comes in a person’s last year of life. Health care as a share of GDP has been rising in the post-war period, but with an ageing population will have to rise even further.

It is not just the effect of ageing but advances in treatment and more diseases of modernity. The impact is less spending, higher taxes and higher borrowing. Government debt has already increased in recent years.

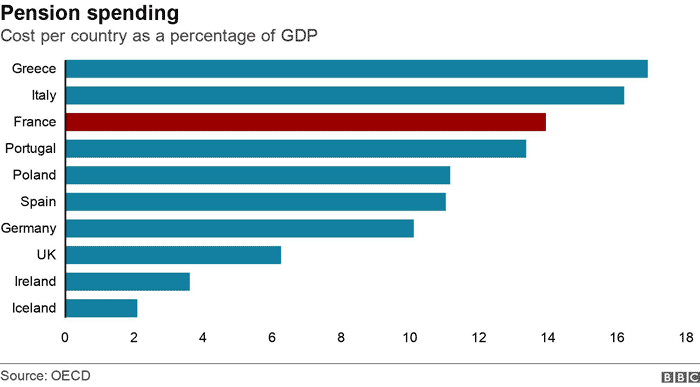

But whilst we have more people receiving pension, we will have a shrinking base of workers to pay income tax. In the post-war period, the rise in life-expectancy was fine because we could use economic growth to pay for more pension spending. But, since 2010, global growth has slowed down and that raises concerns of whether we can deal with the ageing population in the future. UK Pension spending as a share of GDP rose from 2% in 1950 to 8% in 2019.

Italy already spends 16% of GDP on pensions, with France on 14%. This will continue to rise, but will tax revenues keep up?

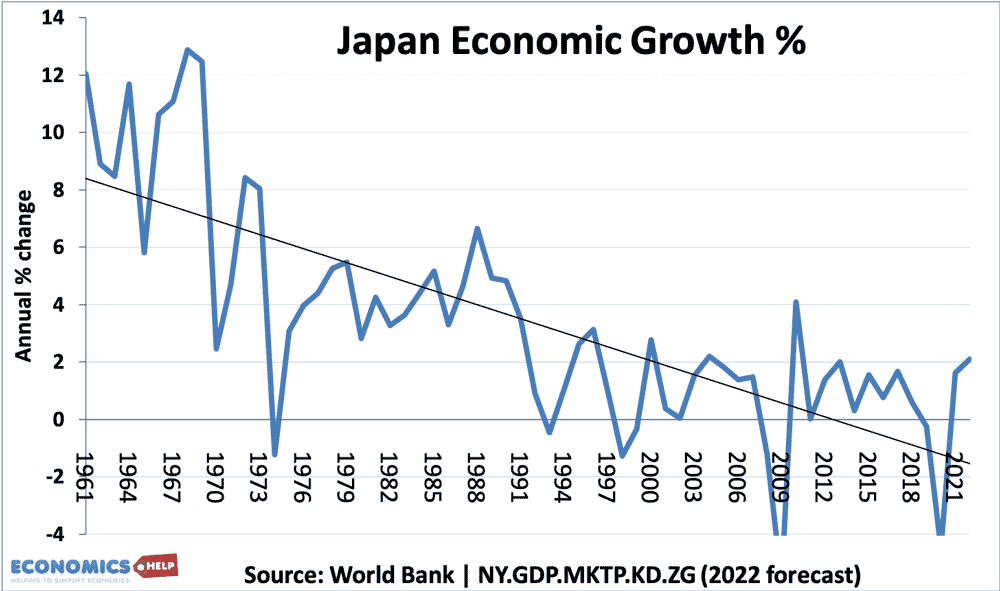

The problem is that an ageing population is of itself a major cause of slower economic growth. Case in point, Japan. Japan’s population was the first to age rapidly, it also has had sclerotic economic growth for over two decades. When a population is ageing, it reduces incentives for business investment and innovation. The elderly spend relatively less on shopping malls, entertainment and going out. Therefore, the need for investment declines. This creates a spiral of low growth, low investment and low productivity.

