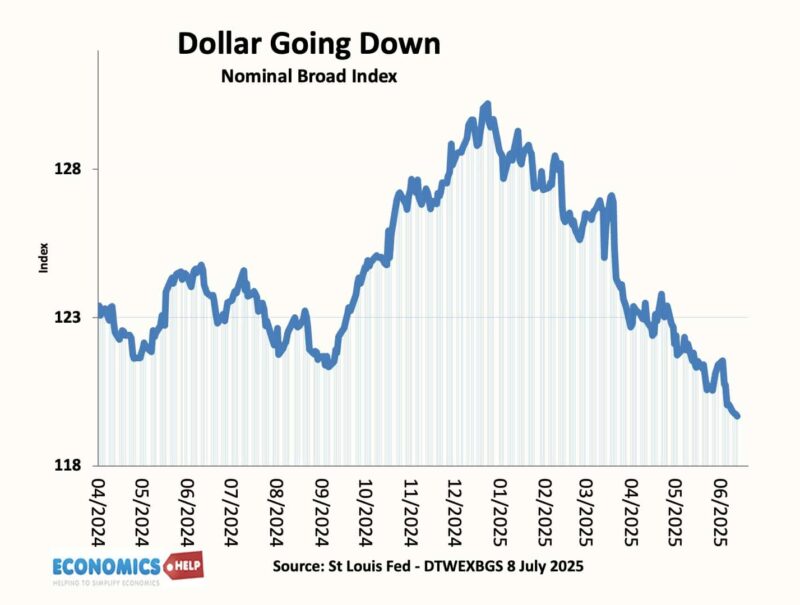

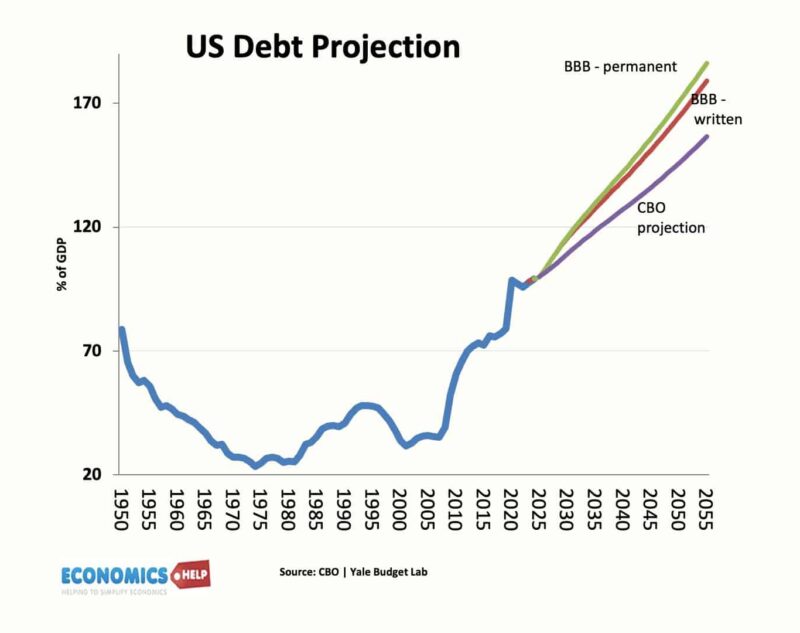

Since the start of the year, the dollar has fallen 11%. And this fall in the dollar has occurred despite the US having significantly higher short-term rates which should in theory, be boosting the dollar value. Investors are worried about US instability, higher tariffs, the threat of inflation, lower growth and now a rapid rise in debt. Though US debt was set to rise anyway, the recent big beautiful bill will see US debt rise an extra $3.3 trillion in the next 10 years.

By 2055, debt will be over 170% of GDP and this assumes no major external shock or economic slowdown. The impact of higher deficits is that the US will spend an increasing share of GDP, on just paying interest on the debt.

