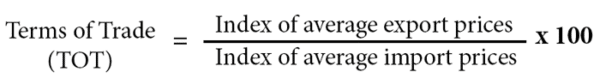

Definition: The Terms of Trade is the average price of exports / by the average price of imports. It is a measure of a countries relative competitiveness.

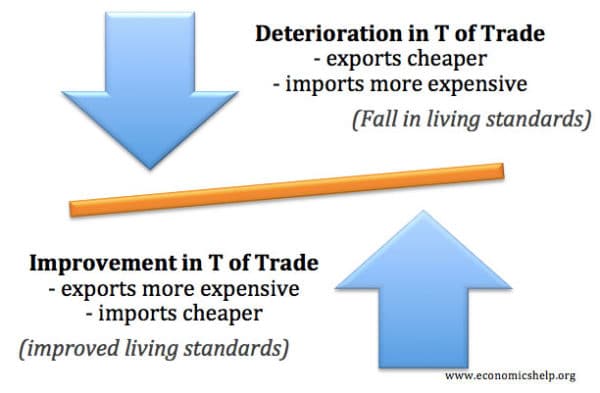

- If export prices rise relative to import prices, we say there has been an improvement in the terms of trade. – A unit of export buys relatively more imports. Generally, this leads to an improvement in living standards as imported goods appear cheaper to consumers.

- If import prices rise relative to export prices, we say there has been a deterioration in the terms of trade. Generally, this leads to a decline in living standards as foreign currency earnings are relatively less and imported consumer goods more expensive.

Effect of a devaluation on the terms of trade

- If a currency falls in value, then we would expect to see an increase in the price of imports. (You would need to pay more in Pound Sterling to buy the same quantity of foreign goods)

- The domestic price of exports should remain unchanged, though the foreign currency price should fall. e.g. Germans should be able to buy British goods with less Euro.

- Therefore, after a devaluation, you would expect to see a deterioration in the terms of trade.

- Since July 2007, the value of Sterling has fallen approximately 20%. In this period import prices have risen by 15% (as you might expect)

Effect of an appreciation on the terms of trade

- An appreciation will make imports cheaper. But, exports will become more expensive.

- Therefore, after an appreciation, you would expect to see an improvement in the terms of trade.

Factors that affect the terms of trade

- Exchange rate. A fall in the exchange rate should reduce the terms of trade. This is because a decline in the exchange rate will make exports cheaper.

- An appreciation in the exchange rate should improve the terms of trade because exports will rise in price and imports become cheaper.

- Competitiveness of firms. Export prices will be affected by the cost of raw materials and productivity.

- Relative inflation rates in different countries. Higher UK inflation would cause (at least temporary) improvement in the terms of trade as UK export prices would be rising faster than import prices. (Though inflation is likely to cause a depreciation in the exchange rate, which will cause exports to then fall in price.)

- Profit margins – do firms pass the effects of devaluation on to consumers in the form of lower prices? It is possible that movements in the exchange rate do not have the expected effects on the terms of trade. Rather than cut import prices, firms may keep prices the same.

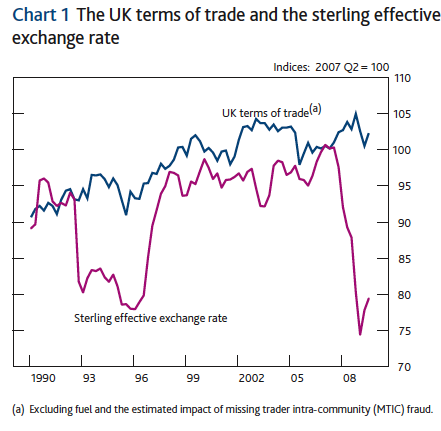

UK terms of trade and Sterling exchange rate

Source: B of E Publication Explanation of Stability of Terms of Trade

- The appreciation in the Sterling exchange rate index between 1990 and 2005 caused a rise in terms of trade.

- The rapid devaluation in Sterling at the start of 2008, only caused a modest fall in the terms of trade.

Why did the UK terms of trade not deteriorate as expected in 2008?

- Demand for UK exports is relatively inelastic. Therefore, a weaker Pound has encouraged exporters to put up their profit margins and increase their prices rather than cut prices

- If demand for UK exports was more elastic, there would be more incentive to keep prices low to try and increase sales.

- Supply is inelastic. The greater profitability of exports has so far not encouraged more firms to enter the market and reduce export prices. In the future, the greater profitability of exports may encourage higher supply in exports reducing profit margins and prices of exports.

- UK exporters have been pricing at a foreign currency price. If exporters set their price in fixed foreign currency price. Then a depreciation in the exchange rate would automatically lead to a higher sterling price to reflect the same foreign currency price.

Related

Within the paragraph titled “Effect of an appreciation on the terms of trade”, you say that exports become more competitive. However, surely if a currency appreciates, exports become less competitive and so balance of trade deteriorates. Here, I am assuming that combined PED of imports and exports is > 1. Could someone please clarify this for me.

Max i think you’re right. As the dollar appreciates, our exports become less internationally competitive. This is because our trade partners will have to pay more for the same amount. However just to note, in the short term our CAD will improve due to countries requiring the same amount of our commodities however in the long term, countries will find alternatives and as a result will worsen CAD in the long term. This is seen after Mining Boom 2 in 2011-12. Hope this helped but i can’t help you with PED.

I understand that the depreciating exchange rate causes an injection due to increased exports, but surely the net effect would be negative for living standards.

As the currency depreciates, all of the holders of that currency lose real wealth. I think of it as the equivalent of everyone losing money on the foreign exchange market, leading to lower real income, within the entire economy.

It should also be considered that most of the production in any economy in the 21st century is reliant on exports from other nations. When a phone (for example) is produced, different parts are produced and assembled in different countries. If a countries’ currency appreciated, then the price of imports would rise. This would significantly raise costs of production, even for “domestically produced” goods. This would reduce profit margins, probably causing low-scale unemployment and also cost-push inflation. Cost push inflation is particularly dangerous to an economy as it runs the risk of stagflation. This would not increase the welfare of people in the domestic economy.

Please leave a reply if you see a flaw in my economic reasoning 🙂

What you are referring to – a depreciation of currency causing cost-push inflation – is a valid argument. However, demand-pull inflation may occur as well as net exports rise, which may not be such a bad thing considering the fact that the export multiplier effect may take place. The degree of spare capacity determines the extent of inflation, on the contrary, a devaluation of currency always results in a certain degree of inflation.

U are really good at reasoning

If possible I kindly request to help out with the “effects which can be faced by the producers of raw materials and food stuffs for exports resulting from deterioration or declining of the terms of trade

“Effect of an appreciation on the terms of trade

An appreciation will make imports cheaper. But, exports will become more competitive.

Therefore, after an appreciation, you would expect to see an improvement in the terms of trade.”

Surely an appreciation in the FX rate will make exports less competitive?

I want to know the measures of unfavourable terms of trade.

import restriction

regional economic integration

export diversification

technological development

WANT TO KNOW TERMS OF TRADE AND THE THEORIES OF TRADE

Any diagram related to this topic ???

A demand and supply diagram may suffice.

Kindly requesting for your help about this question

Explain the effects of a deterioration in the terms of trade on the earnings of producers of raw materials and food stuffs

How will a decrease in export prices effect our economy