As elections loom, the Turkish economy is facing a self-inflicted economic crisis of high inflation, and a cost of living crisis that dwarfs what we see elsewhere in Europe.

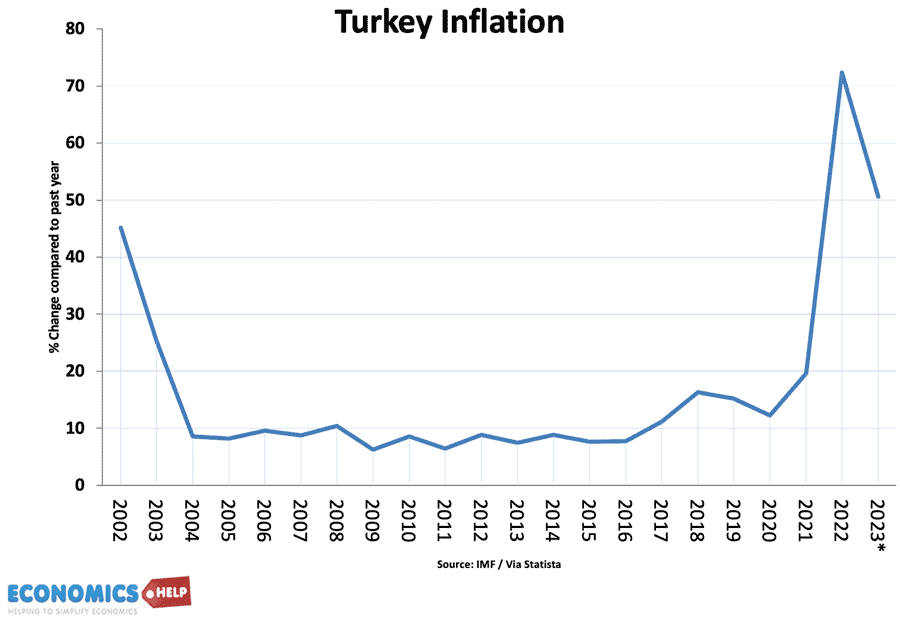

In recent years, Turkey has seen inflation rate surge to over 80% – leaving over 53% of people in Turkey unable to meet their daily expenses. Yet, as we shall see this is largely a self-created crisis from the unorthodox policies of the government, a reminder of how political short-termism can have devastating effects. Why did things go so wrong in Turkey? and how bad might they get?

