Readers question: How much will the Pound devalue?

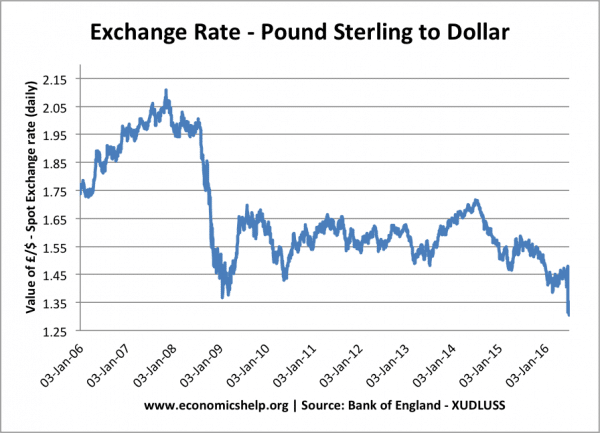

Since the start of 2016, the Pound has been depreciating against other currencies – especially the US dollar. Since Brexit end of June, the Pound has fallen another 10% heading to a 30 year low against the US dollar.

Pound Sterling against the Dollar

This is daily spot rates, from the Bank of England. But is already out of date, with the Pound falling on 6 July to $1.28.

Why Pound may fall further

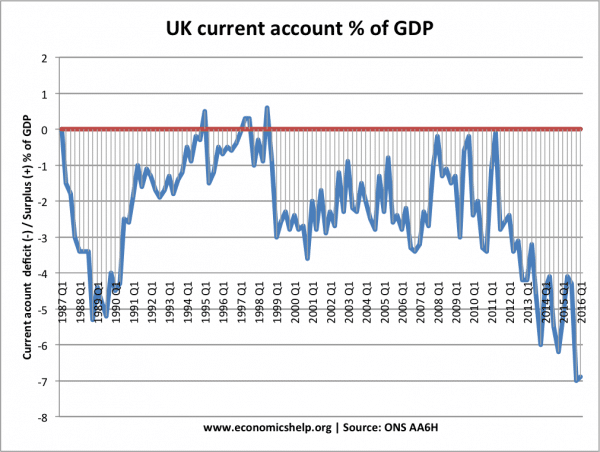

1. Current account deficit. The size of the UK current account deficit 6.9% of GDP in the last quarter – shows the UK has an imbalance between imports and exports. It is a near record size deficit since records began in 1955. (record was the 7.2% deficit in Q4 2015). This size of current account deficit will place strong downward pressure on the value of the Pound. The outflow of currency to buy imports is unsustainable without a corresponding inflow of capital and financial flows to finance it.

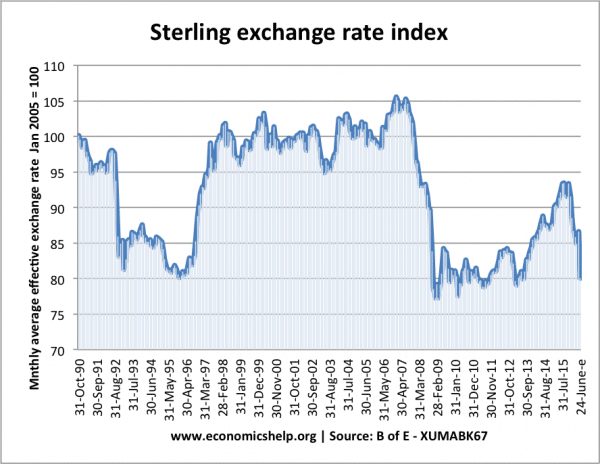

2. Overvalued. Back in 2014, the IMF reported it felt the Pound was overvalued by 5-15% because of “lack of competitiveness and limited export diversification”. This lack of competitiveness is reflected in the current account deficit. Limited export diversification may have been a factor in the limited improvement in the UK exports during the Sterling depreciation of 2011-13 (though Eurozone weakness was also a factor).

3. Capital flight from UK. Although there is a temptation to get carried away by bad news post Brexit, there does appear to be less willingness for foreign investors to keep money in the UK. Outside the EU, the uncertainty and loss of direct access to the Single Market, makes UK economic prospects weaker and due to this, some investors are moving money outside the UK, or at least not investing in the UK, with this decline in foreign portfolio flows, the previous factors keeping Pound strong have been removed.

