Last week the UK economy slipped into recession. But, was it avoidable? Why are interest rates not coming down when households are facing the greatest squeeze on incomes for a generation? Although inflation is falling it is still above the inflation target, but it is a mistake to prolong a recession, when inflation is expected to fall anyway?

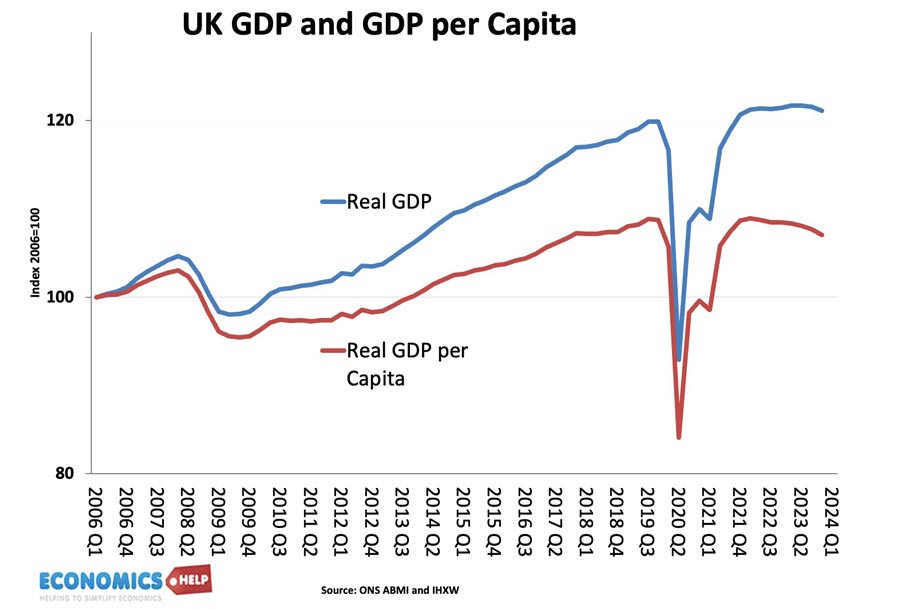

The first problem the Bank of England faces is that the economy is in a dire state. Average real GDP growth has barely managed 1% in the past 12 years, take away population growth, and average real GDP growth per capita is barely increasing at all.

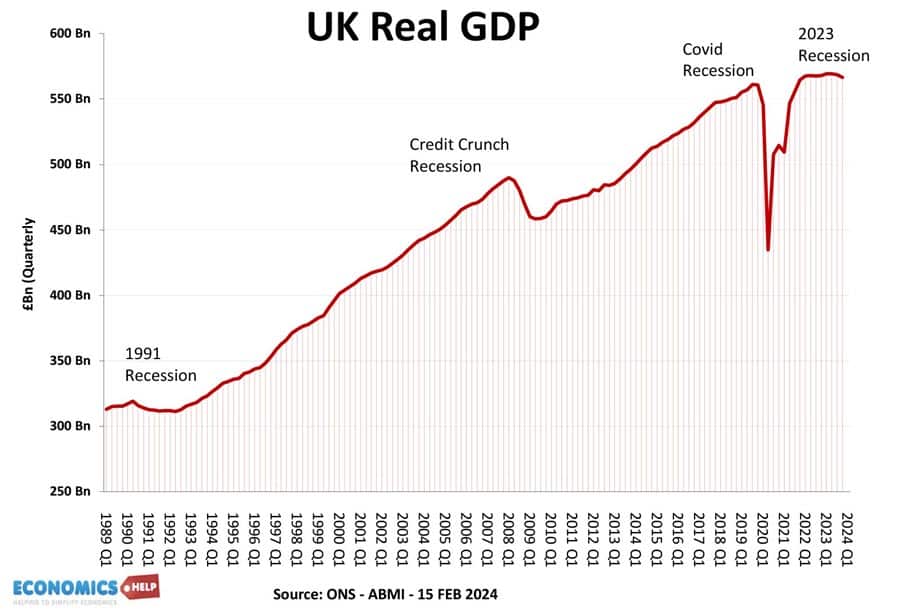

When you have very low economic growth, it doesn’t take much to push the economy into recession. One key factor in the recession was the big drop in retail sales at the end of last year. It is a reflection of how households are stretched by high taxes, high interest rates, inflation and stagnant wages.

