Hampshire is one of the more prosperous parts of England, average house prices are over £400,000, but Hampshire County Council has the largest deficit in the UK. Like many local councils, it is at risk of bankruptcy. The council is spending more, but residents appear to be getting less. In 2011, the council spent 52% of its budget on social care, now it is 83%. It means that old fashioned local council services that are widely used like libraries, street lighting even lollipop ladies are being cut. It seems governments are getting bigger, but can do fewer useful things.

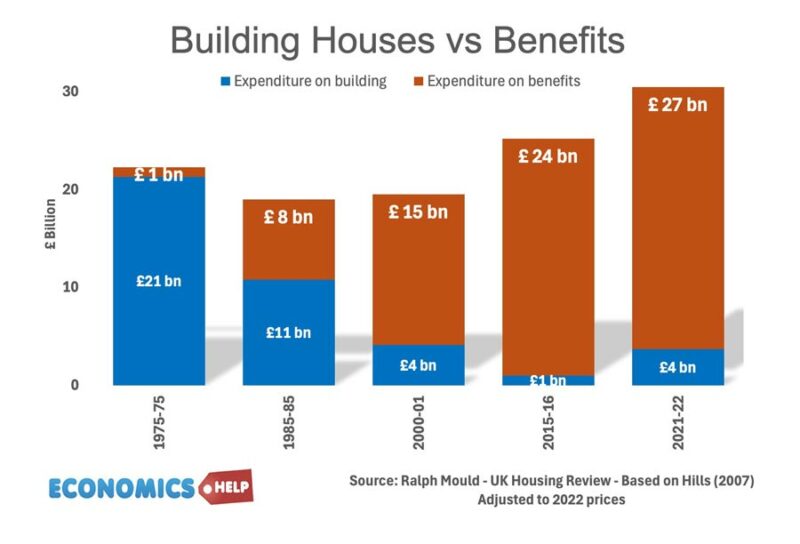

In 1975, 95% of government housing expenditure was spent on building new homes, and just 5% on benefits. In 2022, it is just 12% on building new houses, with £26 billion going on housing benefits.

Building council homes was an effective use of public money because it provided affordable homes. But, we stopped doing it in the early 1980s. Since then house prices and rents have soared. But, this has become very expensive for the government. The government has to spend more on housing benefits. It would be more, if they had not introduced two child cap. But a combination of unaffordable rents and squeezing benefits has caused a rise in homelessness, which of course falls to local councils and it is very expensive to provide temporary accommodation. Last year, councils spent an estimated £2.3bn on dealing with the problem of homelessness. It is this crisis management which is squeezing more popular spending on services like parks, infrastructure and actually building new homes.

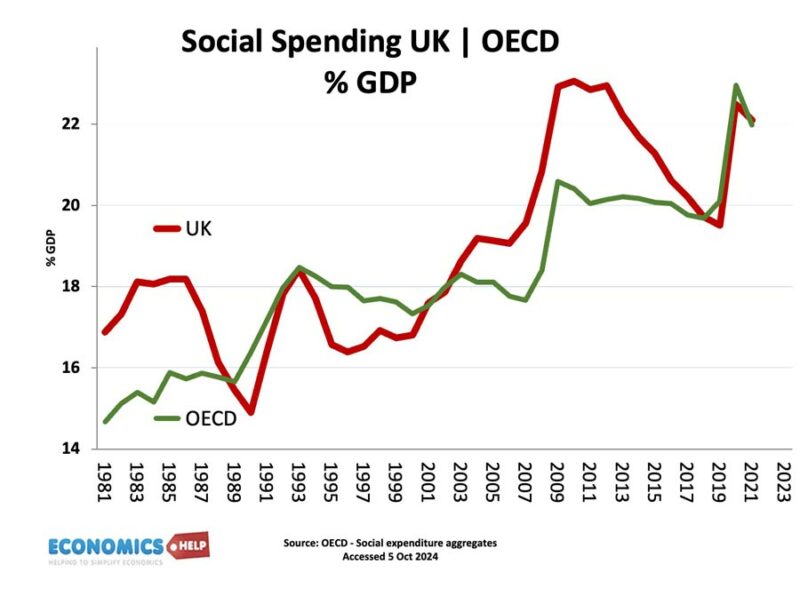

The UK is not an isolated case, across the western world, governments are getting bigger but It is being driven by a rise in pensions and social spending. Voters are increasingly frustrated as they see taxes rise but seemingly the quality of public services decline.