4. Decline in capital investment (inward investment). The other aspect of the UK financial account on the balance of payments was the direct inward investment (foreign firms building factories in the UK, e.g. Chinese investment in power plants). Post Brexit, these plans have been put on hold, and outside the Single Market, there may be a long-term decline in desirability of investing in UK. Without these direct inward investment flows, there will be downward pressure on Sterling.

5. Previous falls

In 1992-1993, after leaving the ERM, the pound fell 29%. During the financial crisis, the Pound dropped 34%. It is possible we could see a similar major revaluation in the value of the Pound. This could see the Pound fall against the dollar towards $1.15.

6. Monetary easing. The Bank of England have indicated that they will cut interest rates to 0% to protect economy against decline in spending. It raises scope of potentially more quantitative easing. This monetary easing, will reduce value of Pound. Lower interest rates make it less attractive to save in the UK.

Any good news for the Pound?

In this current climate, it is hard to see any good news for the Pound. If the real exchange rate is overvalued by 10%, the shock and uncertainty of Brexit is likely to make this revaluation happen. However, sometimes markets over-react to perceived bad news, such as Brexit. It could also be other economies, such as US and Eurozone see a similar economic downturn to the UK, in which case the fall in the Pound may be halted.

One thing that may happen is that as the Pound falls, we see changes in consumer behaviour, e.g. UK citizens avoid more expensive foreign holidays, and exports rise. The fall in the Pound will be self-correcting.

- Who wins and loses from a falling Pound? – why a falling Pound can be beneficial for aspects of the economy

I am amazed that the Politicians go on about how a low pound makes exports a good thing but when exports are cheaper it makes imports more expensive and as the UK in general imports more than they export a low pound hits the overall economy to it’s detriment but the Politicians never mention this.

I have lived on the Continent since the time the pound was worth BEF 140. This converts to Euro 3,50. The pound is now worth, as you know, just over Euro 1,17. Roughly 65% less than it did. If devaluation helps the trade balance as some maintain, Britain should be the export leader in the world.

The fall of the pound can only be a bad thing. We import so much, as opposed to what we export,surely it can only lead to inflation, which can only hit the pocket of the man in the street, this in turn, will lead to recession.

we should be putting interest rates up, not cutting them.

This is the moment of truth. We’ve had it so easy for so long, lying back in the comfort zone. So, now it’s about time to get off our pity-pots and heave up our pants and get all our British educated brains to develop new industries; and get on the road to the world market outside the EU. This can be a blessing in disguise, and if not, it will at least keep us off the pity-pot. Let’s do it, now.

Surely for many years now we have seen the flight of manufacturing from the Uk to lower cost countries and the de-industrialisation of our country is been disastrous.

If we have a long sustained lower rate currency surely there will be an incentive to return to producing goods and selling them rather than depending so heavily on finance and services

I have read quite a bit of rhetoric on the subject of the falling pound. There is always some kind of economic justification and they normally make sense however yesterday I changed my mind. The reason is simple, yesterday the economic data was great. More inward investment from Nissan and GDP growth revised up by 0.2%. In normal times we would have seen a Sterling rally but no, instead Sterling fell on the news and by 0.45% logical right? Well not really unless you look at it under a different light. Politics. The simple fact is that nobody wants single countries anymore they want trading blocks. The EU just passed CETA and the Euro is up and in anycase it is a trading block which everyone loves. Today a judge in northern Ireland made brexit look real again and so the pound fell another 0.45%. Just imagine what will happen when we actually leave. Here is my prediction:

The moment we trigger article 50: Sterling down at least 15%

This will be follow by falls between 0.25% and 1% every day until we give up trying to leave.

Expect to see 1 GBP = 0.50 USD in 2017 with inflation rampant as a result to the tune of 3 – 10% a year.

There will be only punishment until we reverse our decision and we all know that inflation of this type will be politically destabilising which will lead to another vote where we will vote the way we should have in the first place.

I think the lesson to be learned here is that sovierenty in today’s world is an illusion. No country has the right to call the shots or decide the way they want to live, we must all respect the status quo and respect the parameters which we know full well exist.

So I think it would be best if we avoided saying silly things like:

Let go back to building factories and making steal.

Or why don’t Oxford graduates go and pick strawberries.

I once learned that it is a great sign of intelligence to be able to admit when one is defeated and I don’t think it takes a genius to see that this is a battle we cannot hope to win. So let’s just give it up and go back to sipping a nice warm cup of tea by our range rovers shall we and leave the picking of our strawberries to the continentals.

Maybe I’m missing something, but as far as I’m aware, the UK doesn’t really manufacture anything.

It was too costly to already manufacture anything in the UK. What exactly do we export?