Definition – Demand is price inelastic when a change in price causes a smaller percentage change in demand. It occurs where there is a price elasticity of demand (PED) of less than one.

Goods which are price inelastic tend to have few substitutes and are considered necessities by users.

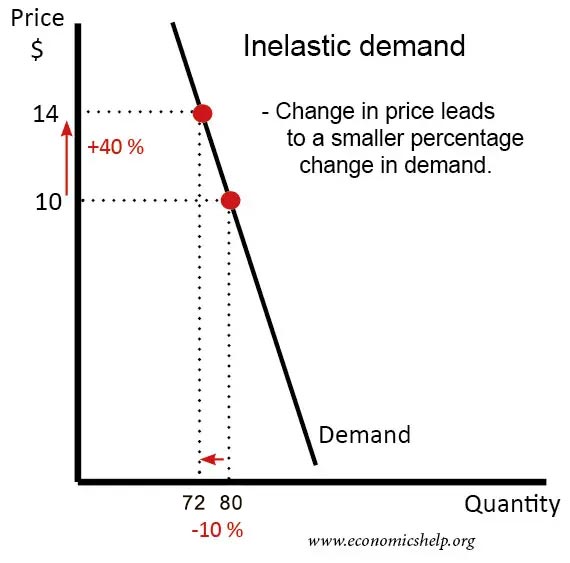

Diagram of price inelastic demand

For example, in the above case price rises 40% ($10 to $14 – 4/10)

Quantity demanded falls (-8/80) = 10%.

Therefore PED = -10/40 = -0.25

Examples of inelastic demand

- Petrol – those with cars will need to buy petrol to get to work

- Cigarettes – People who smoke become addicted so willing to pay a higher price

- Salt – no close substitutes

- Chocolate – no close substitutes

- Goods where firms have monopoly power. For example, Apple computers, iPhone, Microsoft Windows, rail fares for commuters.

- Water – when you are in the desert and very thirsty (but not if you are in England!)

Factors that make demand inelastic

- No substitutes. If you have a car, there is no alternative but to buy petrol to fill up the car. If you rely on the train to get to work, the train firm can increase prices with little fall in demand.

- Little competition. If a firm has monopoly power then it is able to charge higher prices. For example, prices on motorway service stations tend to be higher, because consumers can’t choose where to buy food, without leaving the motorway.

- Bought infrequently. If you buy a good infrequently, such as salt, you are less likely to be sensitive to price.

- A small percentage of income. A good like salt is a small percentage of income, therefore you will tend to be less concerned about price.

- Short-run. In the short-run, demand tends to be more price inelastic. It takes time for consumers to look for alternatives.

- Location. If you have the best location, then demand will be more inelastic. Hotels with great sea view can charge more than one in the suburbs.

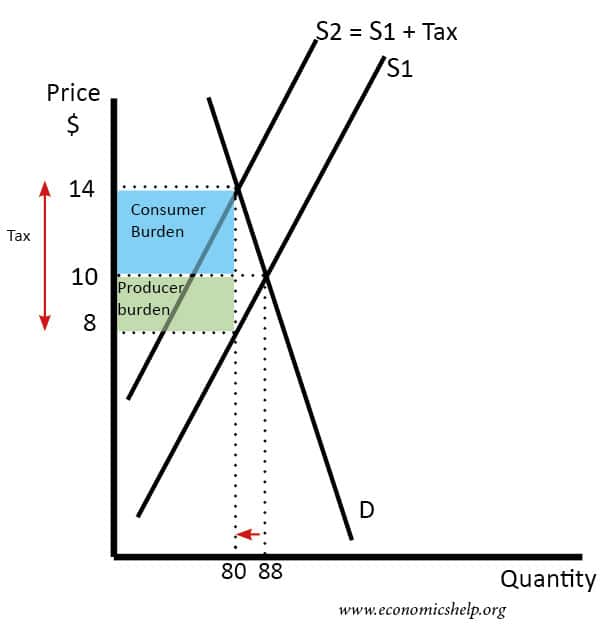

Impact of Tax on inelastic demand

- A tax will shift the supply curve to the left, leading to a higher price and a fall in demand.

- If demand is inelastic, then the tax will have the effect of raising the price significantly and reducing quantity only slightly. This will help to increase tax revenue for the government.

- Most of the tax will be borne by consumers. (The consumer burden is 80*4= $320) (The producer burden is 2*80=$160)

- Cigarettes tend to have inelastic demand; when the government increases a tax, firms are usually able to pass the whole increase onto consumers.

