A look at how interest rates and inflation affect the exchange rate – in short, higher interest rates tend to cause an appreciation in the exchange rate.

Readers Question: In currency investing, would it be more profitable to invest in a country with high-interest rates and high inflation, or low to zero interest rates with low inflation? In other words, is the real interest rate more important than the nominal? Other factors being equal, does it always mean that the currency of a country with higher real interest rate will strengthen over time compared to one with a lower real interest rate?

Yes, the real interest rate is the most important factor.

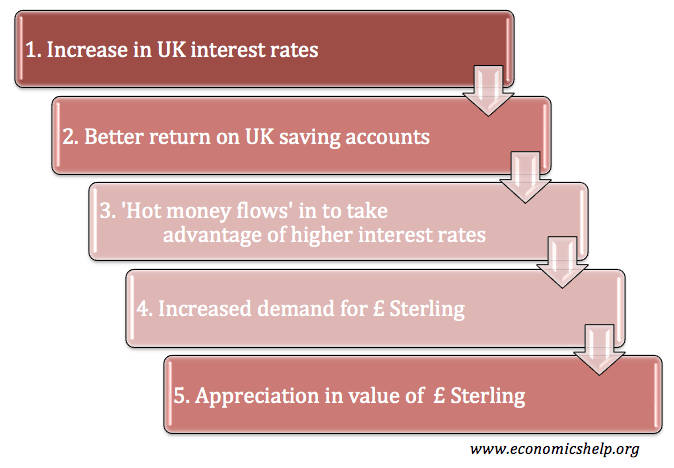

Higher real interest rates tend to lead to an appreciation of the currency. This is because high-interest rates mean saving in that country gives a better return. Therefore investors often move funds to countries with higher interest rates. (this is known as hot money flows)

Effect of increasing interest rates on the value of the currency

Effect of inflation and real interest rates

However, as well as the nominal interest rate, it is also important to look at the inflation rate.

Higher inflation tends to lead to a depreciation in the value of a currency. With high inflation, goods become less competitive so demand falls relative to other countries with lower inflation rates.

Suppose you have two countries:

- India inflation 8%, interest rates 8%. – Real interest rate = 0%

- Singapore inflation 4%, interest rates 5% – Real interest rate = 1%

Ceteris paribus, it would be more advisable to invest in Singapore, which has a positive real interest rate of 1%.

Why not invest in India, where you get an 8% interest rate? If you put your money in India, you would get a good interest rate of 8%, however, with inflation of 8%, you would expect the Rupee to devalue by 8% a year.

In Singapore, you would get a lower nominal interest, but the Singapore currency would only depreciate by 4%.

(note inflation of 4% doesn’t mean a currency will exactly fall by 4%. But, if we exclude other factors, higher inflation tends to depreciate the value because goods are becoming less attractive. This is a simplification to help understand the concept)

When nominal interest rates become important

- Suppose you had a third country UK with inflation of 4% and interest rate of 4%. real interest rate = 0%

- This is the same real interest rate as India. However, in this situation, it would be advisable to invest in UK pounds because a lower inflation rate suggests greater stability. Inflation of 8% in India suggests greater volatility. This volatility will discourage investors in India.

- The higher inflation is, the more volatile it tends to be. Investors may be concerned that inflation of 8% is starting to get out of control.

- It is possible that, even if Indian interest rates increased to 9% (real interest rates of 1%), people would still prefer to invest in UK pounds. This is because although there is a lower real interest rate in the UK, there is a greater sense of stability.

