Readers Question: Why, on the one hand, do commentators talk about organisations and consumers paying off debt and not having money to spend. And on the other hand, Corporations sitting on large piles of cash?

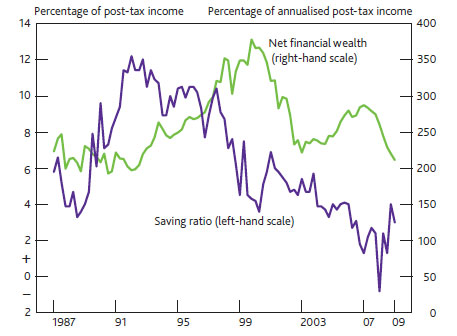

In the boom years 1995-2007, UK economic growth was led by consumer spending and a rise in borrowing. The saving rate fell to close to 0% in 2007. This is a record low, and very different to say the saving rate in Germany which is higher.

UK Saving Ratio: Source: Bank of England

Many consumers took on increased levels of personal debt (re-mortgaging, personal loans and credit cards) to finance higher levels of consumption.

Also, in this period, many banks increased their levels of lending and reduced the amount of cash reserves that they had. This meant banks experienced a shortage of cash ‘liquidity shortage’ when the credit crunch hit in 2007-08.

However, whilst some consumers and banks became heavily indebted not all companies were in this position. Some companies were in a relatively strong financial position with a good profit level.

Recession and Rise in Saving Ratio

In a recession, people tend to change their behaviour quite significantly.

In the boom years, people have the confidence to borrow and spend. But, in late 2007, everything changed, people began to fear unemployment. Therefore, instinctively people start to concentrate on spending less, saving more and paying off their debts. This switch to saving actually causes a fall in consumer spending and even lower growth. (Keynes called it a paradox of thrift – basically individual decision to save more cause a fall in economic output).

Therefore, after the credit crunch, we see a sharp rise in the saving rate from 0% to 5%. People concentrated on paying off their mortgage and don’t take as much new debt on.

Banks also were short of cash and so made it much more difficult to get a mortgage (they didn’t have the cash to lend). So it became difficult for firms and consumers to borrow. Banks were giving higher interest to firms and consumers who save.

Why are some Corporations sitting on large piles of cash?

Not everyone is suffering huge levels of debt. Some companies have large reserves of cash and a decent profit stream. However, they respond to the recession in a similar manner. Concerned about prospects for economic growth and low consumer spending, they don’t take on risky investment decisions. Firms would rather wait to see an improvement in prospects for growth. Therefore, rather than build expensive new factories or try and buy other companies, they wait.

A recent analysis by Bloomberg showed that Europe’s biggest companies (excluding banks) sitting on £445bn cash. This is 16pc higher than the position at the end of 2007 before the credit crunch hit. (Telegraph Dec 2010)

Why Are Banks Not Lending New Created Money?

Another complaint is that the £275bn of extra money (created by Bank of England through their policy of quantitative easing) has not really led to higher levels of bank lending. Banks have sold bonds to the Bank of England gaining higher reserve ratios. However, despite higher cash reserves, banks are still reluctant to lend. They would rather concentrate on improving their reserve ratios (the amount of cash they have) and are reluctant to lend to firms with the prospect of double-dip recession.

In normal circumstances, they would lend this extra cash. But, this balance sheet recession is different to usual.

Basically, the answer is that some groups of people are paying off their debt. Other companies don’t need to pay off debt, but also they don’t want to invest their spare cash because economic circumstances are grim and people would wait.

Related

I’m not sure about the idea that banks were short of “cash” when the credit crunch hit. I suggest it is more accurate to say that they lent in an irresponsible manner before the crunch, and hence that a significant portion of their assets (i.e. loans to customers) turned out to be toxic, or worthless. I.e. in some cases their liabilities exceeded their assets, so they were essentially bust.

If by “cash” one means reserves or central bank money, I suggest that commercial banks are not too bothered if their reserves are negligible. If you Google the word “bank” and the phrase “reserve constrained”, you’ll find plenty of articles etc arguing that banks are not bothered about their reserves.