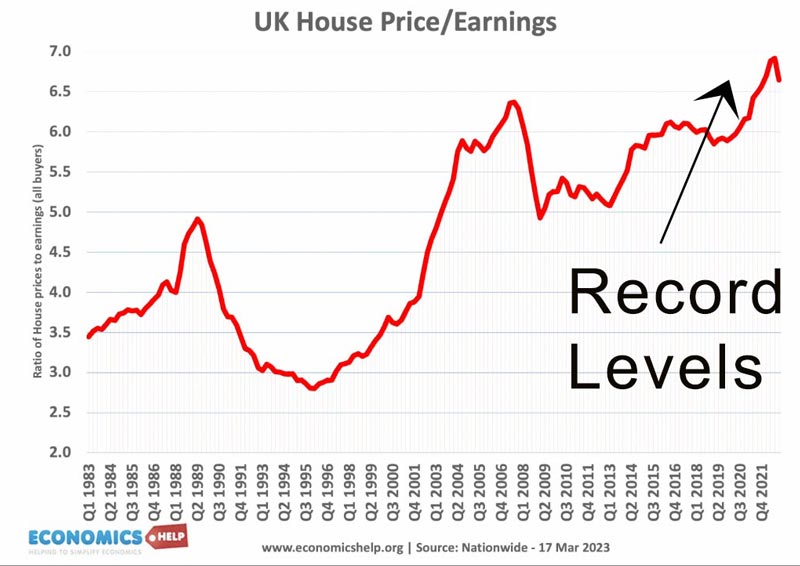

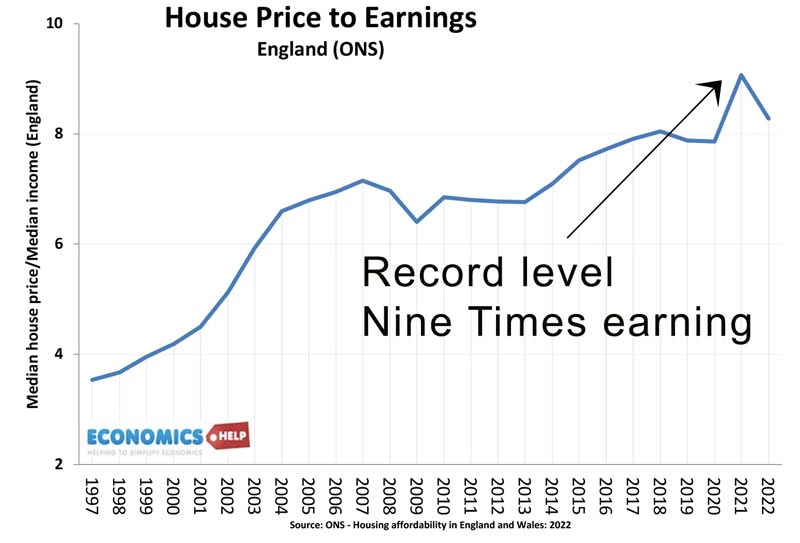

Last autumn, UK house prices reached record levels – with the highest price to income ratio since the nineteenth century.

And just at this moment, the Truss/Kwarteng budget sent mortgage rates soaring – it was a shock to a market heavily reliant on ultra low-rates. This combination of factors was the perfect trigger for a fall in house prices – at the height of the Truss craziness, it looked like we could see a very real crash as mortgage rates topped 7%. But, despite the economic pain of higher mortgage rates, at least there was a silver lining that we might return to a fairer housing market, affordable for most workers. After limited falls in recent months, there are still some who fear prices will be kept artificially high, and we will be left with a housing market, in an even worse state than ever before. We will look at what is continuing to prop up the market and also why it is premature to say the house price crash is over and why there is likely to be further falls in house prices.