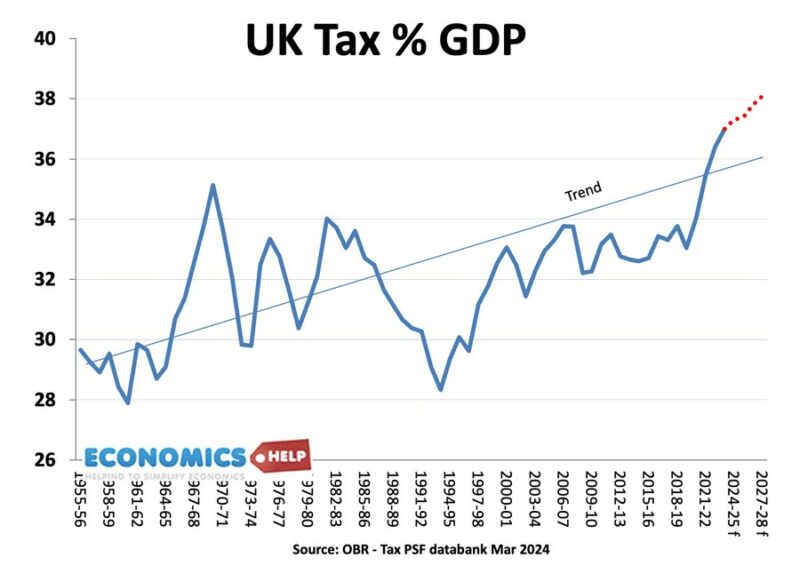

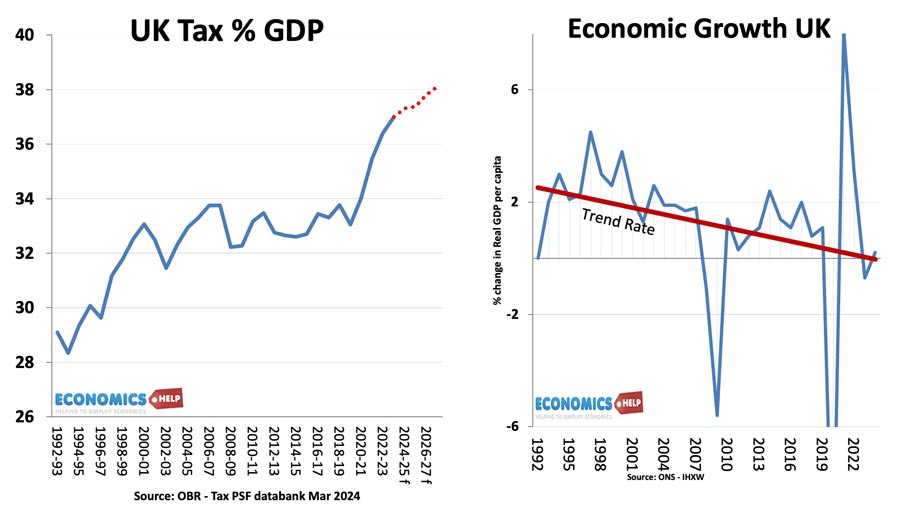

In the UK, taxes have been rising as a share of income, but despite taxes rising they have not been enough to meet the spending requirements of key government services. The most important priority for the UK public is health care, yet waiting lists have passed 7 million, with patients finding it difficult to get appointments.

