M4 Definition

M4 is a broad money supply measure. Briefly, M4 includes all notes and coins in circulation, deposits at banks and building societies, plus assets which are considered relatively liquid (short-term bonds, commercial paper)

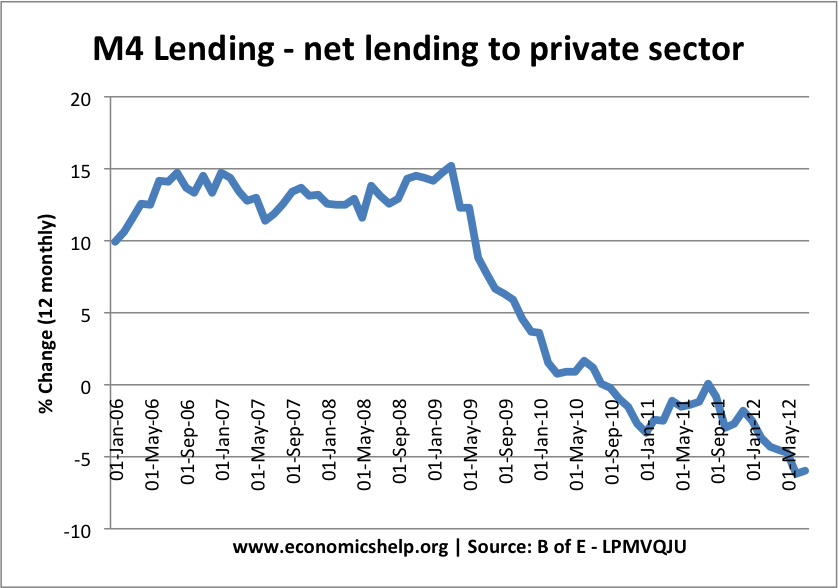

M4 growth is currently negative. M4 lending to private sector is currently 6.0% lower compared to past 12 month (July 2012)

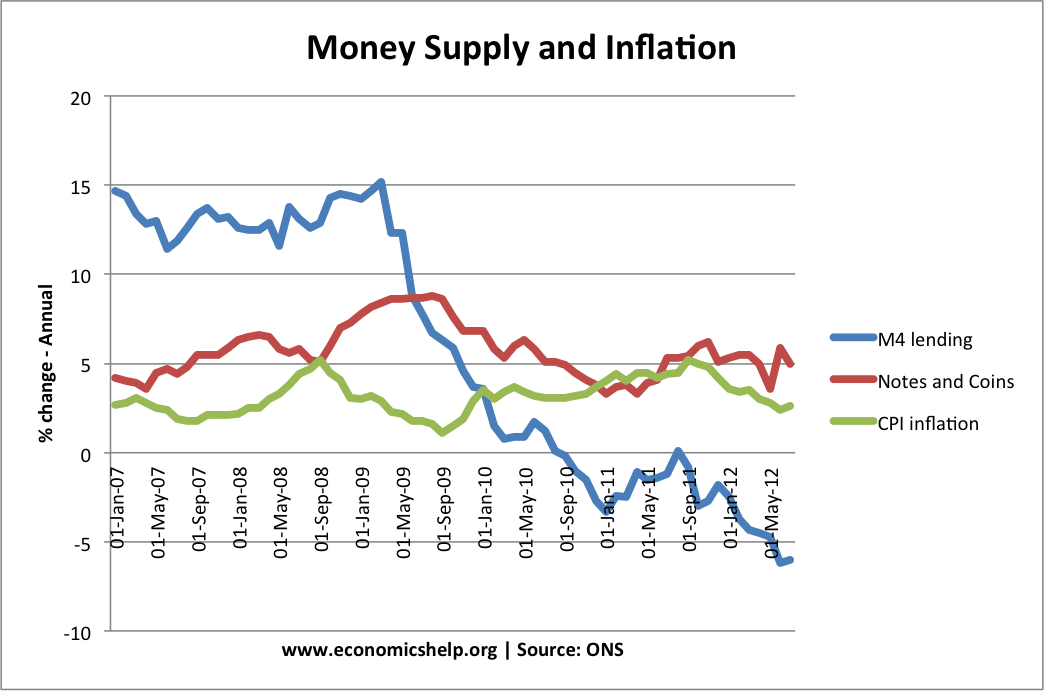

Within this growth of M4, there have been different trends. As this article at FT shows, a major contributor to M4 growth in period 2009-11 has been the impact of quantitative easing (Could UK Money Supply collapse post Q.E ?).

M4 Lending Deposits

M4 net lending (Bank of England code: LPMVQJY) from financial institutions to the private sector has shown negative growth since July 2010.

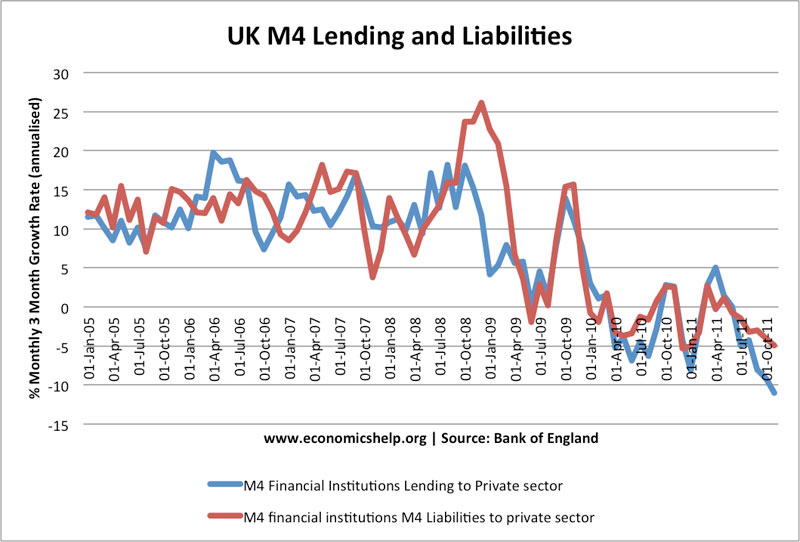

M4 Lending and Retail Deposits

M4 Liabilities to private sector have shown a similar trend.

Importance of M4 Lending

The decline in M4 lending to the private sector highlights the ongoing weakness of the economic recovery. It shows the reluctance of banks to lend to the private sector. Bank lending is low because

- Banks still need to work on improving their balance sheets

- Banks are pessimistic about prospects for economic growth and see private sector lending as a risky business in current climate.

M4 growth is a sign of the lack of underlying inflationary pressures in the economy. It shows that quantitative easing has not led to a boom in broad money supply as some might have expected.

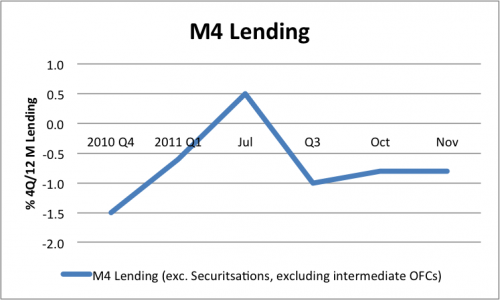

M4 Lending (B62Q) , excluding the impact of securitisations, and excluding intermediate OFCs

M4 Lending (B62Q) , excluding the impact of securitisations, and excluding intermediate OFCs

Sectoral breakdown of M4 at Bank of England

Narrow Money – Notes and Coins

Notes and coins is one of the commonest measures of narrow money. Growth in Notes and coins has been more stable.