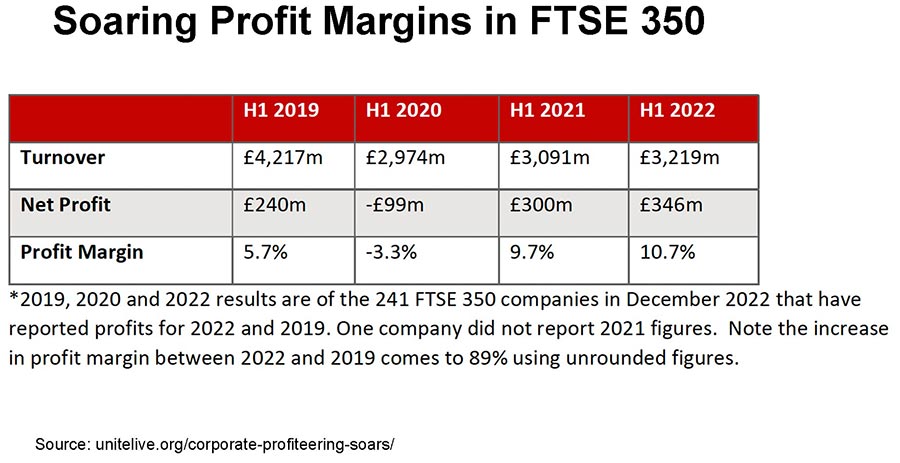

Greed Inflation is a term used to describe a higher inflation rate due to firms increasing their profit margins. In a period of high inflation, it becomes easier for firms to slip in rising profit margins too. Greed inflation is more likely in markets where firms have a degree of monopoly power and they can successfully increase prices.

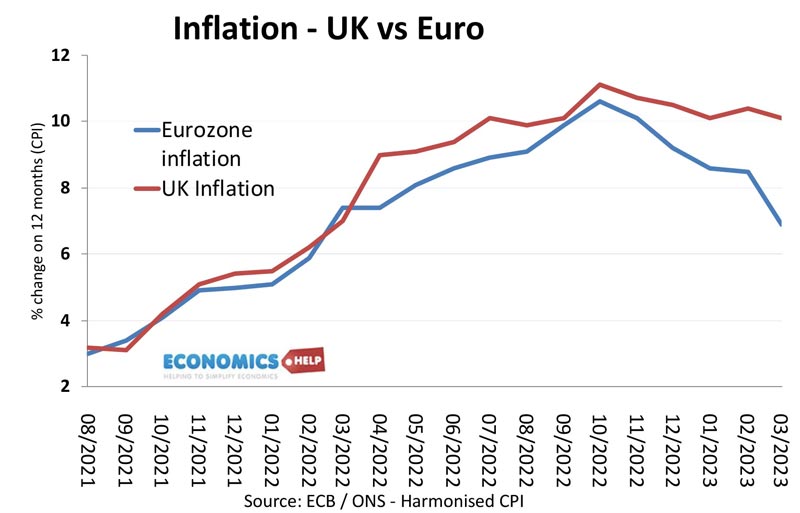

UK inflation has been surprisingly stubborn. Whilst inflation in Europe has fallen to 6%, UK inflation remains stuck in double digits. Whilst real wages for workers fall, some companies are reporting record profits with concerns firms are taking advantage of inflation to increase their profit margins and markups. Some argue that up to 50% of the current inflation is coming from rising profit margins, and not just the rising costs. The high inflation is bad news for the economy because it means a continued squeeze in living standards and higher interest rates. So why is inflation high and when will it fall?

