Eurobonds are a way for countries to borrow as one entity. For example, there would just be a single European bond to finance the net debt of all the individual Eurozone member countries.

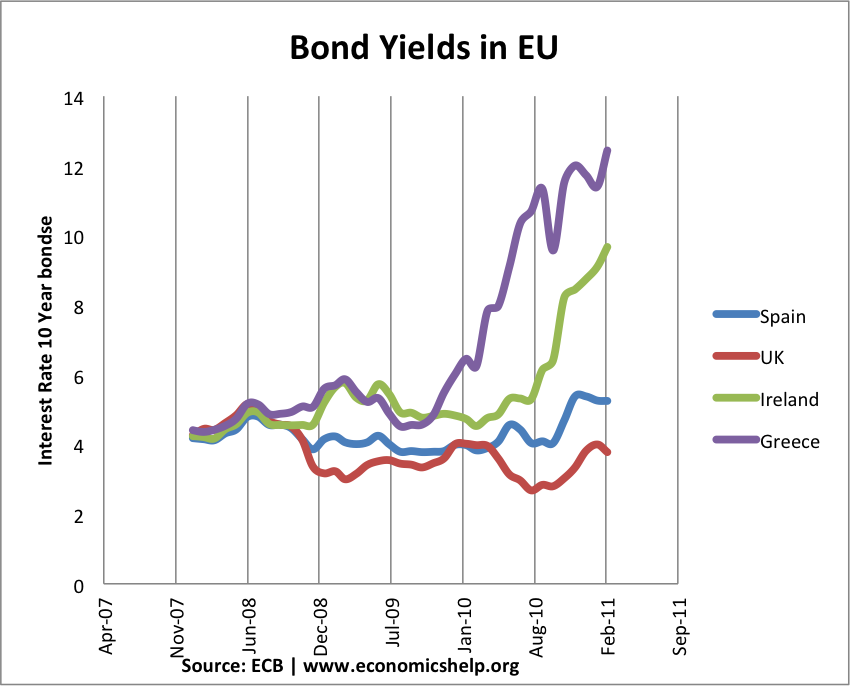

It would mean that the bond would be seen as a safe investment and therefore would have a low interest rate cost. It would be very beneficial for countries who are currently facing rising interest rate costs. They would benefit from the lower interest rate and lower interest rate payments.

Pros of Eurobonds

- It would prevent repeated financial crisis that is creating a destabilising economic and political environment.

- Investors would have greater security in buying the bond because overall Eurozone debt is manageable.

- Interest rate costs would fall for several countries; this would give them much greater ability to repay outstanding debt rather than just keeping up with interest payments.

- It would mean secure countries wouldn’t need to get involved in bailout packages.

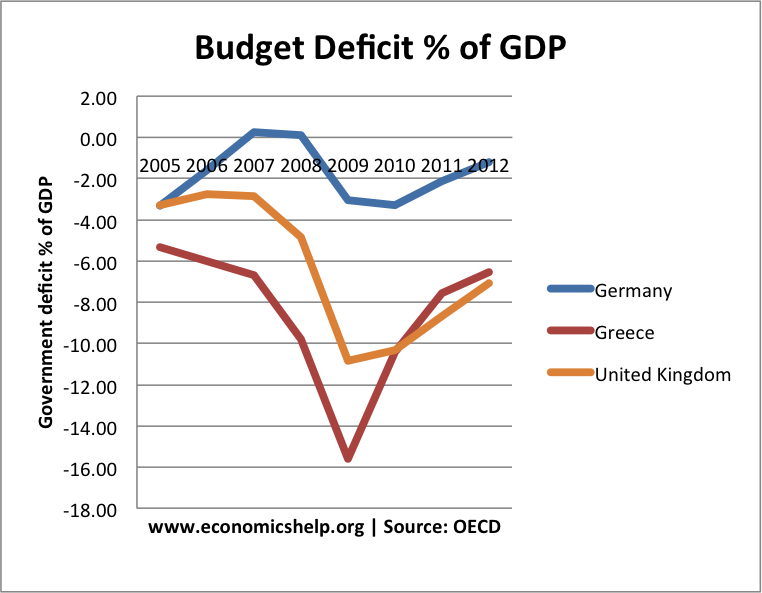

- Austerity measures to try and contain the debt crisis threaten to cause a double-dip recession. For example, Italy is facing the prospect of a second economic downturn because of necessity to cut spending to deal with fears over rising debt costs (despite having a primary budget surplus) Eurobonds which give greater security would give countries more time in reducing long term deficits without sacrificing growth.

- Logical conclusion of single currency. A common monetary policy and common currency needs a single fiscal policy to ensure economic harmonisation.

- Countries in Eurozone suffer from inability to print money and avoid liquidity shortages. The experience of recent months suggests it is more difficult for countries in the Eurozone to borrow. The lack of an independent Central bank to avoid temporary liquidity shortages makes members of the Euro much more vulnerable to panic selling of bonds.

Cons of Eurobonds

- It is unfair to countries who have avoided debt crisis through fiscal responsibility. Germany will see their interest rate costs rise, closer to the Eurozone average. This is why it is politically unpopular in Germany.

- Moral Hazard. If countries can benefit from overall Eurozone average, there may be less incentive to reduce wasteful spending and borrowing. Because debt will be secure, it may encourage countries to borrow more than prudent because they don’t have the same incentive to reduce borrowing.

- If there is a lack of fiscal discipline, overall Eurozone debt could continue to grow possibly making even Eurobonds lose credit worthiness over time.

- Fiscal union is difficult for countries with such divergent political histories. It is one thing for fiscal union within Great Britain (e.g. south of England to North of England) (or from New York to Kentucky). But, European identity is not as strong as national identity. Greek voters are unlikely to enjoy being told to accept wage cuts as part of a Europe wide budget.

Conclusion.

The Euro is facing a repeated crisis. The current approach tends to rely on trying to patch things up as we go along, hoping it will end. But, the dynamics of the Euro mean there is an increasing risk of debt default and solutions to debt default are concentrating on austerity measures which weaken growth and unemployment. A Eurobond would make the situation much more manageable. It is Europe’s best chance for economic recovery.

Europe needs to get away from this vicious cycle of imposing austerity policies on countries struggling to deal with an economic downturn.

Related