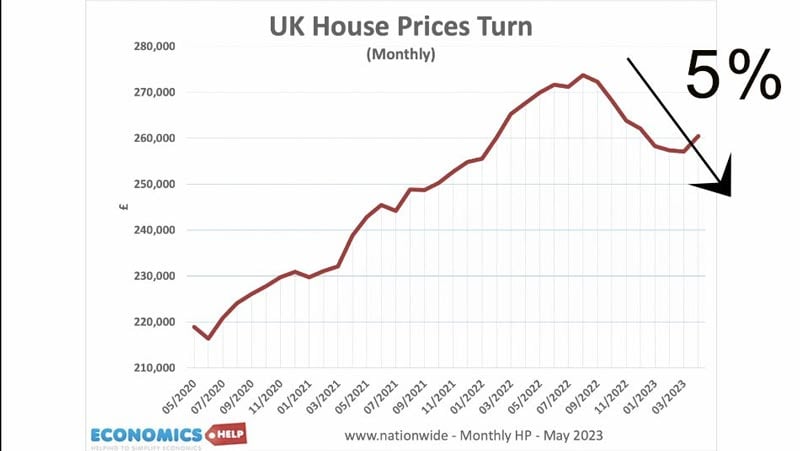

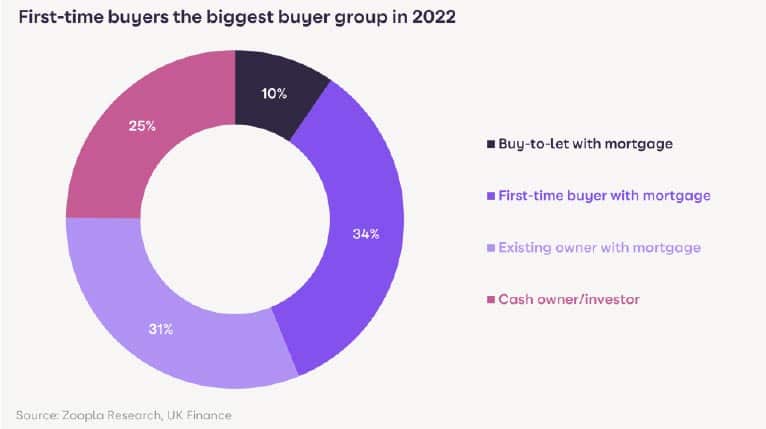

The past seven months have seen a partial correction in house prices with Nationwide showing prices falling 5% and 11% adjusted for inflation. Yet, March saw the first monthly rise since September last time years and it has led some analysts to claim this might be it. For example, Zoopla/Hometrack claim demand from first time buyers is surprisingly strong despite higher interest rates and they are quite bullish about house prices.

Factors pushing down prices

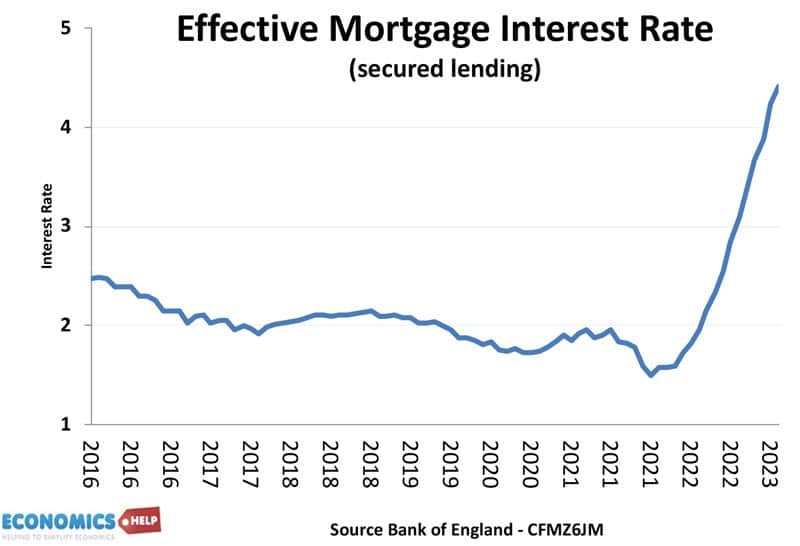

Well, firstly, there are many good reasons to expect falling prices. Mortgage rates are at least double last year. The effective interest rate paid by first time buyers continues to rise.

