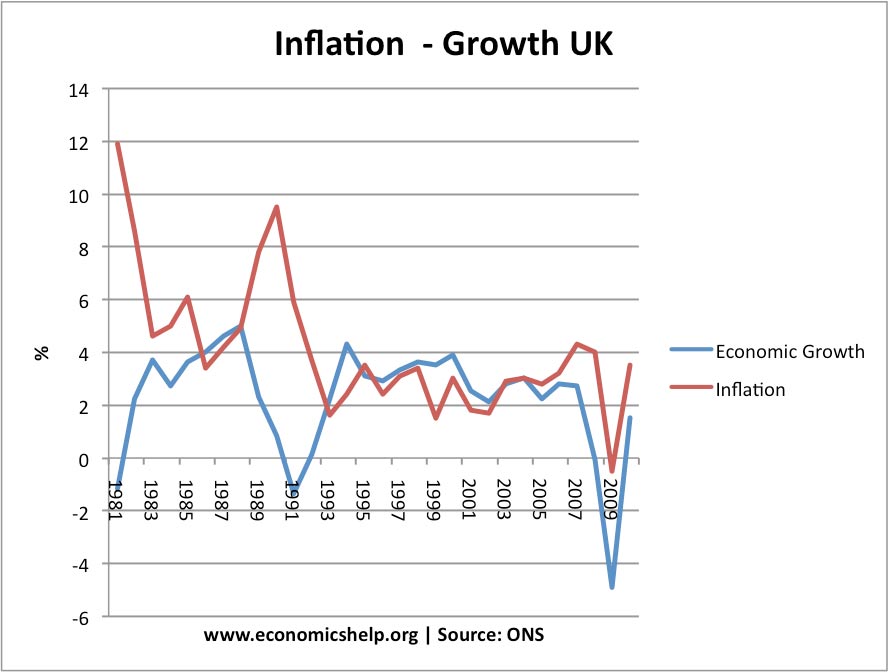

Readers Question: In 2009, both inflation and growth went down, but in 1991, the inflation went up, even though the growth went down. What could be the reason for the difference in behavior? (UK Growth Rates)

In 1990 inflation was high. This high inflation was a result of the previous economic boom. In the late 1980s, UK growth exceeded its long run trend rate. We had growth of 4-5% (above average of 2.5%). Towards the end of the boom, this increasingly led to higher inflation. However, in 1990 and 1991, we experienced a rapid rise in interest rates and a strong exchange rate. This led to an economic downturn and the recession of 1991. As the economy slowed down the inflation rate began to fall.

Note: there does appear a time lag. Inflation continued to fall even after growth rate picked up in 1992 and early 1993.

Sometimes there is a short time lag. This could be due to inflation expectations. When inflation is high, people expect inflation to remain high, and it needs a deep downturn in economy to shift these expectations. When the economy is recovering slowly and unemployment still high, inflation may continue to fall as people forget about past inflation trends.

I should also point out the graph plots annual inflation rates rather than monthly or quarterly figures.

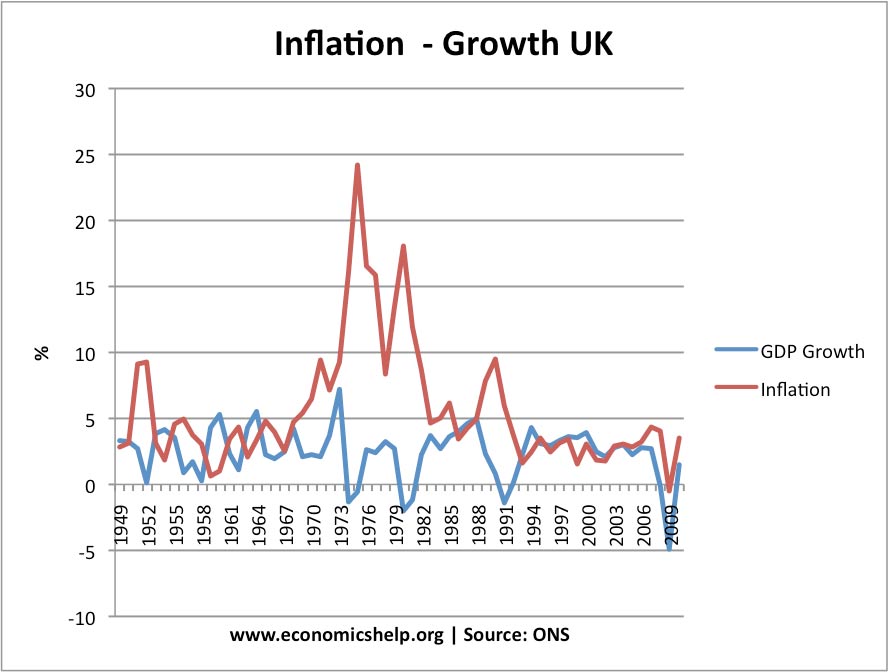

Growth v Inflation in Post War Britain

Related

I think it is not just inflation but price expectations and stability that can have an impact on the real sector. If inflation is stable at 5% every year it is not as bad as if it is 1% year one and 6% year two and 2% year three etc. It results in reallocation of assets based on volatility than value.

can u pls help by giveing me the information abt the cause and effects of business cycle related to world and India plsssss help me out