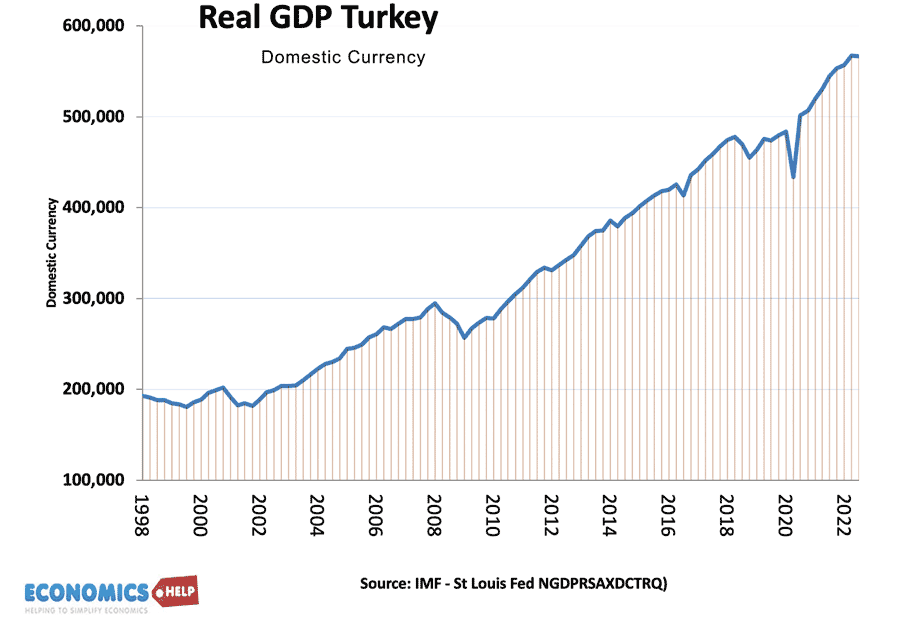

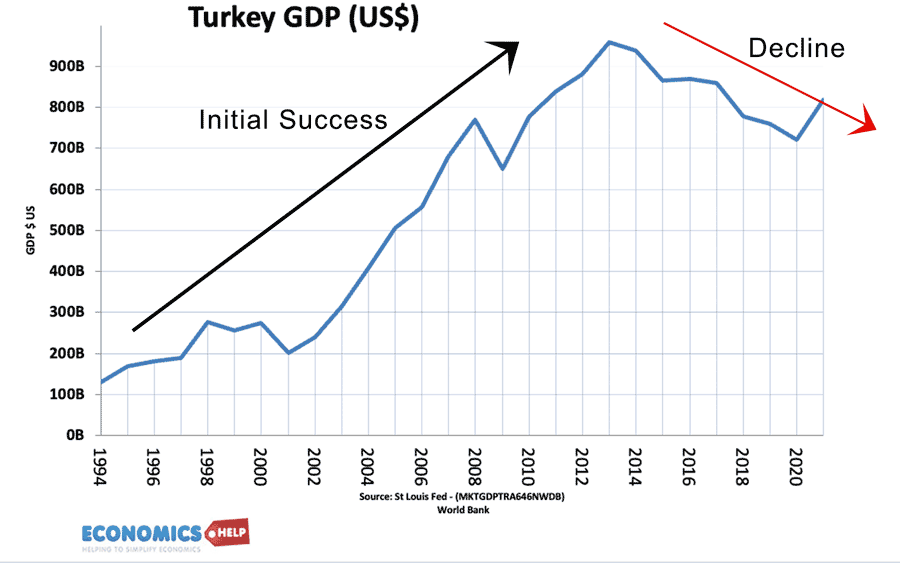

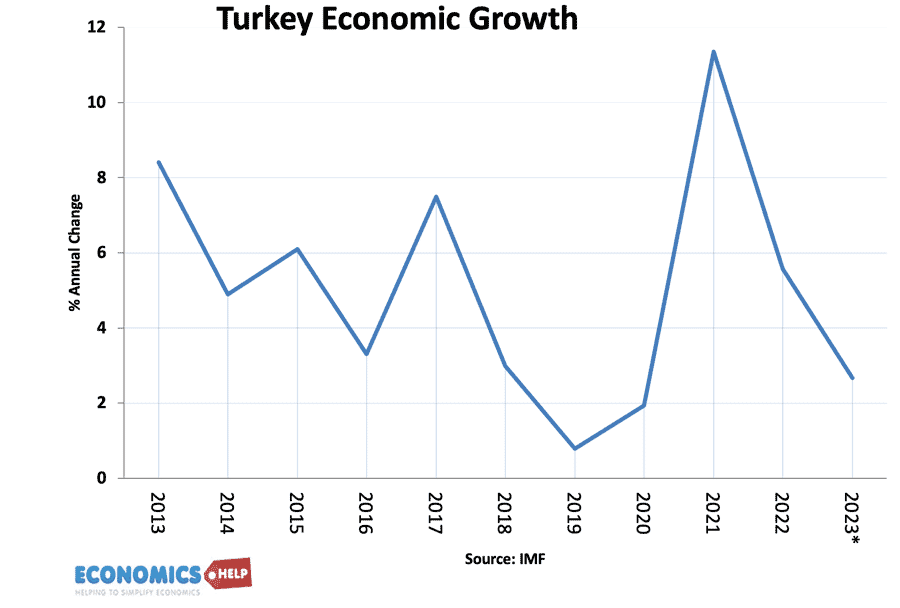

In the past 20 years, Turkey’s economy has posted impressive economic growth figures, causing many to experience rising living standards and providing a base for Erdogan’s electoral support. However, from 2018, the strong desire for higher economic growth caused Erdogan to ignore the advice of economists and pursue a very unorthodox approach to the economy.