Given a continued squeeze on living standards and falling real wages, this is pushing up the percentage of mortgage payments as a share of income. They have risen to 37% of disposable income and could continue rising. In London and the South, the rise is more extreme, with 60% of Londoners pay going on mortgages. This is usually a trigger for a fall in demand, as buying a house becomes unaffordable. The high prices we have also means even seamingly modest interest rate rises are having a much bigger effect than in the past. At the risk of simplification, 5% is the new 10%.

If we look at house price to income ratios, we can see they reached a record level in 2022, and have only seen a very small fall. House price-to-income ratios are still much higher than before the 2007 crash. If we use the ONS measure of house price to incomes, it is a similar story.

What is preventing bigger falls?

So why are prices not falling further and faster? Firstly, just because we would like house prices to fall and become affordable, doesn’t necessarily mean it is guaranteed to happen. We have to be careful of avoiding wishful thinking. In the UK housing market there are a few reasons which deter prices from returning to normal levels.

The first reason is political. With an election around the corner, the government doesn’t want to enter an election with falling house prices – the negative wealth effect can be a major vote loser. In a bid to help first time buyers, the government are proposing a return of the “Help to Buy” scheme. Effectively a way to try and help people get bigger mortgages and be able to buy despite very high prices. Conservative Home had a good article on right to buy, they quote a government source as saying.

“If we can’t do anything on housing supply we are going to have to do something on affordability.”

So we must laugh, if only to keep from weeping.

The government have abolished housing supply targets because of NIMBYism. The result is a sharp fall in house building and a continued shortage of housing, which only worsens the underlying house crisis. Help to Buy is in a many ways a terrible solution to the housing crisis. Rather than tackling the cause of unaffordability, it seeks to give a lucky few a very expensive route onto the property ladder. But, it just means that first time buyers are taking out longer mortgage terms, higher mortgage debt, something which will only their hamper living standards of homeowners for a longer period. A return of help to buy will just delay or push back a more healthy correction to house price affordability.

Yet, support for homeowners and potential homeowners is a key part of political DNA. Come the election and the main parties will be fighting for the label of being homeowner friendly. But, the real policies of being friendly to first time buyers and renters would involve different strategies to building and increasing supply not schemes to get bigger mortgages.

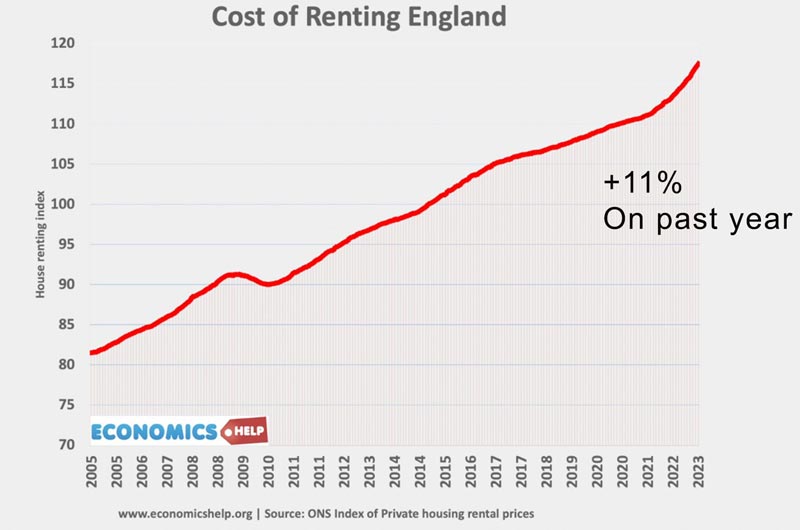

Another reason for the unexpected strength of demand from first-time buyers, is the surge in the cost of renting. Rents have increased 11% in the past years. And the result is that despite rising interest rates, many make the calculation it is better to be paying 40% of your income on a mortgage than 40% of your income on renting. With some private landlords leaving the market, renters are facing an acute shortage of available properties. The result has been a fight for properties, pushing prices even further. Buying a house is definitely unappealing in the current climate of high deposits and high mortgages, but renting is still viewed by many as even more unappealing.

The housing market has caused a widening of intergenerational equity with the result many parents have been helping their children with renting costs or buying. If you were giving support to your children to be able to pay the rent, it is understandable why you would be willing to give a deposit to buy a house. This rise in the bank of Mum and Dad and wealth is one reason for the long-term rise in house price to income ratios and why house prices are being propped up at unaffordable levels.