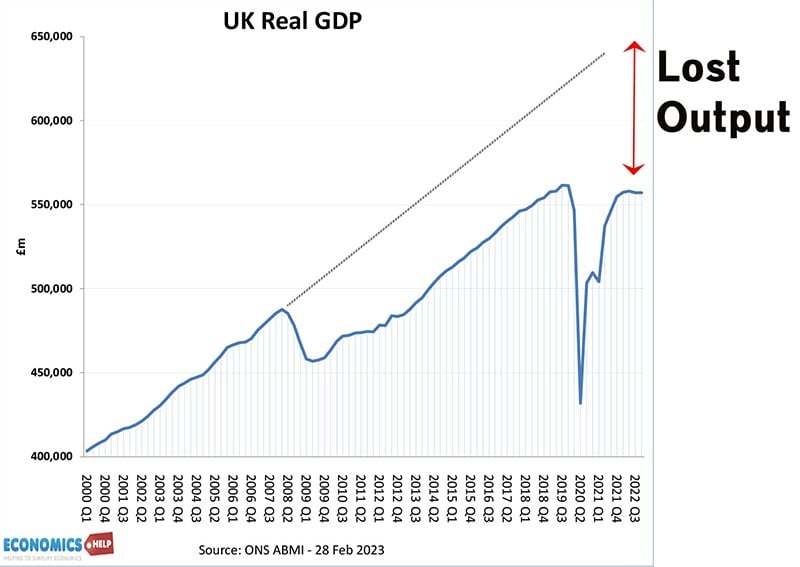

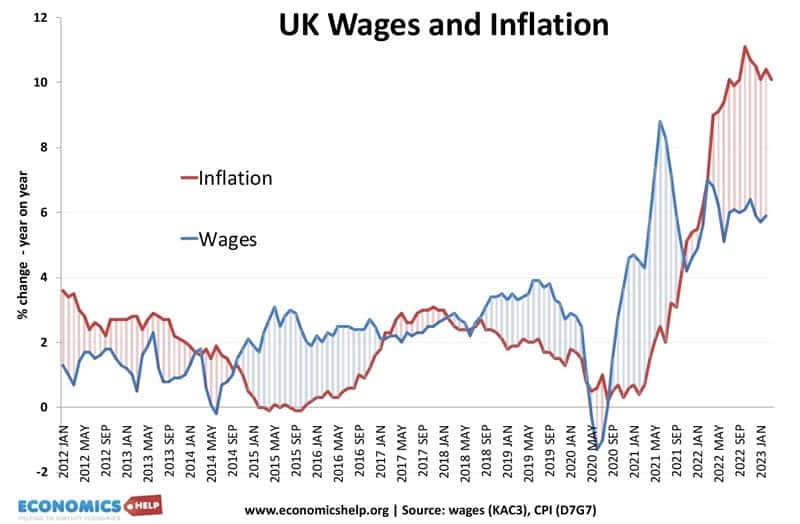

Historically inflation is often caused by strong economic growth. With high demand pushing up prices. But, this is not occurring, UK economic growth is still below the trend rate of growth. Only 0.1% last quarter. A common refrain of ministers is that inflation is at risk from wage inflation, and this is why there is a reluctance to raise the wages of public sector workers. However, wage growth is really not the cause of inflation. We are still looking at an unprecedented fall in real wages.

The IMF agree – their chief economist, Pierre-Olivier Gourinchas agrees – pointing out that instead profit margins are surging as firms benefit from prices rising faster than costs.

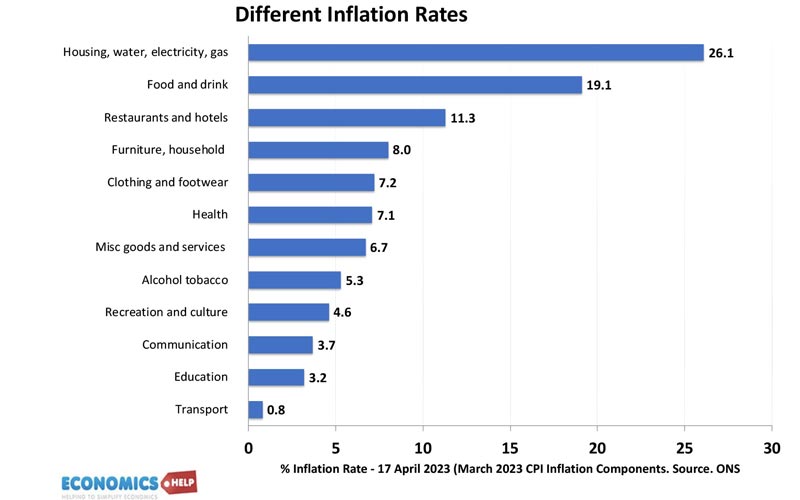

A significant cause of recent inflation is the rising energy prices. Surging gas and oil prices in the past 12 months have led to higher energy bills and it is this that is the biggest current cause of inflation at nearly 25%.

However, wholesale prices of gas and oil have fallen in recent months. But, this has continued to be a very profitable period for the big energy companies. For example, BP announced underlying profits reached $5bn (£4bn) in the first three months of 2023 – the highest level since 2012 and undiminished by falling oil prices.

The next biggest cause of inflation is food inflation of nearly 20%. This is partly related to rising energy prices – higher costs of heating greenhouses, and higher costs of fertilisers. But, at this point it is important to note the rising prices are not just about higher costs of production. Firms are taking advantage of inflation, to increase profit margins. If costs rise 15%, and firms increase prices 25%, who is going to know?

