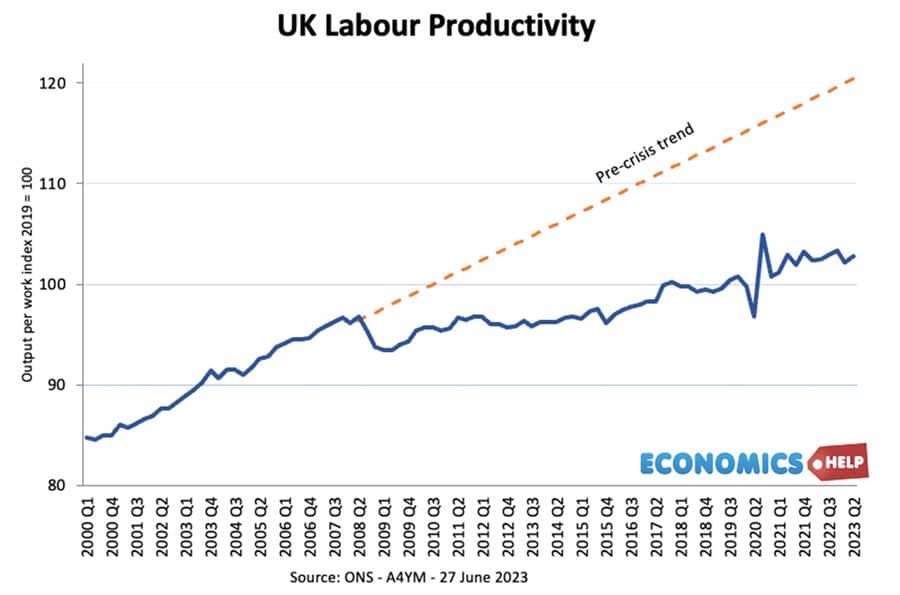

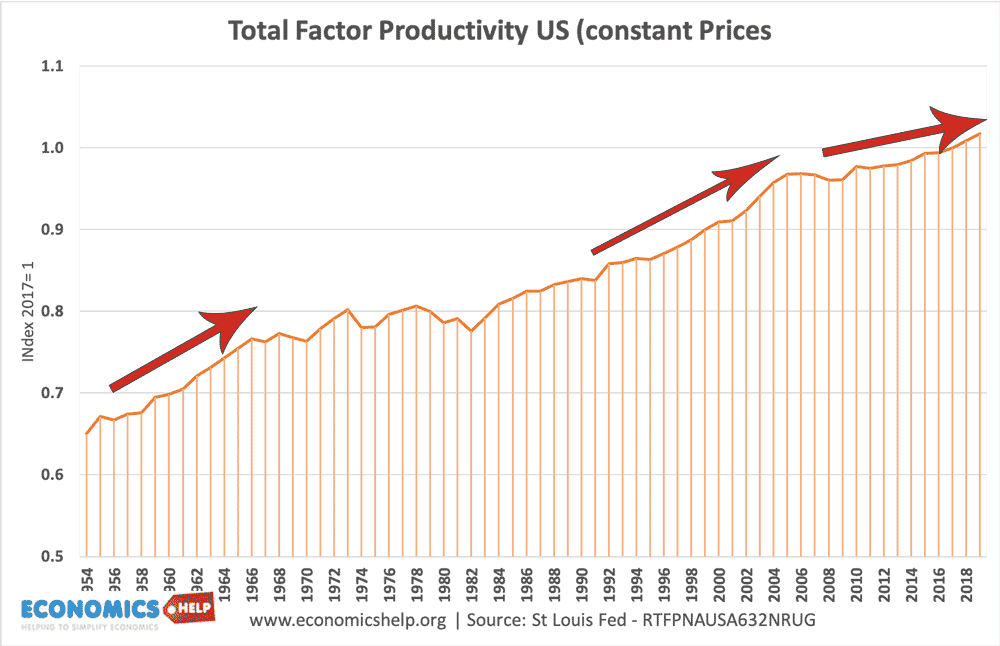

Since 2008, the UK’s growth rate has slowed down sharply. Before 2008, productivity grew at 2.2%, but in the past 15 years, it has averaged just 0.5%. It is not just the UK which has seen a slowdown in productivity, but the UK has definitely fared much worse. It has become known as the UK productivity puzzle. – And like any good Agatha Christie novel, there are many potential culprits, these are the top ten.