Other factors affecting exchange rate

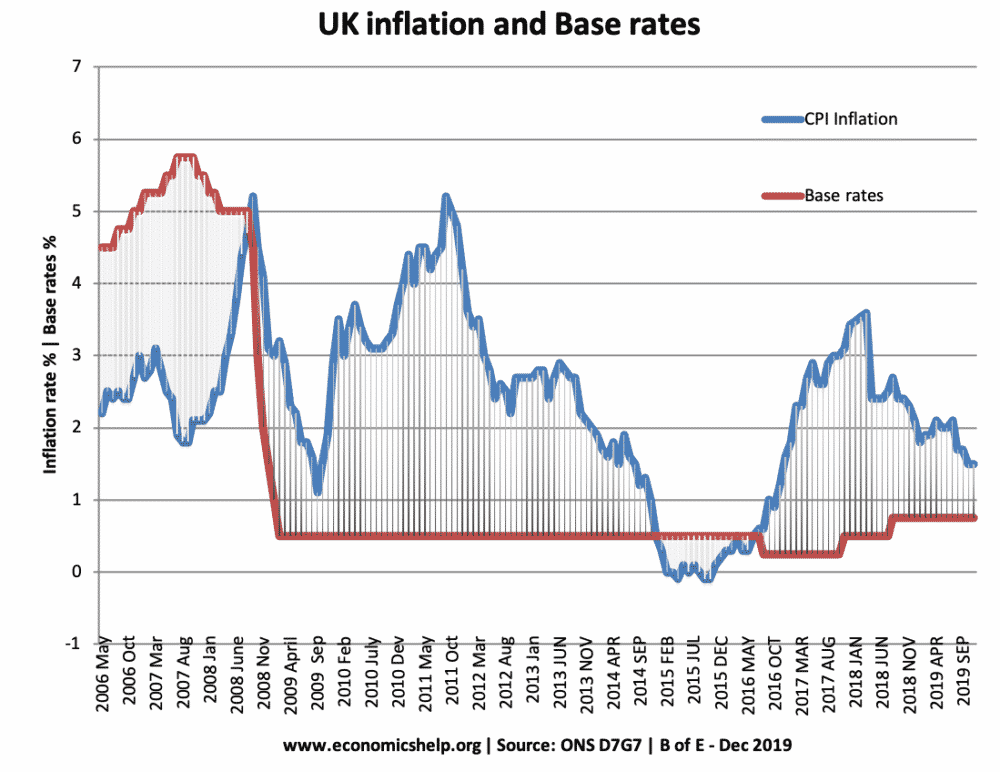

- If we look at the Pound in recent months, it has been relatively strong compared to the Euro and some other countries. This is despite a negative real interest rate. (Base rates are 0.5%, inflation is close to 3%)

- The pound has been in strong demand, despite negative real interest rates of -2.5%

- This is because in the current climate the real interest rate has become less important than the overall fear of debt default in the Eurozone. Therefore, there has been strong demand for the Pound, despite a negative real interest rate.

- Therefore, this shows that the real interest rates are only one factor out of several that can influence the exchange rate.

Example of interest rate cut in 2008/09

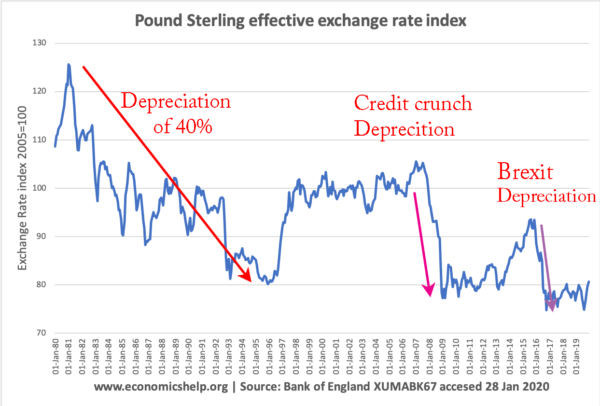

In 2008/09, the Bank of England cut interest rates from 5% to 0.5% a dramatic reduction in interest rates.

This led to a rapid depreciation of 30% in 2008. It is important to note that the depreciation was not just due to lower interest rates. The Pound started falling before interest rates were cut. The credit crunch and financial crash of 2008 hit the UK economy hard because the UK is more reliant on the financial sector than other economies. Nevertheless the cut in interest rates to 0.5% definitely didn’t help the Pound.

Related

great article.

Just wondering why the demand for a currency (cash) increases as interest rates increase. Cash pays 0% interest. Even a savings account is fixed income instrument (or the underlying is). My thinking is that the demand for cash increases because you need to first obtain that cash in order to buy the fixed income securities that are denominated in that currency. Is that correct?

its more secure. banks cant steal it