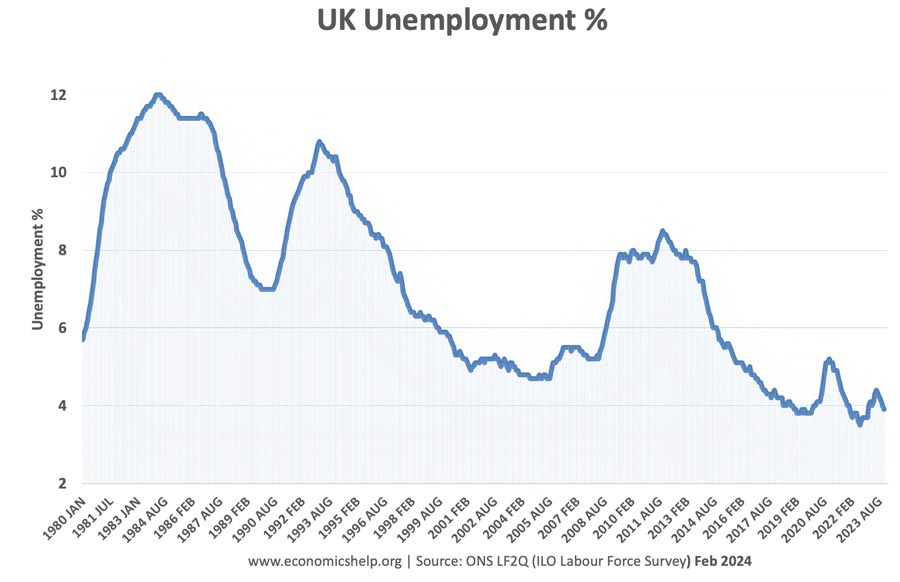

The Bank of England point out that so far this particular recession is relatively mild, GDP only fell by 0.4% compared to say a big drop of 2% in 2009. Also, we have to admit it is a strange recession, when unemployment is near record lows. It is what you might call a technical recession – which means GDP is falling for six months but it lacks the dramatic surge in unemployment that characterises much deeper recessions.

However, on the other hand, you could argue that GDP stats hide the true pain felt by many households. According to Which 10% of households missed paying an essential bill, and with households squeezed there has been a rise in borrowing and a fall in savings. 30% of households have savings of less than £1,000. Average household debt per person is around £34,666 or 100% of earnings. It means many households are vulnerable to higher interest rates. Bloomberg report 3 million households are in debt to their energy supplier and despite prices coming down in April, they will still be 50% higher than before the crisis.

Income Squeeze

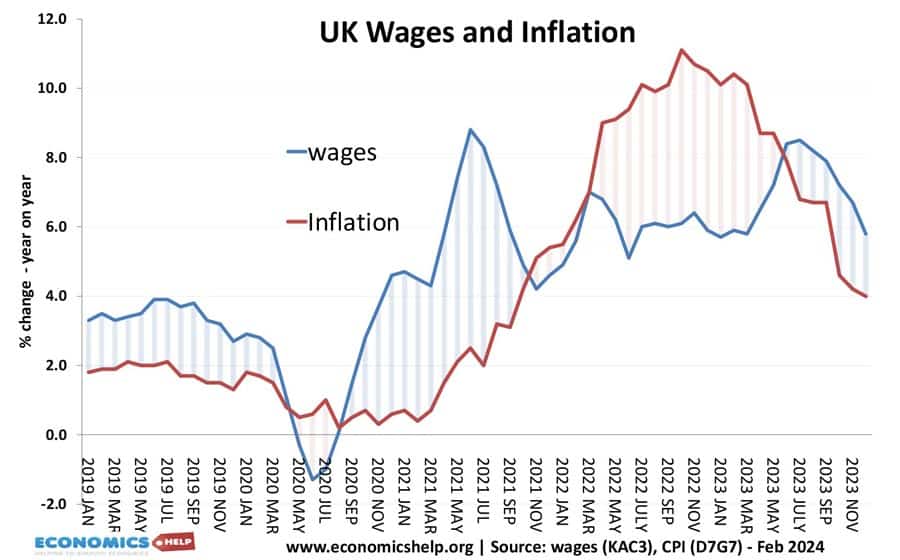

The biggest problem is that real household income has been squeezed by the past two years of high inflation and low wage growth. Even in the next few months, real incomes are expected to decline or stagnate as households try to catch up with a rise in debt. It will also be worse for low-income households who face a continued benefit squeeze and withdrawal of cost-of-living measures. And it’s not just households, industry struggles from low investment and industrial production is still below pre-covid levels.