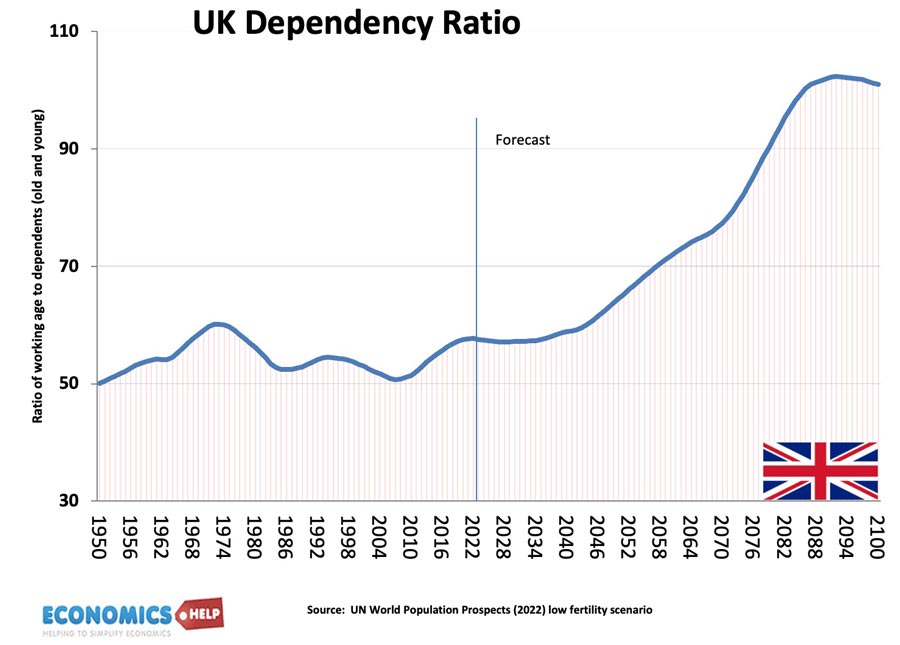

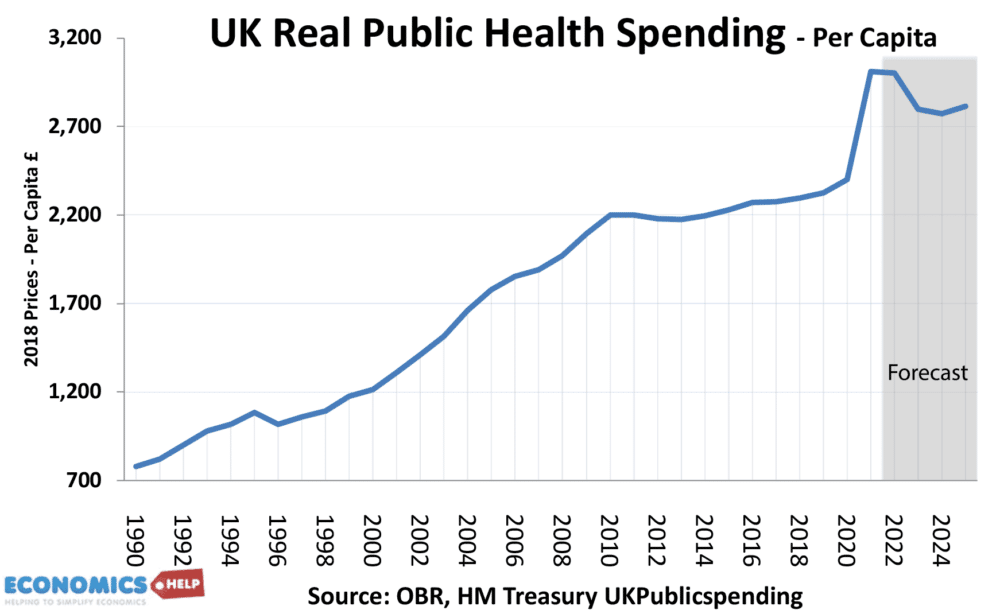

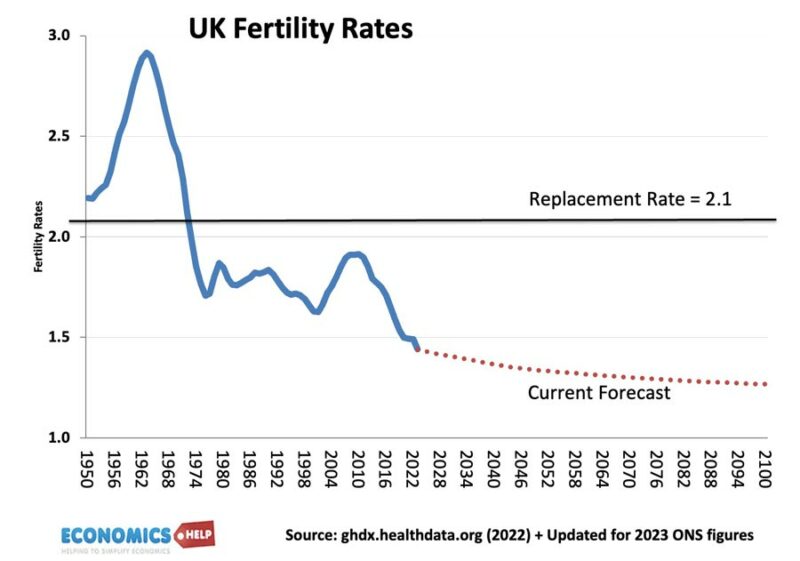

The biggest cause of this global trend is an ageing population. In the post-war period, most western governments set up pensions, a welfare state, and universal health care. But, there was hardly ever any investment in a pension fund, just a reliance on economic growth to provide higher tax receipts. However, there are three major problems with this model. Firstly, people are living longer and having fewer children. It means the share of people in retirement age is soaring. Governments have to pay more pensions from a smaller workforce. Entitlement spending is rising whether it is in the US or UK. Secondly, healthcare spending has soared without being able to keep a lid on waiting lists. In 1990, the UK spent £700 per capita on health care, today it is £2,800.

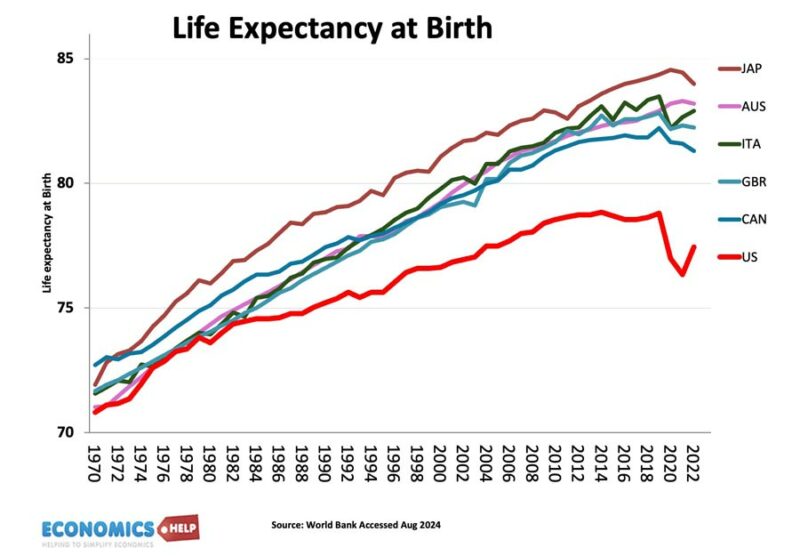

That is real terms – inflation-adjusted increase. But despite higher spending, waiting lists are growing. There are more expensive treatments, people live longer and so need more treatment in old age, but also there has been in increase in sickness amongst younger people, which has added to the pressure. Despite squeezing wages of medical staff, there has also been a failure to keep a lid on costs and improve productivity. For many reasons, productivity in health has grown very slowly, and spending rises, but outcomes have not particularly improved. To some extent, you can point a finger at government bureaucracy and new layers of management, but bear in mind, the US with its semi-private system, spends double the amount of GDP on health care than the UK, yet for all this health care spending, life expectancy in the US has fallen behind many economies who spend less on health care. It’s not just governments who struggle to get value for money.

