In 1909, the UK provided the first state pension to those over 70.

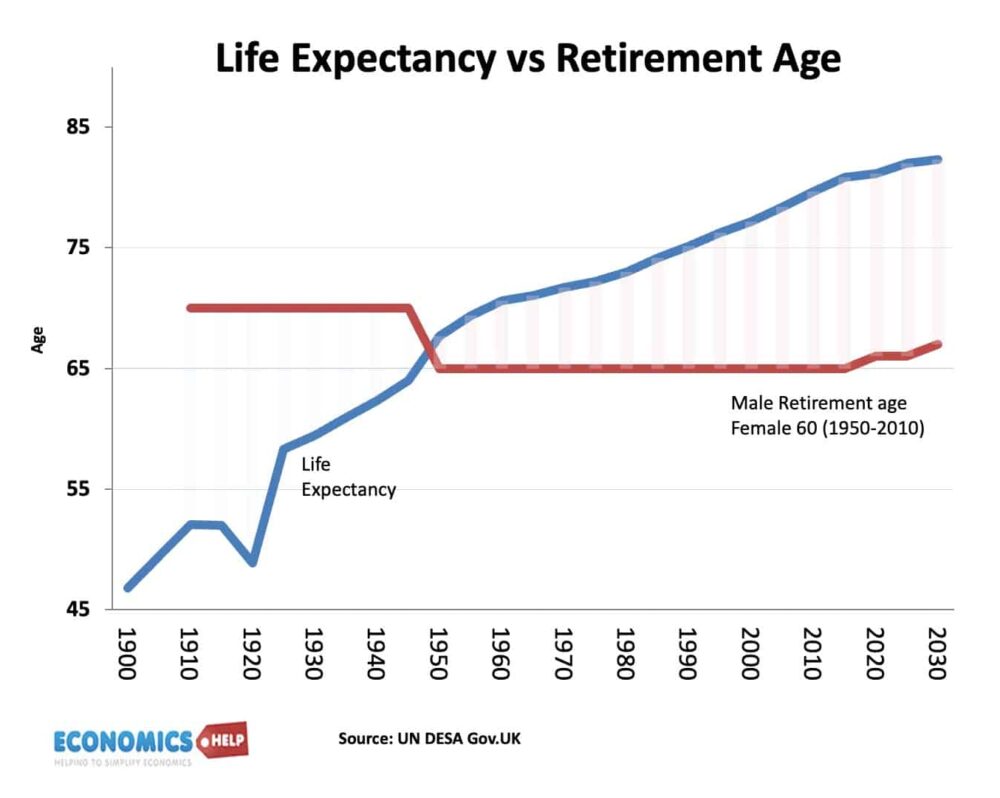

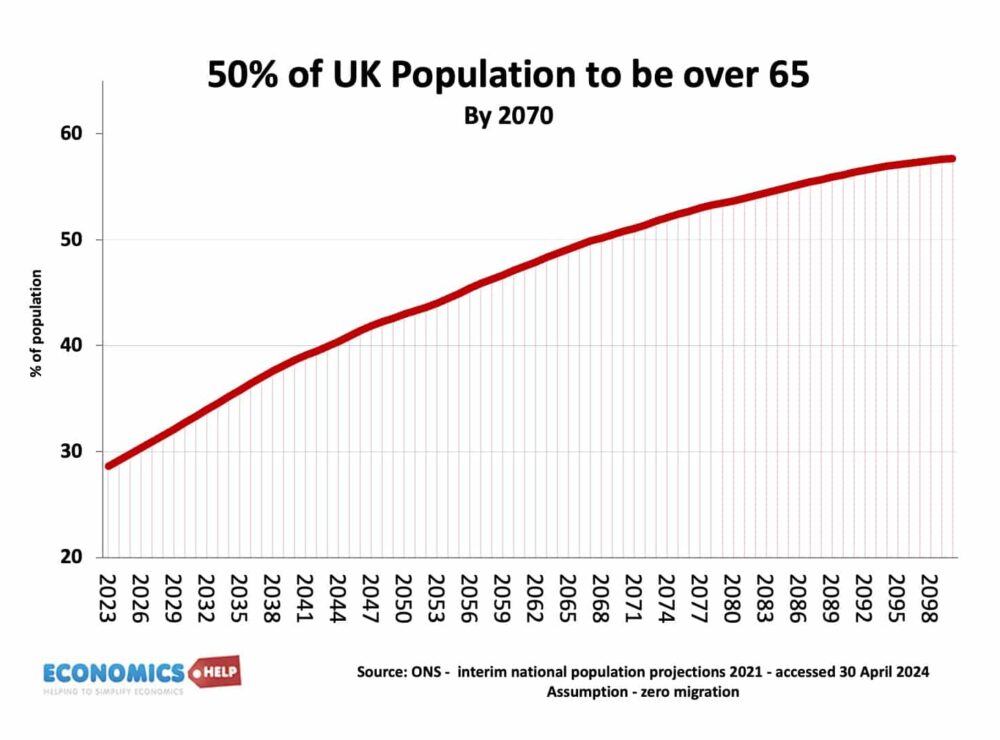

At the time, the average life expectancy was just 52. Since then, the average life expectancy has increased to over 81. But, the pension age today is 66. It means the average person receives a state pension for 22% of their life. But, it is not just that we spend longer in retirement; the share of people over 65 is going to significantly increase, birth rates are declining, and the number of young people will be less.

But, there is more. Under the triple lock guarantee the state pension is often rising faster than average earnings. Since its introduction, the triple lock guarantee has cost an extra £11bn a year. The IFS calculated that by 2050, the triple lock guarantee will cost the government between £5bn and £45bn extra per year. That is a lot of uncertainty, making it difficult to plan. But, if it is the higher end, it would be the equivalent of an extra 6p on the basic rate of income tax. As a share of GDP, state spending on pensions is forecast to rise from 4.5% to 7.5% by 2050. And bear in mind, as society ages, spending on health care as a share of GDP is set to rise too. Yet, as government spending rises there will be a smaller working population to pay taxes. It’s all a bit of a headache, and remember, the state pension is paid for out of current receipts. There is no investment fund. The expected rise in pension spending will be need to be paid for by you the future tax payers.

Of course, it would have been a great idea to have a sovereign investment fund. Norway used its oil sales to create a fund worth now over $1.7 trillion, the UK invested nothing. Even now a long-term solution to future pensions could be to start a pension fund, but in a climate of short-term fiscal fixes, unlikely to say the least.

Between 1979 and 2010, the state pension was linked to inflation, causing it to fall from 24% of earnings to just 16% by 2010. It led to situations where in periods of low inflation, the state pension would rise by just 75p a week. But, with a triple lock and the new state pension, this has now recovered to 25% of earnings. It is worth bearing in mind, that by OECD standards the UK state pension is not particularly generous. The UK relies on a higher share of private pensions to make up a persons overall pension. But, as a share of work income, the UK pension replacement rate is relatively low at 50%. What is really striking is that the UK currently has relatively low level of public spending on pensions. In fact, in 2010, when the triple lock guarantee was introduced, it was part of a pensioners’ commission, which suggested two other reforms. Firstly, the pension age should rise to reflect higher life expectancy. Secondly, workers should take part in auto-enrollment of private pension schemes to create more pension income independent of government.

