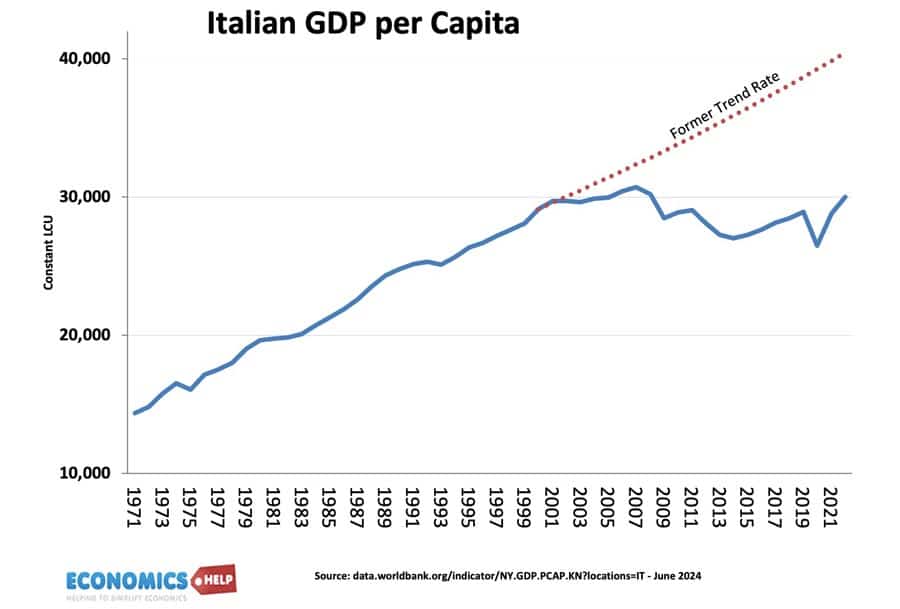

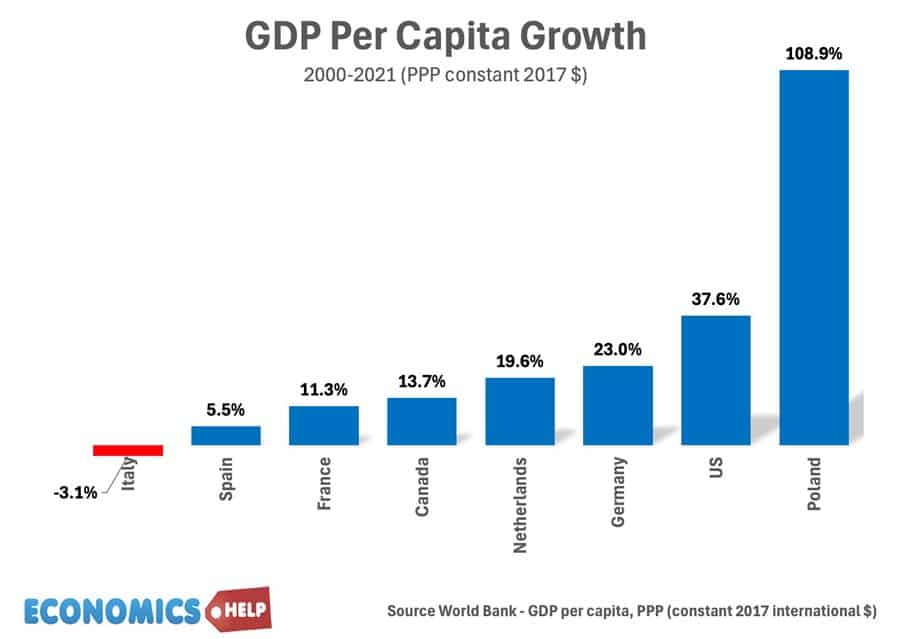

Around 2000, something remarkable happened to the Italian economy. It stopped growing and went into a 20 year long-decline.