Is it a mistake to have high interest rates?

There are three main criticisms for recent rate rises. Firstly, interest rates have significant time lags, so the past increases which started in 2022 still haven’t been felt by the economy. In 2024, millions of homeowners are still remortgaging to higher fixed rate deals. Therefore, there is still a squeeze on living standards to come. Monetary policy is like moving a very slow-moving ship. Once you turn the levers to depress the economy, it takes a long time, should you want to reverse course. It might sound confusing but even if the Bank were to cut interest rates, the average homeowner would still face higher mortgage rates this year.

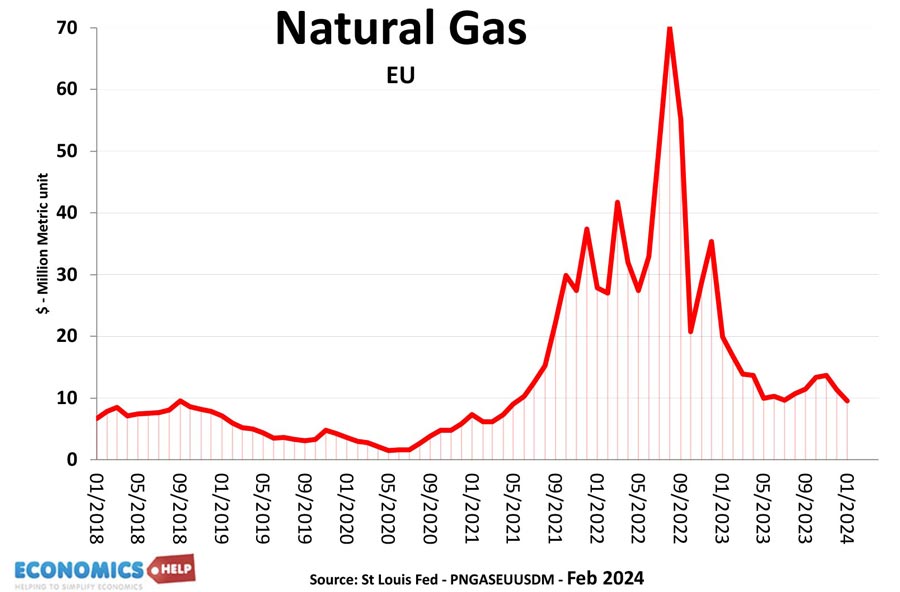

The second complaint is that higher interest rates are only having a limited impact on actually reducing inflation. Inflation was primarily caused by cost-push factors, higher energy prices, higher food prices and second-round effects on wages. But, with energy prices coming down, this aspect of inflation will fall without needing to put the economy into recession. UK workers have very limited bargaining power.

As inflation falls, nominal wage growth has already fallen quite sharply. If we look at the causes of inflation, an overheating economy barely registers. With the economy in recession, there is no classic demand-pull inflation. With this unusual situation, changing interest rates has made relatively little difference to either inflation going up or inflation coming down. I would say no impact. If you raise interest rates high enough, it will eventually squeeze inflation out of the system because as you enter a recession, it will put downward pressure on prices. But the question is – is it desirable?

Related to this point, is that higher interest rates are much less effective than they used to be. Higher rates hurt recent homebuyers, business and consumers with large debts. It is this group of the economy which is facing falling real incomes and growth. But, the irony is that for the first time in history, higher rates actually created a net positive income effect. In other words, higher interest rates helped savers gain more dividends and this outweighed the negative effect of higher borrowing costs. So how can you expect higher rates to have much impact on reducing demand when net income actually increases? Now, this unusual situation is related to the fact more people have a fixed-rate mortgage, and in the coming months, higher rates will increasingly bite. But, the problem is that higher rates have a very uneven effect. To purge inflation from the system requires a lot of pain for a small group of the economy, but actually benefit others. Ironically a solution to this is use fiscal policy i.e. changing tax rates to influence demand, but for obvious reasons politically impossible.