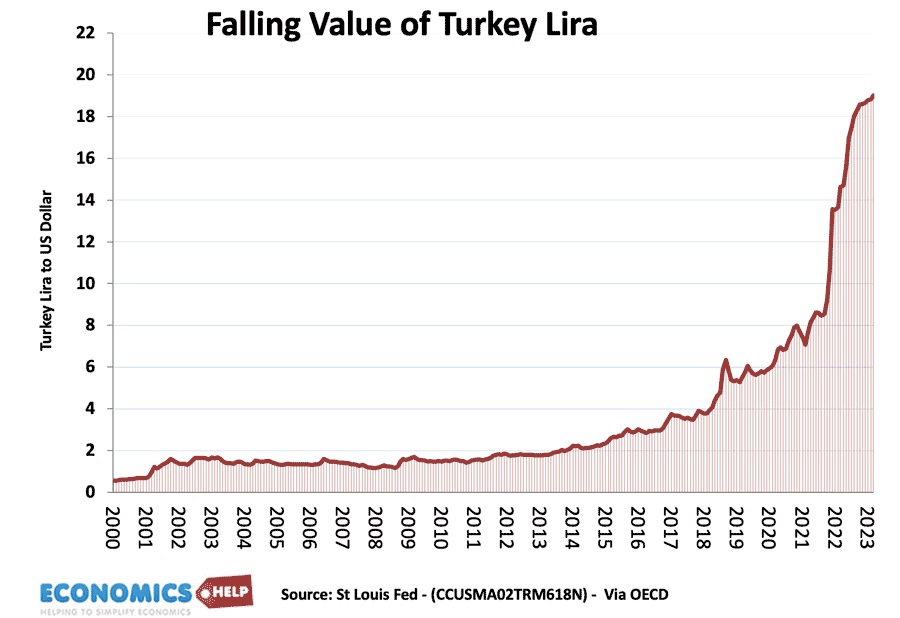

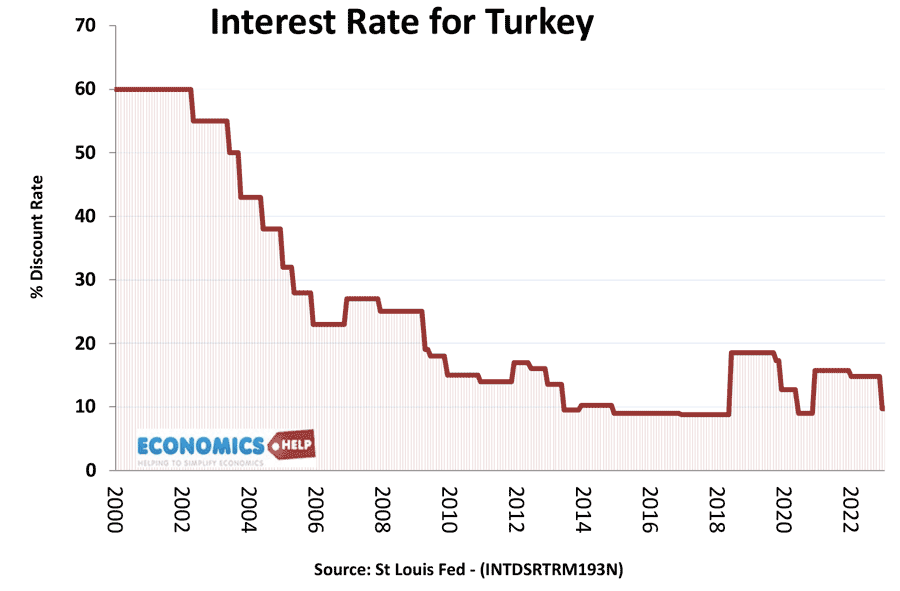

Rather bizarrely, Erdogan blamed Turkey’s high inflation on high interest rates, and claimed that high interest rates only make people poorer. Ignoring advice he sacked three Central Bankers and effectively ran the economy by personal dictat. But, the economic effect of cutting interest rates in a time of inflation, was to predictably further stoke inflationary pressures, and as he explained his new economic policy live on TV, it led to an immediate slide in the Lira. Once falling 15% during a single tv address.

