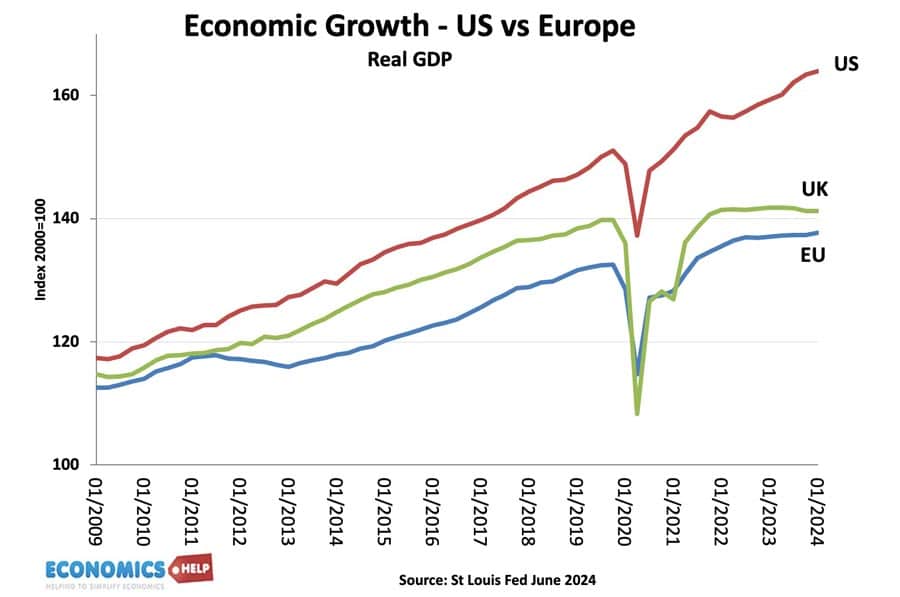

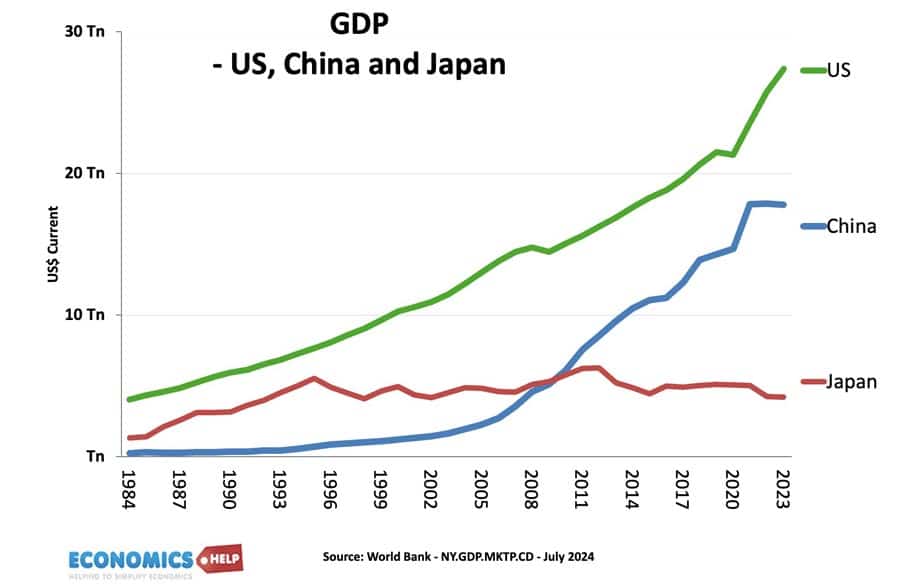

The US economy has been outperforming the rest of the world. It has left the European economy in the dust. In the 1990s with everyone buying a Sony Walkman, it was Japan which was going to overtake the US, but it never did. The market capitalisation of Apple is now worth 80% of the entire Japanese economy. This decade it was supposed to be China who would overtake the US, but whilst the US booms, China is having its own 2008 style property collapse.