Homeownership is seen as so desirable compared to the other options, that there has been a change in attitude amongst first-time buyers. Increasingly first-time buyers are choosing longer mortgage terms. (By the way, I took out a 43 year mortgage in 2005, the longest possible). But, it does mean much higher interest rate costs over the term of your mortgage. It’s another way we are propping up the overvalued housing market. The concern is that it encourages buyers to overextend themselves and makes them vulnerable to any future rise in interest rates.

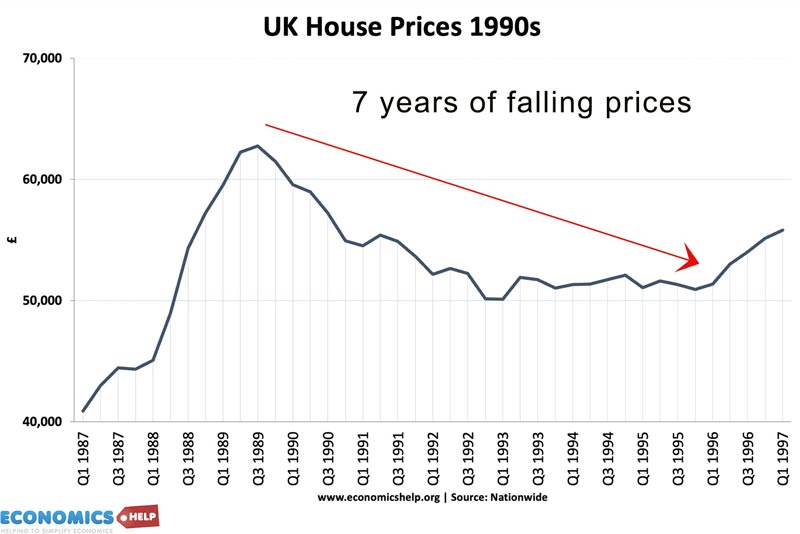

Another reason to factor into the housing market is that sellers are notoriously reluctant to drop asking prices. This is partly psychology. If your house is valued at £270,000, we don’t like the idea of selling at a ‘loss’ If you look at say the 1992 crash, it took considerable time for house prices to fall. But, the fall and later stagnation in prices lasted a long-time. Between 1989 and 1996 house price to incomes fell from 5 to 2.7. It was a dramatic improvement in housing affordability over seven years. But, it is hard to see anything similar today.

Another factor limiting nominal house price falls, is the fact we still have inflation of 11% and rising nominal wages. Even if house prices stagnated, inflation is effectively improving affordability, even though it is not so noticeable. Inflation was a big factor in the 1970s and early 90s house price corrections.

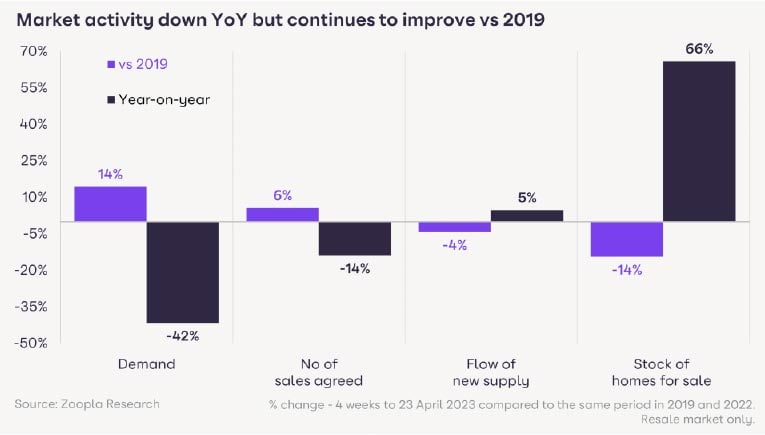

A final point about the current situation, is that although 800,000 homeowners face considerable rise in interest rates this year as fixed rate mortgages need renewing, it is unlikely to lead to a rise in distressed owners selling. Mortgage criteria were tightened post credit crunch, meaning that most homeonwers will not be forced into selling, even if it will reduce disposable income. This contrasts to say 1992 or 2007, where the rise in interest rates did lead to higher repossessions and more people selling. One feature of the current market is the lack of homes for sale. Volumes are still relatively low and this relative shortage is keeping prices higher than they otherwise would have been.