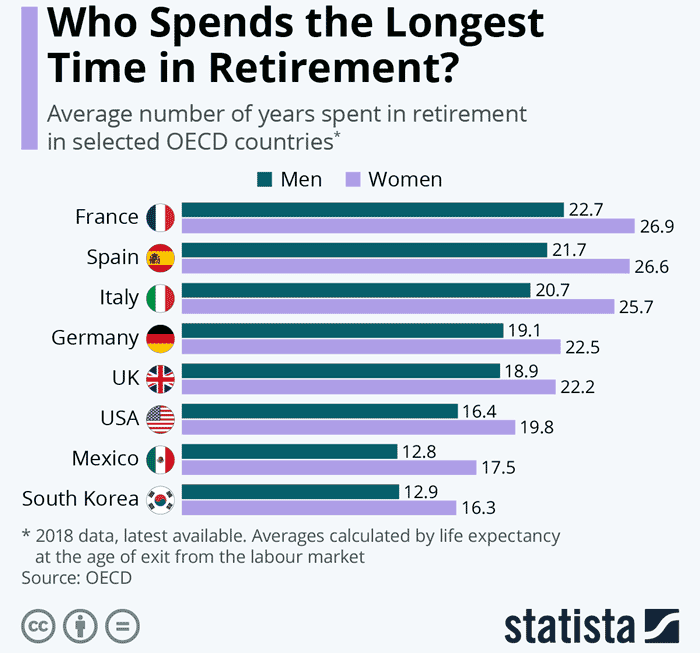

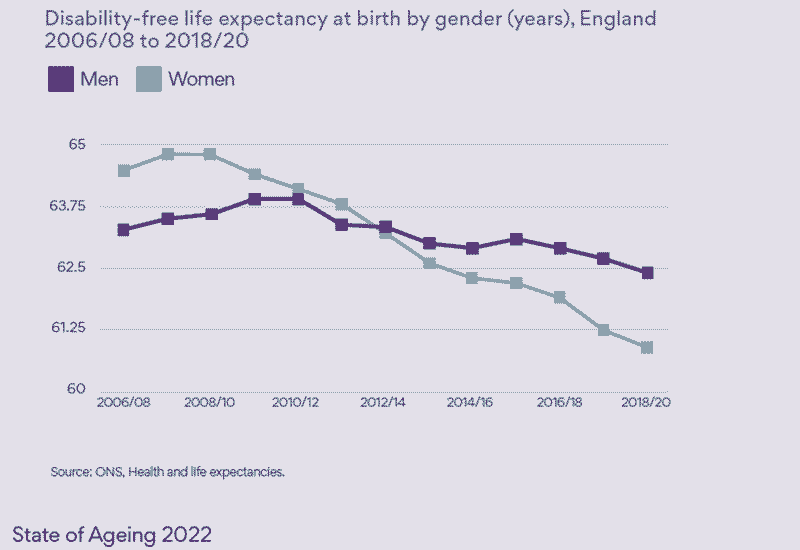

The problem is workers have expectations of retiring at an early age, and when governments try to change – this it is met with a backlash. The UK has already raised its retirement age and has plans for future raises to 68 – one of the highest in world. France by contrast is facing massive protests from its plan to raise the retirement age from 62 to 64. The problem with raising the retirement age is that rising ill-health is reducing the disability-free life expectancy of many. This can also vary by region, with health life expectancy ranging from 51 years in Blackpool to 71 in Richmond upon Thames.

In an ideal world, AI and robots will be available to take the place of young workers. But, in recent years productivity growth has stalled and is much less than we have hoped. As birth rates fall, the decline in the workforce is only going to get more dramatic.

Benefits of Ageing?

The one very considerable benefit of this trend is a fall in unemployment. Often the scourge of western economies, mass unemployment seems to be a thing of the past. With an ageing population, the young at least will have innumerable job opportunities.

Another potential benefit of an ageing population is that a relative shortage of workers should put upward pressure on wages and increase the incentive for firms to increase productivity. However, rather concerningly that has not really happened in the past 13 years. Whilst corporate profit rates have increased, median wage growth has lagged behind.

Ageing and immigration

It is not just the UK which has reported a shortage of workers, but many countries in the developed world. As this becomes more acute, it will over time create an incentive to encourage immigration. The easiest solution to an ageing population is attracting migrants. But, this itself has issues. Firstly there is the political backlash to high rates of migration, but perhaps more concerningly, in the future as working populations decline, we could increasingly see a global fight for young skilled workers. In Britain, the Brexit debate was dominated by concern over high levels of migration. But, in eastern Europe, there is the other side of the coin, with countries facing a mass exodus of young skilled workers, which exacerbates their population declines. For example, an estimated 8 million Romainians live outside their country. Labour flight is a real problem. Developing countries increasingly face a shortage of medical workers, attracted overseas by higher wages and the developed world’s need for skilled labour.

