Readers Question: Can you explain what happens to wealth when e.g share price, property prices fall?

Do they just vanish into thin air, or is money just being transferred from one person to another? In other words, are all investment a zero-sum game? What happens when prices rise?

Is there a simple example that can illustrate this concept?

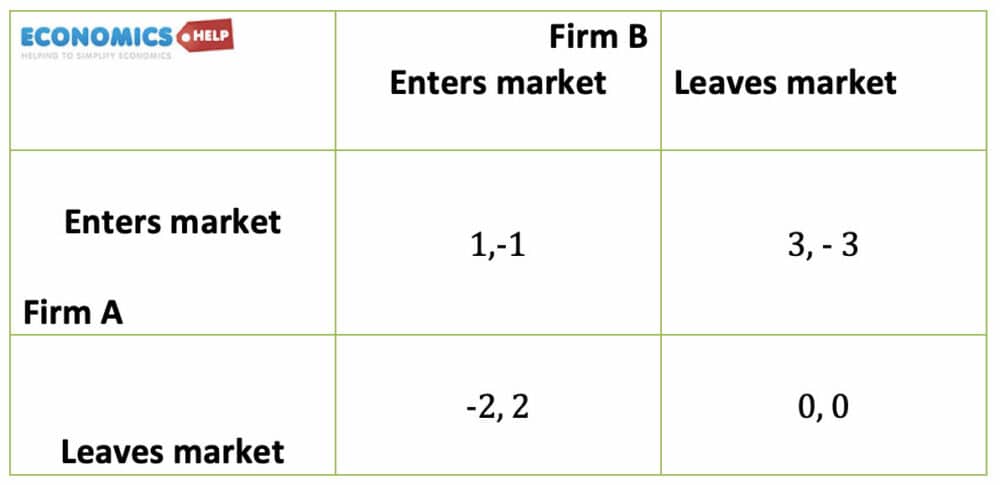

A zero-sum game means that if one person gains, then it has to be matched by an equivalent loss from someone else. No extra output is created, it is merely a question of how the cake is split up.

For example, suppose I buy Euros in exchange Pounds from someone else (and let’s assume zero transaction costs).

- I have an increase in quantity of Euros, the other person see an increase in quantity of Pound sterling.

- If the value of the Euro increases, then I am better off. However, the person who sold Euros will see a decline in the value of their currency holdings.

- If I buy Euros, there is unlikely to be any change in output or welfare for society.

- By correctly predicting an appreciation in the Euro – I have gained at the other persons expense.

- Therefore, foreign currency speculation could be seen as a zero sum game.

Often investing in the stock market may feel like a zero sum game. Suppose, we take the top 100 companies (FTSE-100). One investment fund may pick the best performing companies. These investors will see an increase in their wealth. Another investment fund may pick poorly performing companies, therefore they see a fall in their wealth.

As an investor picking shares to buy doesn’t add to output. Mostly it is about trying to choose the best performing company.

Capital Investment

However, buying shares could actually help the performance of a company, especially if the company is short of finance. When companies are fairly new, they may struggle to raise sufficient finance for investing. However, a stock market listing enables them to raise finance at low cost. This means firms can grow. As a consequence firms can increase output and society can benefit from the growth of efficient firms.

Example Eurotunnel.

To finance the ambitious Eurotunnel project, shares were sold. The finance raised helped to build the channel tunnel and create better transport links between UK and France. This is an example of how buying shares can enable an increase in productive capacity that wouldn’t have been done otherwise.

Investment Reduces Output

It is also possible investors can reduce the value of a company. For example, it is possible speculators could create a negative impression about the state of banks, encouraging a bank run. During the credit crunch, there was a lot of focus on investors who were short selling banks – essentially betting bank shares would fall. This contributed to financial instability and credit crunch.

What Happens when there is a fall in Assets like Houses?

If there is a fall in the value of your home then no one else really benefits from that. (expect perhaps potential first-time buyers who find it easier to buy a house.)

Therefore a fall in the value of your house is not a zero-sum game because no one is obviously benefitting from the decline in your wealth.

Furthermore, a fall in the value of your house could potentially be very bad news for your bank. If you default, they will lose money.

The fall in house prices in the US since 2006 has been a major drag on the US economy and created substantial bad debts. Therefore the fall in wealth had a knock-on effect to everyone else in the economy, resulting in lower economic growth and the need for bank bailouts.

1 thought on “Is Investment a Zero Sum Game?”

Comments are closed.