A sharp cut in interest rates – well below the inflation rate – gave Turkey the cheapest borrowing costs of anywhere in the OECD. This led to strong investment and higher consumption.

Nominal interest rates

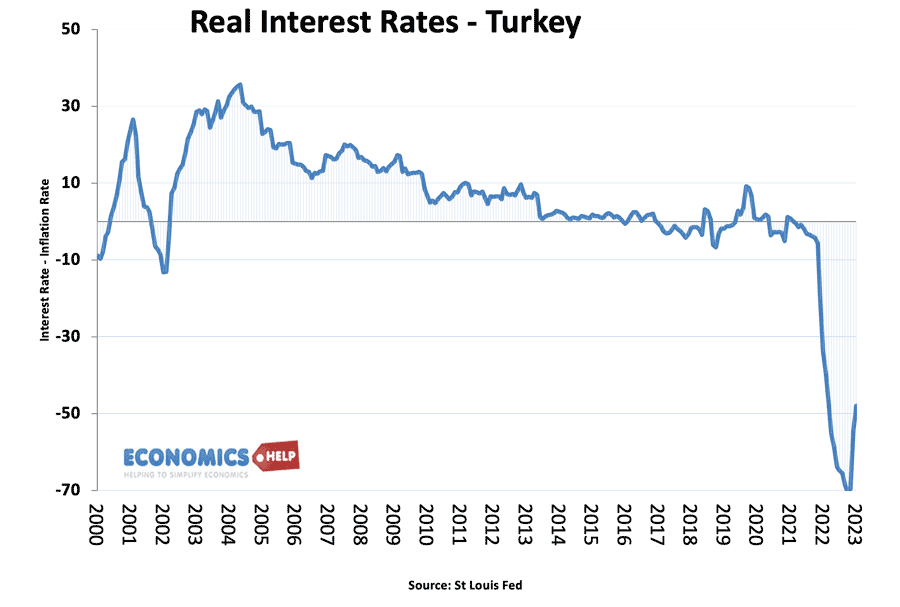

Real

Real interest rates adjusted for inflation.

However, this increase in borrowing and cheap money only stoked inflation further. Inflation was devastating for the middle class with workers shocked to see grocery and energy bills doubling in a short time. To put it into context, Turkey’s inflation is like the UK or US’s inflation, but at least ten times worse. The result is that savings are quickly being eroded and wealth evaporates, leaving a trail of uncertainty and confusion. When inflation is so high, it also leads to other costs with frequent haggling over prices and supply contracts. In response the government have increased the minimum wage and pensions, but although seemingly generous they were soon eroded by inflation.

Costs of Inflation

Erdogan claimed high interest rates hurt the poor the most. But, the truth is that it is inflation that really damages the well-being of the average worker. Big business and the better connected have been able to insulate themselves from inflation to some extent, by holding foreign currency or buying tangible assets, such as land and property. But, for many poorer workers, this inflation hedge is not viable. Instead, workers are struggling to pay their bills and getting into debt. Goods once seen as basic items, have become luxuries. Super high inflation has also led to a brain drain with the most skilled workers seeking better conditions and stability abroad.

The inflation has had a predictable effect on the Turkish Lira causing a rapid devaluation. As the currency weakens, this pushes up the price of imports. And for an energy importer like Turkey, this was devastating. It has also made Turkey more dependent on cheap energy from Russia. Due to its dire economic situation, Turkey has not taken part in sanctions on Russia but continues to buy Russian oil and coal at a discounted price.