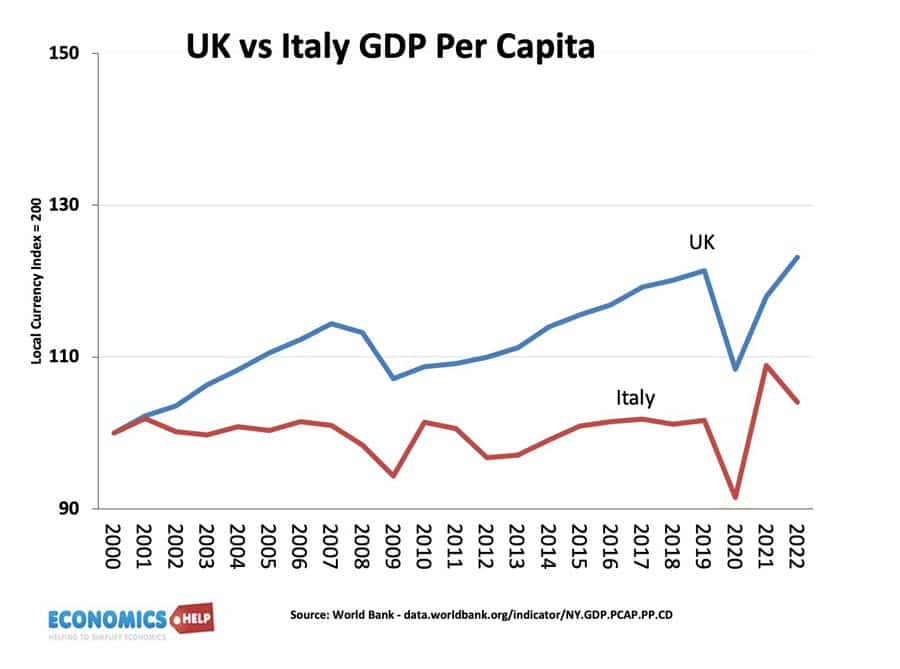

Even if you adjust for population, Italy’s performance was strikingly worse than its main competitors. If we look at productivity, Italy fell far behind. It has effectively lost two decades with real wages remaining virtually stagnant. Italy was an outlier. But, 10 years later and the UK seems to be embarking on a similar journey.

Now real GDP in the UK has increased more than Italy since 2010, but 75% of the UK’s economic growth is due to a rising population. If we look at average incomes and there is a similar story of stagnation. Is the UK copying Italian economic disease or is something entirely different? And does Italy’s recent recovery offer a more hopeful future?

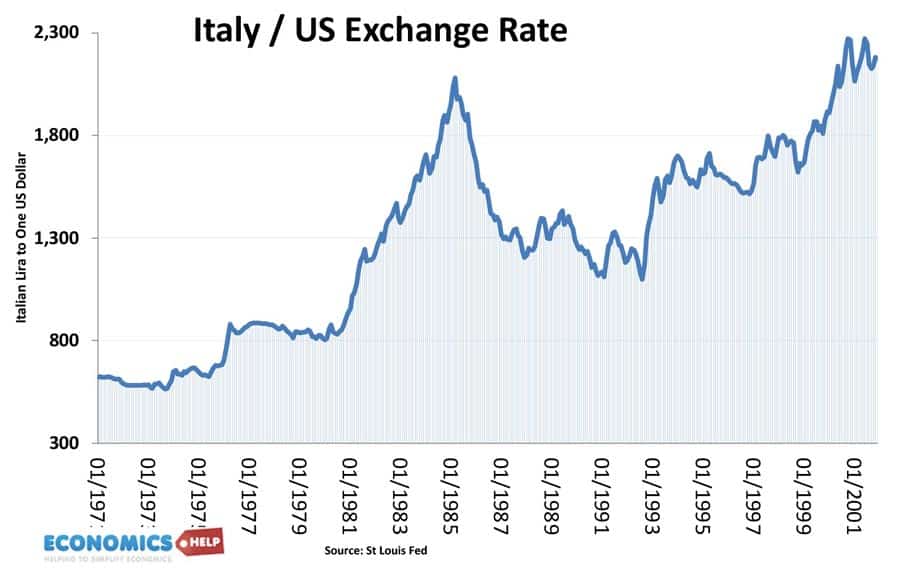

in the first half of 2000, the UK really outperformed Italy. One difference was that Italy joined the Euro, the UK didn’t. In the post-war period, the Italian economy did relatively well, catching up with richer northern European countries and even enjoyng a similar growth rates to Germany. But, a part of this story was the Italian reliance on devaluation in the Lira. Italy had higher inflation, but frequent falls in the value of the currency enabled Italian manufacturing to remain competitive.