Paul Donovan, chief economist at UBS Wealth Management, believes much of the current inflation is due to this profit-push or greed inflation. He said: “I believe that much of the current inflation is driven by profit expansion. Typically one would expect about 15% of inflation to come from margin expansion, but the number today is probably around 50%.

Last month Fabio Panetta of the European Central Bank said that “there could be an increase in inflation due to increasing profits.

Although the Bank of England has often warned about wage inflation, despite little evidence, Catherine Mann, one of the nine members of the monetary policy committee, said she was concerned about the ability of firms to take advantage of consumer willingness to tolerate higher prices. This reflects increased monopoly power – especially in sectors such as groceries and energy distribution. A report by Unite highlighted many examples of profit-push inflation

For example, Tesco, Sainsbury’s and Asda – the top three supermarkets – doubled their combined profits to £3.2 billion in 2021 compared to 2019. Despite new competition from the likes of Lidl and Aldi – Tesco, Sainsbury’s and Asda still control over 56% of the market share.

High energy prices have been a major factor in rising inflation. This stems from rising gas prices in 2022. But, the nature of UK electricity market means that all electric producers saw a rise in prices, even though gas accounts for just 40% of the industry. It means other electric producers making higher profit margins, with Treasury officials claiming UK generators, have already made more than £10 billion in “excess profits”

It is also a global phenomenon A big cause of rising prices in 2022 is supply chain shortages, but the crisis caused the eight top shipping companies such as Maersk and COSCO to make a combined £62 billion in 2021 – boosting their profits by an incredible 20,650% on 2019 (i.e., 200 times higher). Paying out £4.7 billion in dividends last year. Australian Competition and Consumer Commission have argued that freight companies effectively “get together and engage in cartel activity.

US corporate profitability has soared both in nominal terms and also as a share of GDP. A reflection that the current cost of living is not affecting others equally. And this period of high inflation has been an opportunity to increase profit margins and underlying profitability.

Why is UK inflation higher than Eurozone inflation?

There are some technical reasons, the price cap guarantee means falling gas wholesale prices do not get directly converted into lower inflation. Spain which has no price guarantee already has inflation of 3.1% Next month May, we should see, the last big gas price rise – fall out of the inflation index, reducing the rate by 1.1%.

However, despite these technical factors, higher UK inflation has been a factor for a couple of years. A few factors spring to mind.

Firstly, the relatively weak Pound Sterling pushed up import prices, making the rise in energy prices even worse for the UK.

Secondly, the many impacts of Brexit have contributed to inflation for a variety of reasons. A shortage of workers especially in agriculture has led to some food shortages. Brexit has made cross-channel trade more difficult and expensive. When European food supplies were hit early in the year. The additional logistical challenges of getting food into the UK meant it was the UK which was facing graver shortages, another factor pushing up prices.

What’s going to happen next to inflation?

Earlier this year, I predicted inflation would fall this year – I was in good company, other economists and the Prime Minister Rishi Sunak were confident inflation would halve this year. There was a certain logic to this prediction – falling gas prices, a weak economy and falling real wages. But, inflation has been much more stubborn and persistent then we forecast, a concerning rise in core inflation and some signs the UK is more vulnerable to inflation than elsewhere. All that being said, Inflation is still going to fall later this year. But, its stubbornness is a concern for both workers and the economy.

Why is lower inflation forecast?

The headline rate will move closer to the core inflation as energy prices rises drop out of the index. Global Food prices have fallen 25% in recent months. One reason we haven’t seen this translate into falling prices is the time delays of long-term contracts, but over time, buyers will be able to benefit from these lower prices and eventually.

Secondly, higher interest rates will increasingly bite. As people remortgage and face lower disposable income. The impact of higher interest rates on inflation is realtively weak, but it will still have a negative effect. Thirdly, despite growth in nominal wages, they have been well below the headline rate of inflation, suggesting inflation expectations are still low. It is not possible to have continued double-digit inflation with such low wage growth and falling energy prices. However, the stubbornness of inflation definitely is unwelcome, it just means we face a worse trade off. Higher costs of living, lower real wages and the prospect of higher interest rates.

Is Quantitative easing to blame?

What about the quantitative easing and the increase in money supply during Covid? Is this the reason for the inflationary surge? Well, a few points. Firstly, the large increase in money supply between 2009 and 2021 had no impact on inflation. It did not filter through into higher consumer demand, but often increased bank balance sheets and found its way into the stock market. The increase in money supply during covid is not the primary cause of inflation because the same dynamic played out. It is not quantitative easing that is a major cause of current inflation in the UK. Outside of the US Demand has been pretty weak. Inflation is cost-push and profit-push driven.

Further reading