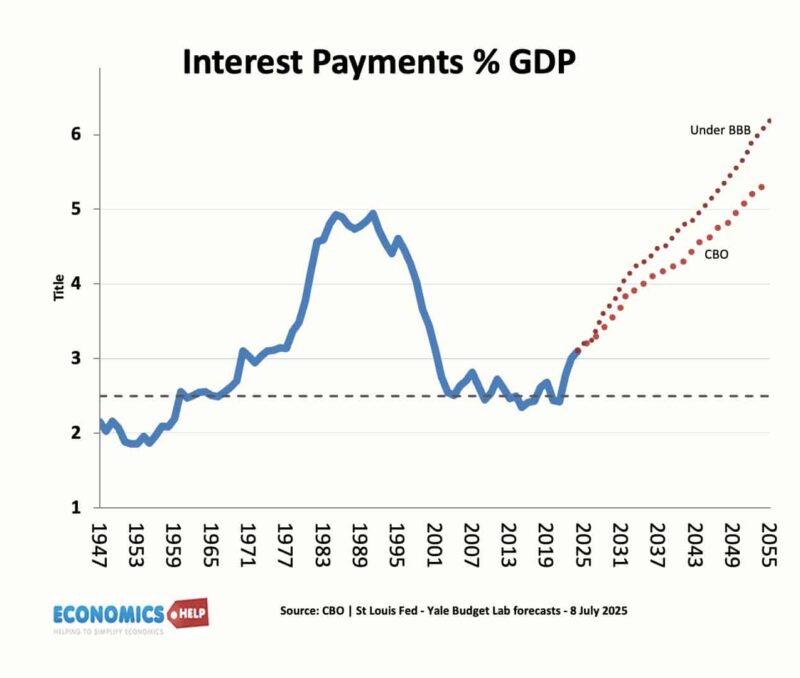

Debt interest payments will rise to 6.2% of GDP. In the post-war period, US economic growth averaged 2.5%, so when interest payments are double the growth rates, it creates a dynamic of rise in levels of debt to GDP, which has long-term implications for the dollar.

Past warnings

Now, I have been studying economics for 30 years, and every year without fail, you see an article or video about the imminent demise of the US dollar. I never really paid those articles any attention, because in the past 30 years, the fundamentals supported the long-term strength of the US dollar. However, I do tend to agree with economists like Kenneth Rogoff that this time really is different. The dollar will not suddenly evaporate or crash, it will be more of a slow burn, a gradual decline.

Debt

The biggest source of US government spending is social security. Initially set up like a pension trust fund. But from 2011, social security’s trust fund was running annual deficits. Paying out more in benefits than it received in taxes. However, the CBO predict the programme will be insolvent by 2032 and will run out of scheduled benefits beginning in 2033. It means that by 2034, recipients will only receive 77% of the intended benefits. An average loss of $5,000 a year. Someone born in 1965 will not be able to retire until they are 67, just in time for Social Security to cut payments. Social security has unfunded obligations of $22.4 trillion. Come the early 2030s, with debt already surging, the government will face a tricky dilemma of cutting social security payments or finding a way to maintain payments the retired have got used to. It’s not just social security, Medicare which provides health care for nearly 67 million people, will face its own cash crunch in 2036. This matters for the dollar because markets are concerned that the response to higher debt may be to increase the money supply to buy debt and this will reduce the value of the dollar.

Economic Growth

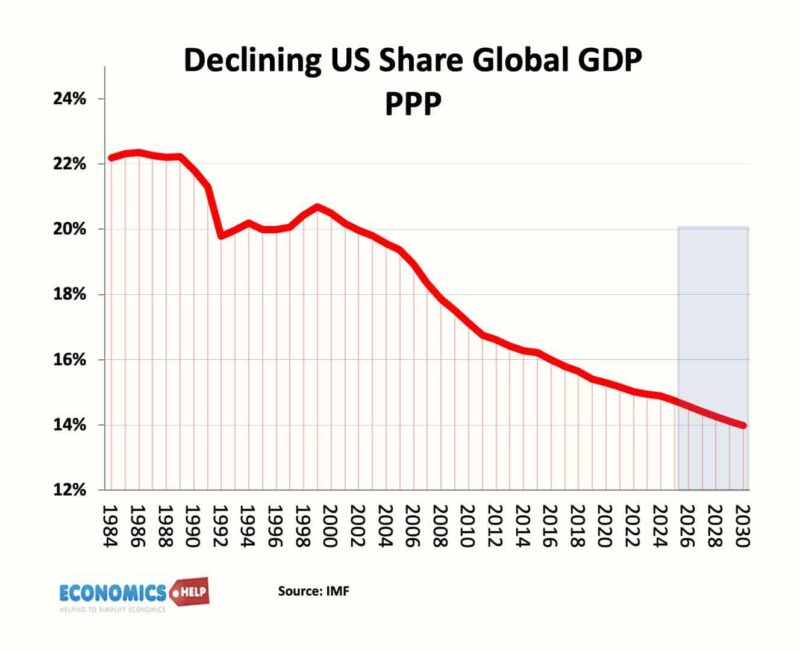

In recent years, the dollar’s strength has been partly related to the US economy growing more rapidly than other countries, but many of the factors which resulted in strong growth, are now under threat.