However, once in the Euro, this flexibility was lost. Italian firms just became uncompetitive and experienced a growing current account deficit. For a while, Italy just increased its debt but the Euro party came crashing down in the 2012 Euro debt crisis. Italian bond yields spiked as investors suddenly realised there was no lender of last resort. In response, Italy embarked on a decade of austerity, cutting spending in a bid to run a primary budget surplus. But this was really hard because Italy pay over 8% of government revenue just on financing their debt. Italian debt levels are amongst the highest in the OECD. This Euro-enforced austerity, caused Italy to have a double dip recession, and a futher fall in real GDP. There was little Italy could do, no independent monetary policy, no exchange rate independence and now forced to follow fiscal austerity.

How does the UK compare? Well retaining it own currency definitely gave the UK more flexibility. The great financial crisis really affected the UK because they were so reliant on finance. In response Sterling depreciated a massive 30%, which in theory should make UK goods more competitive and boost economic growth. Now as it happened in a global recession, there was little actual increase in UK exports, but without the exchange rate flexibility, it could have been worse. With an independent Central Bank, the UK never had a liquidity crisis, bond yields fell in the UK despite raising debt levels. Yet, for different reasons to Italy, the UK also embarked on austerity and cutting government investment. This meant the weak receovery of 2010 was partially sniffed out, leading to very low investment and growth over the next decade. The UK investment was the worst in the G7. The Bank of England tried hard to boost the economy, but QE pumped money into the finance sector and housing market, which did little to boost actualy investment.

Supply Constraints

However, even though austerity is a factor behind low growth in both countries, there is much more to such a long term decline. Italy’s low economic growth has been blamed on poor management and lack of incentives and innovation. It is claimed there is a underlying problem of cronyism and corruption which has infiltrated many firms and government departments, it creates a drag on dynamism and innovation.

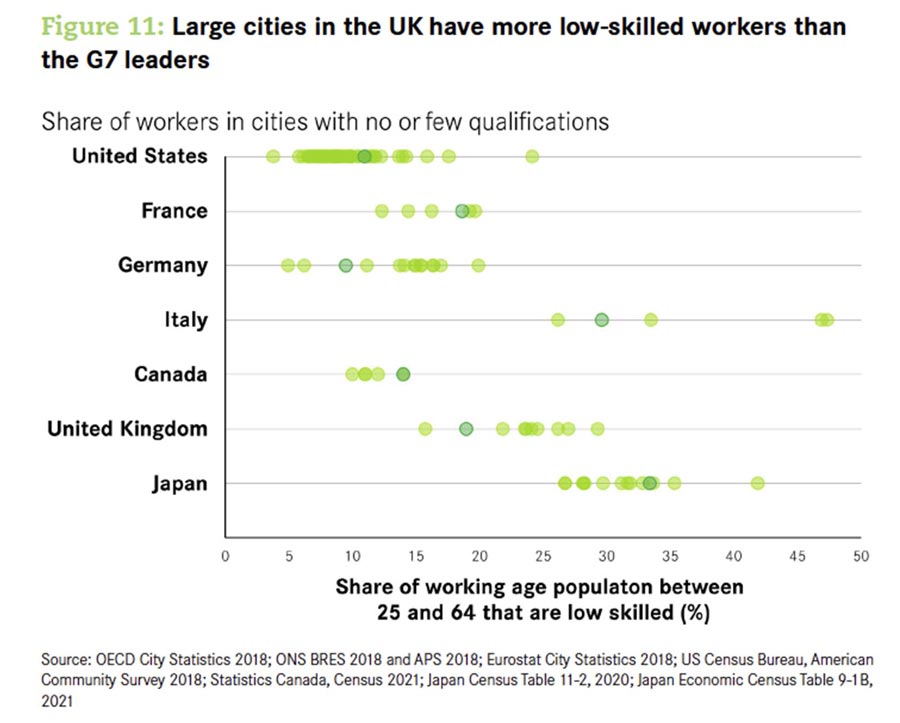

It’s also striking to look at levels of skilled labour. Italy has real problems with one of the lowest rates of young people in education or training, and this is reflected in the number of workers with low skills and qualifications. The UK is better than Italy, but still remains behind, with a particular lack of vocational skills. Another problem Italy has faced is losing a large share of the most skilled young workers to emigration and with a shrinking population this is something Italy can’t afford.