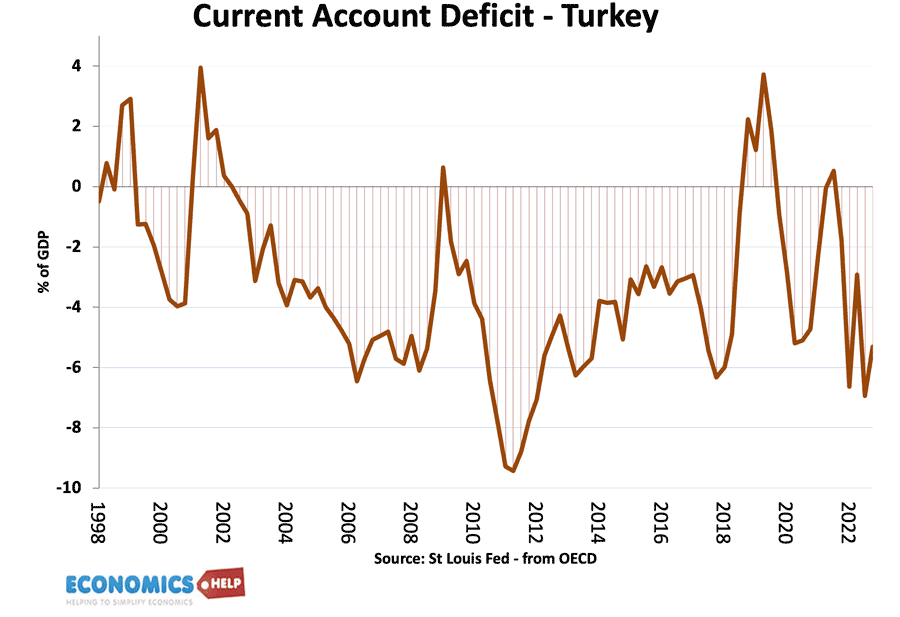

But, Turkey’s problems get worse. It has also a persistent current account deficit, which means Turkey is a net importer. This reflects both high consumer demand for imports and also its poor industrial competitiveness due to high inflation and an underdeveloped exporting sector.

The Turkish government hoped its policy of cutting interest rates and devaluation would enable it to emulate China’s economic miracle of strong export growth. However, this has been an abrupt failure. In a period of high inflation, the benefit of a falling currency to boost competitiveness tends to be very short-lived. Economist Cevdet Akcay, explains that exporters “have become exchange-rate addicts “They were ecstatic at first, but now they’re complaining again.” This is the problem of relying on devaluation to improve exports, it is only very temporary and doesn’t address underlying productivity.