Reasons for low Productivity

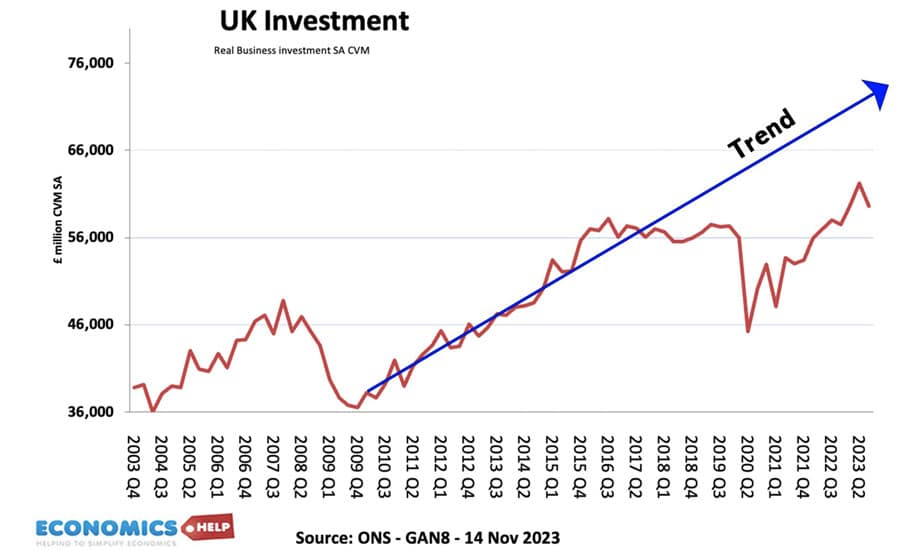

1. Firstly, the UK’s level of investment is very poor.

Total investment is one of the lowest in the developed world. Public sector investment was cut in the austerity years of the 2010s and this seemed to have a knock-on effect in reducing private sector investment, which also struggled particularly since 2016. Investment has been hit by uncertainties, weak demand and difficulty accessing finance. The impact is the UK has a low adoption of new technologies such as robot automation with the UK only 24th in the global league of robot densities. In terms of research and development, the UK has been an international laggard with only 1% of GDP devoted to innovation, though Covid research did see a welcome break to this trend. Investment has suffered from weak consumer spending

2. Policy changes But, on top of this, in the past 15 years, businesses have frequently struggled with radical new changes in government direction. Brexit upended trading relations creating uncertainty. But, there have also been flip-flopping on policies such as corporation tax, industrial policies and education. The radical experiment of the Truss Kwarteng regime was short-lived, but in the aftermath of Covid and oil price rises added to business instability.

3. Difficulty getting anything built. One reason for low investment is the difficulty of building in the UK, this is particularly acute in housing and infrastructure. I covered the turmoil and failures of HS2 in a recent video, it is symbolic of the UK’s difficulty in building infrastructure. Due to expensive planning regulations, high cost of land and lack of skilled workers, the UK finds it more expensive to build infrastructure than its European neighbours. It means many worthwhile transport links never get built, because it is both too expensive and the government has been reluctant to invest. Unfortunately, the cancellation of the flagship, expensive and overbudget HS2 will only make it difficult to build in the future.

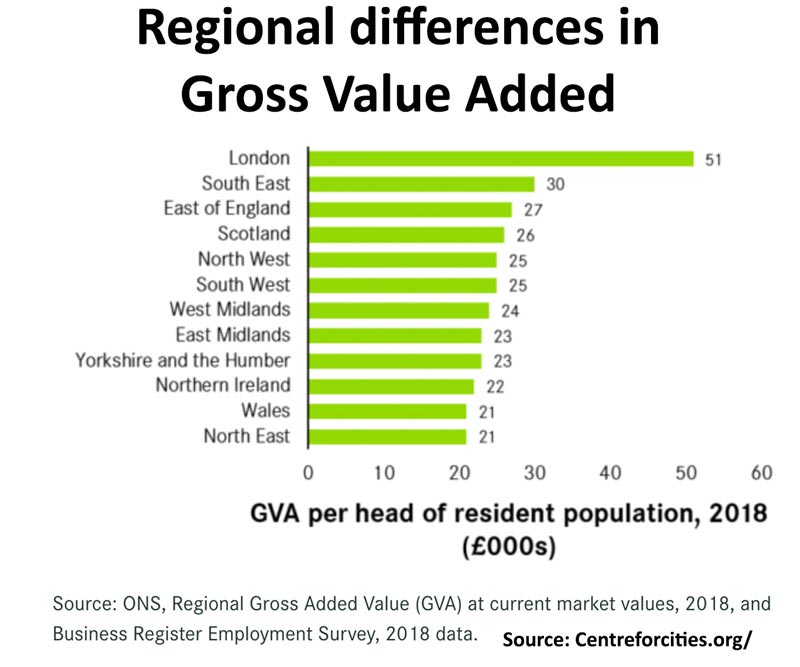

4. Regional inequality.

One of the motivations for building HS2 was to improve connectivity between major UK cities. The UK struggwithfrom regional inequality and an overreliance on London, which attracts best-paid workers businesses. The LSE reports productivity in London and the South East is 63% higher in han Wales. Basically, take out London, and the UK productivity problem is even worse se. Gross Value added in London is more than double other regions. The high cost of housing and dire public transport make it harder to move around the country. Potential growth areas around Cambridge and Oxford are stymied by planning restrictions in building housing and transport. London is burdened by high housing costs and the north by a lack of investment.

