- Supernormal profit is all the excess profit a firm makes above the minimum return necessary to keep a firm in business.

- Supernormal profit is calculated by Total Revenue – Total Costs (where total cost includes all fixed and variable costs, plus minimum income necessary for the owner to be happy in that business.)

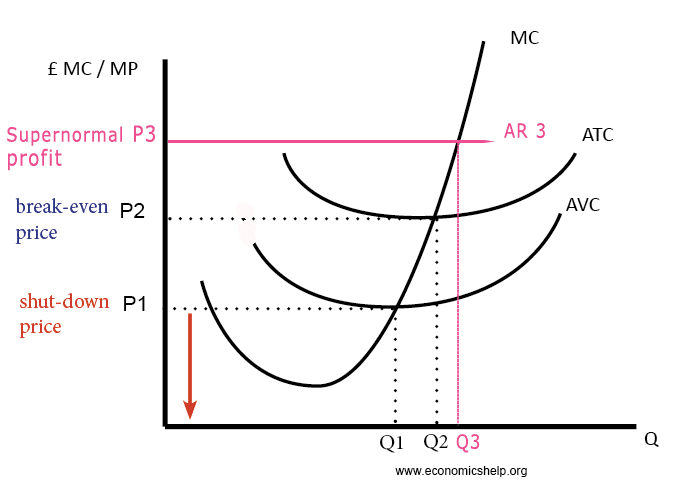

- Normal profit is defined as the minimum level of profit necessary to keep a firm in that line of business. This level of normal profit enables the firm to pay a reasonable salary to its workers and managers. The definition of normal profit occurs when AR=ATC (average revenue = average total cost)

- Supernormal profit is defined as extra profit above that level of normal profit.

- Supernormal profit is also known as abnormal profit. Abnormal profit means there is an incentive for other firms to enter the industry. (if they can)

When the price is P3, the firm makes supernormal profit. This is because at P3, Average revenue is greater than average total cost. (ATC)

Supernormal profit in perfect competition

The theory of perfect competition suggests that supernormal profit can only be earned in the short term. In the long-term firms will make normal profit.

Perfect competition is a market structure which involves:

- Perfect information

- Freedom of Entry and exit

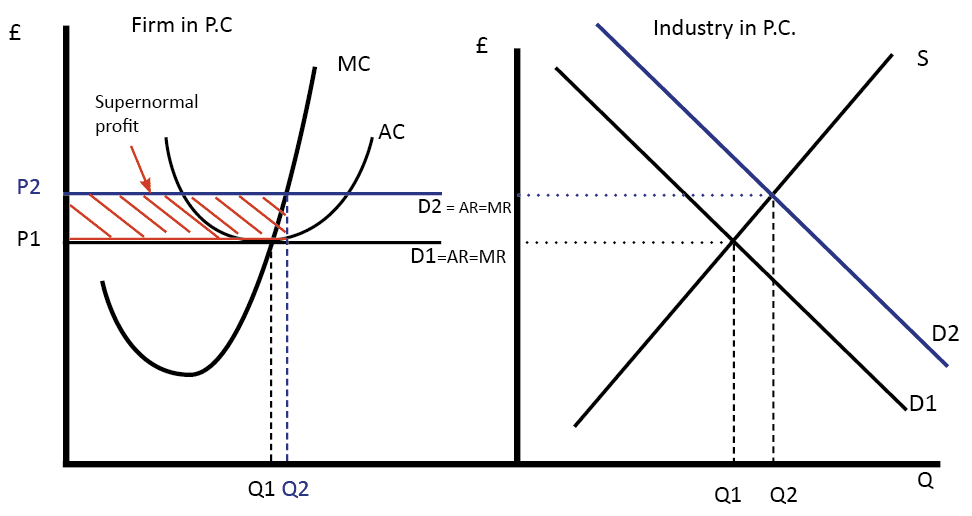

Suppose there is a rise in demand, price rises and a firm can make supernormal profit in the short-term.

The supernormal profit is (AR – AC) * Q2. Other firms will be aware of this fact. Because there are no barriers to entry, firms will be encouraged to enter the market until price falls back down to P1 and normal profits are made.

