Hello. You mention national debt and public sector debt. Are they the same?

Yes, the official measures is the public sector net debt. Often people refer to this as the national debt. (there once was an official statistics called national debt, but this was discontinued quite a while back). However, when people talk of national debt they mean the public sector net debt which is the total amount of debt the government have. If you want to see more definitions – see: understanding government debt statistics, but be aware the ONS are constantly redefining what is meant by government debt.

In the last paragraph you mention deficit. What deficit is that?

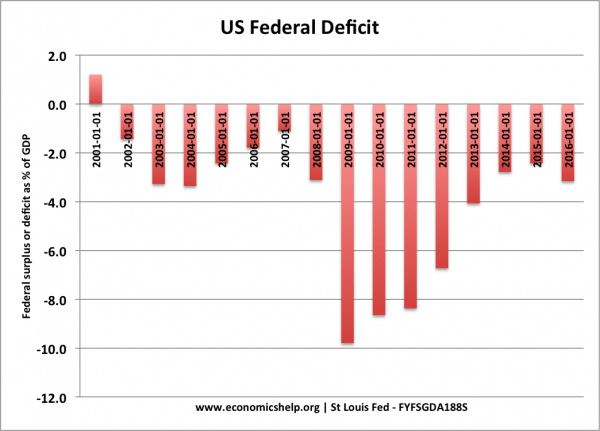

- The deficit is the annual government borrowing requirement. (Public sector net borrowing PSNB)

- The deficit is an annual figure, e.g. for 2010/11 deficit is forecast to be £149bn

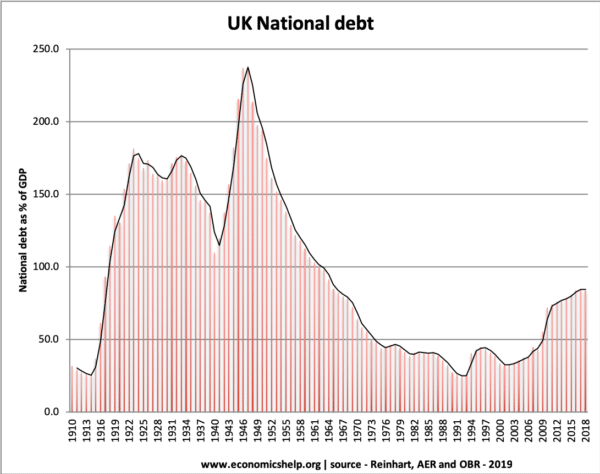

- The debt is the total amount (i.e. add up cumulative deficits over the years)

See also: Debt and Deficit

I also thought the recession was caused by the banking crisis. This, in turn, resulted in some bank bailouts etc.

Yes, the primary cause of the current recession was the banking crisis and credit crunch which led to a sharp fall in bank lending and fall in business/consumer confidence. (Financial Crisis Explained)

Some commentators on the web blame the current UK financial crisis (the huge structural deficit?), in particular, on the banks and the bailouts. Hence the austerity measures aimed at public sector spending instead of being aimed at not helping the banks and instead of getting them to put the mess right.

The financial crisis primarily relates to bank losses/bank defaults and bad mortgage loans

After this financial crisis / credit crisis we have seen a new problem (crisis) – government debt becoming unmanageable, especially in Eurozone

See: different types of economic problems / crisis

There are two ways of measuring the deficit. The ONS also produces a measure which includes financial sector intervention. (the bailouts government lent to banks to buy shares)

However, the figure which includes financial sector intervention is a little different. The government gave banks money but gained shares in return. There is a hope that, at the right moment, the government will be able to sell these bank shares and gain the money back.

Even if you ignore the financial sector intervention, the UK does have a significant structural deficit. This cannot just be blamed directly on the banks. If you want to tackle this deficit, it would require.

- higher taxes

- lower spending

- changes to pension age

- changes to benefits

As part of a package to reduce the deficit, you could introduce higher taxes on banks, but that in itself wouldn’t solve the problem. Though we do need to create a situation where if banks take risks they have to face consequences. We need to secure standard saving accounts, but not the risky CDOs and other gambling measures.

If you look at other countries like Ireland, then the banks played a much greater role in causing a rise in government borrowing. Before the crisis, Ireland had a very low public sector debt. This increased dramatically when the government bailed out the failing Irish banks.