Costly

But, as well as increasing private pensions, under current rules, the state pension could rise to 32% of mean full times earnings by 2050, an extra £2,500 in today’s money. And, don’t forget this extra income gets paid to a lot more people. So can the UK afford the triple pension lock guarantee

Yes, in theory? But, if you double the share of GDP going to pensions, there is an opportunity cost, it will require lower spending elsewhere or higher taxes. The best question to ask is a pension triple lock the best use limited wealth?

For example, since the triple lock, working age benefits have been indexed linnked. Between 2010 and 2030 the real value of state pension will rise by 20%, the real value of unemployment benefits will fall 5%. The government have announced cuts to disability allowance on the grounds they don’t have the funds to meet their own fiscal targets. There is also relatively low levels of public investment.

In the post-war period, we could afford spending more years in retirement because economic growth was increasing overall income – we could kind of have our cake and eat it. But since 2007, the UK economy has slowed down, and tax revenues are growing more slowly than expected. Debt keeps rising higher than forecast. If you can’t rely on growth, you need to find it elsewhere. The problem is that as society ages, you tend to get lower growth, rising savings, and less investment. The OBR keeps predicting productivity increases, but they have a habit of not materialising. This is certainly what Japan has experienced.

Hard to Change

But, whist there is an awareness the triple lock guarantee in an ageing society is a big fiscal headache, no one wants to challenge the status quo. In 2023, there were 12.6 million receiving the state pension out of 46.5 million registrated to vote. Older people are more likely to actually vote too.

It is tempting to view this question in the prism of old vs young people. Governments favour old because they are a strong voting block. But, this ignores the simple fact we are all old and young at some point in our life. The biggest beneficiaries of the triple lock will in a way be current workers, who when they retire will see a bigger real pension than there parents. In theory, if you believe future pensions are going to be more generous, then there is less pressure to save for private pension, though with auto-enrollment private pension contributions have definitely increased. At least with new state pension it is universal without a means tested element.