As a share of global GDP the US is declining, but lower growth will see this fall by more. Like many countries, the US is an ageing society. The proportion of the population over 65 will rise from 58 million in 2022 to 85 million in 2050. That’s a 47% rise. In recent years, high levels of migration would countered this ageing effect to some extent. But, this source of nominal GDP growth looks to be cut much faster than expected. The Recent bill by extending tax cuts provides a temporary boost to growth, but after 2029, that impact fades. Long-term demographic factors are all pretty bleak; the working age population of the US is expected to fall. But, this prediction was made in 2022, before the new migration policy, on top of that the tariff war is creating uncertainty and increased costs to trade, which will negatively affect growth. The stop-start US trade war combined with rising debt is also undermining the dollar’s reputation for an international safe haven.

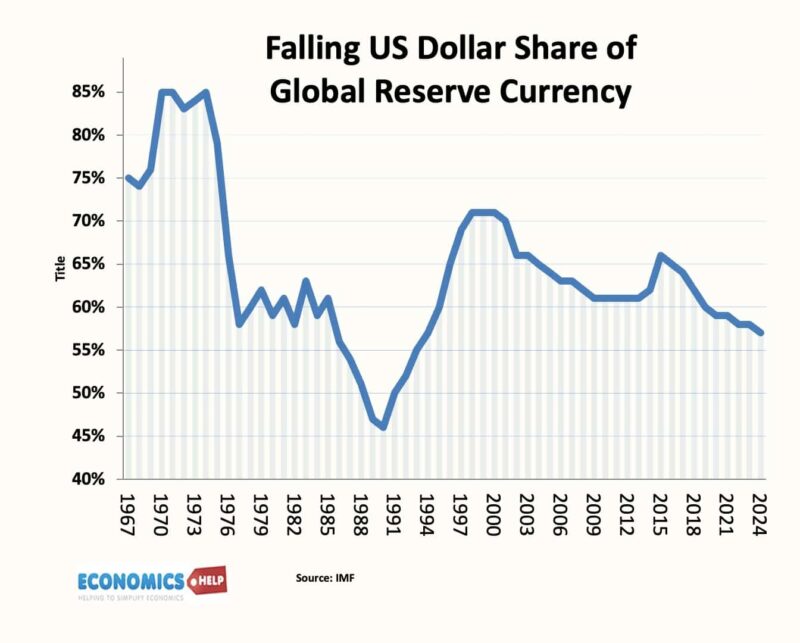

In 1978, the US dollar has accounted for 85% of global reserve currencies. Today, that is 58%. As the economists notes, that was expected to fall another 10% in the next decade, but the tariff war will only accelerate the decline.

Exorbitant Privilege

In the 1960s, the French minister Valéry Giscard d’Estaing complained of the ‘exorbitant privilege’ of the US dollar. It meant the US could live beyond its means running persistent trade deficits with devaluation, low borrowing costs and seigniorage of printing money other countries use. Even this year, we have seen a rise in long-term borrowing costs for the US, which is a big deal when you consider the growing size of the deficit.

In the post-war period, it was the US who set up Bretton Woods, the world trade organisation and system of free trade, a system that largely benefitted the US economy, notwithstanding high profile decline of US manufacturing jobs to China. But, for better or worse, it strengthened the position of the US dollar as both reserve currency and currency of international denomination. But, since the start of 2025, investors are bracing themselves for a sea change in US policy. For example, US and Korea have a free trade agreement signed in 2012, but President Trump is now threatening Korea and Japan with 25% tariffs. It suggests past agreements count for little.

Foreign holdings US Debt

In 2000, foreign holdings of US treasuries amounted to $1 trillion, by 2025, that had risen to $8 trillion, ironically partly a reflection of the US trade deficit and corresponding capital flows into the US. But, it means 30% of US debt is held overseas. But, if overseas investors became wary of holding dollar assets for any reason be it growing debt, concerns over rule of law, fears over trade policy or higher tax on foreign earnings of US income, it would push up bond yields even more, increasing the cost of debt interest payments more than even forecast.

Debt and the Dollar

The worry is that it could push the US into a tipping point, where a debt ceiling is breached and an increasingly less independent Federal Reserve increases money supply to fund the debt. In the 2010s, QE funded part of debt with minimal inflationary impact, at least until 2022. But, if inflation is stubbornly above target and the Fed responds with effectively printing money, the inflationary impact could become much more real.

Long-Term Shifts

What could really harm the dollar is a long-term decline in the performance of the US economy. In recent decades, the real strength of the economy has been, not in manufacturing but high tech investment. In particular, the US strong academic sector has manged to combine strong research and development, with a capacity to translate research and ideas into commercial success. In this sense the size of the US and large funds of private equity have enabled the US to really dominate in big tech and be a market leader in AI. However, recently the federal government have curtailed funding for many scientific research programmes, which in the long-term could undermine some of this past success. Also, even something like cut backs to the IRS could lead to easier tax avoidance and tax revenues becoming more disappointing.