Population Growth

One contrast between the two countries is that the UK has seen strong growth in the population, with high levels of net migration providing more workers. Italy by contrast has seen a drastic fall in birth rate, and a fall in the working age population. With an ageing population, people save more, consume less and it also discourages investment.

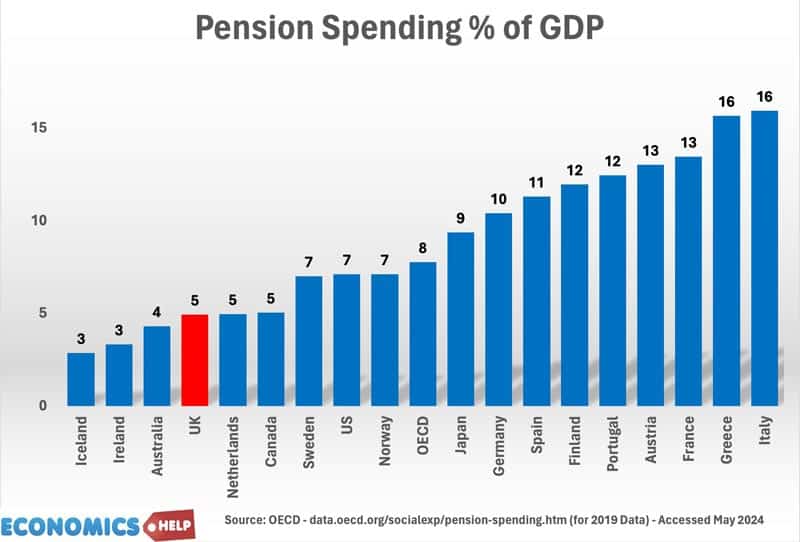

Another big contrast between the two countries is the pension system. Italy spends 16% of GDP on pensions, the UK just 5%. No wonder Italy has been weighed down by high debt levels. Now it is always good to remember there’s more to life than economics and one good thing about Italy is high life expectancy, life in Italy is good, whatever happens to the economy, but the result is the government have to pay more pensions. In 2021 pensioners were 41% of the working age population in Italy, but only 33% in the UK. Nevertheless, the concern for the UK is that the population is set to age more in the coming years.

Uncertainty and Brexit

Another reason often cited for Italian economic problems is political uncertainty 68 governments in 77 years. The early 2000s, were also dominated by the scandal and uncertainty of the Breslusconi era. By contrast the UK’s first past the post system is supposed to promote strong stable government with clear majorities able to promote long-term policy. In this respect post 2016, the UK has been endevouring to catch up with Italian chaos. There’s been a revolving door of five prime ministers and frequent changes of chancellor and direction of economic policy. The UK’s difficult departure from Brexit ushered in a seeming new strand of political uncertainty.

The UK performance since 2016 has been affected by Brexit, not just uncertainty but new trade rules which have been disruptive. It is a factor why UK GDP per capita is still lower than pre-covid levels. Ironically, in the past four years, Italy has been one of the fastest growing economies in Western Europe. Admittely, this is against very weak opposition, but it has been helped by the European Union recovery fund. Italy has already received €100bn and is set to receive more. Italy is the biggest recipient of EU funds and this has provided a boost to investment and recovery. By contrast, Brexit has been a self-inflicted wound for the UK, especially for firms importing and exporting with Europe.

North South Divide

Another reason for Italy’s economic difficulties has been ascribed to a growing north south divide. Real GDP per capita is 40% less in the south of Italy than the north, something that has got worse in recent decades rather than better. There is an uneven distribution of industry and investment and this has held back overall economic growth. The UK also has a regional problem with economic activity and wealth focused on London. London real GDP per capita is significantly higher than elsewhere in the country and has become a magnet for investment, migration and growth. it also has the most overvalued housing market. Like Italy, the UK struggles to invest in other areas of the economy, a recent report by Centre for Cities found the UK’s lack of investment in secondary cities was a major reason for decline.

Conclusion

In many ways the stories of Italian and UK decline are different. Italy’s decline really kicked in after 2000 For the UK it was 2009 worsened by austerity and Brexit. But, the concern for the UK is that once you start to stagnate it can be difficult to get going again, and some of the italian problems like ageing population, political instability and creeping up on the UK. But, whatabout Italy’s recent recovery, Please check out my global economic channel which looks at why Italy went from worst to last.