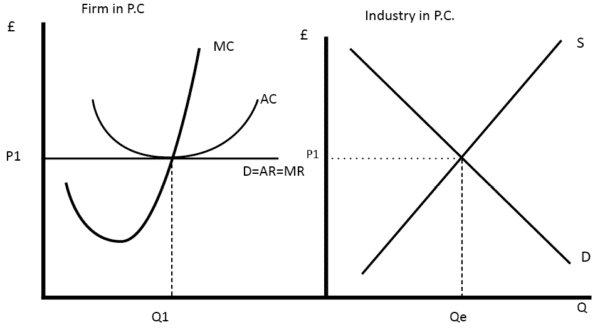

Perfect competition in the long-run

This is why only normal profits will be made in the long run. At Q1 – AR=ATC.

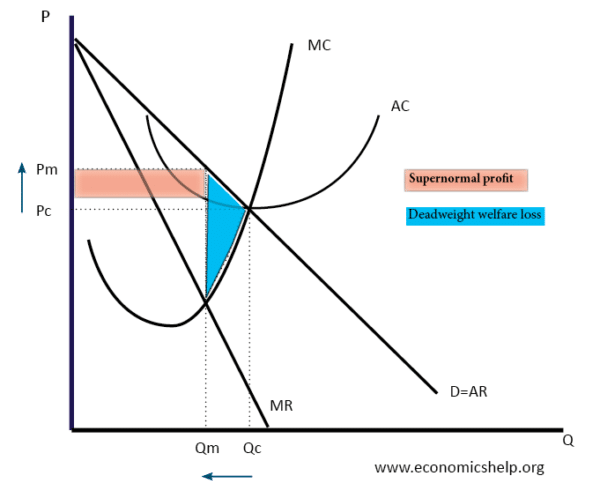

Supernormal profit in monopoly

However, most markets don’t have these features of perfect information and freedom of entry and exit. Most markets have a degree of barriers to entry and exit. There are sunk costs which deter entry. Therefore, even if firms are making supernormal profit, new firms may not be able to enter and compete.

Diagram showing supernormal profit in monopoly. It is the red shaded area.

Examples of supernormal profit in the real world

- Apple. In 2015, Apple was the world’s most profitable company with profits of $53.4 billion. It also had cash reserves of $216bn. This is accumulated profit saved in their bank accounts. The supernormal profit of Apple comes from its very strong brand loyalty and products which have sold well, despite high prices.

- JP Morgan Chase & Co. In 2015, J P Morgan Chase made profits of $24.4 billion.

- Berkshire Hathaway. An investment trust owned by Warren Buffet. Berkshire Hathaway made profits of $24.1 billion.

- In 2018, Shell made profits of $21.4 billion. In the past, it has been one of the most profitable firms in the world (most profitable company). This is clearly supernormal profit. There are strong barriers to entry in the oil/petroleum market.

- In 2011, Tesco was making supernormal profits of £3.54bn (BBC) in 2011. At the time it was difficult for new firms to compete in the supermarket industry. Tesco’s has significant economies of scale and strong brand loyalty. However, since 2011, its profitability has faltered because new European supermarkets (Lidl and Netto) have entered the market – making UK supermarkets more competitive and less profitable.

Pros and cons of supernormal profit

Pros

- Firms can use profit to invest in research and development

- Signal that firms are successful and producing products that firms want.

- Governments can collect corporation tax from the share of profit.

- Enables firms to build up reserves to survive economic downturn

- Possibility of supernormal profit is an incentive for entrepreneurs to enter new markets.

Cons

- If supernormal profit is gained from monopoly power, it represents a transfer of income from consumers to owners of monopolies and is allocatively inefficient.

- Firms may not use for investment – but give dividends to wealthy shareholders.

- Very profitable firms like Apple, Google, often have difficulty to usefully spend profit so develop large cash reserves, representing unused resources.

- Global multinationals are adept at avoiding corporation tax by shifting production and profits to low tax countries like Bermuda and Luxembourg.

Related

Thanks this was helpful, our tutors asked this question in the assignment but it was in none of our readings!

same same can relate so much haha

thanx u helped alot

thanks you just made me to get an A in economics

When there is a supernormal profit in an economy and it changes back to normal what happens in the economy

I have appreciated that a lot.

thank you peter

Thanku for guidelines in eco.problem

IS THERE EVIDENCE THAT ABNORMAL PROFITS EXIST IN THE INDUSTRY

PLEASE HELP ME ON THIS ONE

Example is the electric company, gas company, or any utility company. They are natural monopolies. The railways or subway is another natural monopoly.

Thank you. This helped me a lot.

I have now understood how Zambian breweries gain their profits