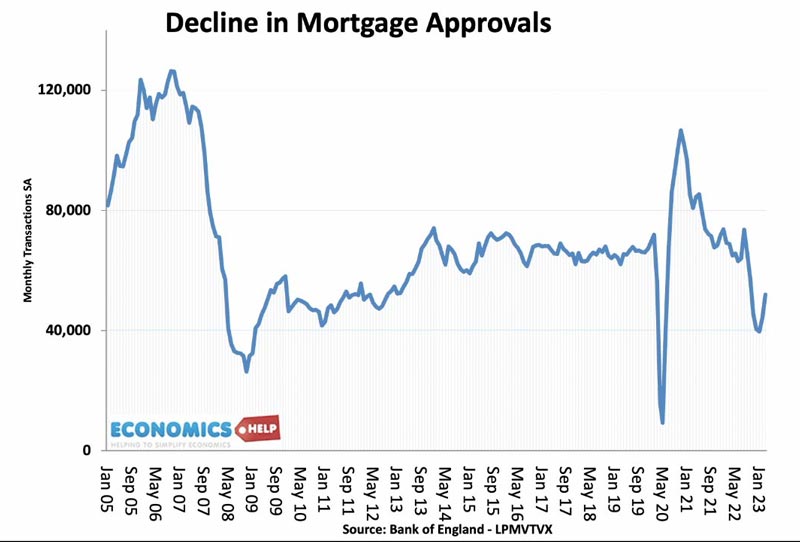

However, despite these factors propping up house prices, it would be a mistake to declare all price falls are over. Firstly, homeowners will take time to adjust to the new climate of a buyers market. Secondly, effective interest rates are still rising and there are credible reports that many households are struggling to get a mortgage – even with relatively high income and good deposit. The mortgage rate effect has not been fully felt by homeowners and prospective buyers. Thirdly Bank of England stats show mortgage approvals and mortgage lending are at a low level. Despite a small recover in the first quarter of 2023, excluding the pandemic shutdown, it is still close to the lowest level since 2009.

A key factor that will determine house prices in the next 12 months is the trajectory of interest rates. UK inflation has been surprisingly stubborn staying at above 10% for a considerable time. It will undoubtedly fall later this year as energy price rises fall out of the index. But its stubbornness may motivate the Bank to have one final increase in interest rates, which is definitely bad news for the housing market and house prices. But, perhaps more important than the next rise is whether interest rates of 4-5% are here to stay. If they are, there will be a continued readjustment from not just homebuyers but buy to let investors and the commercial market.

Finally, the IMF warn that European house prices are vulnerable to disorderly falls as continued inflation makes markets re-evaluate interest rates – “Empirical models linking house prices to their fundamental drivers point to an overvaluation of 15–20% in most European countries That is a reasonable view of the UK too – 15% overvaluation given current interest rates and affordability.

A return to price to income ratio of four, like the post-war average, would require a 25% fall in house prices in the next 12 months. However, this kind of quick correction is unlikely. The house price to income ratio is only one factor out of many. Resistance from sellers, a continued shortage of supply and the desperate nature of the renting sector are all propping up prices – even though there is a logic of prices falling.

The difficulty with predicting the UK housing market is that there are so many conflicting factors. There are several factors pushing down prices, but equally a few which are propping them up.

What I expect to happen is two things. Modest falls in nominal house prices combined with inflation will improve affordability to some extent. But, at the same time, the housing market will become increasingly unequal with only those with wealth and above average salaries able to buy and keeping price to income ratios higher than the past. We will get the worst of both worlds, a stagnating market and many households over-extending themselves to buy even at the inflated prices.

From one perspective the housing market is clearly overvalued, but at the same time, there are still lots of people wanting to buy into this overvalued market. It’s not a recipe for a happy outcome. If you liked this video, check this one out on why the housing market causes so many problems in the UK.