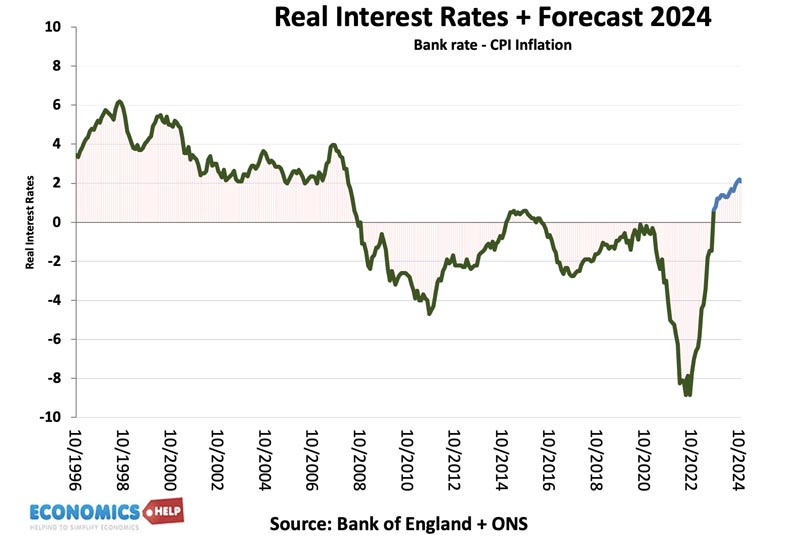

In the 2010s, many savers very reasonably complained that real interest rates were negative – inflation was higher than base rates of 0.5%. But, now we have a sharp reversal with base rates higher than inflation. The Bank’s most recent inflation forecast is for inflation to fall to 2% by the end of the year. As inflation falls, we could see the real interest rates rise to possibly +3%. It will be the highest level for decade. The truth is even if the Bank of England cut interest rates, inflation would continue to fall. So it raises the question why would you want to have the highest level of real interest rates for over a decade, when the economy is in recession, the high street is struggling and households are struggling to pay their bills?

In Defence of High Rates

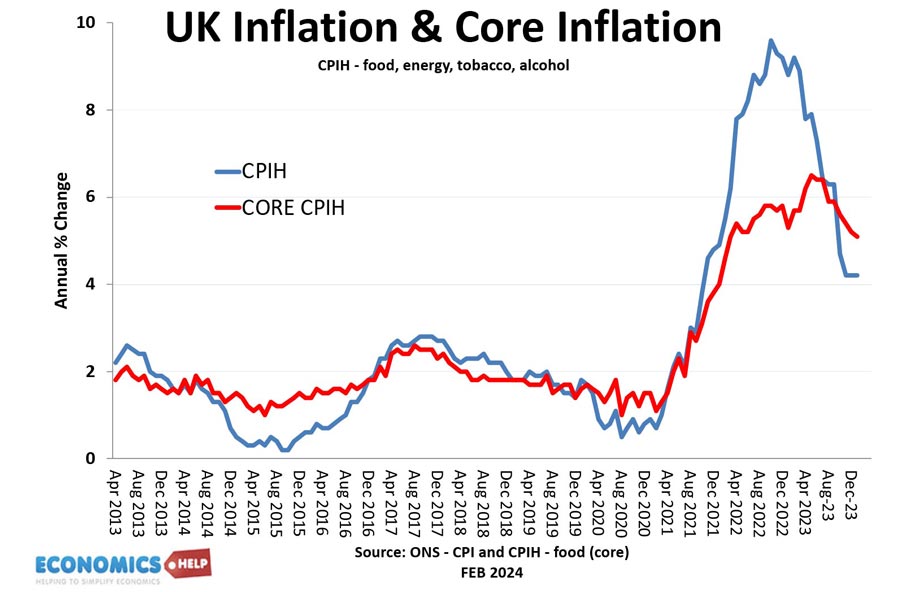

Now, if we wanted to defend of the Bank of England’s stance, we could look to the problem of continued inflation. Headline inflation might have fallen to 4%, but underlying core inflation is still higher. Workers are trying to catch up for lost real wages, by higher nominal wages.