In 1980, US GDP was 41% of the G7 economies. In 2024, it is 60% of the G7. Since 2000 US real wage growth has exceeded over advanced economies. The US has seen 17% real growth compared to falling real wages in Spain, Italy and Japan. Since Covid its performance has been particularly good, helped by a booming shale oil industry, and an unprecedented fiscal expansion which has seen a boom in manufacturing investment, near-record low unemployment and a strongly performing economy – at least by international comparisons.

US Exceptionalism

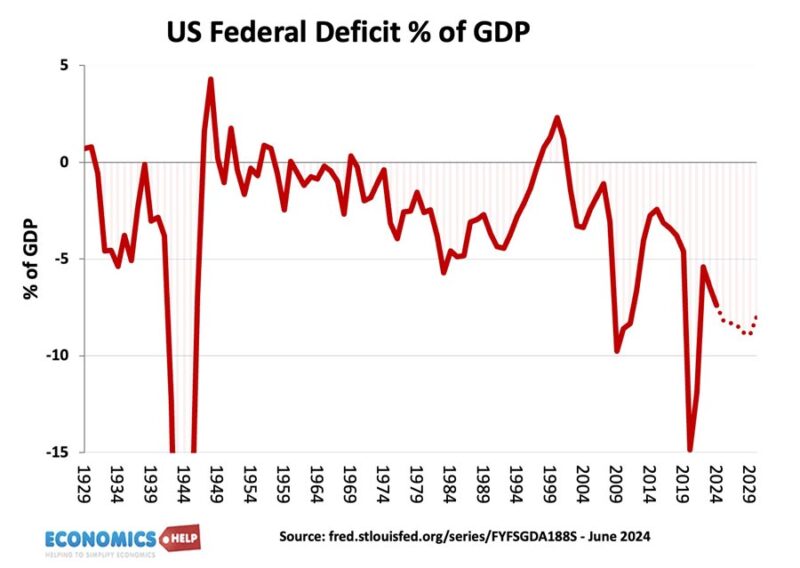

The US is now an energy exporter making it less vulnerable to oil price rises. The revenue of the big 5 tech companies is bigger than that of major economies like Australia. The US stock market is worth 61% of the global total stockmarket value. For all the past predictions of American decline, It seems American exceptionalism is slow to fade away. Yet, the relative success of the American economy is not matched by political stability. Despite high growth, the US budget deficit continues to widen and both candidates go into the election promising tax cuts and higher spending. The plans of both candidates will increase the US debt by unprecedented levels. $4 trillion in the case of Harris. $7.7 trillion in the case of Trump.