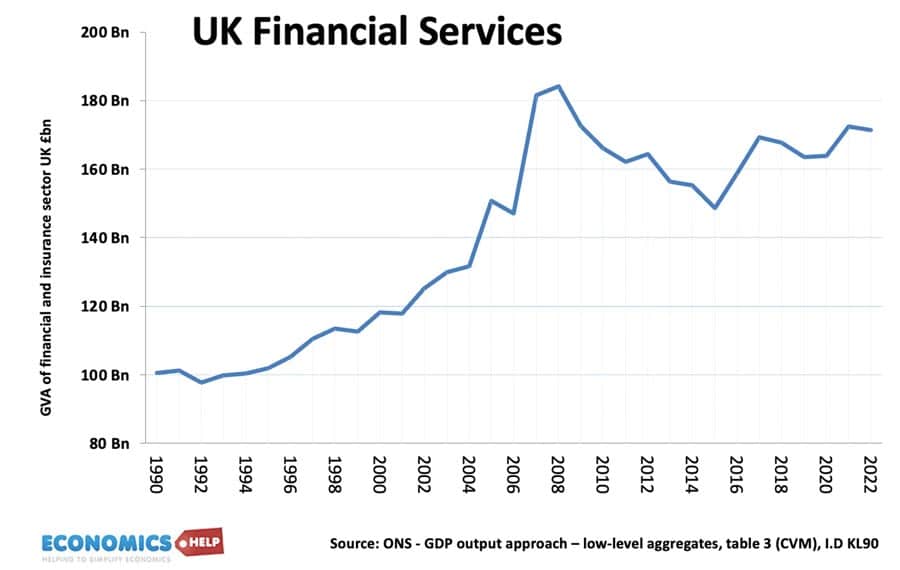

5. Over-reliance on finance.

One reason for the UK’s shocking performance post-2008 is the over-reliance on finance. The UK’s financial sector as a share of GDP is the 2nd largest in the world. In the boom years, excess risk-taking in finance helped to exaggerate productivity growth. But, after 2008, the large decline in the finance industry and new regulations to limit speculation hit overall productivity. A UK Parliament report suggested that over-reliance on finance was holding back investment into more productive industries. After recovering from the financial crash, the next big blow to UK productivity we’ll look at is the impact of Brexit, but first I’d like to briefly mention a product, that might help your own personal productivity.

6. Brexit. Britain’s long-drawn-out out departure from the EU from the vote in 2016 to leaving single market in 2021, upended trading relations with Europe. This particularly affected small medium-sized sized businesses who faced higher costs, uncertainties and barriers to trade. It has discouraged investment and reduced the UK’s trade openness. The economist reports one conservative estimate that Brexit led investment to be 11% lower than otherwise. Others suggest it could be higher. Although Brexit has faded from the news, In January 2024 firms will still face new obligations and costs for exporting to Europe.

7. Education and training Another problem the UK faces is deficiencies in education and training. The UK has been successful at getting more people to university, but has struggled in vocational training. There is a lack of cooperation between colleges, the government and businesses to train workers with skills needed by the private sector. It doesn’t help that vocational skills are often looked down on with schools keener to send people to university. The lack of skills has also encouraged an approach of a low-wage, low skilled workforce. Firms have preferred labour-intense production methods, rather than higher wage, higher skilled workforce. Inflation, the increase in the minimum wage and a shortage of workers have to some extent made firms re-evaluate this and consider more capital-intensive production.

8. Global slowdown. One reason the for UK’s slowdown in labour productivity is that the world has seen lower productivity growth in the past two years. Gains from technology have slowed down. The internet hasn’t been as transformative as we might expect, it hasn’t caused a technological revolution, like say electricity or micro-computers. AI and green technology may change that in the coming years. But a new wave of technological breakthroughs would be very welcome.

9. Labour Participation falling In recent years at least, the UK had has an additional problem with falling labour participation. There has been a rise in long-term sickness which has led to older, more experienced workers leaving the workforce with decades of on-the-job training. Now there are multiple reasons, such as long-covid, a rise in waiting lists, and general deterioration in health. But, it affects productivity, and a lack of skilled workers, the UK has had to rely on immigration to fill vacancies – and despite high level businesses still complain they have difficulty in some areas.

10. Access to finance. Many small medium-sized firms warn that getting long-term finance for business expansion is difficult in the UK, with banks reluctant to take risks. Unlike on the continent, more firms gain finance from the stock market which tends to favour short-term returns other long-term investments. The recent rise in interest rates is also an additional shock, making it hard to change this picture.

11. Growth in asset prices. Another factor complicating investment for business has been the boom in asset prices in the past decade. Low interest rates caused a boom in house and land prices. And It has meant the UK has seen a rise in wealth-to-incomecome ratio. But, as house prices rise, this encourages investment in real estate, and rather than more productive and dynamic sectors such as manufacturing and research and development.

Related