The bad news is that we are only at the start of this demographic crunch. Recent data on birth rates, show the UK fertility is falling much faster than forecast. The ONS is frequently wrong about population forecasts. Recent data shows UK fertility fell to just 1.44.

The share of people over 65 will grow and so will spending on pensions. The OBR claim on current policy, government spending will rise to 55% of GDP by 2050. The problem is that even if governments maintain current policies they will not get much credit. After paying taxes, we expect a pension. But, the rise in entitlement spending is crowding out other more attractive areas of public spending. The Government’s share of spending on research and development has declined from 17% of the total to 8% – public investment in the UK has been particularly squeezed in the UK. In the 50s and 60s, it was 4.5% of GDP. Now it struggles to reach 2%. This damages long-term growth, but when governments are squeezed it is more tempting to cut investment.

Regulations

There is more to the problem than demographics, growing scope of governments has often brought regulatory over-reach. Planning regulations can impose ever-higher costs on investment and business. The new Thames Crossing has spent £800m on planning process and it’s not even certain it will happen. The Planning process runs to 400,000 pages. If printed out, it would be longer than the tunnel itself. In East Dunbartonshire, 15 new council properties will cost £8 million to build because of new regulations, and the high cost of building. It’s no wonder councils cannot build new housing. Let’s not mention HS2.