Example – effect of tax on cigarettes

Inelastic demand and revenue

- If demand is price inelastic, then firms will increase revenue from raising the price.

- If the price of train fares increases from £30 to £40 (33.3%).

- And demand falls from 1,000 to 980. (-2%)

- The PED = -2/33 = – 0.06

- Revenue was £30 x 1,000 = £30,000

- Revenue is now was £40 x 980 = £39,200

Other types of inelastic demand

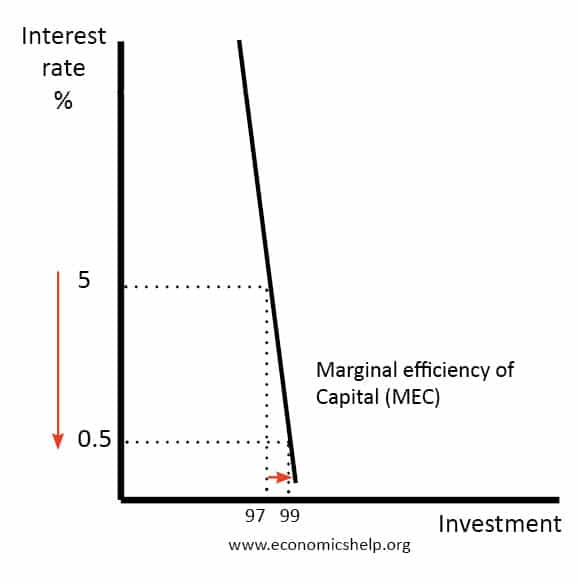

We can also talk about interest inelastic demand. This is the same concept but examines how sensitive demand for investment is to changes in the interest rate.

In this case, a cut in interest rates from 5% to 0.5% has only caused a small increase in investment, showing that demand for investment is interest inelastic.

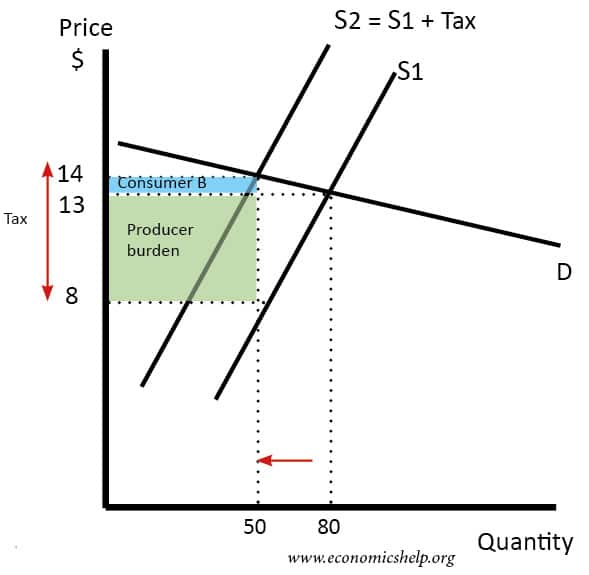

Price elastic demand

The opposite of inelastic demand is elastic demand. If demand is price elastic – an increase in price causes a bigger % fall in demand.

If demand is elastic. It means consumers are more sensitive to changes in prices. Therefore, an increase in tax will cause a big fall in demand, and the price will rise only slightly. Therefore, the government will see a fall in tax revenue. Also, if demand is price elastic, the consumer burden will be smaller than if demand is inelastic.

When demand is price elastic, most of the tax rise is borne by the producer burden.

Related

hi this is akbar.i want to know about fully knowledge in elasticity and inelasticity in economics.

THANK you

Explanation… Well represented

when a good is a necessity the customer can not do a way with it’s meaning that when it price increase it’s degree of responsiveness is inelastic , how ever car which is luxury demand is more expensive than water which is a necessity to man, examine the cause to this reality

Thank you! You gave me just enough info to inspire my written assignment. Most of my classmates chose gasoline. I chose salt.

What about coffee and crack cocaine?

Yes. Demand is likely to be inelastic for those.

I’d love to hear about cocaine and heroin too. Due to the effect of addiction, can we say their demand is inelastic

Another inelastic product is toilet paper, can finish until the paperwork is done 🙂

Elastic demand usually have substitute. For example, pizza,hamburger, etc. Or other examples like (Loya milk,peak milk, Miksi milk).

Inelastic demand usually don’t have a close substitute. For example, we have petrol, salt etc.

If the substitutes for inelastic demand increases, how will it affect the elasticity?

Factors affecting inelastic demand