Impact of Ageing on Interest Rates

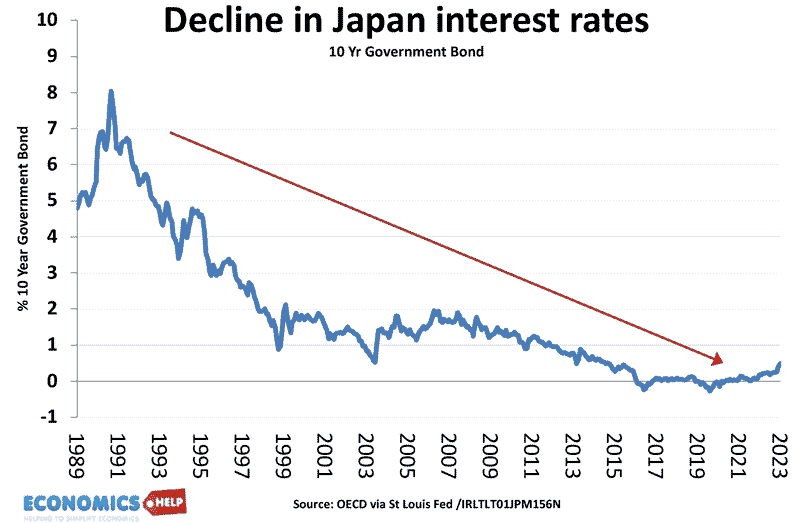

An ageing population has led to a decline in long-term real interest rates and this has important implications for equity, property prices and savings. Basically, elderly people have higher levels of savings and this excess demand for savings pushes down long-term real interest rates. We can see it in Japan, which has had close to zero interest rates since the mid 1990s. In 2023, interest rates rates rise due to inflationary pressures. But, the long-term trend over the next decades is likely to be down. This has a big effect on property prices.

Ageing and House Prices

The Bank of England claimed 90% of the rise in the house price-to-income ratio between 1985 to 2018 was due to low long-term interest rates. And ironically this rise in property values, benefitted most older age groups who saw relative growth in wealth compared to young people.

This is a concern. Whilst young people face higher tax burdens to pay for rising health care and pensions, they are facing stagnating real incomes and higher costs of living. Ironically, these cost of living pressures is in itself contributing to the ageing population, with economic factors and high costs of living as a major factor behind declining fertility rates.

However, whilst the UK has seen a rise in wealth inequality in recent decades. The Japanese experience also shows that when the ageing population magnifies and is combined with shrinking population, there is scope for a fall in land values, and property values. Since 1990s, Japan has experienced a 60% fall in house prices, though they have recovered somewhat since 2010. If the European population does fall by 30% in the next century, it will have a major effect on property and land prices and could lead to cheaper asset values.

Whilst significantly cheaper house prices may not seem on the horizon for many western countries, an ageing population and declining populations have the capacity to fundamentally alter things like house prices, wages and land value.

Changing Economies

An ageing population will also lead to fundamental changes in spending patterns, which can affect the economy. More demand for social care, less demand for pubs and clubs in the centre of town. There is a risk, the social hubs of towns can be affected, unless the change in demographics can be catered for. The Economist highlights this Japanese town of Toyama which is adjusting to its ageing and falling population – by turning old schools into old folks centres and making the city smaller, denser more compact and less car-reliant.

Another factor of the ageing population is that we will see big changes in global populations. The western world will see declining populations, whilst sub-saharan Africa will continue to increase its population. This year, India’s population exceeded China and China will soon see a dramatic drop in its population The Russian population also faces a major decline, As life expectancy plummets due to covid, war, ill health, and this comes on top of one of the lowest fertility rates in the world.

Ageing and Perception

We tend to see an ageing population through a negative lens, but it is not all doom and gloom. Firstly, there is an issue of perception. Older people may be less dynamic but can still offer much to society, either through work or social care, e.g. grandparents offering childcare support. Old age can bring knowledge and wisdom. President Biden shows that an octogenarian isn’t necessarily past working. A big issue is that the experience of old age can vary tremendously depending on health and quality of life. A concern is that an ageing population, plus a rise in long-term sickness pushes people out of the labour force even before the statutory retirement age. But, on the other hand, there is still scope for new technology that can give many solutions to help provide care for old people and hopefully provide a better quality of life in retirement, which raises the scope for people working part-time later into life.

One thing is for sure, an ageing population will require a large change in attitudes and the distribution of resources.

Further reading