Temporary becomes permanent

Milton Friedman once quipped that there is no such thing as temporary government spending. Temporary soon becomes permanent. In the 1930s, US agriculture received temporary subsidies during the great depression. Over the next decades, subsidies to farmers just kept growing. It was in no one’s political interests to take away the subsidies. US agricultural subsidies now account for around $25 billion a year. It is the same in Europe where the EU has spent 40 years trying to undo the damage of the Common Agricultural Policy. The current Labour government made an effort to tackle a long-term rise in spending on benefits, by means testing winter fuel allowance, but despite saving little over £1bn, there was a big political backlash. Once benefits are there, it’s always easiest to leave. A big problem in UK politics for the past decades has been the underfunding of social care – it is why so many councils are being squeezed and councils face bankruptcy. They have a legal requirement to provide care, but not the funds.

In 2019, Theresa May introduced a manifesto policy to fund social care by using the value of people’s homes they owned. It was labelled the dementia tax and she nearly lost the election to Jeremy Corbyn. No wonder difficult decisions are delayed to some time in the future. Because of pressure on spending, there are many difficult choices and trade-offs, but in an era of political populism, governments have resorted to higher-impact short-term tax cuts or spending pledges, which often have poor return

What does governent spend money on?

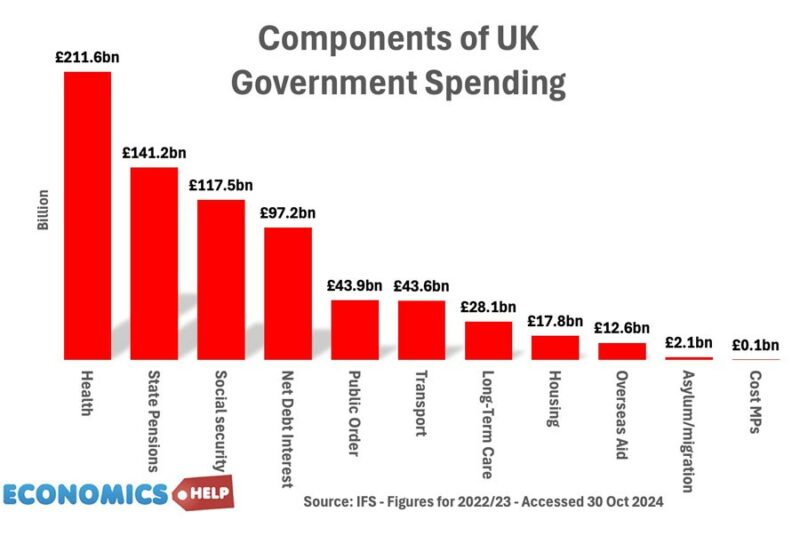

How much does the government actually spend its money on? In 2022/23 the UK government spent a total of £1.2 trillion. The biggest areas of spending are health, pensions, and working age benefits. The fourth largest is debt interest payments. And this is another problem which is increasing rapidly. Government spending is rising faster than our willingness to pay higher taxes. The result is higher borrowing and higher debt interest payments. The recent rise in interest rates and inflation significantly increased the cost of debt interest. It’s not just a UK phenomenon, US debt is soaring as a share of GDP. It is forecast to rise to record levels. But in the upcoming election, Trump will increase debt by $7.7 trillion. Harris by $4 trillion.(Committee Responsible Federal Budget) It was only 30 years ago, the US was running budget surpluses under Bill Clinton.

The other unwelcome reality is that economic growth is slowing down. The one exception in the developed world is the US. In the post-war period, growth of 2.5% was common in the UK. Since 2010, per capita growth is less than 0.5%. This is another headache for the government. It is why taxes have had to rise, without any seeming improvement in public services. In the post-war period, the UK spent more, debt fell, and living standards improved. Has that golden period come to an end?

However, the growing size of a government doesn’t have to be a failure. The Scandinavian model suggests you can have an even bigger government but relative satisfaction. The Danish model is one example. Government spending as a share of GDP is higher taxes are significantly higher. VAT is 25% rather than 20%. But, it’s not just about spending more. The Danish health care system is helped by a state-of-the-art IT system, managed by US multinationals, it also uses a health ID card. But, most importantly around 88% are happy with paying high taxes. It is not a socialist economy, it is still market-based but a welfare state which works. The problem for UK is a creeping rise in government spending, but never enough to really make things work. If you want US tax levels, then the only real solution is to pay thousands of pounds in private health insurance.