Dollar’s Staying Power

However, before we write off the dollar, we have to bear in mind, it has a long history of surviving. Firstly, there is no obvious alternative. The Euro was once a potential, but there isn’t the same unity, or level of debt issue. Japan’s economy is in decline, and it has its own debt problem. In fact, the demographic problems facing the US are faced by just about every major economy. Also, a decline in the dollar’s dominance is not necessarily a bad thing.

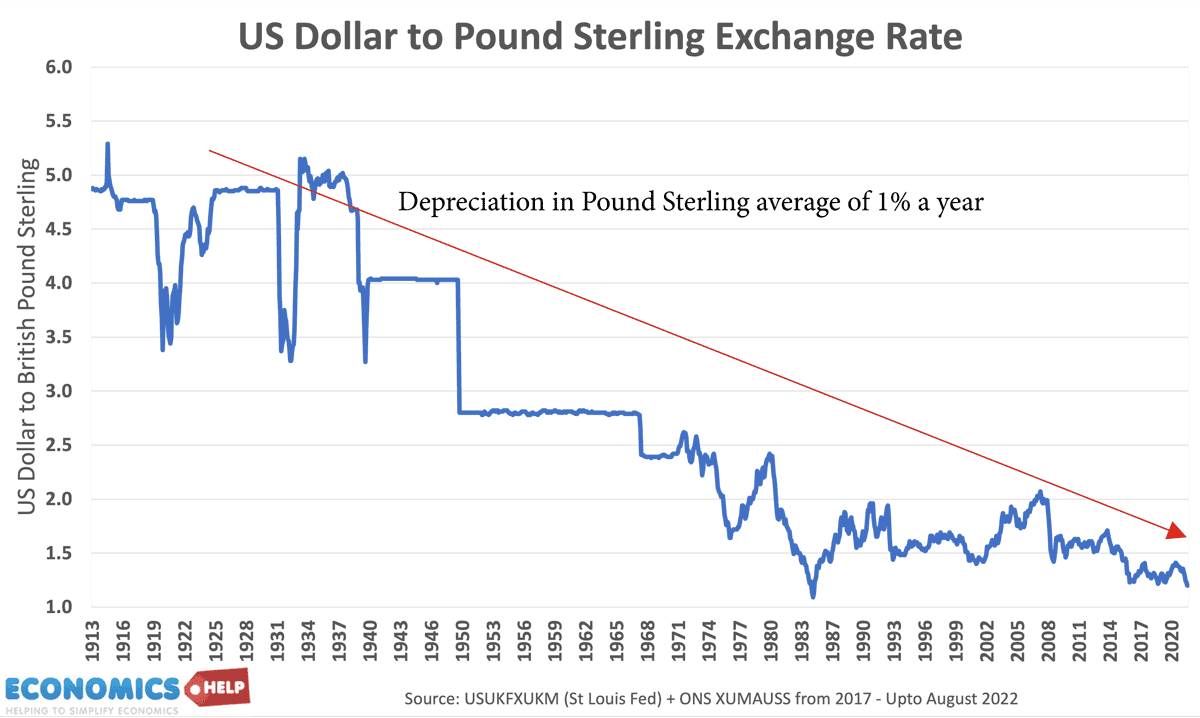

The British Pound once enjoyed a similar position, but damaged by two world wars, its economy couldn’t support and the Pound has been declining for 100 years. Also, fears over tariff wars may blow over. So far, tariffs have only had a marginal impact on US inflation; you would need a magnifying glass to see impact on CPI.

It is possible that within a year, tariffs are somewhat more stable and less impactful than previously feared. I think it is fair to say, though that uncertainty is pretty high. In terms of the US debt, any projections for more than 5 years become highly speculative. For example, one of the unexpected trends of recent years was health care costs rising much slower than expected. Not least because one reason was lower life expectancy. It is quite possible that something like Ozempic or technological breakthrough could make a revolutionary change to the US chronic health conditions, which reduces costs. But, equally hoping for much better spending projections could go the other way. The world and the US, in particular, is seeing much more extreme weather events, that are really costly in terms of higher insurance and federal emergency funding. However, one thing is for sure after 2025, the dollar will never be quite the same again.

Sources

https://epicforamerica.org/social-programs/5-facts-about-social-securitys-solvency

https://www.npr.org/2024/05/06/1249406440/social-security-medicare-congress-fix-boomers-benefits

https://budgetlab.yale.edu/research/financial-cost-senate-passed-budget-bill

https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/