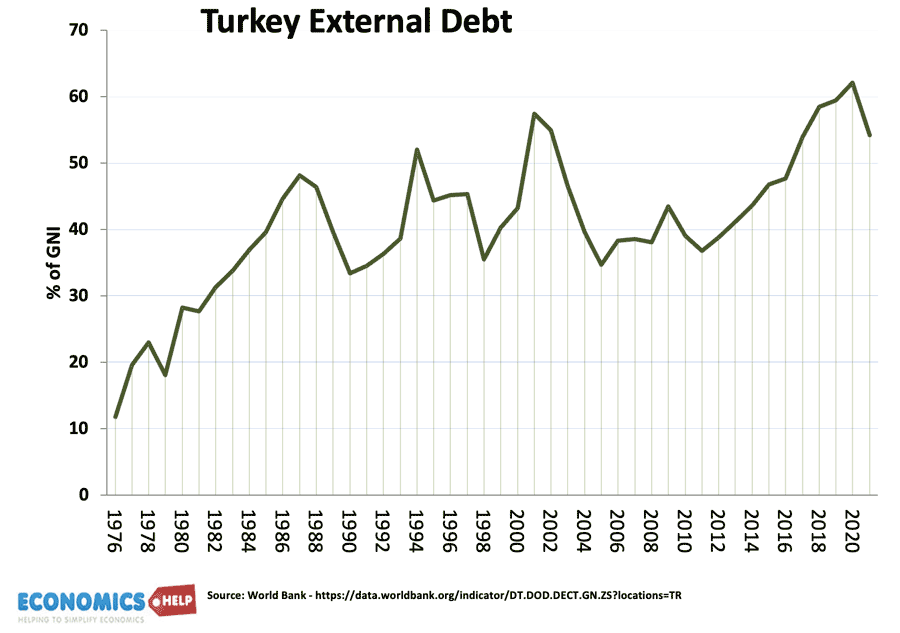

Turkey also has a growing external debt, which has become increasingly difficult to finance Because the devaluation has increased the effective cost of foreign debt interest repayments.

The large Turkish current account deficit also means it needs to attract capital flows to finance the deficit. Turkey needs to find approximately $200 billion a year to fund its current account deficit and maturing debt But after attempts to shore up the currency, the state only has limited foreign currency reserves of just $85bn.

It makes Turkey vulnerable to relying on credit from energy producers like Russia and Qatar. Last year it received $25bn in informal funds. I.e. mostly credit from Russia, but this is unsustainable.

Turkey has been trying to tread a fine line, the meeting point of east and west. Attracting the best of Europe and Asia. However, Erdogan’s increasing authoritarianism, high inflation, falling currency and perceived closeness to Russia have made western firms more reluctant to invest in Turkey.

The result is all the classic signs of an economy vulnerable to capital flight. Devaluation, external debt and weak growth could all cause Turkey to default like Sri Lanka did recently.

One strategy Turkey has toyed with is to be a hub for reselling Russian coal, oil and gas. In theory, Turkey can buy Russian oil at discounted prices and resell to the rest of Europe. But, Europe is committed to a long-term rejection of Russian energy and find alternative sources. The recent falls in oil and gas prices have eased the crisis in Turkey, but have also made the EU’s plan to move on from Russian energy more realistic.

Despite all these economic problems of inflation, devaluation and higher living costs, we can be surprised to see the current economic growth in Turkey as quite high. There are a number of explanations – the whole point of an ultra low interest rate policy is to provide a temporary boost to consumption and investment. It is very cheap to borrow this encourages spending. And therefore, we get short-term growth. Secondly, when inflation is high and eroding the value of your money, you might as well spend it as soon as possible.

The problem with this high consumption is that it is not sustainable in the long-term. It is like a sugar-rush of energy from eating sweets. It provides a rush of blood sugar, but when the injection expires, you are left with low energy. The usual after-effect of this kind of artificial consumption boom is a painful readjustment and recession. It is somewhat reminiscent of the late 1980s Lawson boom in the UK. Where high confidence and rising asset prices, led to a boom in consumption, current account deficit and rising inflation. But the hangover from this super-charged boom was a painful recession.

In the short-term, Erdogan is running the economy to give the highest growth for the upcoming election. But, the failure of the economic strategy is that the inflationary growth has imposed very significant costs on potential voters. The problem is that after the election there is likely to be a reckoning as the high levels of consumption cannot be maintained given the very high inflation.

Reasons for Independent Central Bank

It is one reason why we have an independent Central Banks. It reduces the temptation for politicians to pump prime the economy just before an election. But what happens next for Turkey? The Erdogan government have effectively given up on inflation. But relying on low-interest rates to boost growth is at best a short-term policy, and there is no evidence it has led to long-term investment. And on top of all these problems, the devastating damage from the earthquake earlier this year could cost up to $80 billion bn or 10% of GDP to repair.

To reduce inflation, will almost certainly require higher interest rates and an economic slowdown. It will be a painful process.

The only silver lining is that Turkey has had periods of high inflation before and despite all the current costs, has a strong entrepreneurial spirit for maintaining business despite these problems. But, the current inflation is a very real problem for the majority of Turkish people, reducing living standards and damaging the long-term prospects of the economy. It could prove pivotal in the upcoming presidential elections.