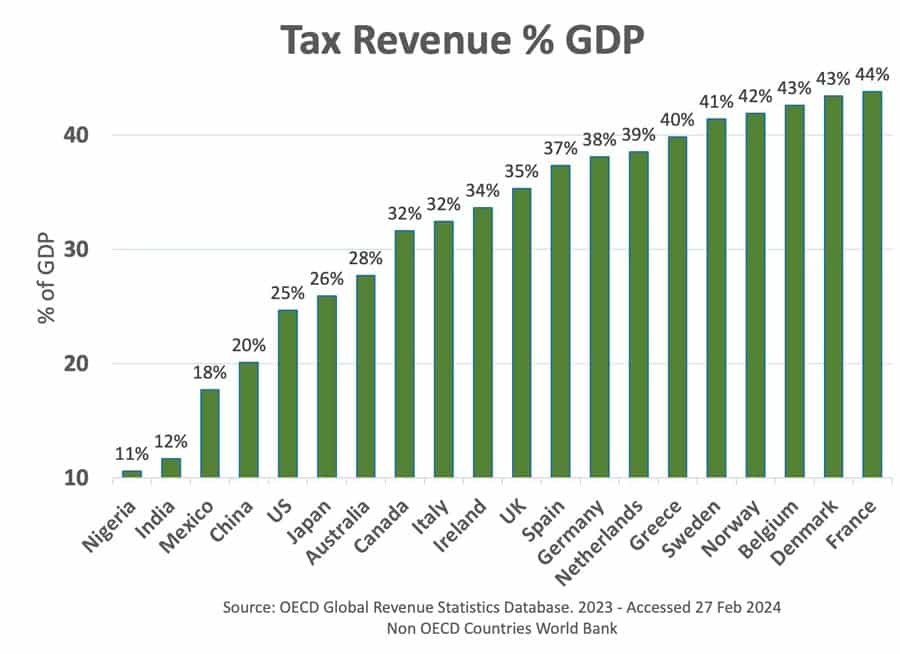

One solution is to increase taxes. If you look at European countries with more generous state pensions, they tend to have higher tax rates than the UK. One possible policy to raise funds is a reform of inheritance tax to take into account lifetime transfers. Because of high house prices, there is going to be a huge wealth transfers in the coming decades, but most of the wealthy avoid any inheritance tax though gifting trusts and funds to their children well before their death. But, inheritance tax is one of the most unpopular policies. Whilst it’s easy to say tax the wealthy for all needs, there are also practical limitations, which inevitably means looking at other areas of spending. Means testing winter fuel allowance was an effort to reduce the long-term cost of an ageing population, but despite saving only £1bn a year, it received a very large political backlash. I wouldn’t be surprised if it made a come back in 2029. The Isle of Man which has even bigger fiscal headache, tried to end the triple lock, but was forced by political pressure to put it back.

So if pension spending is set to rise and tax rises are either too unpopular or too difficult, does that mean, we can expect to see significant rises in retirement age? If you wanted to keep the same fraction of retirement to life expectancy as say 1980, this would require a state pension age of 73. The international longevity centre claim to keep a stable ratio of workers per retiree, the retirment age would need to be 71 by 2050.

Raising Retirement Age

Certainly raising the retirement age can feel like a neat solution, but it does have some drawbacks. Life expectancy may be rising, but healthy life expectancy is something different. England has seen a fall in healthy life expectancy in the past 14 years, meaning the average age at which people are fit to work has fallen from 63 to 61. This is a big problem when you want people to work until they are 71.

Raising the retirement age can be particularly a problem for more manual type jobs. Secondly, the big gap between working age benefits and pension-age benefits, means raising the retirement age does have affect on increasing poverty rates for those who miss out.

The pension triple lock guarantee made sense in 2010. In that state pensions had fallen to a low level related to earnings. The past 10 years have seen a welcome rise in value of pension. But now pensions have caught up, it’s really debatable whether the pension triple lock is a good long-term solution. And if it does keep rising, the pressure to raise the retirement age will only get stronger.

Sources:

https://www.economicsobservatory.com/can-the-uk-afford-the-triple-lock-on-state-pensions

https://www.bbc.co.uk/news/articles/cvg8gw5g47ro

https://www.oecd.org/en/data/indicators/pension-spending.html

Well done for a very good article, informative however, what it does not mention is because f the clever UK tax system, most of the benefit and the increase in state pension is clawed back by the Revenue, thanks to the low personal allowance of £12,570 – this means any income/pension abo ensuring pensioners and the ve this is taxed at 20 percent which in effect wipes out the triplelock

How clever is that ensuring that pensioners and the low paid always remain in poverty! These

pnsions are not a gift but have been pad for by 45 years Tax, N.I Contributions and vat just incase you forgot!