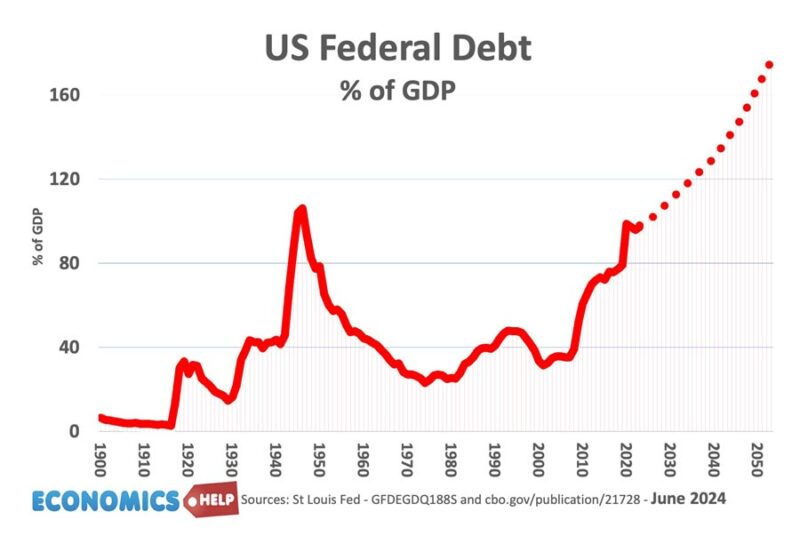

Debt

The problem for America is that if you look into the future, there is a hangover around the corner. Even if we ignore the 2024 promises, the US has a problem. Debt is forecast to rise to 180% of GDP. America is ageing, and a host of government spending on health debt interest and pensions will need to rise. As alarming as this sounds, it needn’t be a major problem given America’s wealth, but there is no guarantee the political system will act rationally. Could this rise in debt, combined with political instability, and the reversal of policies which made the American economy strong – finally tip the American economy into a prolonged decline?

The end of the dollar?

The dollars global status as the dominant global currency have definite benefits for the US economy. US Treasuries are the global gold standard for savings. It means that when the US wants to borrow more, there is no shortage of foreign and domestic investors willing to buy up US debt. This helps keep the dollar strong, and interest rates relatively low. In 2022, under Liz Truss, the UK wanted a big rise in borrowing, but it triggered a meltdown in Sterling and the UK bond market. It’s hard to see that happening in the US. The dominance of the dollar also helps to reduce transaction costs for American businesses and gives the US political clout. This could be seen in the freezing of Russian dollar assets after the Ukraine invasion of 2022. This was a real wake up call for those countries sceptical of American interests. China certainly sought to reduce dollar holdings and encourage trade settled in Yuan. In fact many predicted this economic sanction would trigger the imminent decline of the dollar as a global reserve currency. But, the reality is the dollar is still in a position of dominance

According to the IMF, the dollar’s share of central bank reserves peaked in 2001 at 73% and has since fallen to 59% a similar level to 1995. But, the Chinese Yuan is nowhere near to replacing it. The truth is investors still trust America more than China. China’s authoritarianism and capital controls, make it unattractive as global reserve currency. Since 2022, the Yuan’s share of international reserves has shrunk. What has happened is that the US dollar has been slowly replaced by other Western currencies and US allies like the Swiss Frank, Danish Krone and Canadian dollar. The Euro still lags behind because it lacks an equivalent European-wide bond like the US Treasury.