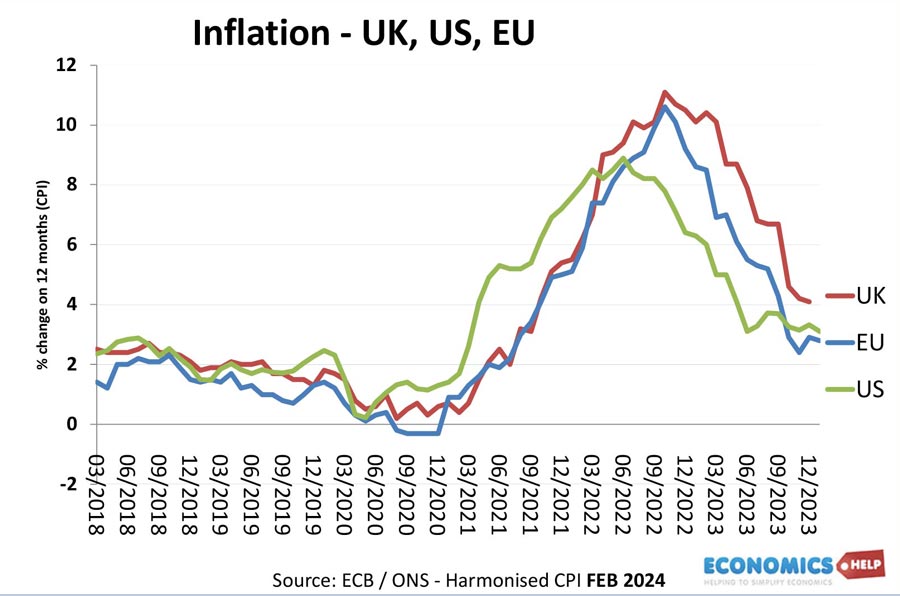

There is a stickiness in UK inflation, which has been higher than many of our international competitors. Firms face some labour shortages note helped by falling participation rates. Whilst gas prices are falling, there are new cost-push pressures. For example, oil and shipping costs have risen in response to the turmoil in the Middle East. The Bank of England have a target of reducing inflation to 2%, so they are reluctant to start cutting rates when inflation is still higher. Also, the Bank of England claim there tentative signs of the economy recovering.

Consumer confidence has risen from the depths of early 2023, though it is still -21. Retail sales rebounded in January. But, these green shoots of recovery still look very fragile at best.

Past problems

The Bank of England was hurt by being the curve in 2022. The scale of QE during Covid was a mistake and it was a mistake to keep interest rates so low for long. Recently, I made a video about the Truss mini-budget of September 2022 and it surprised me to remember that before mini-budget Inflation was 10%, but interest rates were only 2.2%. No wonder, interest rates shot up so quickly when the budget was badly received by markets. But, anyway, the point is they were criticised for allowing inflation to rise too much. But, now they are overcompensating by placing too much stress on reducing inflation and regaining credibility. But it is worth bearing in mind, the Bank’s remit is not just for inflation. They need to meet the target in a way that sustains growth and employment. Also, the 2% inflation target was created rather arbitrarily and adopted without any research about whether that is the best target for an economy like the UK.

Problems of Monetary Policy

The unwelcome truth is that monetary policy is a very imperfect instrument. It’s not a simple matter of raising interest rates and you get X% reduction in inflation. The inflation we’ve had recently has not come from a booming economy, so trying to slow down the economy has pushed us into recession and made relatively little impact on inflation which is driven by global factors.

Having said that I don’t envy the Bank of England’s job. The truth is that the problems of the UK economy are much deeper than criticisms of monetary policy. If we cut interest rates to 4%, it’s not like the economy would suddenly start doing well again. The real problem can’t be fixed by monetary policy. It is low-productivity growth, low investment and regional imbalances. These kind of problems cannot be solved by some magic monetary policy. In fact the past decade of QE did more harm than good. This video explains how QE increased inequality and contributed to the inflation of 2022. Do check it out and consider subscribing.

Related