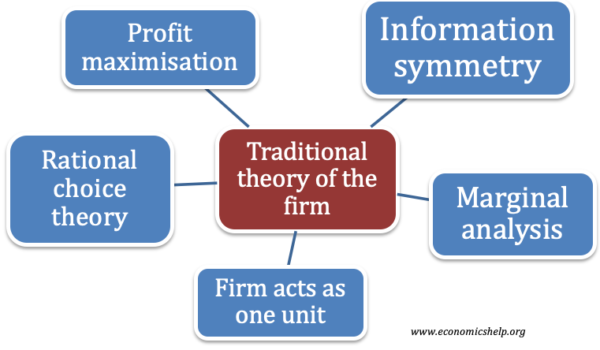

The traditional theory of the firm is based on classical economics and the work of early economists, such as David Ricardo and Leon Walras. The basic assumptions of the traditional theory of the firm are

- Firms seek to maximise profits.

- Information symmetry. Owners and workers of the firm have access to good information which enables them to maximise profits.

- Firms act as an homogenous unit with owners wishing to maximise profits and these aims being achieved by managers and workers.

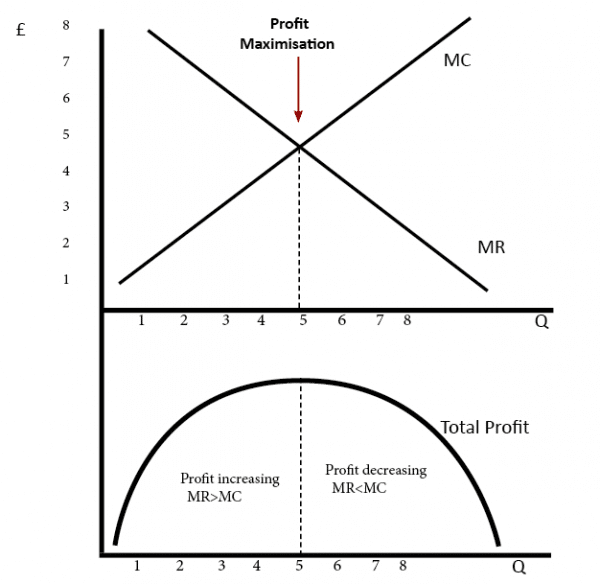

- To maximise profits a firm makes use of marginal analysis. In particular profit maximisation occurs at an output where marginal revenue = marginal cost.

- Firms and managers are rational. With their rational objectives being to maximise profits.

Profit maximisation

It is assumed that firms wish to maximise profits because this will enable the owners and managers to maximise their own salary, bonus and dividends. To maximise profits, they will seek to cut costs and set the profit maximising price and level of output.

Whilst the traditional theory of the firm provides a starting point for investigating the behaviour of firms, the traditional theory of the firm is increasingly questioned by modern economists.

Criticisms of the traditional theory of the firm include

- Firms are not a homogenous unit. Owners may want profit maximisation, but managers and workers may have different objectives.

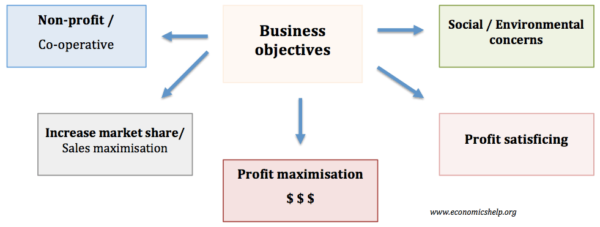

- Other objectives to profit maximisation. Profit maximisation is not the only goal of a firm, it could include maximising sales, maximising market share, social responsibility (e.g. looking after the environment) and co-operatives which seek to improve the welfare of all society.

- Marginal approach to firms is not replicated in the real world. businessmen do not have time or the ability to work out the marginal cost and marginal revenues. They tend to use a rough ‘rule of thumbs’ such as average cost + profit margin. Prices may also be sticky (not change) even if marginal cost and marginal revenue changes.

- Imperfect information. Firms have imperfect information about prices, costs and competitors. Also, workers are not like a typical factor of production. They may become demotivated or discouraged if work appears boring or lacking in interest. This can affect the objectives of firms.

- Behavioural economics. Recent behavioural economists, Thaler and Aversky state the importance of human psychology in determining the behaviour of firms – a much more complex set of circumstances than simple profit maximisation.

Alternative theories of the firm

1. Sales maximisation/market share

With sales maximisation, firms sell at lower prices and seek to increase sales. They may have a constraint to make a minimum amount of profit to keep owners happy. But, they may go for sales maximisation for various reasons

- Increase market share and therefore monopoly power. This can enable long-term profit maximisation

- Gives a greater sense of prestige to be at the head of a big company and dominate the market

- Gaining market share gives a sense of success that may be more measurable in the world than profit.

- Managerial salaries are likely to increase in a bigger company.

2. Growth maximisation

Growth maximisation is similar to sales maximisation, but growth implies increasing size of firm and this may involve the firm taking on risky expansion, borrowing to invest in new capital. This may make the firm less financially secure, but offers prospect of rapid growth through investment and acquisition. The traditional theory of the firm underplays the role of mergers and acquisitions as a way for firms to increase in size and gain more market share and prestige.

3. Managerial utility maximisation

A limitation of the traditional theory of the firm is that it equates utility maximisation with profit maximisation, but in the real world it is much more complex and there are many things that determine a managers utility.

Getting on with workers. A boss doesn’t want to annoy his fellow workers just to make more profit for owners. The boss may sacrifice some profits to make his fellow workers happy, for example avoiding job losses.

Fringe benefits. Managers may get a lot of utility from fringe benefits like having fun at work, lavish offices and taking time off to play golf.

If the direction of firms is governed by managers, there may be a form of profit satisficing – where managers do enough to keep the owners happy but then pursue these other objectives.

4. Corporate responsibility and social welfare

The fourth model assumes that firms have a mixture of objectives. Profit may be one, but the firm may have a mission statement to prioritise environmental welfare or offer some services to the local community. Therefore, the firm may invest surplus profit in community schemes which benefit local stakeholders rather than shareholders. For example, a football club may choose a price lower than market equilibirum to keep matches affordable to local supporters and it may re-invest profits in community schemes.

Sometimes corporate responsibility may be masked as clever marketing strategy and the percentage of profit invested in the community/charity is actually very low.

Different potential business objectives

Related pages