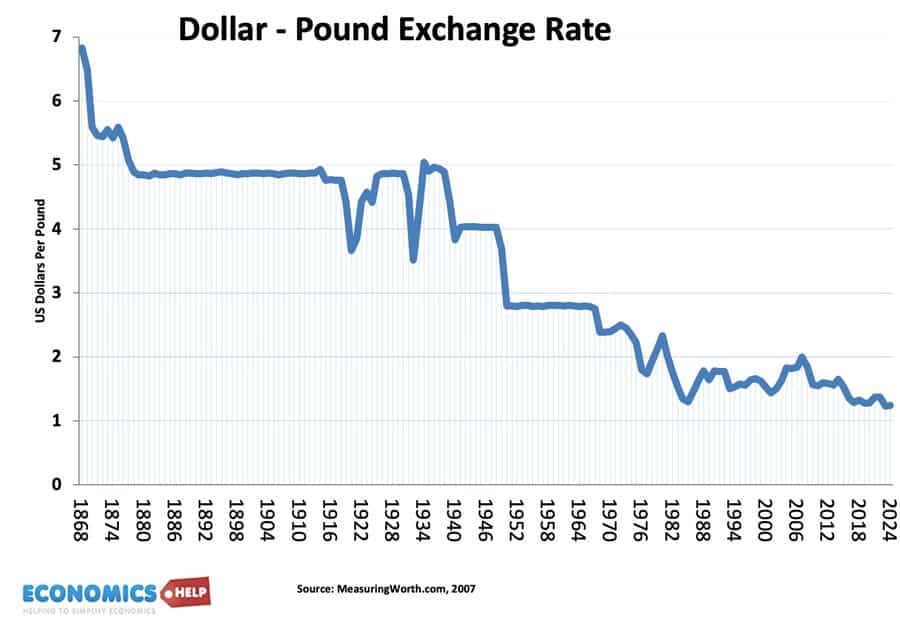

When I started studying economics 30 years ago, I remember reading articles about the imminent decline of the dollar and the end of American economic power. Today, there are no shortage of YouTube videos predicting the same imminent demise of the dollar and there will probably be for the next 30 years. But, even a stuck clock is right twice a day. Past reserve currencies like the Dutch Gilder and Pound Sterling all had their time in the sun and then faded away. There is no law which states the dollar will remain strong. But, the big question is what could cause the dollar to fall?

What Could Cause Dollar to Decline?

Well imagine a situation, where US debt rises, but due to political failings, there is no agreement on how to reduce the budget deficit. Faced with populist pressures, taxes keep being cut, whilst spending keeps rising. But amidst this, there is some external shock. It could be extreme weather events, another surge in global commodity prices or a global recession. The one certainty of economics is that in the next few decades, there will be many unexpected shocks which will necessitate a big rise in government borrowing. Usually, debt rises during a war, the US debt forecast is unusual because it is set to rise even assuming peacetime and no major shock. But, what do you do if there is a rise in inflation and debt at the same time? Foreign investors may no longer be convinced that US treasuries are of good value. Don’t forget in the 1970s and 80s, holders of US treasuries were burnt by inflation. The real value of the US Treasury fell because inflation was higher than their yield.

If a politician is struggling to maintain election promises and the budget deficit is widening, they may resort to putting pressure on Federal Reserve to increase the money supply.

It is true, in one sense the US can never go bankrupt because it borrows in its own currency and it has full control to increase its currency and use this to buy US debt. But, if the money supply increases in a time of inflation, then you start to get an acceleration of inflation. Higher US inflation will make US goods less attractive, it makes US Treasuries less attractive so foreign demand falls. The dollar starts to devalue and as the dollar devalues, investors start to sell dollar assets causing further pressure on the dollar. If the dollar can no longer reliably hold its value, then its attractiveness as a means of exchange and store of value all change and investors will diversify into other currencies, be it the Swiss Franc, Euro or Indian Rupee. Maybe no currency fully replaces the dollar. But it will mean the US loses its special privilege to borrow at low rates and the world loses the US treasury as a safe haven destination for global savings.

On the one hand, a fall in the dollar isn’t necessarily bad news. It will make it expensive for Americans to travel abroad and it will make it more expensive to import goods, but it will provide a boost for US exporting firms. The key thing is how quickly does the dollar devalue.

The UK Pound has been steadily devaluing for 100 years, the UK is definitely in relative decline, but whatever Youtube doomsters may say- living standards are actually significantly better than they were 100 or 50 years ago.

American Strengths

On the other hand, it is possible that the exceptional American economy continues despite political weakness. The American economy has many strengths, excellent universities, world-leading productivity growth, a plentiful supply of immigrant labour, true the population is ageing but much more slowly than in Europe and Asia. The land of freedom means dynamism and entrepreneurial spirit are valued. The US’s continental size means good ideas have a large domestic market. Light touch regulation may contribute to the lower US life expectancy, but it does help economic growth. It would take a lot to derail the US economy – it is like a big ocean liner, even if the captain of the ship falls asleep or goes off to play golf, the ocean liner will keep going because of its momentum and all the other crew who have a vested interest to keep the ship going.

When we talk about American economic strength we are conveniently ignoring the very real problem of inequality, monopoly power and the fact many Americans struggle economically. This is why Americans feel poor despite the American economy being incredibly rich. The fact so many Americans feel left behind could also create political constraints such as a populist policy to set high tariffs or deport many immigrant workers, who have become deeply integrated into US economy.

Related

American Economy – at Economist